Intro

The Michigan 1099 form is a crucial document for businesses and individuals who need to report various types of income to the Internal Revenue Service (IRS) and the state of Michigan. In this article, we will delve into the details of the Michigan 1099 form, its importance, and how to obtain a printable version.

The Michigan 1099 form is used to report income such as freelance work, self-employment, and other types of miscellaneous income. This form is typically required for individuals who have earned more than $600 in a calendar year from a single payer. The form is used to report this income to the IRS and the state of Michigan, and it is an essential part of the tax filing process.

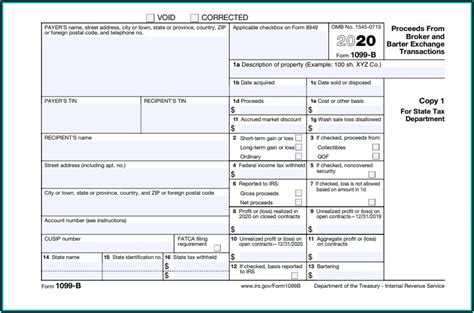

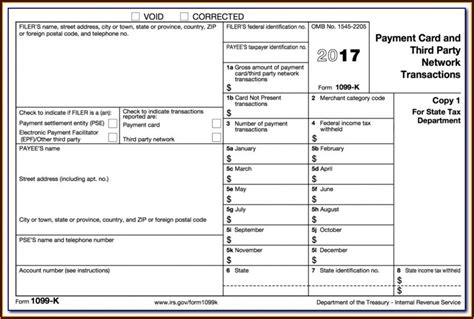

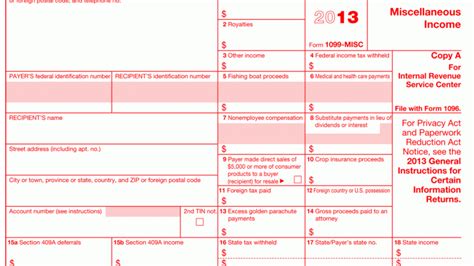

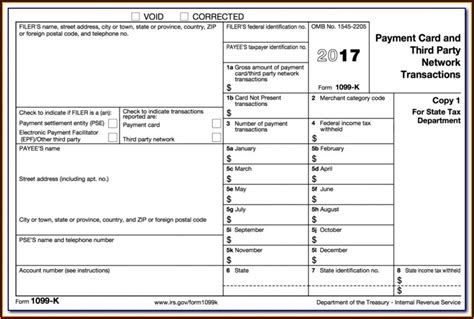

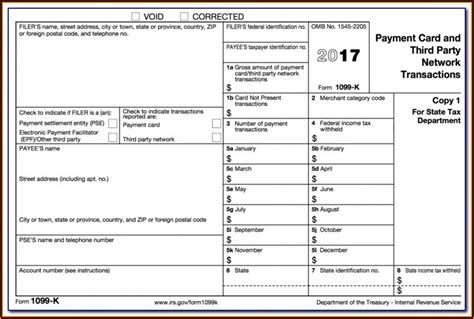

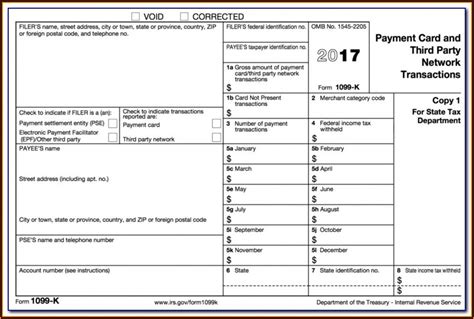

For businesses and individuals who need to file the Michigan 1099 form, it is essential to understand the different types of 1099 forms that are available. The most common types of 1099 forms include the 1099-MISC, 1099-INT, and 1099-DIV. The 1099-MISC form is used to report miscellaneous income, such as freelance work and self-employment. The 1099-INT form is used to report interest income, and the 1099-DIV form is used to report dividend income.

Miscellaneous Income and the 1099-MISC Form

The 1099-MISC form is one of the most commonly used 1099 forms, and it is used to report miscellaneous income. This type of income can include freelance work, self-employment, and other types of income that are not subject to withholding. The 1099-MISC form is typically required for individuals who have earned more than $600 in a calendar year from a single payer.

To obtain a printable version of the Michigan 1099 form, individuals can visit the official website of the IRS or the state of Michigan. The form can be downloaded and printed, and it is essential to ensure that the form is completed accurately and submitted on time.

Importance of the Michigan 1099 Form

The Michigan 1099 form is a crucial document that plays a significant role in the tax filing process. The form is used to report income that is not subject to withholding, and it is essential to ensure that the form is completed accurately and submitted on time.

Failure to file the Michigan 1099 form can result in penalties and fines, and it can also delay the processing of tax refunds. Therefore, it is essential to understand the importance of the Michigan 1099 form and to ensure that it is completed and submitted correctly.

How to Obtain a Printable Version of the Michigan 1099 Form

To obtain a printable version of the Michigan 1099 form, individuals can visit the official website of the IRS or the state of Michigan. The form can be downloaded and printed, and it is essential to ensure that the form is completed accurately and submitted on time.

Here are the steps to obtain a printable version of the Michigan 1099 form:

- Visit the official website of the IRS or the state of Michigan

- Search for the Michigan 1099 form

- Download the form and print it

- Complete the form accurately and submit it on time

Benefits of Using a Printable Version of the Michigan 1099 Form

Using a printable version of the Michigan 1099 form offers several benefits, including:

- Convenience: The form can be downloaded and printed from the comfort of your own home or office.

- Accuracy: The form can be completed accurately and submitted on time, reducing the risk of errors and penalties.

- Time-saving: The form can be completed quickly and efficiently, saving time and effort.

Common Mistakes to Avoid When Completing the Michigan 1099 Form

When completing the Michigan 1099 form, it is essential to avoid common mistakes that can result in penalties and fines. Here are some common mistakes to avoid:

- Inaccurate information: Ensure that all information is accurate and complete.

- Late filing: Ensure that the form is submitted on time to avoid penalties and fines.

- Incorrect form: Ensure that the correct form is used for the type of income being reported.

Gallery of Michigan 1099 Forms

Michigan 1099 Form Gallery

Frequently Asked Questions

What is the Michigan 1099 form used for?

+The Michigan 1099 form is used to report miscellaneous income, such as freelance work and self-employment.

How do I obtain a printable version of the Michigan 1099 form?

+You can obtain a printable version of the Michigan 1099 form by visiting the official website of the IRS or the state of Michigan.

What are the benefits of using a printable version of the Michigan 1099 form?

+The benefits of using a printable version of the Michigan 1099 form include convenience, accuracy, and time-saving.

What are the common mistakes to avoid when completing the Michigan 1099 form?

+The common mistakes to avoid when completing the Michigan 1099 form include inaccurate information, late filing, and using the incorrect form.

How do I avoid penalties and fines when completing the Michigan 1099 form?

+To avoid penalties and fines, ensure that the form is completed accurately and submitted on time, and use the correct form for the type of income being reported.

In conclusion, the Michigan 1099 form is a crucial document that plays a significant role in the tax filing process. It is essential to understand the importance of the form, how to obtain a printable version, and how to complete it accurately to avoid penalties and fines. By following the tips and guidelines outlined in this article, individuals can ensure that they complete the Michigan 1099 form correctly and avoid any potential issues. We encourage readers to share their experiences and tips for completing the Michigan 1099 form in the comments section below. Additionally, we invite readers to share this article with others who may find it helpful, and to visit our website for more information and resources on tax-related topics.