Intro

Discover the meaning of ACH debit, a type of electronic payment, and learn about direct deposit, bank transfers, and transaction processing in this informative guide.

The world of finance can be complex and overwhelming, especially when it comes to understanding the various payment methods and transactions that occur in our daily lives. One such term that may leave you wondering is "ACH debit." In this article, we will delve into the meaning of ACH debit, its significance, and how it affects your financial transactions.

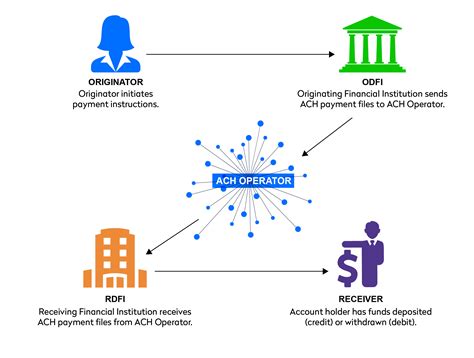

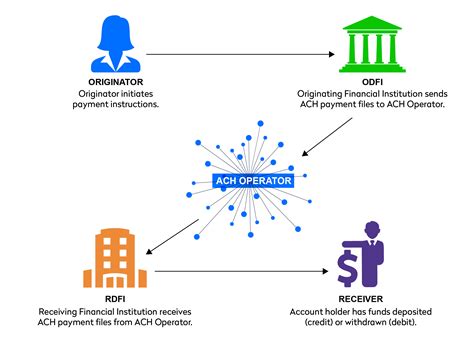

To begin with, ACH stands for Automated Clearing House, which is a network that facilitates electronic payments and transactions between banks and financial institutions. An ACH debit, specifically, refers to a type of electronic payment that is deducted directly from your checking account. This payment method is commonly used for bill payments, direct deposits, and online transactions.

The importance of understanding ACH debit cannot be overstated, as it has become an integral part of our financial landscape. With the rise of online banking and digital payments, ACH debit has become a convenient and efficient way to manage your finances. However, it is essential to be aware of the potential risks and benefits associated with this payment method.

In the following sections, we will explore the working mechanism of ACH debit, its benefits, and the steps you can take to ensure secure and successful transactions. We will also discuss the differences between ACH debit and other payment methods, such as credit card transactions and wire transfers.

What is ACH Debit?

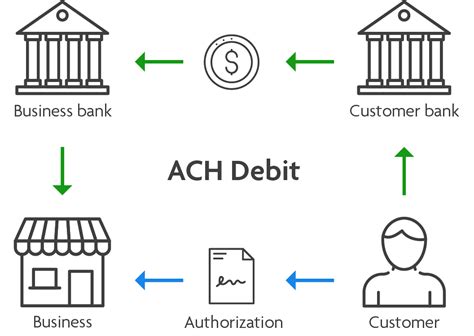

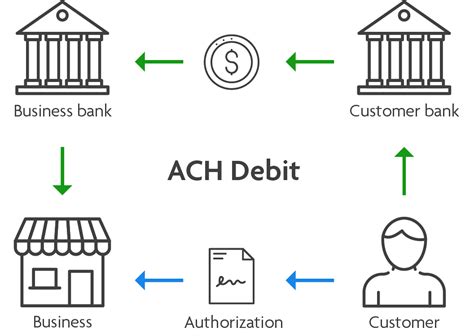

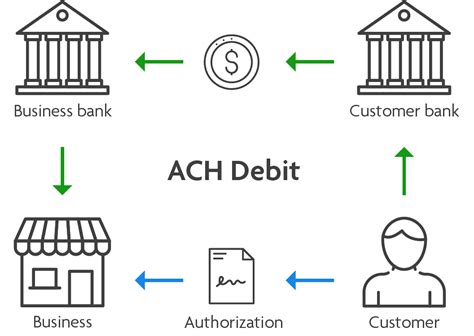

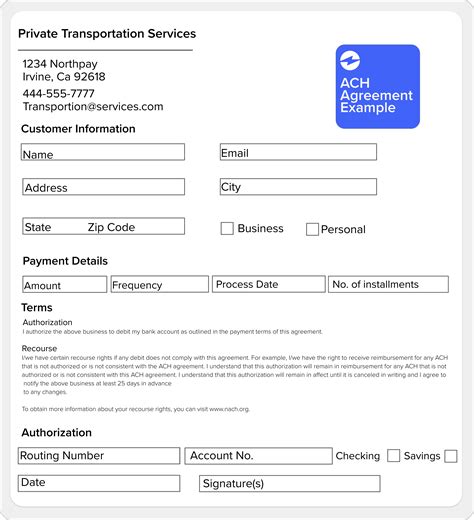

An ACH debit is a type of electronic payment that is initiated by the payee, who is the recipient of the payment. This payment method is commonly used for recurring payments, such as utility bills, mortgage payments, and insurance premiums. When you set up an ACH debit, you authorize the payee to deduct a specified amount from your checking account on a predetermined date.

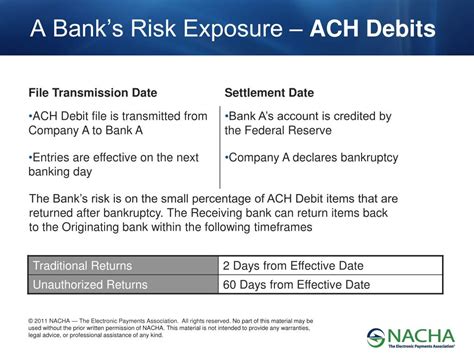

The ACH network facilitates the transaction by transmitting the payment information from the payee's bank to your bank. The payment is then deducted from your account, and the funds are transferred to the payee's account. This process typically takes 2-3 business days, although same-day ACH transactions are becoming increasingly popular.

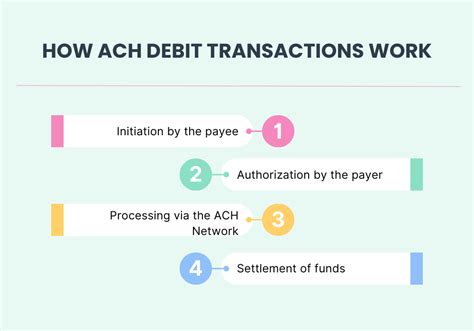

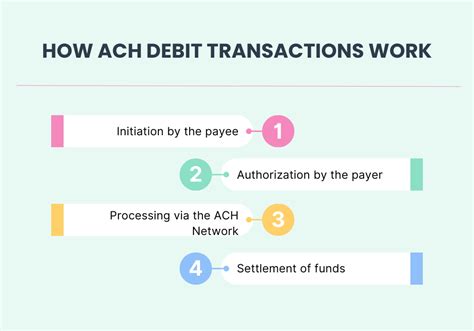

How Does ACH Debit Work?

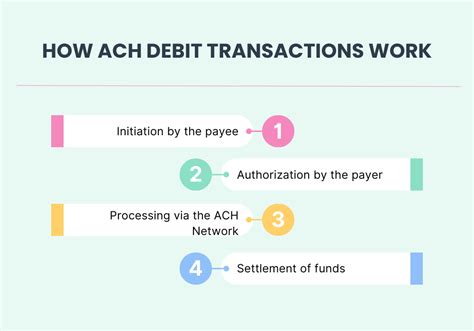

The ACH debit process involves several steps, which are outlined below:- Authorization: You authorize the payee to initiate an ACH debit from your checking account. This can be done online, over the phone, or in person.

- Payment Initiation: The payee initiates the ACH debit by sending a payment request to their bank.

- ACH Network: The payment request is transmitted to the ACH network, which routes the transaction to your bank.

- Account Verification: Your bank verifies the payment information, including the account number and routing number.

- Funds Transfer: The payment is deducted from your account, and the funds are transferred to the payee's account.

Benefits of ACH Debit

ACH debit offers several benefits, including:

- Convenience: ACH debit allows you to make payments automatically, without the need to write checks or visit a bank branch.

- Cost-Effective: ACH debit transactions are typically less expensive than credit card transactions or wire transfers.

- Fast: ACH debit transactions are processed quickly, with funds being transferred within 2-3 business days.

- Secure: ACH debit transactions are secure, as they are facilitated by the ACH network, which has robust security measures in place.

Common Uses of ACH Debit

ACH debit is commonly used for various types of transactions, including:- Bill Payments: Utility bills, mortgage payments, and insurance premiums.

- Direct Deposits: Payroll deposits, government benefits, and tax refunds.

- Online Transactions: E-commerce purchases, subscription services, and charitable donations.

Risks and Precautions

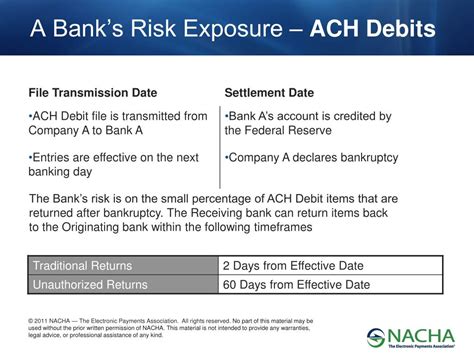

While ACH debit is a convenient and secure payment method, there are some risks and precautions to be aware of:

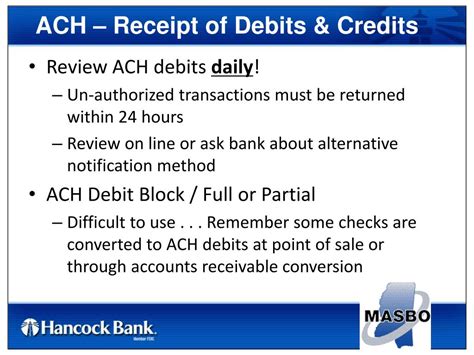

- Unauthorized Transactions: Monitor your account activity regularly to detect any unauthorized transactions.

- Insufficient Funds: Ensure that you have sufficient funds in your account to cover the payment amount.

- Payment Errors: Verify the payment information, including the account number and routing number, to avoid payment errors.

Best Practices for ACH Debit

To ensure secure and successful ACH debit transactions, follow these best practices:- Monitor Your Account: Regularly review your account activity to detect any suspicious transactions.

- Verify Payment Information: Double-check the payment information, including the account number and routing number.

- Keep Your Account Information Up-to-Date: Notify your bank of any changes to your account information, such as a new address or phone number.

ACH Debit Image Gallery

What is ACH Debit?

+ACH debit is a type of electronic payment that is deducted directly from your checking account.

How Does ACH Debit Work?

+ACH debit works by transmitting the payment information from the payee's bank to your bank, which then deducts the payment amount from your account.

What are the Benefits of ACH Debit?

+ACH debit offers several benefits, including convenience, cost-effectiveness, speed, and security.

In conclusion, ACH debit is a convenient and secure payment method that offers several benefits, including convenience, cost-effectiveness, speed, and security. By understanding the working mechanism of ACH debit and following best practices, you can ensure secure and successful transactions. We hope this article has provided you with a comprehensive understanding of ACH debit and its significance in the world of finance. If you have any further questions or comments, please do not hesitate to reach out. Share this article with your friends and family to help them understand the importance of ACH debit in their financial lives.