Intro

Master Account And Ledger Management Basics, including journal entries, financial reporting, and account reconciliation, to streamline accounting processes and ensure accurate ledger balancing and financial statement preparation.

The importance of proper account and ledger management cannot be overstated, as it serves as the foundation for a company's financial health and stability. Effective management of accounts and ledgers enables businesses to track their financial transactions, make informed decisions, and maintain compliance with regulatory requirements. In this article, we will delve into the basics of account and ledger management, exploring the key concepts, benefits, and best practices that businesses can adopt to optimize their financial management.

Account and ledger management is a critical aspect of financial management, as it provides a clear picture of a company's financial position and performance. By maintaining accurate and up-to-date accounts and ledgers, businesses can identify areas of strength and weakness, make informed decisions about investments and resource allocation, and ensure compliance with financial regulations. Moreover, proper account and ledger management helps to prevent financial errors, reduce the risk of fraud, and improve overall financial transparency.

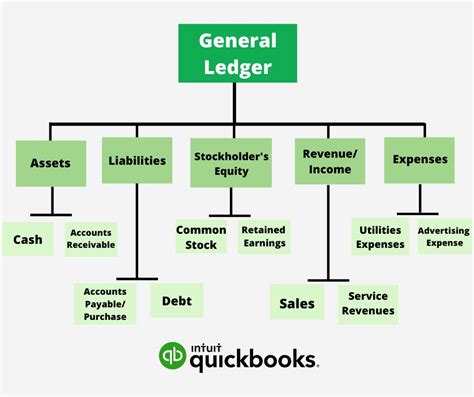

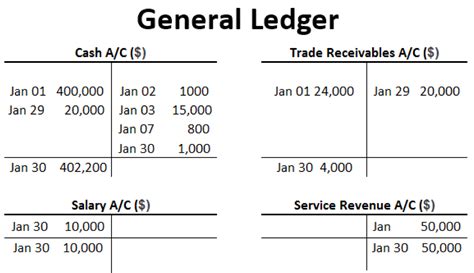

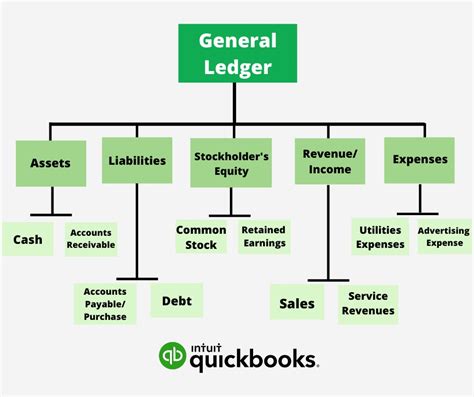

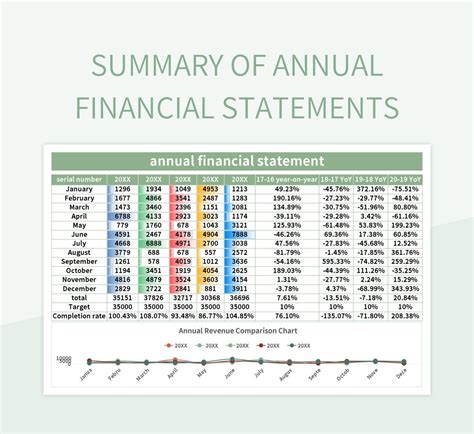

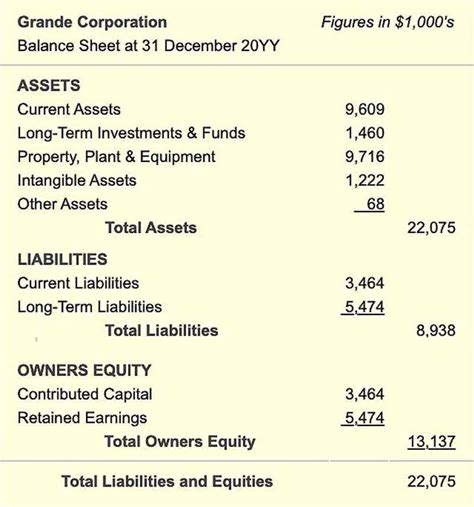

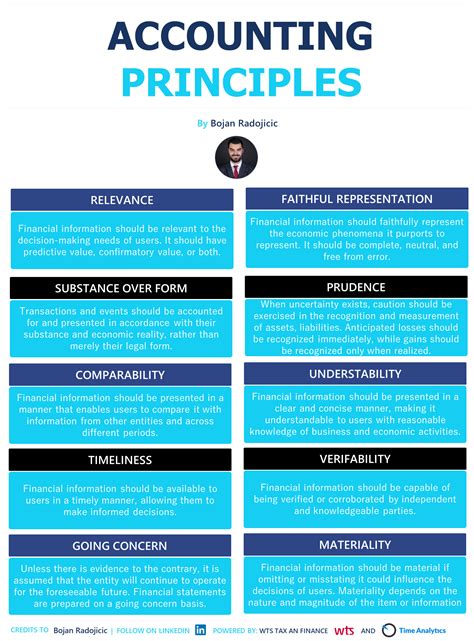

The basics of account and ledger management involve understanding the different types of accounts, ledgers, and financial statements that are used to record and report financial transactions. This includes the chart of accounts, general ledger, journals, and financial statements such as the balance sheet and income statement. By understanding these fundamental concepts, businesses can establish a robust financial management system that supports their growth and success.

Introduction to Account and Ledger Management

Account and ledger management involves the process of recording, classifying, and reporting financial transactions in a systematic and organized manner. This includes the use of various accounts, ledgers, and financial statements to track financial activities, such as revenues, expenses, assets, liabilities, and equity. The primary objective of account and ledger management is to provide accurate and timely financial information that supports business decision-making and ensures compliance with financial regulations.

Key Components of Account and Ledger Management

The key components of account and ledger management include: * Chart of accounts: A comprehensive list of all accounts used by a business to record financial transactions. * General ledger: A centralized ledger that contains all the financial accounts of a business, including assets, liabilities, equity, revenues, and expenses. * Journals: Specialized ledgers used to record specific types of financial transactions, such as sales, purchases, and cash transactions. * Financial statements: Periodic reports that provide a summary of a company's financial position and performance, including the balance sheet, income statement, and cash flow statement.Benefits of Effective Account and Ledger Management

Effective account and ledger management offers numerous benefits to businesses, including:

- Improved financial accuracy and transparency

- Enhanced decision-making capabilities

- Increased efficiency and productivity

- Better compliance with financial regulations

- Reduced risk of financial errors and fraud

- Improved cash flow management and financial planning

By implementing a robust account and ledger management system, businesses can gain a competitive edge, improve their financial performance, and achieve their strategic objectives.

Best Practices for Account and Ledger Management

To optimize account and ledger management, businesses should adopt the following best practices: * Establish a comprehensive chart of accounts that meets the company's specific needs * Maintain accurate and up-to-date financial records * Use specialized journals to record specific types of financial transactions * Prepare regular financial statements to support business decision-making * Implement internal controls to prevent financial errors and fraud * Provide ongoing training and support to accounting staffBy following these best practices, businesses can ensure that their account and ledger management system is effective, efficient, and compliant with financial regulations.

Common Challenges in Account and Ledger Management

Despite the importance of account and ledger management, many businesses face common challenges that can compromise the accuracy, efficiency, and effectiveness of their financial management system. These challenges include:

- Inadequate accounting staff training and expertise

- Insufficient internal controls and financial procedures

- Inaccurate or incomplete financial records

- Inefficient accounting software and systems

- Lack of compliance with financial regulations

By understanding these common challenges, businesses can take proactive steps to address them and optimize their account and ledger management system.

Overcoming Common Challenges in Account and Ledger Management

To overcome common challenges in account and ledger management, businesses should: * Provide ongoing training and support to accounting staff * Implement robust internal controls and financial procedures * Invest in efficient accounting software and systems * Ensure compliance with financial regulations * Regularly review and update financial records and proceduresBy taking these steps, businesses can overcome common challenges and optimize their account and ledger management system to support their growth and success.

Technological Advancements in Account and Ledger Management

The accounting profession has undergone significant technological advancements in recent years, with the development of cloud-based accounting software, artificial intelligence, and machine learning. These technological advancements have transformed the way businesses manage their financial transactions, providing greater efficiency, accuracy, and transparency.

Benefits of Technological Advancements in Account and Ledger Management

The benefits of technological advancements in account and ledger management include: * Improved financial accuracy and efficiency * Enhanced decision-making capabilities * Increased productivity and reduced labor costs * Better compliance with financial regulations * Improved cash flow management and financial planningBy leveraging technological advancements, businesses can optimize their account and ledger management system, improve their financial performance, and achieve their strategic objectives.

Future of Account and Ledger Management

The future of account and ledger management is likely to be shaped by technological advancements, changing regulatory requirements, and evolving business needs. As businesses continue to adopt cloud-based accounting software, artificial intelligence, and machine learning, the accounting profession is likely to become more automated, efficient, and transparent.

Trends Shaping the Future of Account and Ledger Management

The trends shaping the future of account and ledger management include: * Increased adoption of cloud-based accounting software * Growing use of artificial intelligence and machine learning * Evolving regulatory requirements and compliance * Changing business needs and expectations * Greater emphasis on financial transparency and accountabilityBy understanding these trends, businesses can prepare for the future of account and ledger management, optimize their financial management system, and achieve their strategic objectives.

Account and Ledger Management Image Gallery

What is account and ledger management?

+Account and ledger management involves the process of recording, classifying, and reporting financial transactions in a systematic and organized manner.

What are the benefits of effective account and ledger management?

+Effective account and ledger management offers numerous benefits, including improved financial accuracy and transparency, enhanced decision-making capabilities, and increased efficiency and productivity.

What are the common challenges in account and ledger management?

+Common challenges in account and ledger management include inadequate accounting staff training and expertise, insufficient internal controls and financial procedures, and inaccurate or incomplete financial records.

How can businesses overcome common challenges in account and ledger management?

+Businesses can overcome common challenges in account and ledger management by providing ongoing training and support to accounting staff, implementing robust internal controls and financial procedures, and investing in efficient accounting software and systems.

What is the future of account and ledger management?

+The future of account and ledger management is likely to be shaped by technological advancements, changing regulatory requirements, and evolving business needs, with a greater emphasis on financial transparency and accountability.

In conclusion, account and ledger management is a critical aspect of financial management that requires careful attention and planning. By understanding the basics of account and ledger management, adopting best practices, and leveraging technological advancements, businesses can optimize their financial management system, improve their financial performance, and achieve their strategic objectives. We encourage readers to share their thoughts and experiences on account and ledger management, and to explore the resources and tools available to support their financial management needs.