Intro

Boost financial management with 5 automated credit card tips, including payment scheduling, balance tracking, and reward optimization, to simplify transactions, reduce debt, and improve credit scores.

The world of credit cards can be complex and overwhelming, especially with the numerous options available in the market. However, with the right strategies and tools, managing credit cards can become more efficient and rewarding. In recent years, automation has played a significant role in simplifying various aspects of personal finance, including credit card management. Automated credit card tips can help individuals optimize their credit card usage, avoid unnecessary fees, and make the most out of their rewards programs.

Automating certain aspects of credit card management can lead to significant benefits, such as improved financial discipline, reduced debt, and increased savings. By leveraging technology and automation, individuals can streamline their credit card payments, track their expenses, and receive personalized recommendations for improving their credit scores. Moreover, automated credit card tips can help individuals stay on top of their credit card accounts, detect potential fraud, and avoid interest charges.

The importance of automated credit card management cannot be overstated, especially in today's digital age. With the rise of mobile banking and online payment platforms, individuals have more control over their financial lives than ever before. By embracing automation and leveraging the latest technologies, individuals can take their credit card management to the next level, achieving greater financial stability and peace of mind. Whether you're a seasoned credit card user or just starting to build your credit history, automated credit card tips can provide valuable insights and practical advice for optimizing your credit card experience.

Introduction to Automated Credit Card Tips

Benefits of Automated Credit Card Tips

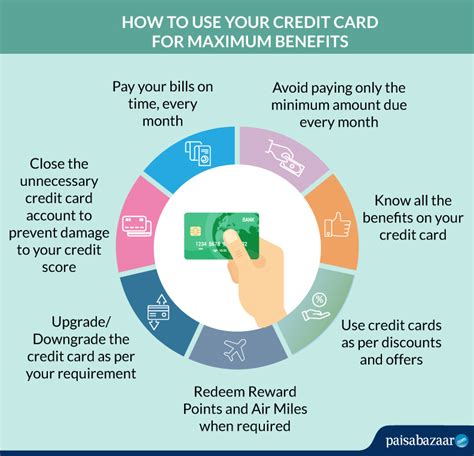

The benefits of automated credit card tips are numerous and significant. Some of the most notable advantages include: * Improved financial discipline: Automated credit card tips can help individuals develop healthy financial habits, such as paying their bills on time and avoiding unnecessary purchases. * Reduced debt: By providing personalized recommendations and expert advice, automated credit card tips can help individuals manage their debt more effectively, reducing their reliance on credit cards and minimizing their interest charges. * Increased savings: Automated credit card tips can help individuals optimize their credit card rewards programs, earning more points, miles, or cashback on their purchases and redeeming them for valuable rewards. * Enhanced credit scores: By monitoring their credit reports and providing personalized recommendations, automated credit card tips can help individuals improve their credit scores, unlocking better loan rates and more favorable credit terms.Automating Credit Card Payments

Steps to Automate Credit Card Payments

Automating credit card payments is a straightforward process that can be completed in a few simple steps: 1. Log in to your online banking platform or mobile app. 2. Navigate to the credit card section and select the "payments" or "billing" option. 3. Choose the payment method you prefer, such as a bank account or another credit card. 4. Set up the payment amount and frequency, such as the minimum payment or the full balance. 5. Confirm the payment details and authorize the automated payment.Tracking Credit Card Expenses

Tools for Tracking Credit Card Expenses

Some of the most popular tools for tracking credit card expenses include: * Budgeting apps: Apps like Mint, You Need a Budget (YNAB), and Personal Capital offer advanced budgeting features, including credit card tracking and expense categorization. * Spreadsheets: Spreadsheets like Google Sheets or Microsoft Excel can be used to track credit card transactions, create budgets, and analyze expense trends. * Online tools: Online tools like Credit Karma or Credit Sesame provide credit card tracking features, including transaction monitoring, budgeting, and credit score analysis.Optimizing Credit Card Rewards Programs

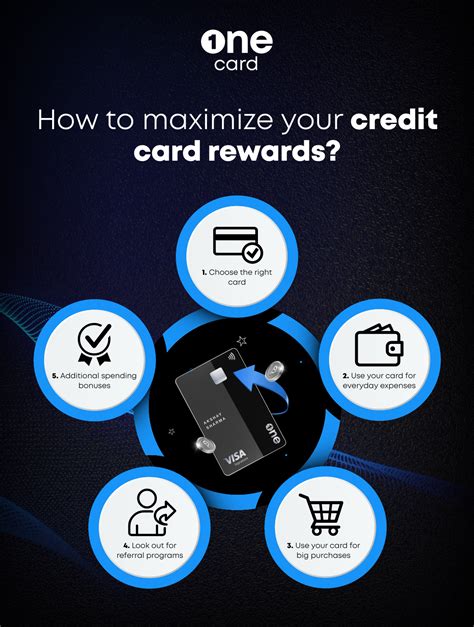

Strategies for Optimizing Credit Card Rewards Programs

Some of the most effective strategies for optimizing credit card rewards programs include: * Earning more points, miles, or cashback: Automated credit card tips can provide recommendations for earning more rewards, such as using credit cards for everyday purchases, taking advantage of sign-up bonuses, or participating in rewards programs. * Redeeming rewards for maximum value: Automated credit card tips can help individuals redeem their rewards for maximum value, such as booking travel through a credit card portal or transferring points to airline or hotel loyalty programs. * Maximizing credit card benefits: Automated credit card tips can provide recommendations for maximizing credit card benefits, such as using travel insurance, purchase protection, or concierge services.Improving Credit Scores

Strategies for Improving Credit Scores

Some of the most effective strategies for improving credit scores include: * Reducing debt: Automated credit card tips can provide recommendations for reducing debt, such as creating a debt repayment plan, consolidating credit card balances, or negotiating with creditors. * Avoiding late payments: Automated credit card tips can help individuals avoid late payments, such as setting up automatic payments, using payment reminders, or contacting credit card issuers to request payment extensions. * Maintaining a healthy credit utilization ratio: Automated credit card tips can provide recommendations for maintaining a healthy credit utilization ratio, such as keeping credit card balances low, avoiding new credit inquiries, or monitoring credit report errors.Automated Credit Card Tips Image Gallery

What are automated credit card tips?

+Automated credit card tips are personalized recommendations and expert advice for managing credit cards, optimizing rewards programs, and improving credit scores.

How can I automate my credit card payments?

+You can automate your credit card payments by setting up automatic payments through your online banking platform, mobile app, or by contacting your credit card issuer directly.

What are the benefits of automated credit card tips?

+The benefits of automated credit card tips include improved financial discipline, reduced debt, increased savings, and enhanced credit scores.

How can I optimize my credit card rewards program?

+You can optimize your credit card rewards program by earning more points, miles, or cashback, redeeming your rewards for maximum value, and maximizing your credit card benefits.

What are the best tools for tracking credit card expenses?

+The best tools for tracking credit card expenses include budgeting apps, spreadsheets, and online tools like Credit Karma or Credit Sesame.

In conclusion, automated credit card tips can provide valuable insights and practical advice for optimizing credit card management, reducing debt, and improving credit scores. By leveraging automation and technology, individuals can streamline their credit card payments, track their expenses, and maximize their rewards earnings. Whether you're a seasoned credit card user or just starting to build your credit history, automated credit card tips can help you achieve greater financial stability and peace of mind. We invite you to share your thoughts and experiences with automated credit card tips, and to explore the various resources and tools available for managing your credit cards effectively.