Intro

Discover 5 ways to accept credit card payments, including online payment gateways, mobile payments, and POS systems, to boost sales and customer convenience with secure cc processing and transaction management.

The world of e-commerce has undergone a significant transformation in recent years, with the rise of online payments and digital transactions. One of the most popular payment methods is credit card payments, which offer convenience, security, and flexibility to customers. In this article, we will explore the importance of accepting credit card payments and provide a comprehensive guide on how to do so.

Accepting credit card payments is crucial for businesses that want to stay competitive in the market. It offers a wide range of benefits, including increased sales, improved customer satisfaction, and reduced cart abandonment rates. Moreover, credit card payments provide a secure and reliable way to process transactions, reducing the risk of fraud and chargebacks. With the increasing demand for online shopping, businesses that do not accept credit card payments may miss out on potential sales and revenue.

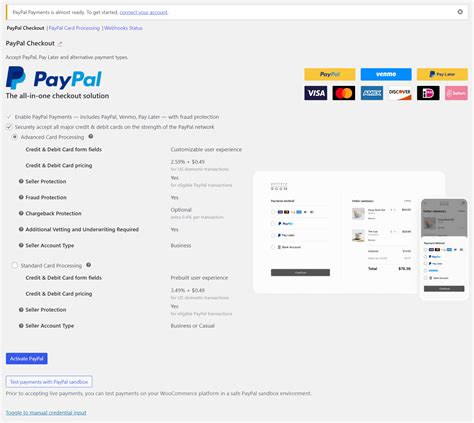

The process of accepting credit card payments involves several steps, including setting up a payment gateway, obtaining a merchant account, and integrating the payment system with the website or mobile app. Businesses can choose from various payment gateways, such as PayPal, Stripe, or Square, each offering its own set of features and fees. Additionally, businesses need to ensure that their payment system is compliant with industry standards, such as PCI-DSS, to protect sensitive customer data.

Introduction to Credit Card Payments

Types of Credit Cards

There are several types of credit cards available, each offering its own set of features and benefits. The most common types of credit cards include: * Visa * Mastercard * American Express * Discover Each type of credit card has its own set of rules and regulations, and businesses need to ensure that they are compliant with these standards to avoid any issues or penalties.Benefits of Accepting Credit Card Payments

How to Accept Credit Card Payments

To accept credit card payments, businesses need to follow several steps, including: 1. Setting up a payment gateway: Businesses need to choose a payment gateway, such as PayPal or Stripe, to process credit card transactions. 2. Obtaining a merchant account: Businesses need to obtain a merchant account to accept credit card payments. 3. Integrating the payment system: Businesses need to integrate the payment system with their website or mobile app. 4. Ensuring compliance: Businesses need to ensure that their payment system is compliant with industry standards, such as PCI-DSS.Payment Gateways for Credit Card Payments

Features of Payment Gateways

Payment gateways offer a wide range of features, including: * Secure transactions: Payment gateways provide a secure way to process transactions, reducing the risk of fraud and chargebacks. * Recurring payments: Payment gateways offer recurring payment options, allowing businesses to charge customers on a regular basis. * Mobile payments: Payment gateways offer mobile payment options, allowing customers to make transactions on-the-go. * Reporting and analytics: Payment gateways provide reporting and analytics tools, allowing businesses to track transactions and sales.Security Measures for Credit Card Payments

Best Practices for Credit Card Payments

To ensure secure and reliable credit card payments, businesses need to follow best practices, including: * Regularly updating software and systems * Using strong passwords and authentication * Monitoring transactions and sales * Providing clear and transparent information to customersGallery of Credit Card Payment Options

Credit Card Payment Options Image Gallery

Frequently Asked Questions

What is the best payment gateway for credit card payments?

+The best payment gateway for credit card payments depends on the specific needs and requirements of the business. Some popular payment gateways include PayPal, Stripe, and Square.

How do I ensure the security of credit card payments?

+To ensure the security of credit card payments, businesses need to use SSL encryption, tokenization, and comply with industry standards such as PCI-DSS.

What are the benefits of accepting credit card payments?

+Accepting credit card payments offers a wide range of benefits, including increased sales, improved customer satisfaction, and reduced cart abandonment rates.

How do I set up a payment gateway for credit card payments?

+To set up a payment gateway for credit card payments, businesses need to choose a payment gateway, obtain a merchant account, and integrate the payment system with their website or mobile app.

What are the different types of credit cards?

+The most common types of credit cards include Visa, Mastercard, American Express, and Discover.

In conclusion, accepting credit card payments is crucial for businesses that want to stay competitive in the market. By understanding the importance of credit card payments, choosing the right payment gateway, and ensuring security and compliance, businesses can provide a convenient and secure way for customers to make transactions. We hope this article has provided valuable insights and information on how to accept credit card payments and improve your business. If you have any further questions or comments, please do not hesitate to reach out. Share this article with your friends and colleagues to help them understand the importance of credit card payments and how to accept them.