Intro

Boost finances with the 5 Ways Savings Challenge, a money-saving strategy incorporating budgeting, frugal living, and expense tracking to achieve financial freedom.

The concept of savings challenges has become increasingly popular in recent years, as people look for innovative ways to manage their finances and build wealth. A savings challenge is a fun and engaging way to save money, and it can be tailored to suit individual financial goals and needs. In this article, we will explore five ways savings challenges can help you achieve your financial objectives.

Savings challenges are designed to help individuals develop healthy financial habits and save money over a set period. These challenges can be as simple as saving a certain amount of money each day or as complex as following a specific savings plan. The key to a successful savings challenge is to set realistic goals and track progress regularly. By doing so, individuals can stay motivated and focused on their financial objectives.

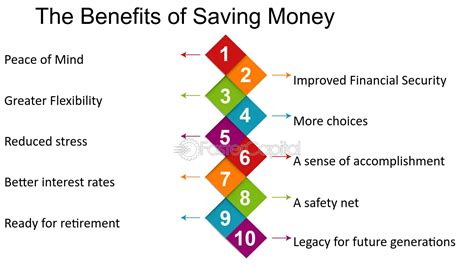

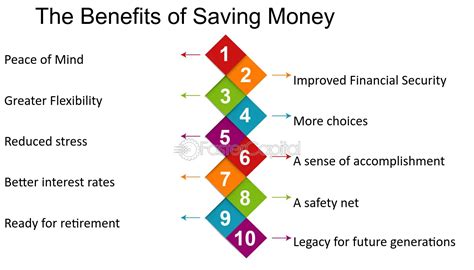

The importance of savings challenges cannot be overstated. In today's economy, having a safety net of savings can provide peace of mind and financial security. Savings challenges can help individuals build an emergency fund, pay off debt, or save for long-term goals such as retirement or a down payment on a house. Moreover, savings challenges can be a fun and rewarding way to manage finances, as individuals can see the progress they are making towards their goals.

Understanding Savings Challenges

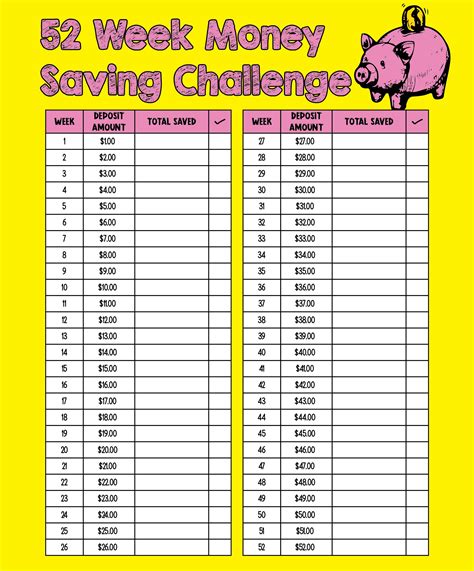

Savings challenges are a great way to develop healthy financial habits and save money. These challenges can be customized to suit individual financial goals and needs, and they can be as simple or as complex as desired. Some popular types of savings challenges include the 52-week savings challenge, where individuals save an amount equal to the number of the week, and the savings jar challenge, where individuals save their loose change in a jar.

To get the most out of a savings challenge, it's essential to set realistic goals and track progress regularly. This can be done by creating a budget and tracking expenses, as well as setting reminders and notifications to stay on track. Additionally, individuals can share their savings goals with a friend or family member to increase accountability and motivation.

Types of Savings Challenges

There are many different types of savings challenges that individuals can participate in. Some popular options include: * The 52-week savings challenge * The savings jar challenge * The no-spend challenge * The savings match challenge * The envelope savings challengeEach of these challenges has its unique benefits and drawbacks, and individuals should choose the one that best suits their financial goals and needs.

Benefits of Savings Challenges

Savings challenges offer numerous benefits, including:

- Developing healthy financial habits

- Building an emergency fund

- Paying off debt

- Saving for long-term goals

- Increasing financial literacy

By participating in a savings challenge, individuals can take control of their finances and make progress towards their financial goals. Savings challenges can also be a fun and rewarding way to manage finances, as individuals can see the progress they are making towards their goals.

How to Create a Savings Challenge

Creating a savings challenge is a straightforward process that involves setting realistic goals and tracking progress regularly. Here are some steps to follow: * Determine your financial goals * Choose a type of savings challenge * Set a realistic timeline * Track your progress * Stay motivated and accountableBy following these steps, individuals can create a savings challenge that suits their financial goals and needs.

5 Ways Savings Challenges Can Help You Achieve Your Financial Objectives

Here are five ways savings challenges can help you achieve your financial objectives:

- Developing healthy financial habits: Savings challenges can help individuals develop healthy financial habits, such as saving regularly and tracking expenses.

- Building an emergency fund: Savings challenges can help individuals build an emergency fund, which can provide peace of mind and financial security.

- Paying off debt: Savings challenges can help individuals pay off debt, such as credit card balances or personal loans.

- Saving for long-term goals: Savings challenges can help individuals save for long-term goals, such as retirement or a down payment on a house.

- Increasing financial literacy: Savings challenges can help individuals increase their financial literacy, which can lead to better financial decision-making.

By participating in a savings challenge, individuals can take control of their finances and make progress towards their financial goals.

Tips for Success

Here are some tips for success when participating in a savings challenge: * Start small and be consistent * Track your progress regularly * Stay motivated and accountable * Avoid impulse purchases * Consider automating your savingsBy following these tips, individuals can increase their chances of success and achieve their financial objectives.

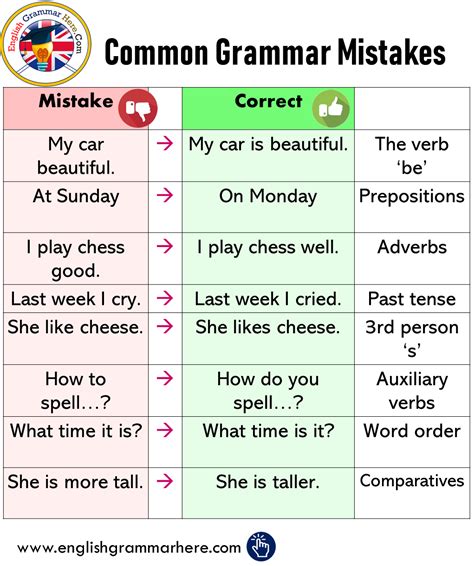

Common Mistakes to Avoid

When participating in a savings challenge, there are several common mistakes to avoid, including:

- Setting unrealistic goals

- Not tracking progress regularly

- Giving up too easily

- Not having a clear plan

- Not being consistent

By avoiding these common mistakes, individuals can increase their chances of success and achieve their financial objectives.

Overcoming Obstacles

When participating in a savings challenge, individuals may encounter obstacles, such as unexpected expenses or financial setbacks. Here are some tips for overcoming these obstacles: * Stay focused on your goals * Be flexible and adjust your plan as needed * Seek support from friends or family members * Consider seeking professional advice * Stay positive and motivatedBy following these tips, individuals can overcome obstacles and stay on track with their savings challenge.

Savings Challenge Image Gallery

What is a savings challenge?

+A savings challenge is a fun and engaging way to save money, where individuals set a goal to save a certain amount of money over a set period.

How do I create a savings challenge?

+To create a savings challenge, determine your financial goals, choose a type of savings challenge, set a realistic timeline, track your progress, and stay motivated and accountable.

What are the benefits of participating in a savings challenge?

+The benefits of participating in a savings challenge include developing healthy financial habits, building an emergency fund, paying off debt, saving for long-term goals, and increasing financial literacy.

How can I stay motivated and accountable during a savings challenge?

+To stay motivated and accountable during a savings challenge, track your progress regularly, share your goals with a friend or family member, and consider automating your savings.

What are some common mistakes to avoid during a savings challenge?

+Common mistakes to avoid during a savings challenge include setting unrealistic goals, not tracking progress regularly, giving up too easily, not having a clear plan, and not being consistent.

In summary, savings challenges are a fun and engaging way to save money and achieve financial objectives. By participating in a savings challenge, individuals can develop healthy financial habits, build an emergency fund, pay off debt, save for long-term goals, and increase financial literacy. To get the most out of a savings challenge, it's essential to set realistic goals, track progress regularly, and stay motivated and accountable. We encourage you to share your experiences with savings challenges in the comments below and explore the various resources available to help you achieve your financial goals.