Intro

Discover General Ledger Accounting, a core financial management tool, using ledger accounts, journal entries, and trial balances for accurate financial reporting and accounting processes.

The world of accounting can be complex and overwhelming, especially for those who are new to the field. One of the most fundamental concepts in accounting is the general ledger, which serves as the foundation for a company's financial records. In this article, we will delve into the world of general ledger accounting, exploring its importance, benefits, and key components. Whether you are an accounting professional or simply looking to understand the basics of financial management, this article is designed to provide you with a comprehensive understanding of general ledger accounting.

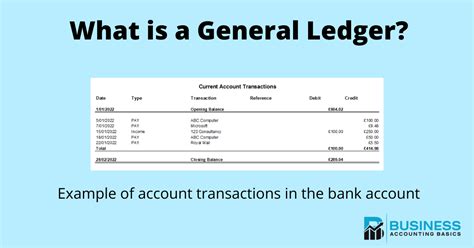

General ledger accounting is a critical aspect of financial management, as it provides a centralized system for recording and tracking all financial transactions within an organization. The general ledger is essentially a bookkeeping system that allows companies to categorize, record, and report their financial transactions in a systematic and organized manner. By using a general ledger, businesses can ensure accuracy, efficiency, and compliance with financial regulations, ultimately leading to better decision-making and improved financial performance.

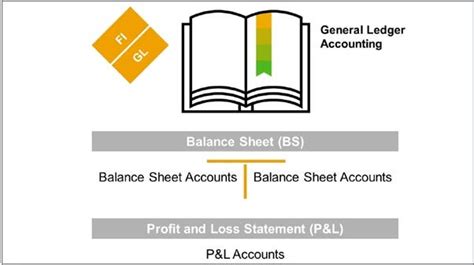

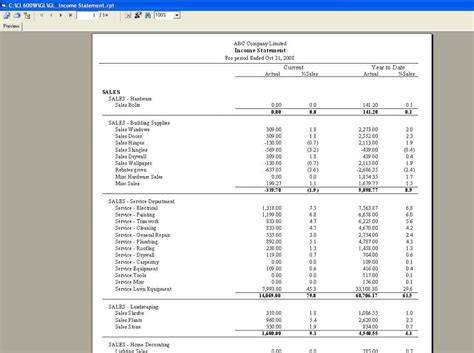

The importance of general ledger accounting cannot be overstated, as it plays a vital role in maintaining the financial health and stability of an organization. By providing a comprehensive and accurate record of all financial transactions, the general ledger enables businesses to track their income, expenses, assets, liabilities, and equity, making it easier to identify areas of improvement and make informed financial decisions. In addition, the general ledger serves as a critical tool for financial reporting, allowing companies to generate balance sheets, income statements, and other financial reports that are essential for stakeholders, investors, and regulatory bodies.

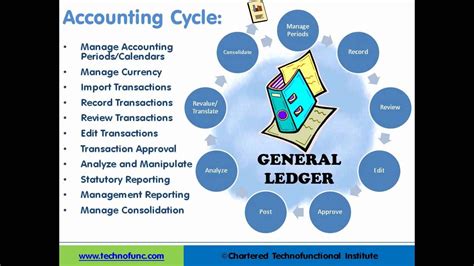

Introduction to General Ledger Accounting

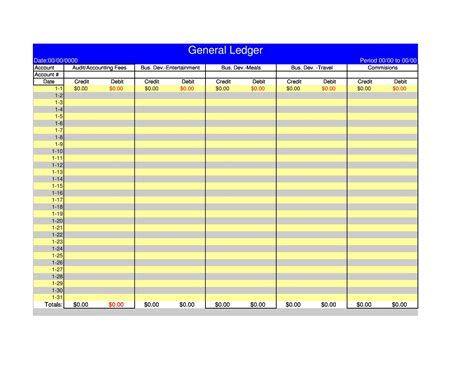

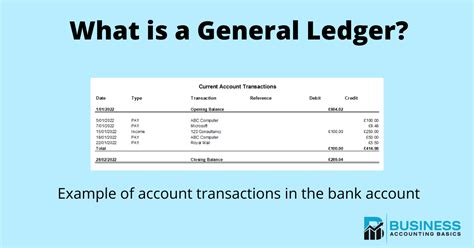

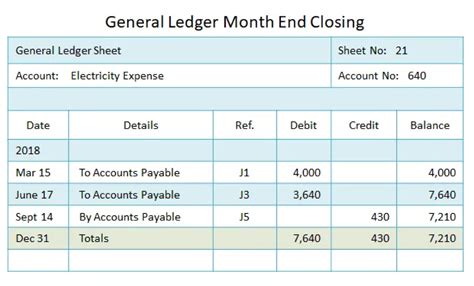

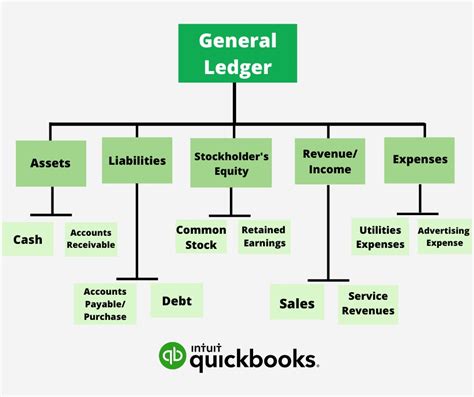

To understand general ledger accounting, it is essential to familiarize yourself with its key components. The general ledger typically consists of a chart of accounts, which is a list of all the accounts used by the company to record its financial transactions. These accounts are usually categorized into five main groups: assets, liabilities, equity, revenues, and expenses. Each account has a unique identifier, known as an account number, which is used to record and track transactions related to that specific account.

Key Components of General Ledger Accounting

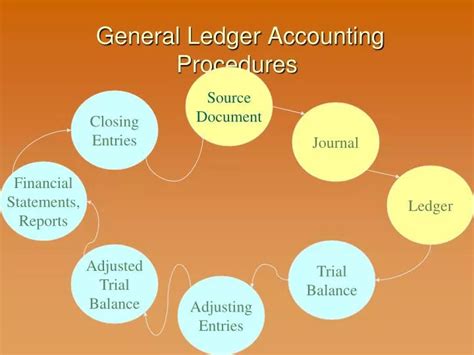

The general ledger also includes a journal, which is a record of all financial transactions, and a ledger, which is a summary of all transactions related to a specific account. The journal and ledger work together to provide a complete and accurate picture of a company's financial activities. In addition, the general ledger may include other components, such as financial statements, budgets, and forecasts, which are used to analyze and interpret the financial data.

Benefits of General Ledger Accounting

The benefits of general ledger accounting are numerous and significant. Some of the most notable advantages include: * Improved financial accuracy and efficiency * Enhanced financial reporting and analysis * Better decision-making and planning * Increased transparency and accountability * Compliance with financial regulations and standards * Reduced errors and discrepanciesHow General Ledger Accounting Works

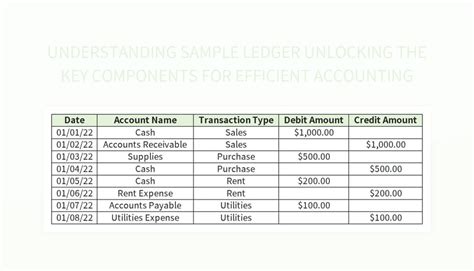

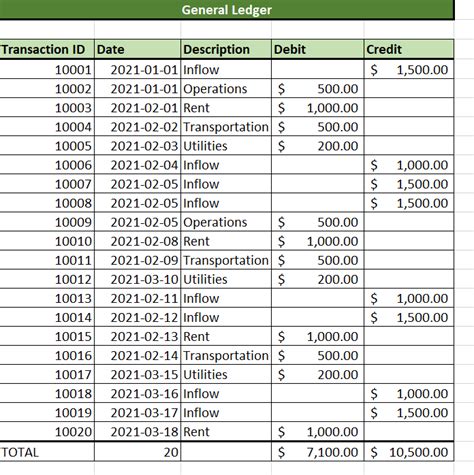

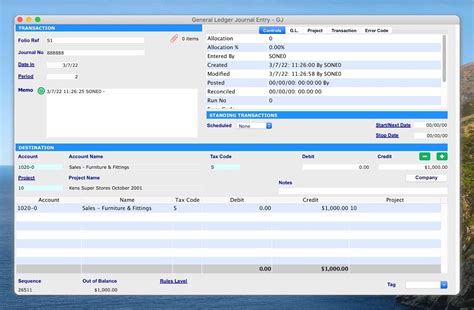

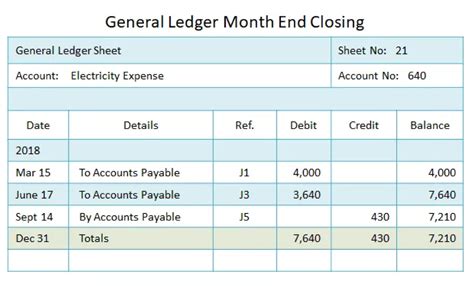

To understand how general ledger accounting works, let's consider an example. Suppose a company purchases office supplies for $1,000. The transaction would be recorded in the journal as a debit to the office supplies expense account and a credit to the cash account. The journal entry would look like this: Debit: Office Supplies Expense ($1,000) Credit: Cash ($1,000)

The transaction would then be posted to the ledger, where it would be recorded in the office supplies expense account and the cash account. The ledger would show the following: Office Supplies Expense: $1,000 Cash: -$1,000

General Ledger Accounting Best Practices

To ensure the accuracy and efficiency of general ledger accounting, it is essential to follow best practices. Some of the most important best practices include:

- Regularly reconciling accounts to ensure accuracy

- Using a standardized chart of accounts

- Implementing a robust system of internal controls

- Providing ongoing training and support for accounting staff

- Regularly reviewing and updating financial statements and reports

Common Challenges in General Ledger Accounting

Despite its importance, general ledger accounting can be challenging, especially for small businesses or organizations with limited accounting resources. Some common challenges include:

- Inaccurate or incomplete financial data

- Inefficient accounting processes

- Lack of standardization and consistency

- Insufficient training and support for accounting staff

- Difficulty in implementing and maintaining internal controls

Future of General Ledger Accounting

The future of general ledger accounting is likely to be shaped by technological advancements and changing regulatory requirements. Some of the trends that are expected to impact general ledger accounting include:

- Increased use of cloud-based accounting software

- Greater emphasis on automation and artificial intelligence

- Improved data analytics and reporting capabilities

- Enhanced security and compliance features

- Greater focus on sustainability and social responsibility

Gallery of General Ledger Accounting

General Ledger Accounting Image Gallery

Frequently Asked Questions

What is general ledger accounting?

+General ledger accounting is a system of recording and tracking financial transactions within an organization.

What are the benefits of general ledger accounting?

+The benefits of general ledger accounting include improved financial accuracy and efficiency, enhanced financial reporting and analysis, and better decision-making and planning.

What are the key components of general ledger accounting?

+The key components of general ledger accounting include a chart of accounts, journal, ledger, and financial statements.

How does general ledger accounting work?

+General ledger accounting works by recording financial transactions in a journal, posting them to a ledger, and generating financial statements.

What are the best practices for general ledger accounting?

+The best practices for general ledger accounting include regularly reconciling accounts, using a standardized chart of accounts, and implementing a robust system of internal controls.

In conclusion, general ledger accounting is a critical aspect of financial management that provides a centralized system for recording and tracking financial transactions within an organization. By understanding the importance, benefits, and key components of general ledger accounting, businesses can ensure accuracy, efficiency, and compliance with financial regulations, ultimately leading to better decision-making and improved financial performance. We hope this article has provided you with a comprehensive understanding of general ledger accounting and its significance in the world of finance. If you have any questions or comments, please feel free to share them below.