Intro

Discover the Ach Billing Definition, understanding Automated Clearing House payments, electronic funds transfer, and online transaction processing for secure and efficient billing solutions.

The Automated Clearing House (ACH) billing definition is a fundamental concept in the financial industry, particularly in the context of electronic payments and transactions. ACH billing refers to the process of transferring funds from a customer's bank account to a merchant's bank account through the Automated Clearing House network. This network is a secure, reliable, and efficient system that facilitates electronic transactions between financial institutions.

In essence, ACH billing is a type of payment processing that enables businesses to collect payments from their customers by debiting their bank accounts directly. This method is commonly used for recurring payments, such as subscription-based services, utility bills, and loan payments. ACH billing is a popular choice among businesses due to its cost-effectiveness, convenience, and high success rates compared to other payment methods.

The importance of ACH billing cannot be overstated, as it has revolutionized the way businesses collect payments from their customers. With ACH billing, companies can reduce their administrative burdens, minimize the risk of late or missed payments, and improve their cash flow management. Moreover, ACH billing provides customers with a convenient and flexible way to make payments, as they can authorize transactions online, over the phone, or through mobile devices.

As the financial industry continues to evolve, ACH billing is likely to play an increasingly significant role in the way businesses operate. With the rise of digital payments and the growing demand for convenient, secure, and efficient transaction methods, ACH billing is poised to become an essential tool for companies seeking to streamline their payment processes and improve their customer experiences.

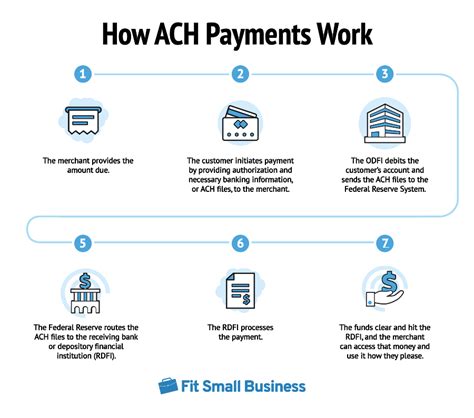

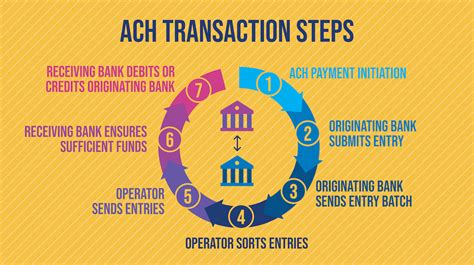

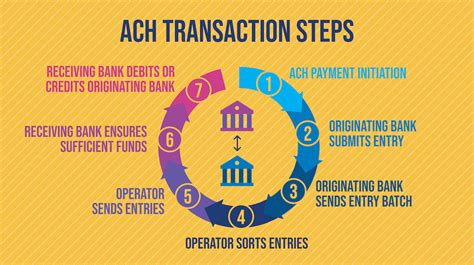

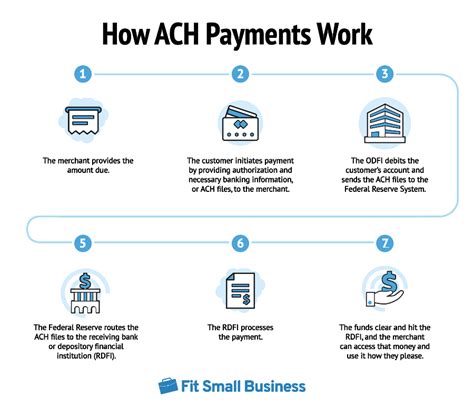

How ACH Billing Works

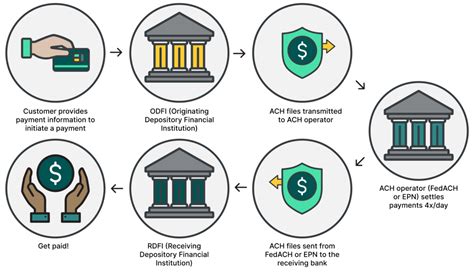

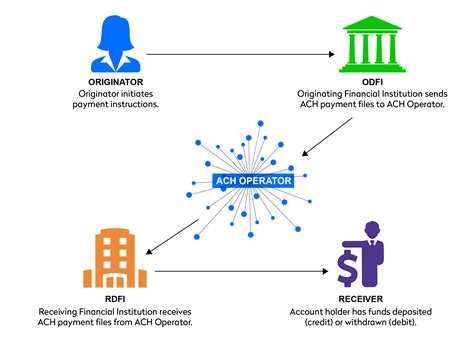

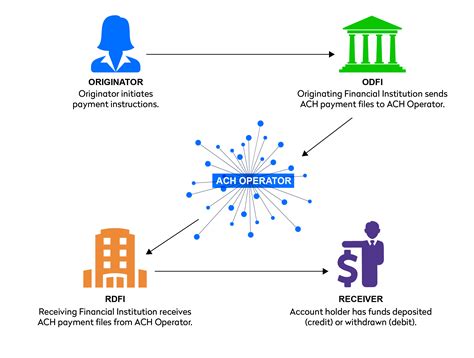

The ACH billing process involves several key steps, including authorization, transaction initiation, and settlement. To initiate an ACH transaction, a customer must provide their bank account information and authorize the merchant to debit their account. The merchant then sends the transaction request to their bank, which forwards it to the ACH network for processing.

The ACH network verifies the transaction and ensures that the customer's account has sufficient funds to cover the payment. If the transaction is approved, the ACH network debits the customer's account and credits the merchant's account. The entire process typically takes 2-3 business days, although same-day ACH transactions are becoming increasingly popular.

Benefits of ACH Billing

The benefits of ACH billing are numerous and significant. Some of the most notable advantages include:- Cost-effectiveness: ACH transactions are generally less expensive than credit card transactions, with lower processing fees and no interest charges.

- Convenience: ACH billing allows customers to make payments online, over the phone, or through mobile devices, making it a convenient option for businesses and consumers alike.

- High success rates: ACH transactions have high success rates compared to other payment methods, reducing the risk of late or missed payments.

- Improved cash flow management: ACH billing enables businesses to predict and manage their cash flow more effectively, as payments are typically made on a scheduled basis.

Types of ACH Transactions

There are two primary types of ACH transactions: direct deposit and direct payment. Direct deposit involves the transfer of funds from a business to an individual, such as payroll payments or tax refunds. Direct payment, on the other hand, involves the transfer of funds from an individual to a business, such as bill payments or loan payments.

Additionally, ACH transactions can be classified as either single-entry or recurring. Single-entry transactions are one-time payments, while recurring transactions are scheduled to occur at regular intervals, such as monthly or quarterly.

ACH Billing Security

Security is a top priority when it comes to ACH billing, as sensitive financial information is involved. To protect against unauthorized transactions and ensure the integrity of the ACH network, several security measures are in place, including:- Authentication: Merchants must verify the identity of their customers and obtain their authorization before initiating an ACH transaction.

- Encryption: ACH transactions are encrypted to prevent unauthorized access to sensitive financial information.

- Tokenization: Sensitive financial information, such as bank account numbers, is replaced with tokens or unique identifiers to prevent unauthorized access.

Best Practices for ACH Billing

To ensure the success of ACH billing, businesses should follow best practices, including:

- Clearly disclosing ACH transaction terms and conditions to customers

- Obtaining explicit authorization from customers before initiating ACH transactions

- Providing customers with convenient payment options, such as online payment portals or mobile apps

- Implementing robust security measures to protect sensitive financial information

- Monitoring ACH transactions closely to detect and prevent potential errors or fraud

By following these best practices, businesses can minimize the risk of errors, improve customer satisfaction, and maximize the benefits of ACH billing.

Common ACH Billing Errors

Despite the many benefits of ACH billing, errors can and do occur. Some common ACH billing errors include:- Insufficient funds: Customers may not have sufficient funds in their bank accounts to cover ACH transactions.

- Incorrect account information: Merchants may enter incorrect bank account information, resulting in failed transactions.

- Authorization issues: Customers may not provide explicit authorization for ACH transactions, leading to failed transactions or disputes.

To minimize the risk of these errors, businesses should implement robust quality control measures, including verifying customer account information and obtaining explicit authorization before initiating ACH transactions.

ACH Billing and Compliance

ACH billing is subject to various regulations and compliance requirements, including the Nacha Operating Rules and the Electronic Fund Transfer Act (EFTA). Businesses must comply with these regulations to avoid penalties, fines, and reputational damage.

Some key compliance requirements include:

- Obtaining explicit authorization from customers before initiating ACH transactions

- Providing customers with clear disclosures regarding ACH transaction terms and conditions

- Implementing robust security measures to protect sensitive financial information

- Monitoring ACH transactions closely to detect and prevent potential errors or fraud

By complying with these regulations, businesses can minimize the risk of errors, improve customer satisfaction, and maintain the integrity of the ACH network.

Future of ACH Billing

The future of ACH billing is promising, with emerging trends and technologies poised to transform the payment landscape. Some of these trends include:- Same-day ACH transactions: Same-day ACH transactions are becoming increasingly popular, enabling businesses to receive payments faster and improving cash flow management.

- Real-time payments: Real-time payment systems, such as the Federal Reserve's FedNow service, are being developed to enable instant payments and improve the efficiency of the payment system.

- Blockchain technology: Blockchain technology has the potential to revolutionize the payment industry, enabling secure, transparent, and efficient transactions.

As the payment landscape continues to evolve, ACH billing is likely to play an increasingly significant role in the way businesses operate. By staying ahead of emerging trends and technologies, businesses can maximize the benefits of ACH billing and improve their customer experiences.

ACH Billing Image Gallery

What is ACH billing?

+ACH billing is a type of payment processing that enables businesses to collect payments from their customers by debiting their bank accounts directly.

How does ACH billing work?

+ACH billing involves the transfer of funds from a customer's bank account to a merchant's bank account through the Automated Clearing House network.

What are the benefits of ACH billing?

+The benefits of ACH billing include cost-effectiveness, convenience, high success rates, and improved cash flow management.

Is ACH billing secure?

+Yes, ACH billing is a secure payment method that involves robust security measures, including authentication, encryption, and tokenization.

What is the future of ACH billing?

+The future of ACH billing is promising, with emerging trends and technologies poised to transform the payment landscape, including same-day ACH transactions, real-time payments, and blockchain technology.

In summary, ACH billing is a convenient, cost-effective, and secure payment method that enables businesses to collect payments from their customers by debiting their bank accounts directly. By understanding the benefits, working mechanisms, and best practices of ACH billing, businesses can maximize the benefits of this payment method and improve their customer experiences. As the payment landscape continues to evolve, ACH billing is likely to play an increasingly significant role in the way businesses operate. We invite you to share your thoughts and experiences with ACH billing in the comments section below.