Intro

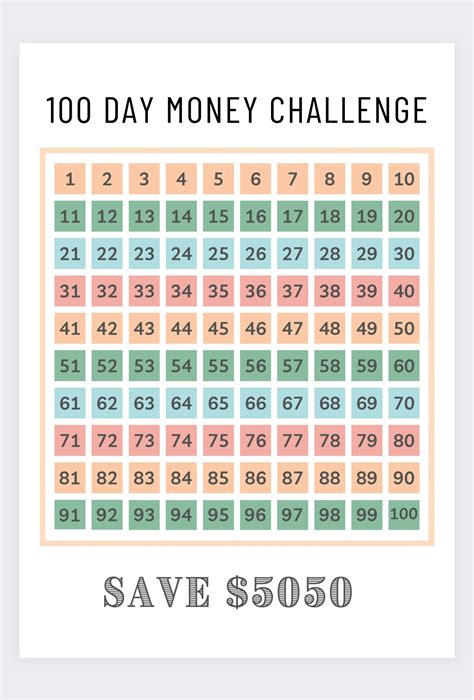

Boost savings with the 100 Day Savings Challenge, a financial discipline strategy using daily savings plans, budgeting tips, and money management techniques to achieve short-term savings goals.

The concept of saving money is not new, but it can be daunting, especially for those who struggle with managing their finances. However, what if you could save a significant amount of money in just 100 days? The 100 Day Savings Challenge is a popular trend that has been gaining attention in recent years, and for good reason. This challenge is designed to help individuals develop healthy savings habits and reach their financial goals in a short period.

The idea behind the 100 Day Savings Challenge is simple: save a specific amount of money each day for 100 days. The amount can vary depending on your financial situation and goals, but the key is to be consistent and make saving a priority. By the end of the 100 days, you will have saved a substantial amount of money that can be used for various purposes, such as paying off debt, building an emergency fund, or achieving a long-term goal.

One of the benefits of the 100 Day Savings Challenge is that it helps individuals develop a savings mindset. By committing to save a certain amount each day, you will become more mindful of your spending habits and make conscious decisions about how you allocate your money. This challenge also helps to build discipline and willpower, which are essential for achieving financial success.

How to Get Started with the 100 Day Savings Challenge

Once you have determined your daily savings amount, you can set up a separate savings account or use an existing one to track your progress. You can also use a budgeting app or spreadsheet to monitor your daily savings and stay motivated. It's essential to make saving a habit by setting up automatic transfers from your checking account to your savings account.

Benefits of the 100 Day Savings Challenge

The 100 Day Savings Challenge offers several benefits, including: * Developing a savings mindset and building discipline * Reducing debt and improving credit scores * Building an emergency fund and increasing financial stability * Achieving long-term financial goals, such as buying a house or retiring early * Improving overall financial health and well-beingTips for Success in the 100 Day Savings Challenge

Common Challenges and How to Overcome Them

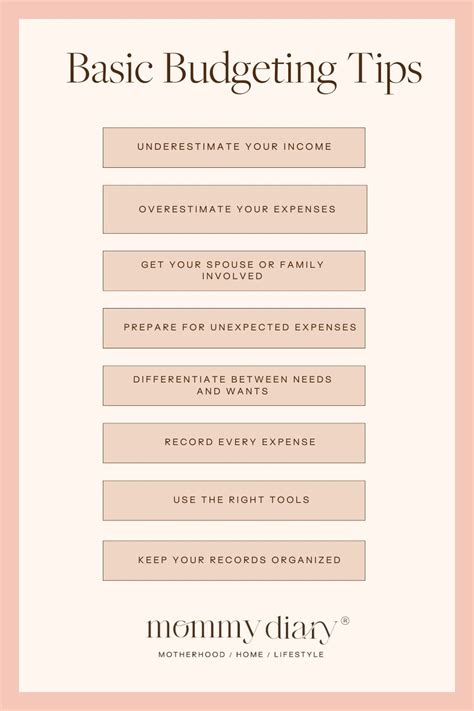

While the 100 Day Savings Challenge can be rewarding, it's not without its challenges. Some common obstacles include: * Lack of motivation and discipline * Unexpected expenses and financial setbacks * Difficulty sticking to a budget and tracking expenses * Feeling deprived or restricted by the challengeTo overcome these challenges, consider the following strategies:

- Find a savings buddy or accountability partner to provide support and motivation

- Use a budgeting app or spreadsheet to track your expenses and stay on top of your finances

- Prioritize needs over wants and make conscious decisions about how you allocate your money

- Reward yourself for reaching milestones and staying on track with the challenge

Real-Life Examples of the 100 Day Savings Challenge

These examples demonstrate the potential of the 100 Day Savings Challenge to help individuals achieve their financial goals and develop healthy savings habits. By committing to save a specific amount each day, you can make significant progress towards your goals and improve your overall financial well-being.

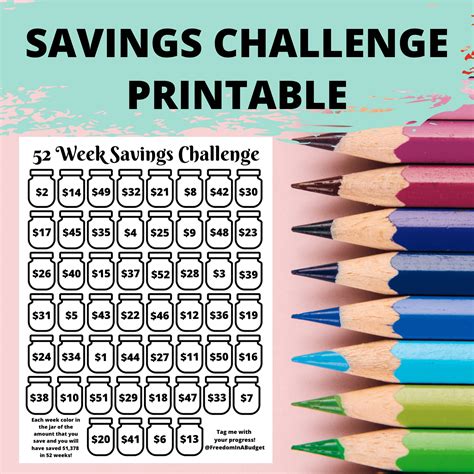

Variations of the 100 Day Savings Challenge

While the traditional 100 Day Savings Challenge involves saving a fixed amount each day, there are several variations that can be used to make the challenge more interesting and effective. Some examples include: * The "52-week savings challenge," where you save an amount equal to the number of the week (e.g., Week 1: Save $1, Week 2: Save $2) * The "reverse 100 Day Savings Challenge," where you start with a higher daily savings amount and decrease it by $1 each day * The "100 Day Savings Challenge with a twist," where you add a specific amount to your savings each day based on a particular event or activity (e.g., saving an extra $5 for each day you exercise)Conclusion and Next Steps

To get started with the challenge, determine your daily savings amount, set up a separate savings account, and track your progress. Use the tips and strategies outlined in this article to overcome common challenges and stay motivated throughout the challenge. Remember to be patient, disciplined, and consistent, and you'll be on your way to achieving financial success in just 100 days.

100 Day Savings Challenge Image Gallery

What is the 100 Day Savings Challenge?

+The 100 Day Savings Challenge is a savings challenge where you save a specific amount of money each day for 100 days.

How do I get started with the 100 Day Savings Challenge?

+To get started, determine your daily savings amount, set up a separate savings account, and track your progress.

What are the benefits of the 100 Day Savings Challenge?

+The benefits of the 100 Day Savings Challenge include developing a savings mindset, reducing debt, building an emergency fund, and achieving long-term financial goals.

Can I modify the 100 Day Savings Challenge to fit my needs?

+How can I stay motivated throughout the 100 Day Savings Challenge?

+To stay motivated, use visual reminders, such as a savings tracker or vision board, and consider finding a savings buddy or accountability partner.

We hope this article has provided you with the information and inspiration you need to take control of your finances and achieve your goals. Remember to stay disciplined, patient, and consistent, and you'll be on your way to financial success in no time. Share your experiences and tips with others, and don't hesitate to reach out if you have any questions or need further guidance. Together, we can achieve financial freedom and live a more prosperous life.