Intro

Streamline transactions with easy credit card payment processing, secure online payments, and merchant services, making accepting credit cards effortless for businesses and customers alike.

Accepting credit card payments is a crucial aspect of running a successful business in today's digital age. With the rise of e-commerce and online transactions, businesses need to adapt to the changing landscape and provide their customers with convenient and secure payment options. Credit card payments offer a quick and easy way for customers to make purchases, and businesses that do not accept credit cards may be missing out on potential sales. In this article, we will explore the importance of accepting credit card payments and provide a comprehensive guide on how to make it easy for businesses to do so.

The importance of accepting credit card payments cannot be overstated. Credit cards are a widely accepted form of payment, and many customers prefer to use them for online and offline transactions. By accepting credit card payments, businesses can increase their customer base and boost sales. Additionally, credit card payments provide a secure and convenient way for customers to make purchases, which can lead to increased customer satisfaction and loyalty. With the advancement of technology, accepting credit card payments has become easier and more affordable than ever, and businesses of all sizes can benefit from it.

Accepting credit card payments requires a payment processing system that can handle transactions securely and efficiently. There are several types of payment processing systems available, including online payment gateways, point-of-sale (POS) systems, and mobile payment processing systems. Each type of system has its own advantages and disadvantages, and businesses need to choose the one that best suits their needs. Online payment gateways, such as PayPal and Stripe, provide a secure and convenient way for customers to make online payments. POS systems, such as Square and Clover, provide a secure and efficient way for businesses to process in-person transactions. Mobile payment processing systems, such as Apple Pay and Google Pay, provide a convenient and secure way for customers to make payments using their mobile devices.

Benefits of Accepting Credit Card Payments

Increased Sales

Accepting credit card payments can increase sales for businesses, as customers are more likely to make purchases when they have a convenient and secure payment option. Credit cards are a widely accepted form of payment, and many customers prefer to use them for online and offline transactions. By accepting credit card payments, businesses can tap into this large customer base and increase their sales. Additionally, credit card payments provide a secure and convenient way for customers to make purchases, which can lead to increased customer satisfaction and loyalty.Improved Customer Satisfaction

Accepting credit card payments can improve customer satisfaction, as customers are more likely to be satisfied with their purchase when they have a convenient and secure payment option. Credit card payments provide a secure and convenient way for customers to make purchases, which can lead to increased customer satisfaction and loyalty. Additionally, accepting credit card payments can reduce the risk of customer complaints and disputes, as customers are less likely to experience issues with their payment.How to Accept Credit Card Payments

- Choose a payment processing system that meets their needs

- Set up a merchant account with a bank or payment processor

- Integrate the payment processing system with their website or POS system

- Test the payment processing system to ensure it is working correctly

Choosing a Payment Processing System

Choosing a payment processing system is a crucial step in accepting credit card payments. There are several types of payment processing systems available, including online payment gateways, POS systems, and mobile payment processing systems. Each type of system has its own advantages and disadvantages, and businesses need to choose the one that best suits their needs. Online payment gateways, such as PayPal and Stripe, provide a secure and convenient way for customers to make online payments. POS systems, such as Square and Clover, provide a secure and efficient way for businesses to process in-person transactions. Mobile payment processing systems, such as Apple Pay and Google Pay, provide a convenient and secure way for customers to make payments using their mobile devices.Security and Compliance

Encryption and Tokenization

Encryption and tokenization are two security measures that businesses can use to protect credit card information. Encryption involves converting credit card information into a code that can only be deciphered with a decryption key. Tokenization involves replacing credit card information with a token, which is a unique identifier that can be used to represent the credit card information. Both encryption and tokenization provide a secure way for businesses to handle credit card information and comply with the PCI DSS.Common Mistakes to Avoid

Providing Clear and Transparent Pricing Information

Providing clear and transparent pricing information is crucial when accepting credit card payments. Businesses need to clearly display their pricing information, including any fees or charges associated with credit card payments. This can help to avoid customer confusion and dissatisfaction, which can lead to a loss of sales and revenue. Additionally, providing clear and transparent pricing information can help to build trust with customers, which can lead to increased customer satisfaction and loyalty.Best Practices for Accepting Credit Card Payments

Testing the Payment Processing System

Testing the payment processing system is crucial when accepting credit card payments. Businesses need to test their payment processing system to ensure that transactions are processed correctly and securely. This can help to avoid errors and issues with transactions, which can lead to customer complaints and disputes. Additionally, testing the payment processing system can help to identify any security vulnerabilities, which can be addressed to prevent data breaches.Credit Card Payment Image Gallery

What are the benefits of accepting credit card payments?

+The benefits of accepting credit card payments include increased sales, improved customer satisfaction, and reduced costs. By accepting credit card payments, businesses can increase their customer base and boost sales, as customers are more likely to make purchases when they have a convenient and secure payment option.

How do I choose a payment processing system?

+Choosing a payment processing system requires businesses to consider several factors, including the type of business, the volume of transactions, and the level of security and compliance required. Businesses should research different payment processing systems and compare their features and pricing to find the one that best suits their needs.

What is the PCI DSS and why is it important?

+The PCI DSS is a set of security standards that businesses must follow to ensure the secure handling of credit card information. The PCI DSS is important because it helps to protect credit card information and prevent data breaches, which can result in fines and penalties, as well as damage to the business's reputation.

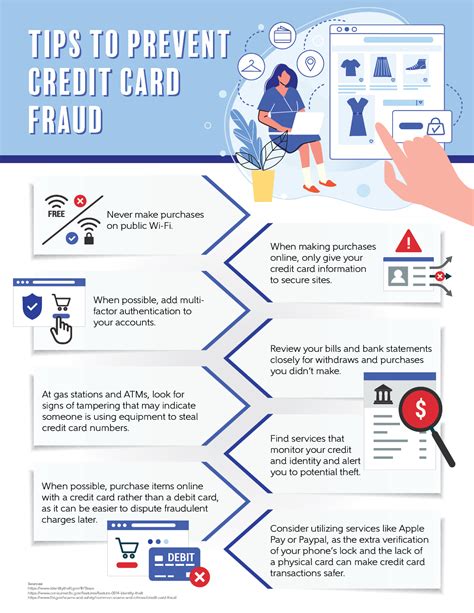

How can I reduce the risk of credit card fraud?

+Businesses can reduce the risk of credit card fraud by implementing certain security measures, such as encryption and tokenization, and by regularly testing their payment processing system to ensure it is secure and compliant with the PCI DSS. Additionally, businesses should provide clear and transparent pricing information and avoid common mistakes, such as not complying with security and compliance regulations.

What are the common mistakes to avoid when accepting credit card payments?

+The common mistakes to avoid when accepting credit card payments include not complying with security and compliance regulations, not testing the payment processing system, and not providing clear and transparent pricing information. These mistakes can result in fines and penalties, as well as damage to the business's reputation, and can lead to customer complaints and disputes.

In

Final Thoughts