Intro

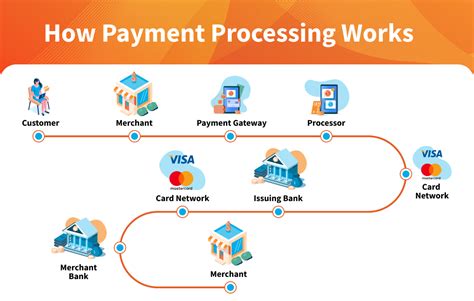

Streamline transactions with easy credit card payment processing, accepting major cards securely, and simplifying online payments with merchant services and payment gateways.

Accepting credit card payments is a crucial aspect of running a successful business in today's digital age. With the rise of e-commerce and online transactions, it's essential for businesses to provide their customers with a seamless and secure payment experience. Credit card payments offer a convenient and widely accepted method for customers to make purchases, and businesses that don't accept credit cards may miss out on potential sales. In this article, we'll explore the importance of accepting credit card payments, the benefits of doing so, and provide a step-by-step guide on how to get started.

Accepting credit card payments can significantly increase sales and revenue for businesses. When customers have the option to pay with their credit cards, they are more likely to make impulse purchases and spend more money. Additionally, credit card payments can help businesses to expand their customer base, as they can attract customers who prefer to use credit cards for their transactions. With the increasing popularity of online shopping, accepting credit card payments is no longer a luxury, but a necessity for businesses that want to stay competitive.

The benefits of accepting credit card payments are numerous. For one, it provides customers with a convenient and secure way to make payments. Credit card payments are also fast and efficient, allowing businesses to process transactions quickly and easily. Furthermore, accepting credit card payments can help businesses to build trust with their customers, as it demonstrates a commitment to providing a secure and reliable payment experience. With the advancement of technology, accepting credit card payments has become easier and more affordable than ever, making it an essential tool for businesses of all sizes.

Benefits of Accepting Credit Card Payments

Increased Sales

Accepting credit card payments can significantly increase sales for businesses. When customers have the option to pay with their credit cards, they are more likely to make impulse purchases and spend more money. According to a study, businesses that accept credit card payments experience an average increase in sales of 20-30%. This is because credit card payments provide customers with a convenient and secure way to make payments, making them more likely to complete a purchase.Improved Cash Flow

Accepting credit card payments can also improve cash flow for businesses. When payments are processed quickly and efficiently, businesses can receive their funds faster, allowing them to manage their finances more effectively. With the ability to accept credit card payments, businesses can reduce the risk of late payments and bad debt, as payments are processed automatically. This can help businesses to improve their cash flow, allowing them to invest in growth and expansion.How to Accept Credit Card Payments

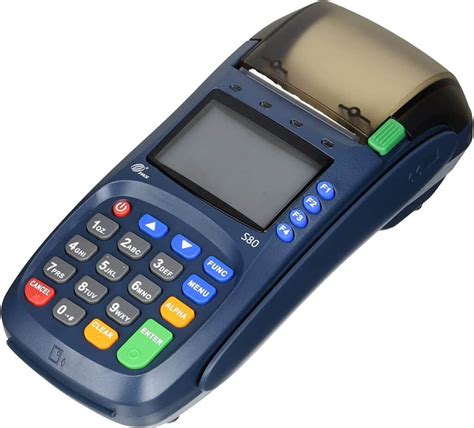

Once a business has set up an account with a payment processor, they can begin accepting credit card payments. This can be done online, in-store, or through a mobile device. Businesses will need to ensure that they have the necessary equipment and software to process credit card payments, such as a payment terminal or a mobile payment app. With the ability to accept credit card payments, businesses can provide their customers with a convenient and secure payment experience, helping to increase sales and revenue.

Choosing a Payment Processor

Choosing a payment processor is an essential step in accepting credit card payments. Businesses should consider several factors when selecting a payment processor, including fees, security, and customer support. Payment processors typically charge a fee for each transaction, which can range from 1-3% of the sale amount. Businesses should also consider the level of security provided by the payment processor, as well as the quality of customer support.Setting Up an Account

Setting up an account with a payment processor is a relatively straightforward process. Businesses will need to provide business and financial information, as well as agree to the terms and conditions of the payment processor. This typically involves filling out an application form and providing documentation, such as a business license and bank statements. Once the account is set up, businesses can begin accepting credit card payments and managing their transactions through an online dashboard.Types of Credit Card Payments

Online Payments

Online payments are a popular way for customers to make purchases, as they provide a convenient and secure way to pay. Businesses can accept online payments through a payment gateway, such as PayPal or Stripe. Online payments are processed quickly and efficiently, allowing businesses to receive their funds faster.In-Store Payments

In-store payments are made through a payment terminal or point-of-sale system. Businesses can accept in-store payments by setting up a payment terminal or point-of-sale system in their store. In-store payments provide customers with a convenient and secure way to pay, and can help businesses to increase sales and revenue.Security and Compliance

PCI DSS Compliance

PCI DSS compliance is essential for businesses that accept credit card payments. The PCI DSS is a set of industry standards that require businesses to implement security measures to protect sensitive customer information. Businesses must ensure that they are complying with the PCI DSS by implementing security measures, such as encryption and tokenization, and by conducting regular security audits.Encryption and Tokenization

Encryption and tokenization are essential security measures for businesses that accept credit card payments. Encryption involves scrambling sensitive customer information, such as credit card numbers, to prevent unauthorized access. Tokenization involves replacing sensitive customer information with a unique token, which can be used to process transactions without exposing the underlying information.Best Practices for Accepting Credit Card Payments

Implementing Security Measures

Implementing security measures, such as encryption and tokenization, is essential for businesses that accept credit card payments. These measures can help to protect sensitive customer information and prevent unauthorized access. Businesses should also ensure that they are using secure payment terminals and point-of-sale systems, which can help to prevent tampering and unauthorized access.Conducting Regular Security Audits

Conducting regular security audits is essential for businesses that accept credit card payments. These audits can help to identify vulnerabilities and weaknesses in a business's security measures, allowing them to take corrective action. Businesses should conduct regular security audits, as well as ensure that they are complying with industry standards and regulations, such as the PCI DSS.Credit Card Payment Image Gallery

What are the benefits of accepting credit card payments?

+The benefits of accepting credit card payments include increased sales, improved cash flow, and enhanced customer satisfaction. By accepting credit card payments, businesses can attract a wider customer base and increase their revenue.

How do I get started with accepting credit card payments?

+To get started with accepting credit card payments, businesses will need to choose a payment processor and set up an account. This typically involves providing business and financial information, as well as agreeing to the terms and conditions of the payment processor.

What are the different types of credit card payments?

+The different types of credit card payments include online payments, in-store payments, and mobile payments. Online payments are made through a business's website or online payment gateway, while in-store payments are made through a payment terminal or point-of-sale system. Mobile payments are made through a mobile device, such as a smartphone or tablet.

How do I ensure the security of credit card payments?

+To ensure the security of credit card payments, businesses should implement security measures, such as encryption and tokenization, and conduct regular security audits. Businesses should also ensure that they are complying with industry standards and regulations, such as the PCI DSS.

What are the best practices for accepting credit card payments?

+The best practices for accepting credit card payments include implementing security measures, such as encryption and tokenization, and conducting regular security audits. Businesses should also ensure that they are complying with industry standards and regulations, such as the PCI DSS, and providing clear and transparent information to customers about their payment options and security measures.

In

Final Thoughts