Intro

Discover how ACH works with 5 key methods, exploring direct deposit, payment processing, and electronic funds transfer, to streamline transactions and optimize financial operations with automated clearing house services.

The Automated Clearing House (ACH) network has revolutionized the way individuals and businesses make and receive payments. ACH works in several ways, making it a versatile and efficient payment system. In this article, we will delve into the world of ACH and explore its various aspects, including its benefits, working mechanisms, and practical applications.

ACH has become an essential part of modern finance, enabling swift and secure transactions. Its importance cannot be overstated, as it has transformed the way we conduct financial transactions. With ACH, individuals and businesses can send and receive payments electronically, eliminating the need for paper checks and other traditional payment methods. This has resulted in increased efficiency, reduced costs, and enhanced security.

The ACH network has been continuously evolving to meet the growing demands of the financial industry. Its adaptability and flexibility have made it an attractive option for individuals and businesses alike. As technology advances, ACH is likely to play an even more significant role in shaping the future of finance. With its ability to facilitate fast and secure transactions, ACH is poised to remain a vital component of the financial landscape.

Introduction to ACH

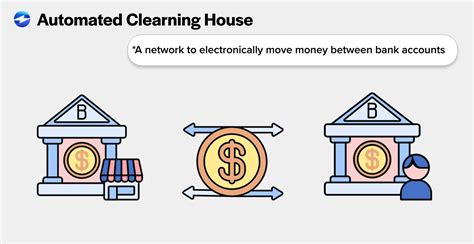

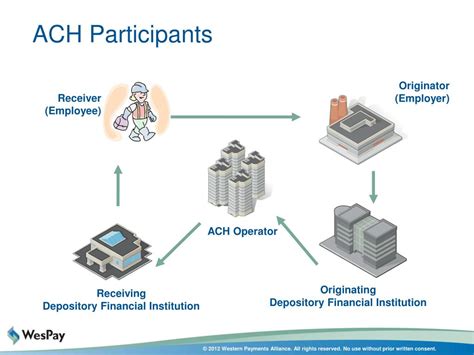

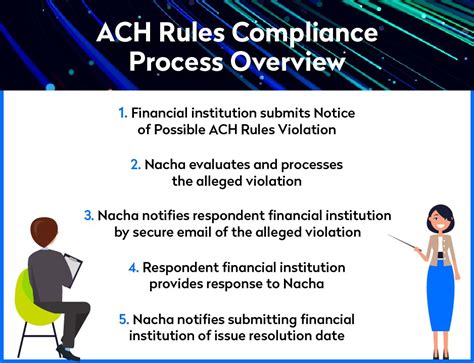

ACH, or Automated Clearing House, is a network that enables the electronic transfer of funds between banks and other financial institutions. It is a widely used payment system that facilitates various types of transactions, including direct deposit, bill payments, and e-checks. ACH is governed by the National Automated Clearing House Association (NACHA), which sets rules and guidelines for the network.

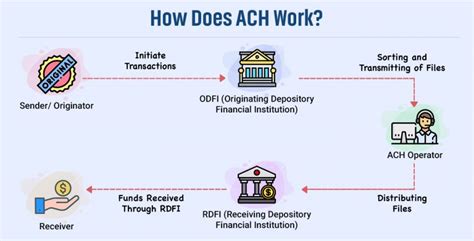

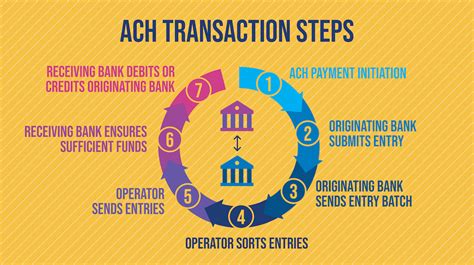

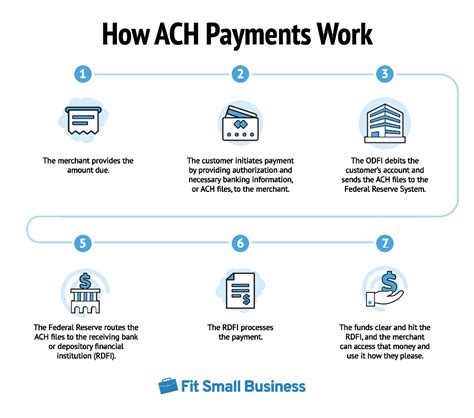

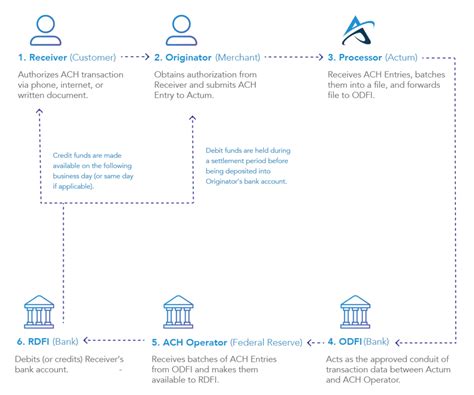

How ACH Works

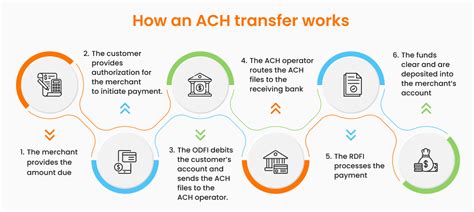

The ACH process involves several steps, including initiation, processing, and settlement. When an individual or business initiates an ACH transaction, the payment is sent to the originating depository financial institution (ODFI). The ODFI then forwards the payment to the ACH operator, which sorts and batches the transactions. The ACH operator then sends the batched transactions to the receiving depository financial institution (RDFI), which credits the recipient's account.

Benefits of ACH

ACH offers several benefits, including:

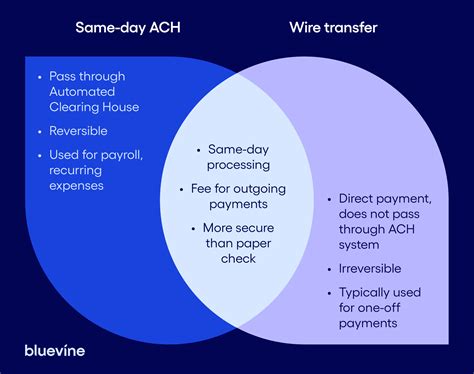

- Faster payment processing: ACH transactions are typically processed within one to two business days.

- Lower costs: ACH transactions are often less expensive than traditional payment methods, such as wire transfers or paper checks.

- Increased security: ACH transactions are encrypted and secure, reducing the risk of fraud and identity theft.

- Convenience: ACH enables individuals and businesses to make and receive payments electronically, eliminating the need for paper checks and other traditional payment methods.

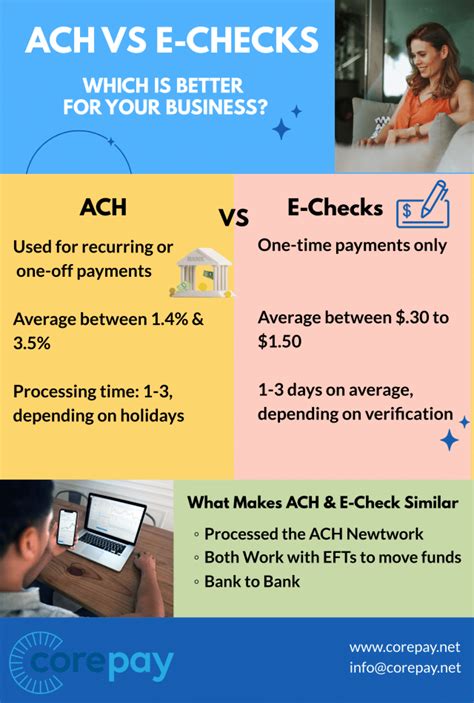

Types of ACH Transactions

There are several types of ACH transactions, including:

- Direct deposit: This type of transaction involves the electronic transfer of funds from an employer or government agency to an individual's bank account.

- Bill payments: This type of transaction involves the electronic payment of bills, such as utility bills or credit card payments.

- E-checks: This type of transaction involves the electronic transfer of funds from one bank account to another.

Security Measures

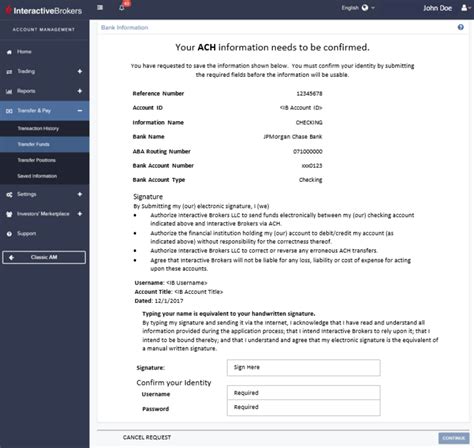

ACH has several security measures in place to protect transactions and prevent fraud. These measures include:

- Encryption: ACH transactions are encrypted to prevent unauthorized access.

- Authentication: ACH transactions require authentication to ensure that the transaction is legitimate.

- Verification: ACH transactions are verified to ensure that the transaction is accurate and complete.

Gallery of ACH Images

ACH Image Gallery

What is ACH?

+ACH, or Automated Clearing House, is a network that enables the electronic transfer of funds between banks and other financial institutions.

How does ACH work?

+ACH works by facilitating the electronic transfer of funds between banks and other financial institutions. The process involves several steps, including initiation, processing, and settlement.

What are the benefits of ACH?

+ACH offers several benefits, including faster payment processing, lower costs, increased security, and convenience.

In conclusion, ACH is a vital component of the financial industry, enabling swift and secure transactions. Its benefits, including faster payment processing, lower costs, and increased security, make it an attractive option for individuals and businesses alike. As technology advances, ACH is likely to play an even more significant role in shaping the future of finance. We invite you to share your thoughts on ACH and its applications in the comments section below. Additionally, feel free to share this article with others who may be interested in learning more about ACH and its benefits.