Intro

Discover 5 simple ways to save $1000, including budgeting, cutting expenses, and investing, to achieve financial freedom and build wealth through smart money management and savings strategies.

Saving $1000 may seem like a daunting task, but with a solid plan and discipline, it's achievable. Having a cushion of $1000 can provide peace of mind, help you cover unexpected expenses, and even serve as a foundation for long-term savings goals. In this article, we'll explore five practical strategies to help you save $1000.

The importance of saving cannot be overstated. It's a fundamental aspect of personal finance that can help you navigate financial challenges, achieve your goals, and secure your future. By prioritizing saving, you'll be better equipped to handle emergencies, pay off debt, and make progress toward your financial objectives. Whether you're looking to build an emergency fund, pay for a big purchase, or simply get into the habit of saving, these strategies will help you get started.

Saving $1000 requires a combination of reducing expenses, increasing income, and making conscious financial decisions. It's essential to be intentional with your money, making sure that every dollar is working towards your goal. By implementing a few simple changes to your daily habits and financial routine, you can make significant progress toward saving $1000. In the following sections, we'll dive deeper into each strategy, providing you with the tools and insights you need to succeed.

Understanding the Importance of Saving

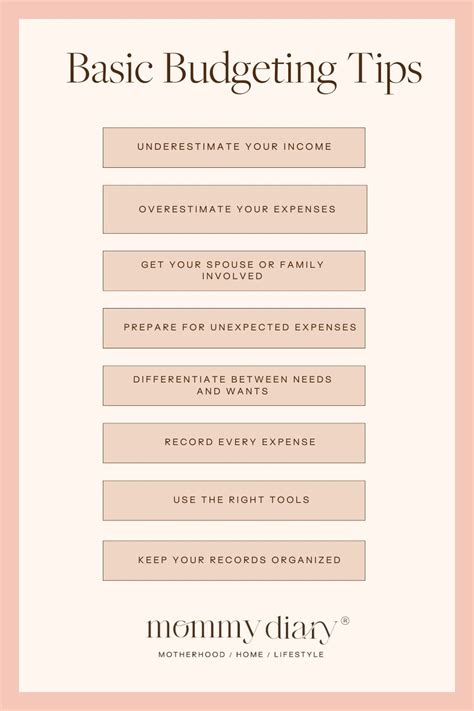

Strategy 1: Create a Budget and Track Your Expenses

Some tips for creating a budget and tracking your expenses include:

- Using the 50/30/20 rule, where 50% of your income goes towards needs, 30% towards wants, and 20% towards saving and debt repayment

- Setting up automatic transfers to your savings account

- Reviewing your budget regularly to make adjustments and stay on track

Strategy 2: Reduce Your Expenses

Some additional tips for reducing your expenses include:

- Using cashback apps and rewards programs

- Shopping during sales and using coupons

- Avoiding impulse purchases and waiting 24 hours before buying something non-essential

Strategy 3: Increase Your Income

Some additional tips for increasing your income include:

- Developing a valuable skill or certification

- Networking and building relationships in your industry

- Starting a small business or blogging

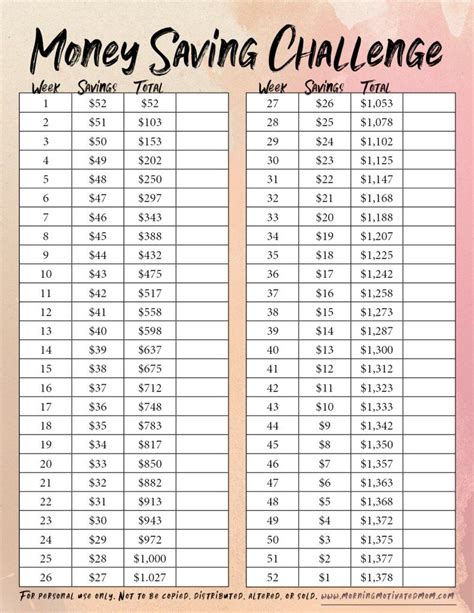

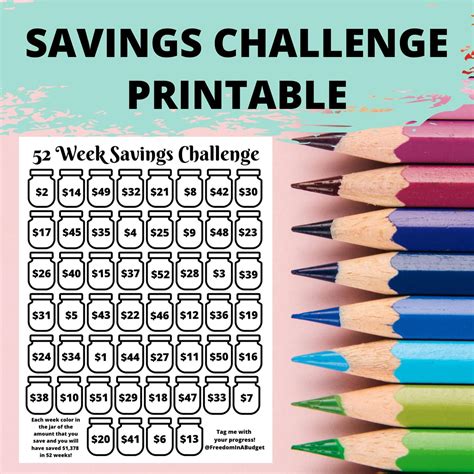

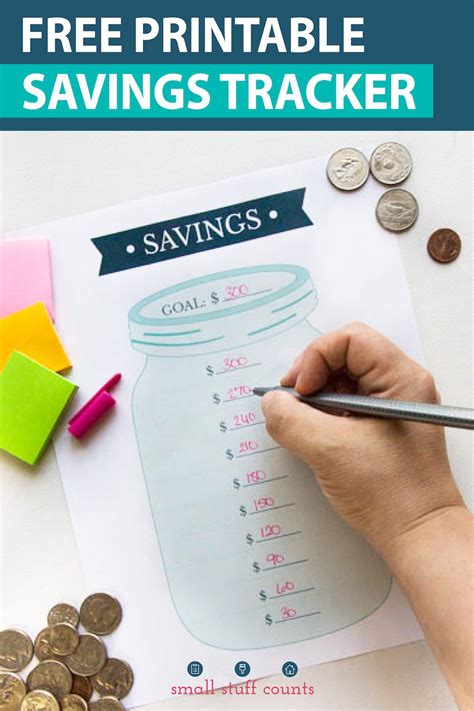

Strategy 4: Use the 52-Week Savings Challenge

Some tips for using the 52-week savings challenge include:

- Setting up automatic transfers to your savings account

- Using a separate savings account specifically for the challenge

- Reviewing your progress regularly and making adjustments as needed

Strategy 5: Take Advantage of Savings Apps and Tools

Some additional tips for using savings apps and tools include:

- Setting up automatic transfers to your savings account

- Using multiple apps and tools to find what works best for you

- Reviewing your progress regularly and making adjustments as needed

Gallery of Savings Strategies

Savings Strategies Image Gallery

How long will it take to save $1000?

+The time it takes to save $1000 will depend on your individual circumstances, including your income, expenses, and savings rate. However, with a solid plan and discipline, you can save $1000 in a relatively short period of time.

What are some common obstacles to saving $1000?

+Common obstacles to saving $1000 include lack of motivation, high expenses, and limited income. However, by creating a budget, reducing your expenses, and increasing your income, you can overcome these obstacles and achieve your savings goal.

How can I stay motivated to save $1000?

+To stay motivated to save $1000, consider setting smaller, achievable goals, tracking your progress, and celebrating your successes. You can also find a savings buddy or accountability partner to help keep you on track.

In conclusion, saving $1000 is a achievable goal that can provide a sense of security and freedom. By creating a budget, reducing your expenses, increasing your income, using the 52-week savings challenge, and taking advantage of savings apps and tools, you can make significant progress toward your goal. Remember to stay motivated, track your progress, and celebrate your successes along the way. With discipline and persistence, you can save $1000 and achieve financial stability. We encourage you to share your own savings strategies and tips in the comments below, and to explore our other articles and resources for more information on personal finance and savings.