Intro

Master break-even analysis with 5 expert tips, calculating costs, revenue, and profit margins to optimize business financials and achieve profitability, including cash flow management and investment strategies.

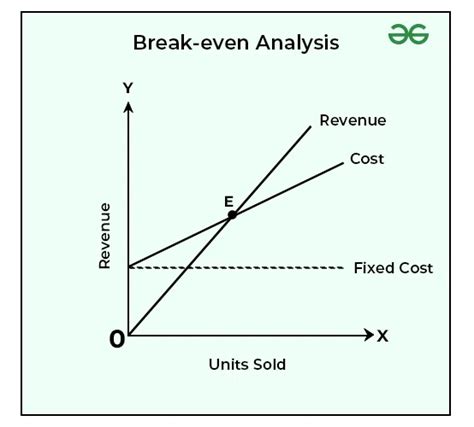

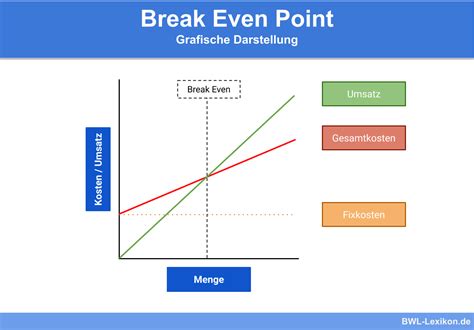

Understanding the break-even point is crucial for any business, as it signifies the moment when the company's total revenue equals its total fixed and variable costs. This analysis is essential for determining the viability of a business model, making informed pricing decisions, and forecasting future profitability. In essence, break-even analysis is a tool that helps entrepreneurs and managers understand when their business will start generating profits.

The importance of break-even analysis cannot be overstated. It provides a clear picture of the financial health of a business, helping decision-makers to identify areas for improvement and make strategic decisions. By calculating the break-even point, businesses can determine the minimum amount of sales required to cover their costs, which is vital for creating realistic sales targets and revenue projections. Moreover, break-even analysis is not limited to new businesses; established companies can also benefit from this analysis by using it to evaluate the impact of changes in costs or pricing on their profitability.

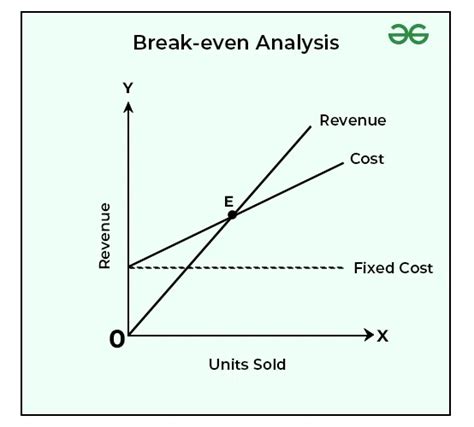

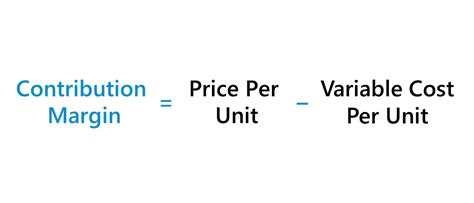

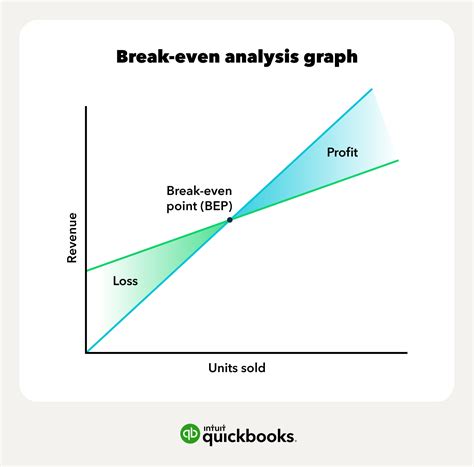

Break-even analysis is a relatively simple yet powerful tool that can be applied to various aspects of business operations. It involves calculating the break-even point, which is the point at which the business neither makes a profit nor incurs a loss. This point is calculated by dividing the total fixed costs by the contribution margin, which is the difference between the selling price and the variable costs per unit. The result is the number of units that must be sold or the amount of revenue that must be generated to break even. Understanding this concept is essential for businesses to make informed decisions about pricing, production levels, and cost management.

Understanding Break-Even Analysis

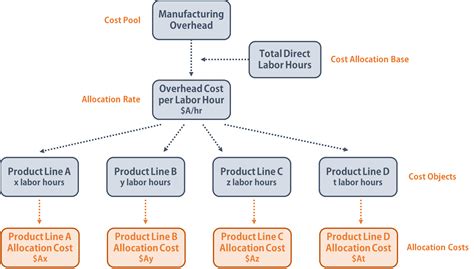

To apply break-even analysis effectively, businesses must first understand the concept of fixed and variable costs. Fixed costs are expenses that remain the same even if the business produces more or less, such as rent and salaries. Variable costs, on the other hand, are expenses that vary with the level of production, such as raw materials and labor costs. The contribution margin, which is the selling price minus the variable costs, is a critical component of break-even analysis. By understanding these elements, businesses can accurately calculate their break-even point and make informed decisions to minimize costs and maximize profitability.

Calculating the Break-Even Point

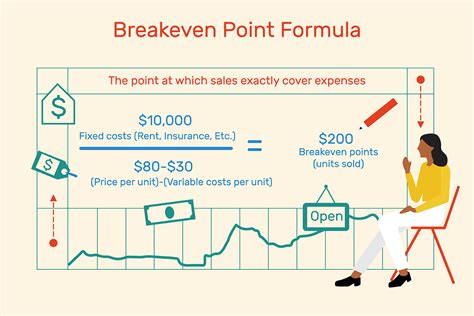

Calculating the break-even point involves a straightforward formula: Break-Even Point (BEP) = Fixed Costs / Contribution Margin. The contribution margin is calculated as Selling Price - Variable Costs. For example, if a company has fixed costs of $100,000, a selling price of $50, and variable costs of $30 per unit, the contribution margin would be $20 ($50 - $30). The break-even point in units would be $100,000 / $20 = 5,000 units. This means the company must sell at least 5,000 units to break even. Understanding this calculation is essential for businesses to set realistic sales targets and manage their costs effectively.

Applying Break-Even Analysis in Business

Break-even analysis can be applied in various aspects of business operations, including pricing strategies, cost management, and production planning. By understanding the break-even point, businesses can make informed decisions about pricing, ensuring that their prices are competitive while also covering their costs. Additionally, break-even analysis can help businesses identify areas where costs can be reduced, thereby lowering the break-even point and increasing profitability. This analysis is also crucial for production planning, as it helps businesses determine the optimal level of production to meet demand while minimizing costs.

Benefits of Break-Even Analysis

The benefits of break-even analysis are numerous. It provides businesses with a clear understanding of their cost structure and helps them make informed decisions about pricing and production. By identifying the break-even point, businesses can set realistic sales targets and develop strategies to achieve them. Break-even analysis also helps businesses to evaluate the viability of new products or services, making it an essential tool for innovation and growth. Furthermore, this analysis can be used to compare the profitability of different products or services, allowing businesses to focus on the most profitable areas of their operations.

Common Mistakes in Break-Even Analysis

Despite its importance, break-even analysis can be subject to several common mistakes. One of the most significant errors is failing to accurately distinguish between fixed and variable costs. Incorrectly categorizing costs can lead to an inaccurate break-even point, which can have serious implications for business decisions. Another mistake is not considering the impact of changes in costs or prices on the break-even point. Businesses must continuously monitor their costs and prices to ensure that their break-even analysis remains relevant and accurate. Additionally, failing to consider external factors such as market trends and competition can also lead to inaccurate break-even analysis.

Gallery of Break Even Analysis

Break Even Analysis Image Gallery

Frequently Asked Questions

What is the break-even point in business?

+The break-even point is the point at which the total revenue equals the total fixed and variable costs, indicating that the business is neither making a profit nor incurring a loss.

How is the break-even point calculated?

+The break-even point is calculated by dividing the total fixed costs by the contribution margin, which is the selling price minus the variable costs per unit.

What are the benefits of break-even analysis?

+Break-even analysis provides businesses with a clear understanding of their cost structure, helps them make informed decisions about pricing and production, and identifies areas for cost reduction, thereby increasing profitability.

Can break-even analysis be applied to different aspects of business operations?

+Yes, break-even analysis can be applied to various aspects of business operations, including pricing strategies, cost management, production planning, and evaluating the viability of new products or services.

What are some common mistakes in break-even analysis?

+Common mistakes include failing to accurately distinguish between fixed and variable costs, not considering the impact of changes in costs or prices, and failing to consider external factors such as market trends and competition.

In conclusion, break-even analysis is a vital tool for businesses, providing insights into the financial health of the company and guiding decision-making processes. By understanding the break-even point and applying break-even analysis effectively, businesses can optimize their operations, reduce costs, and increase profitability. Whether you're an entrepreneur launching a new venture or a manager seeking to improve the performance of an established company, break-even analysis is an essential technique to master. We invite you to share your thoughts on the importance of break-even analysis in the comments below and to explore how this powerful tool can help your business thrive in today's competitive market.