Intro

Discover how ACH payment works with 5 key methods, including direct deposit, online billing, and e-checks, using secure electronic funds transfer, payment processing, and transaction routing for efficient and reliable transactions.

The world of digital payments has revolutionized the way we transact, making it faster, safer, and more convenient. One such payment method that has gained popularity in recent years is the Automated Clearing House (ACH) payment. ACH payments have become a staple in the financial industry, allowing individuals and businesses to transfer funds electronically. But have you ever wondered how ACH payments work? In this article, we will delve into the world of ACH payments, exploring the benefits, working mechanisms, and steps involved in this payment method.

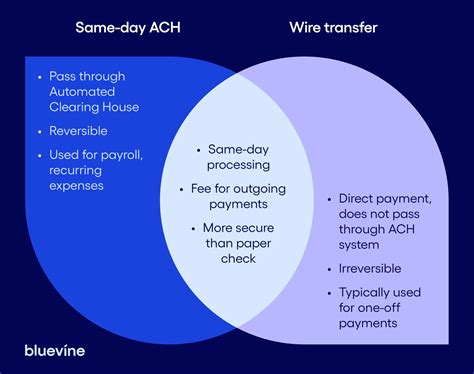

ACH payments have become an essential tool for individuals and businesses alike, offering a secure and efficient way to transfer funds. Whether it's paying bills, receiving payroll, or making online purchases, ACH payments have made it possible to conduct transactions with ease. With the rise of digital payments, ACH payments have become a preferred method, allowing users to avoid the hassle of paper checks and wire transfers. But what exactly is an ACH payment, and how does it work?

What is an ACH Payment?

Benefits of ACH Payments

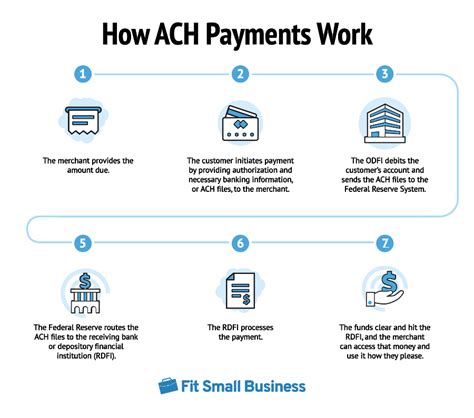

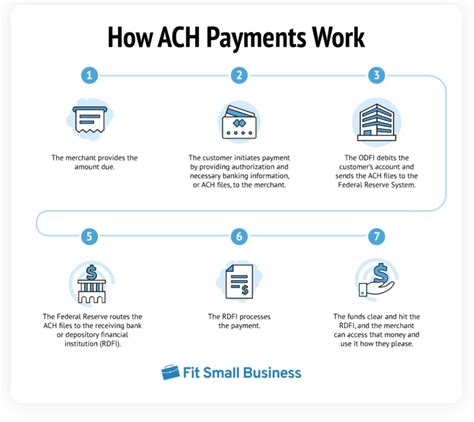

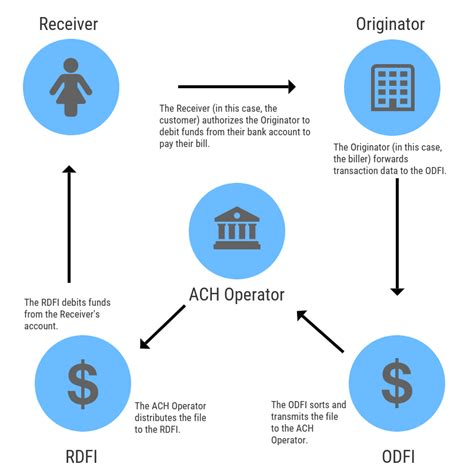

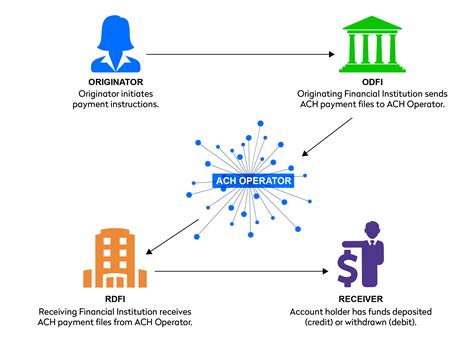

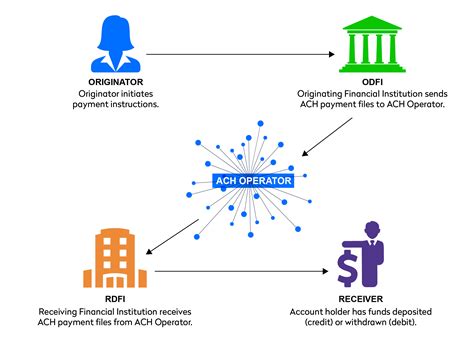

How ACH Payments Work

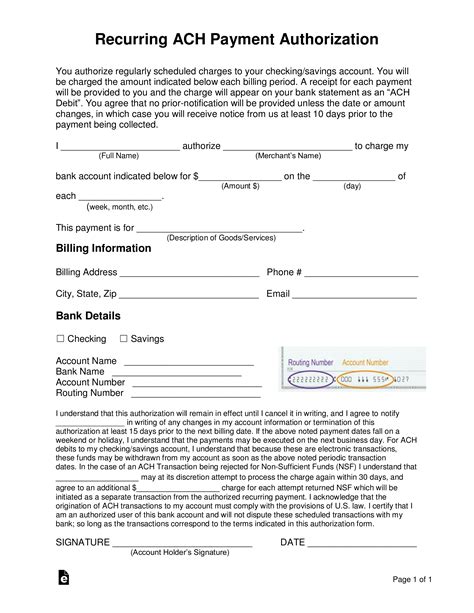

Types of ACH Payments

Security Measures

Gallery of ACH Payments

ACH Payment Image Gallery

Frequently Asked Questions

What is an ACH payment?

+An ACH payment is a type of electronic payment that allows users to transfer funds from one bank account to another.

How do ACH payments work?

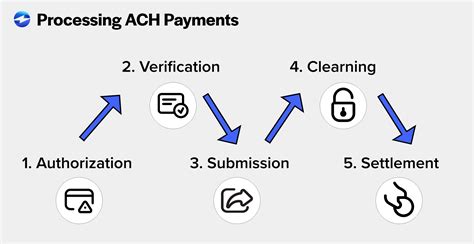

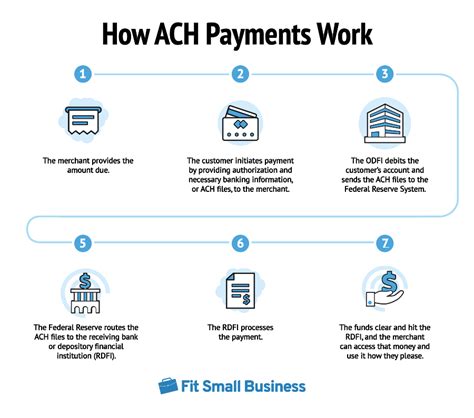

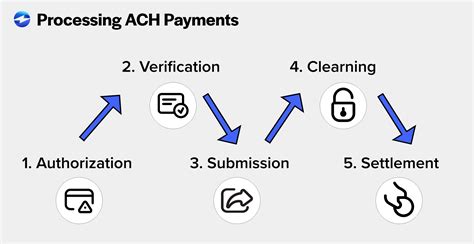

+ACH payments involve several steps, including initialization, authorization, batch processing, clearing, and settlement.

What are the benefits of ACH payments?

+ACH payments offer several benefits, including convenience, security, cost-effectiveness, and speed.

Are ACH payments secure?

+Yes, ACH payments are secure, using encryption, authentication, and verification to protect users' accounts and prevent fraud.

What are the types of ACH payments?

+There are two types of ACH payments: direct deposit and direct payment.

In conclusion, ACH payments have become an essential tool in the financial industry, offering a secure and efficient way to transfer funds. With its convenience, security, and cost-effectiveness, ACH payments have become a preferred method for individuals and businesses alike. Whether it's paying bills, receiving payroll, or making online purchases, ACH payments have made it possible to conduct transactions with ease. We hope this article has provided you with a comprehensive understanding of ACH payments and their benefits. If you have any further questions or would like to learn more about ACH payments, please don't hesitate to comment below or share this article with your friends and family.