Intro

Discover what ACH stands for and its significance in banking, finance, and online transactions, including direct deposit, payment processing, and electronic funds transfer, simplifying financial operations.

The term "ACH" stands for Automated Clearing House, which is a network used for electronic payments and money transfers in the United States. The ACH network is a batch processing system that enables financial institutions to exchange electronic payments, such as direct deposits, bill payments, and e-checks. The ACH network is operated by the Federal Reserve and the Electronic Payment Network (EPN), and it is used by thousands of financial institutions, businesses, and government agencies to process electronic payments.

The ACH network provides a secure and efficient way to transfer funds between bank accounts, and it is widely used for a variety of payment types, including payroll direct deposits, bill payments, tax refunds, and online payments. The ACH network is also used for business-to-business (B2B) payments, such as payments for goods and services, and for government payments, such as tax payments and benefits payments.

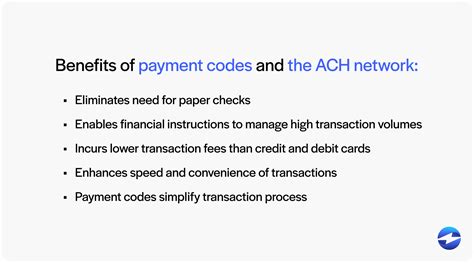

One of the key benefits of the ACH network is that it provides a cost-effective and efficient way to process electronic payments. The ACH network is also highly secure, with multiple layers of security and authentication to protect transactions and prevent fraud. Additionally, the ACH network is widely accepted, with thousands of financial institutions and businesses participating in the network.

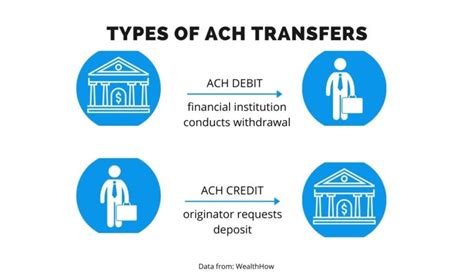

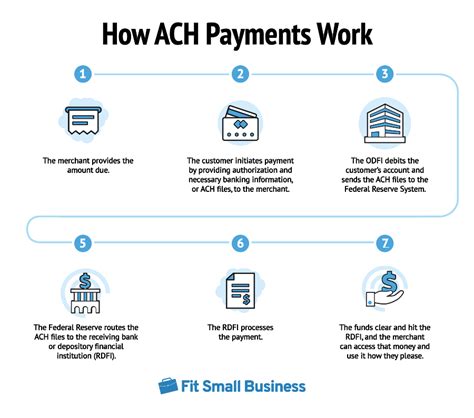

How ACH Works

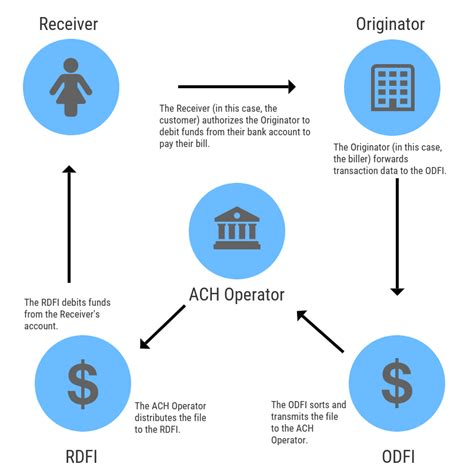

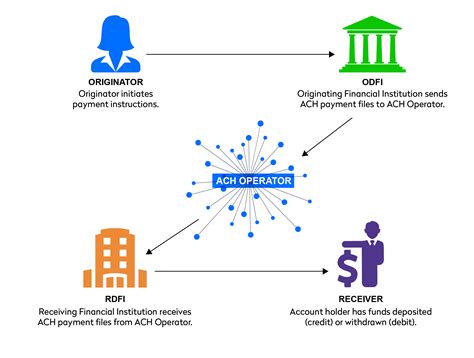

The ACH network works by allowing financial institutions to exchange electronic payment files, which contain information about the payment, such as the payment amount, the sender's account number, and the recipient's account number. The payment files are transmitted through the ACH network, which routes the payments to the recipient's financial institution. The recipient's financial institution then posts the payment to the recipient's account.

The ACH network uses a variety of payment types, including direct deposits, e-checks, and bill payments. Direct deposits are used for payroll payments, tax refunds, and other types of payments, while e-checks are used for online payments and bill payments. Bill payments are used for payments to businesses and organizations, such as utility companies and credit card companies.

Benefits of ACH

The ACH network provides a number of benefits, including: * Cost savings: The ACH network is a cost-effective way to process electronic payments, with lower fees than other payment methods. * Efficiency: The ACH network is highly efficient, with payments processed quickly and accurately. * Security: The ACH network is highly secure, with multiple layers of security and authentication to protect transactions and prevent fraud. * Wide acceptance: The ACH network is widely accepted, with thousands of financial institutions and businesses participating in the network.Types of ACH Payments

The ACH network supports a variety of payment types, including:

- Direct deposits: Used for payroll payments, tax refunds, and other types of payments.

- E-checks: Used for online payments and bill payments.

- Bill payments: Used for payments to businesses and organizations, such as utility companies and credit card companies.

- Business-to-business (B2B) payments: Used for payments between businesses, such as payments for goods and services.

- Government payments: Used for payments from government agencies, such as tax payments and benefits payments.

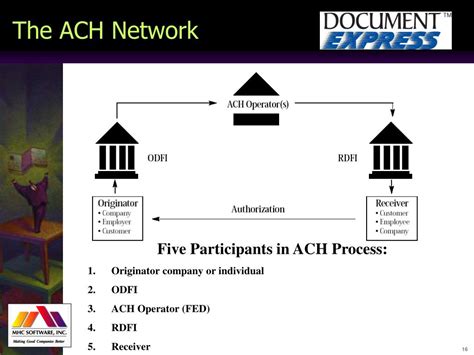

ACH Payment Processing

The ACH payment processing cycle typically involves the following steps: 1. Initiation: The payment is initiated by the sender, who provides the payment information to their financial institution. 2. Transmission: The payment information is transmitted to the ACH network, which routes the payment to the recipient's financial institution. 3. Processing: The recipient's financial institution processes the payment and posts it to the recipient's account. 4. Settlement: The payment is settled, and the funds are transferred from the sender's account to the recipient's account.ACH Security and Compliance

The ACH network has a number of security and compliance measures in place to protect transactions and prevent fraud. These measures include:

- Authentication: The ACH network uses authentication to verify the identity of the sender and the recipient.

- Encryption: The ACH network uses encryption to protect payment information and prevent unauthorized access.

- Secure transmission: The ACH network uses secure transmission protocols to protect payment information during transmission.

- Compliance: The ACH network is subject to a number of regulations and guidelines, including the Nacha Operating Rules and the Gramm-Leach-Bliley Act (GLBA).

ACH Rules and Regulations

The ACH network is subject to a number of rules and regulations, including: * Nacha Operating Rules: The Nacha Operating Rules provide the framework for the ACH network, including the rules and guidelines for payment processing and settlement. * Gramm-Leach-Bliley Act (GLBA): The GLBA provides guidelines for the protection of consumer financial information and the prevention of identity theft. * Bank Secrecy Act (BSA): The BSA provides guidelines for the detection and prevention of money laundering and other financial crimes.ACH Network Participants

The ACH network has a number of participants, including:

- Financial institutions: Banks, credit unions, and other financial institutions participate in the ACH network to process electronic payments.

- Businesses: Businesses use the ACH network to make and receive payments, including payroll payments, bill payments, and B2B payments.

- Government agencies: Government agencies use the ACH network to make and receive payments, including tax payments and benefits payments.

- Payment processors: Payment processors, such as payment gateways and payment service providers, use the ACH network to process electronic payments on behalf of their clients.

ACH Network Benefits for Businesses

The ACH network provides a number of benefits for businesses, including: * Cost savings: The ACH network is a cost-effective way to process electronic payments, with lower fees than other payment methods. * Efficiency: The ACH network is highly efficient, with payments processed quickly and accurately. * Security: The ACH network is highly secure, with multiple layers of security and authentication to protect transactions and prevent fraud. * Wide acceptance: The ACH network is widely accepted, with thousands of financial institutions and businesses participating in the network.ACH Image Gallery

What is the ACH network?

+The ACH network is a batch processing system that enables financial institutions to exchange electronic payments, such as direct deposits, bill payments, and e-checks.

How does the ACH network work?

+The ACH network works by allowing financial institutions to exchange electronic payment files, which contain information about the payment, such as the payment amount, the sender's account number, and the recipient's account number.

What are the benefits of using the ACH network?

+The ACH network provides a number of benefits, including cost savings, efficiency, security, and wide acceptance.

What types of payments can be made through the ACH network?

+The ACH network supports a variety of payment types, including direct deposits, e-checks, bill payments, B2B payments, and government payments.

How secure is the ACH network?

+The ACH network is highly secure, with multiple layers of security and authentication to protect transactions and prevent fraud.

We hope this article has provided you with a comprehensive understanding of the ACH network and its benefits. Whether you are a business owner, a financial institution, or an individual, the ACH network provides a secure and efficient way to make and receive electronic payments. If you have any further questions or would like to learn more about the ACH network, please don't hesitate to comment below or share this article with others.