Intro

Discover the meaning of ACH credit and its significance in electronic payments, transactions, and direct deposits, including ACH transfer, payment processing, and banking systems.

The world of finance is full of complex terms and concepts that can be overwhelming for individuals who are not familiar with them. One such term is "ACH credit," which is a type of electronic payment that is widely used in the United States. In this article, we will delve into the meaning of ACH credit, its benefits, and how it works.

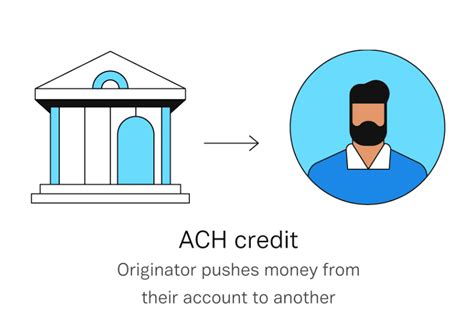

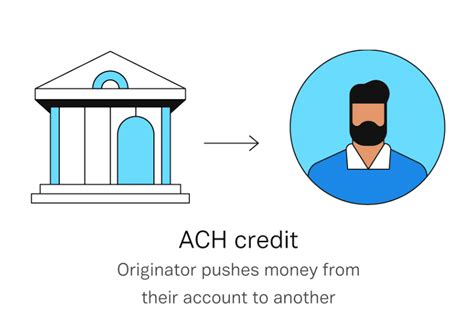

ACH stands for Automated Clearing House, which is a network that facilitates electronic payments between banks and financial institutions. An ACH credit is a type of payment that is initiated by the payer, where the funds are transferred from the payer's account to the payee's account through the ACH network. This type of payment is also known as a direct deposit or electronic funds transfer.

The ACH network is a secure and reliable way to transfer funds, and it is widely used for various types of payments, including payroll, bill payments, and tax refunds. The network is managed by the National Automated Clearing House Association (NACHA), which sets the rules and guidelines for ACH transactions.

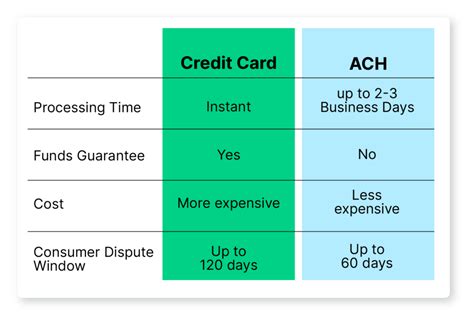

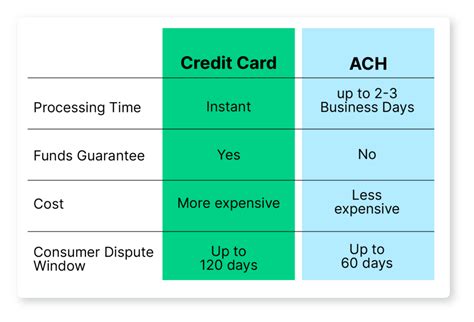

One of the benefits of ACH credit is that it is a fast and efficient way to transfer funds. Unlike traditional check payments, which can take several days to clear, ACH credits are typically processed within one to two business days. This makes it an ideal payment method for individuals and businesses that need to make timely payments.

Another benefit of ACH credit is that it is a cost-effective way to transfer funds. Unlike wire transfers, which can be expensive, ACH credits are typically low-cost or even free, depending on the financial institution. This makes it an attractive option for individuals and businesses that need to make frequent payments.

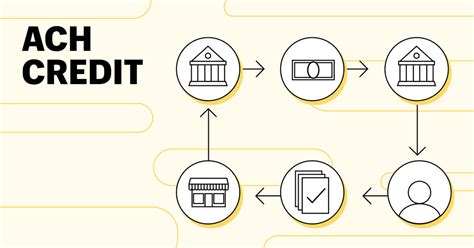

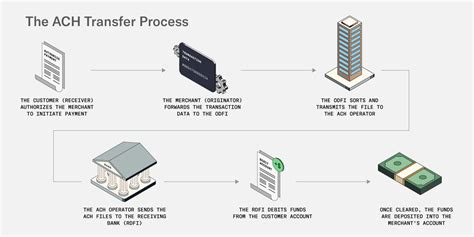

How ACH Credit Works

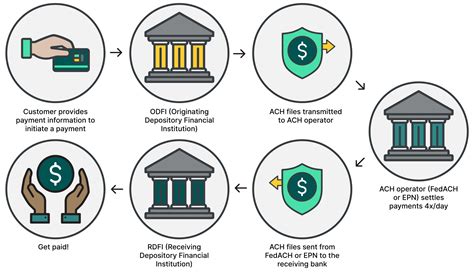

The ACH credit process involves several steps, including initiation, processing, and settlement. The payer initiates the payment by providing the payee's account information and the payment amount to their financial institution. The financial institution then sends the payment request to the ACH network, which processes the payment and transfers the funds to the payee's account.

The ACH network uses a secure and reliable system to process payments, which includes encryption and authentication protocols to prevent unauthorized transactions. The network also uses a system of batch processing, where multiple payments are processed together in a single batch, to improve efficiency and reduce costs.

Benefits of ACH Credit

There are several benefits of using ACH credit, including:

- Fast and efficient payment processing

- Low-cost or free transactions

- Secure and reliable payment processing

- Convenient and easy to use

- Environmentally friendly, as it reduces the need for paper checks

Overall, ACH credit is a convenient and efficient way to transfer funds, and it is widely used for various types of payments. Its benefits, including fast and efficient payment processing, low-cost transactions, and secure payment processing, make it an attractive option for individuals and businesses.

Types of ACH Credit Transactions

There are several types of ACH credit transactions, including:

- Direct deposit: This type of transaction involves depositing funds directly into an individual's account, such as payroll or tax refunds.

- Bill payment: This type of transaction involves paying bills, such as utility bills or credit card bills, using ACH credit.

- Business-to-business (B2B) payments: This type of transaction involves making payments between businesses, such as paying invoices or making supplier payments.

Each type of ACH credit transaction has its own benefits and uses, and they are all widely used in the United States.

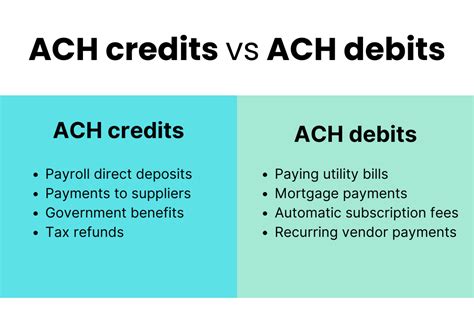

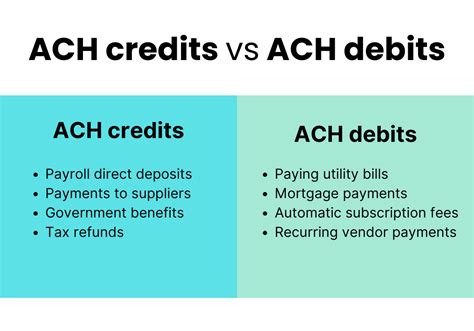

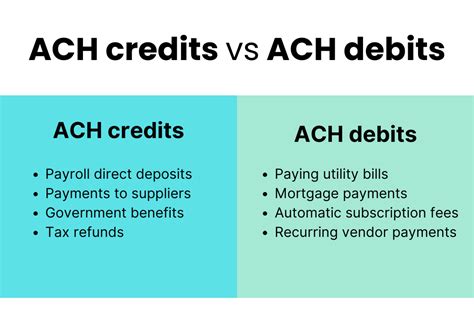

ACH Credit vs. ACH Debit

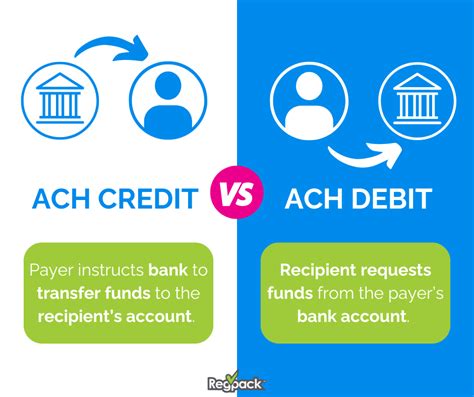

ACH credit and ACH debit are two types of ACH transactions that are often confused with each other. The main difference between the two is that ACH credit is initiated by the payer, while ACH debit is initiated by the payee.

ACH debit is a type of payment that is initiated by the payee, where the funds are withdrawn from the payer's account and deposited into the payee's account. This type of payment is often used for recurring payments, such as monthly subscriptions or utility bills.

While both ACH credit and ACH debit are secure and reliable payment methods, they have different uses and benefits. ACH credit is typically used for one-time payments, while ACH debit is used for recurring payments.

ACH Credit Security

The security of ACH credit transactions is a top priority, and the ACH network uses several measures to prevent unauthorized transactions. These measures include:

- Encryption: The ACH network uses encryption to protect payment information and prevent unauthorized access.

- Authentication: The ACH network uses authentication protocols to verify the identity of the payer and payee.

- Batch processing: The ACH network uses batch processing to improve efficiency and reduce the risk of unauthorized transactions.

Overall, ACH credit is a secure and reliable payment method that is widely used in the United States. Its security measures, including encryption and authentication protocols, make it an attractive option for individuals and businesses.

Common ACH Credit Errors

While ACH credit is a reliable payment method, errors can occur. Some common ACH credit errors include:

- Incorrect account information: If the payer provides incorrect account information, the payment may not be processed correctly.

- Insufficient funds: If the payer does not have sufficient funds in their account, the payment may be rejected.

- Payment processing errors: Errors can occur during payment processing, such as technical issues or system downtime.

To avoid these errors, it is essential to verify account information and ensure that there are sufficient funds in the account before initiating an ACH credit transaction.

ACH Credit Fees

The fees associated with ACH credit transactions vary depending on the financial institution and the type of transaction. Some common ACH credit fees include:

- Per-transaction fees: Some financial institutions charge a per-transaction fee for ACH credit transactions.

- Monthly fees: Some financial institutions charge a monthly fee for ACH credit transactions.

- Setup fees: Some financial institutions charge a setup fee for ACH credit transactions.

It is essential to understand the fees associated with ACH credit transactions before initiating a payment.

ACH Credit Limitations

While ACH credit is a convenient and efficient payment method, it has some limitations. Some common limitations include:

- Payment amount limits: There may be limits on the amount that can be transferred using ACH credit.

- Payment frequency limits: There may be limits on the frequency of ACH credit transactions.

- Eligibility requirements: Some financial institutions may have eligibility requirements for ACH credit transactions, such as minimum account balances or credit scores.

It is essential to understand these limitations before initiating an ACH credit transaction.

ACH Credit Best Practices

To get the most out of ACH credit transactions, it is essential to follow best practices, such as:

- Verifying account information: Verify account information to ensure that payments are processed correctly.

- Monitoring account activity: Monitor account activity to detect any unauthorized transactions.

- Keeping records: Keep records of ACH credit transactions, including payment amounts and dates.

By following these best practices, individuals and businesses can ensure that their ACH credit transactions are secure and efficient.

Future of ACH Credit

The future of ACH credit is promising, with advancements in technology and changes in consumer behavior driving growth and innovation. Some trends that are expected to shape the future of ACH credit include:

- Increased use of mobile payments: The use of mobile payments is expected to increase, with more consumers using their mobile devices to initiate ACH credit transactions.

- Greater use of artificial intelligence: Artificial intelligence is expected to play a greater role in ACH credit transactions, with the use of machine learning algorithms to detect and prevent unauthorized transactions.

- Improved security measures: Security measures are expected to improve, with the use of advanced encryption and authentication protocols to protect payment information.

Overall, ACH credit is a convenient and efficient payment method that is widely used in the United States. Its benefits, including fast and efficient payment processing, low-cost transactions, and secure payment processing, make it an attractive option for individuals and businesses.

ACH Credit Image Gallery

What is ACH credit?

+ACH credit is a type of electronic payment that is initiated by the payer, where the funds are transferred from the payer's account to the payee's account through the ACH network.

How does ACH credit work?

+ACH credit works by initiating a payment request from the payer to the payee, which is then processed through the ACH network and transferred to the payee's account.

What are the benefits of ACH credit?

+The benefits of ACH credit include fast and efficient payment processing, low-cost transactions, and secure payment processing.

What are the limitations of ACH credit?

+The limitations of ACH credit include payment amount limits, payment frequency limits, and eligibility requirements.

How secure is ACH credit?

+ACH credit is a secure payment method that uses encryption and authentication protocols to protect payment information and prevent unauthorized transactions.

We hope this article has provided you with a comprehensive understanding of ACH credit and its benefits. Whether you are an individual or a business, ACH credit is a convenient and efficient payment method that can help you manage your finances effectively. If you have any further questions or would like to learn more about ACH credit, please do not hesitate to comment below or share this article with others.