Intro

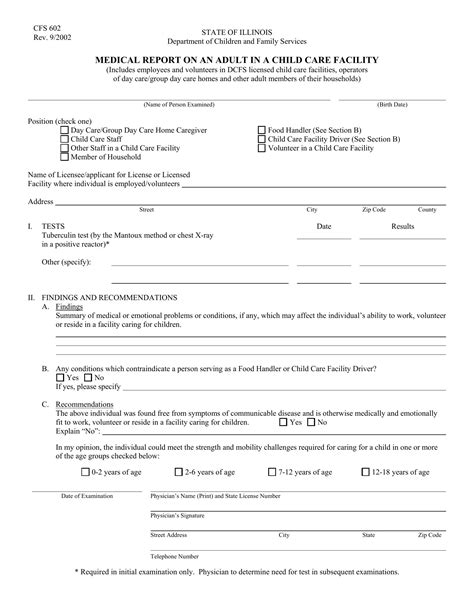

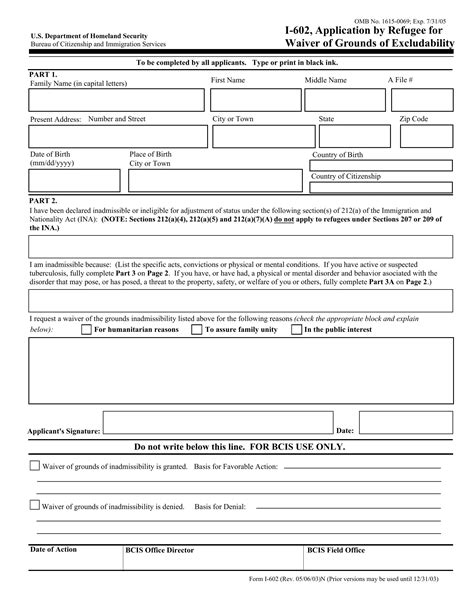

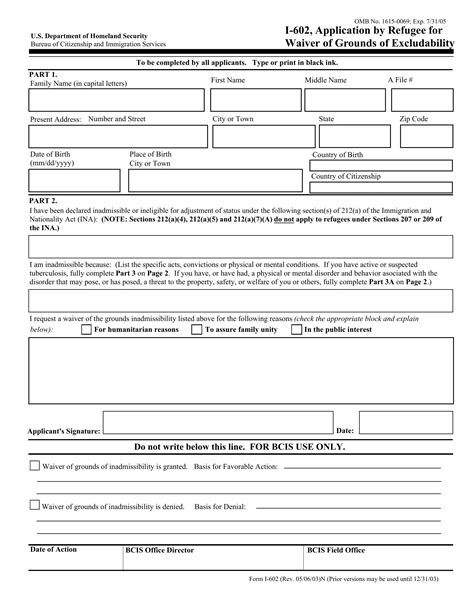

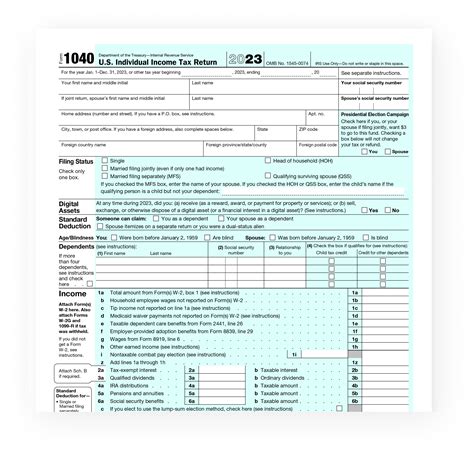

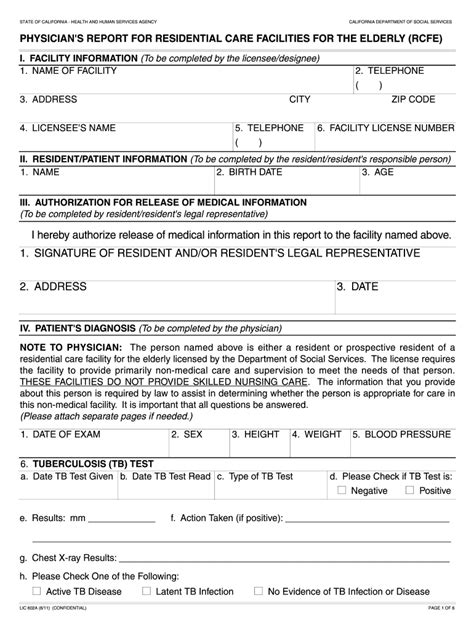

The 602 form printable is a crucial document for various purposes, including tax returns, financial reporting, and other official transactions. Understanding the significance of this form and how to access a printable version can save individuals and businesses a significant amount of time and effort. In this article, we will delve into the details of the 602 form, its applications, and provide guidance on how to obtain a printable copy.

The 602 form is utilized for reporting specific types of income, deductions, and credits. It is essential for taxpayers to accurately fill out this form to ensure they are in compliance with tax laws and regulations. The form's complexity can sometimes overwhelm individuals, which is why having access to a printable version can be incredibly helpful. With a printable 602 form, users can easily review, complete, and submit their tax information without the hassle of manually creating the form or dealing with digital formatting issues.

One of the primary benefits of using a 602 form printable is the ease of use. The form is designed to be straightforward, with clear instructions and sections for entering the required information. This simplicity reduces the likelihood of errors, which can lead to delays or even penalties. Moreover, having a physical copy of the form allows individuals to review and verify their information before submission, further minimizing the risk of mistakes.

Benefits of the 602 Form Printable

The benefits of using a 602 form printable extend beyond ease of use. It also provides a level of transparency and organization that digital forms may lack. With a physical copy, individuals can easily keep track of their tax-related documents and ensure that all necessary information is included. This organization is particularly important for businesses or individuals with complex tax situations, as it helps in maintaining a clear record of financial transactions and tax obligations.

Applications of the 602 Form

The 602 form has various applications, primarily in the context of tax reporting. Some of the key uses include: - Reporting income from specific sources that are not covered by standard tax forms. - Claiming deductions and credits that require detailed documentation. - Filing amendments to previously submitted tax returns. - Providing additional information requested by tax authorities.How to Obtain a 602 Form Printable

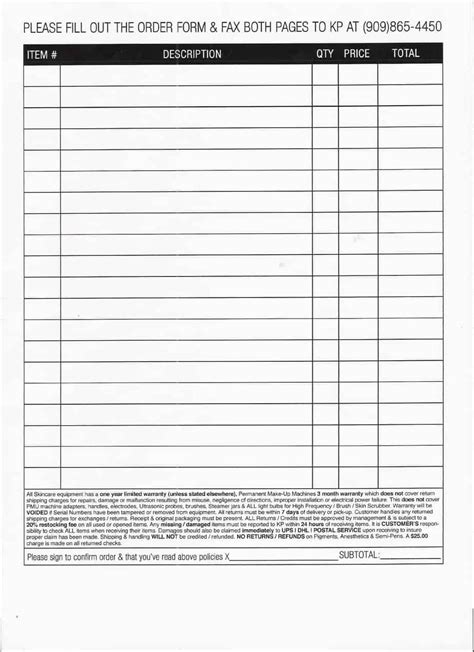

Obtaining a 602 form printable is relatively straightforward. The most common method is to download the form from official tax authority websites or financial institutions' portals. These websites typically offer a range of tax forms, including the 602, in printable formats such as PDF. Users can then print out the form, fill it in, and submit it as required.

Another option is to visit a local tax office or financial advisory service, where printed copies of the 602 form may be available. This method is beneficial for those who prefer a more personal approach or need assistance in understanding the form's requirements.

Steps to Complete the 602 Form

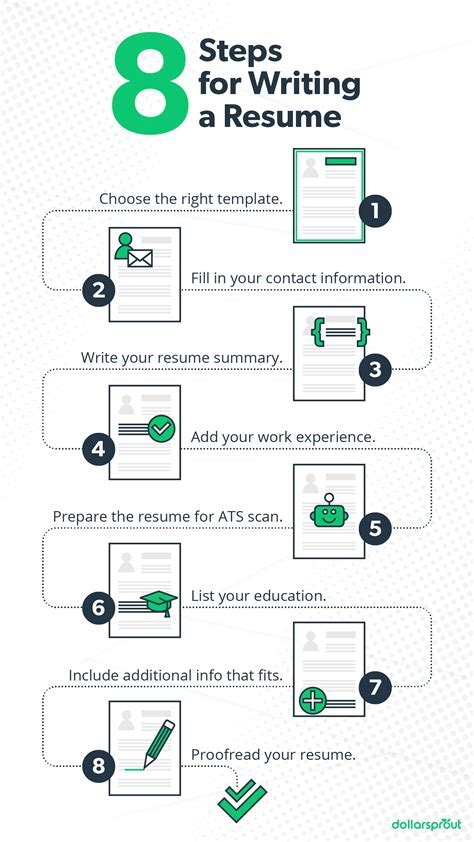

Completing the 602 form involves several steps: 1. **Download or Obtain the Form**: Get a printable version of the 602 form from an official source. 2. **Review Instructions**: Carefully read the instructions provided with the form to understand what information is required. 3. **Gather Necessary Documents**: Collect all relevant financial documents and records that support the information to be entered on the form. 4. **Fill Out the Form**: Accurately complete the form, ensuring all required sections are filled in. 5. **Review and Verify**: Double-check the form for any errors or omissions. 6. **Submit the Form**: Send the completed form to the appropriate authority, following the specified submission guidelines.Tips for Filling Out the 602 Form

When filling out the 602 form, several tips can help ensure the process is smooth and error-free:

- Use Black Ink: Always use black ink to fill out the form, as this improves readability and scanability.

- Be Neat and Legible: Ensure handwriting is clear and easy to read.

- Follow Instructions: Adhere strictly to the instructions provided with the form.

- Double-Check Calculations: Verify all mathematical calculations for accuracy.

- Keep a Copy: Make a copy of the completed form for personal records.

Common Mistakes to Avoid

Some common mistakes to avoid when completing the 602 form include: - Inaccurate or incomplete information - Failure to sign the form - Incorrect calculations - Not attaching required supporting documents - Missing deadlines for submissionConclusion and Next Steps

In conclusion, the 602 form printable is a valuable resource for individuals and businesses needing to report specific financial information. By understanding the form's purpose, benefits, and how to obtain and complete it accurately, users can navigate the tax reporting process more efficiently. Remember, accuracy and timeliness are key when dealing with tax forms, so taking the time to review and understand the requirements of the 602 form is crucial.

Final Thoughts

The importance of using a 602 form printable cannot be overstated. It offers a convenient, organized, and transparent way to manage tax-related documentation. Whether you are an individual or a business, ensuring you have access to this form and understand how to use it correctly can make a significant difference in your tax reporting experience.602 Form Printable Image Gallery

What is the purpose of the 602 form?

+The 602 form is used for reporting specific types of income, deductions, and credits, ensuring compliance with tax laws and regulations.

How can I obtain a 602 form printable?

+You can download the 602 form from official tax authority websites or obtain a printed copy from a local tax office or financial advisory service.

What are the common mistakes to avoid when filling out the 602 form?

+Common mistakes include inaccurate or incomplete information, failure to sign the form, incorrect calculations, not attaching required documents, and missing submission deadlines.

We invite you to share your experiences or ask questions about the 602 form printable in the comments below. Your insights can help others navigate the process more effectively. Additionally, if you found this article helpful, please consider sharing it with others who might benefit from understanding the importance and applications of the 602 form. Together, we can make tax reporting simpler and more accessible for everyone.