Intro

Discover 5 break-even analysis formulas to calculate profitability, including contribution margin, margin of safety, and cash break-even point, with related financial metrics like revenue, fixed costs, and variable expenses.

The break-even analysis is a fundamental concept in business and finance that helps entrepreneurs and managers determine the point at which their company, product, or service will become profitable. It's a crucial tool for decision-making, as it allows businesses to evaluate the viability of their operations and make informed decisions about pricing, production, and investment. In this article, we'll delve into the world of break-even analysis, exploring its importance, benefits, and the formulas used to calculate this critical threshold.

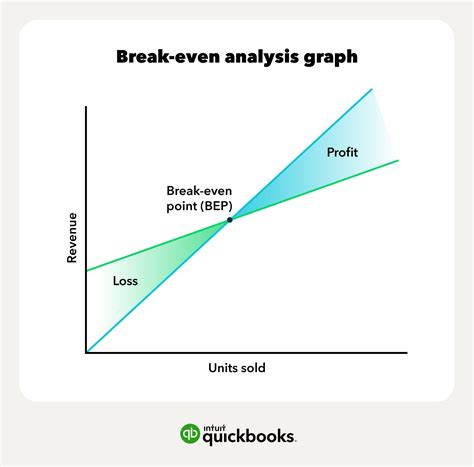

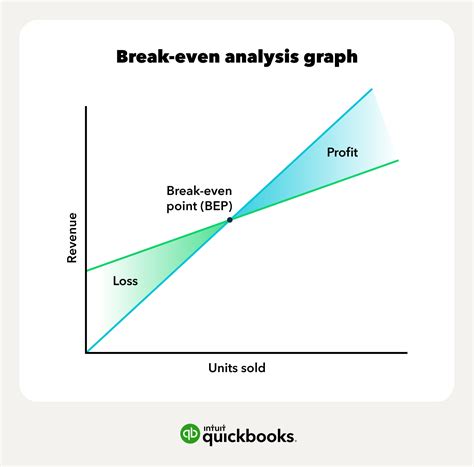

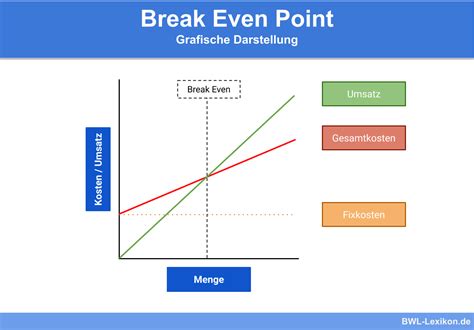

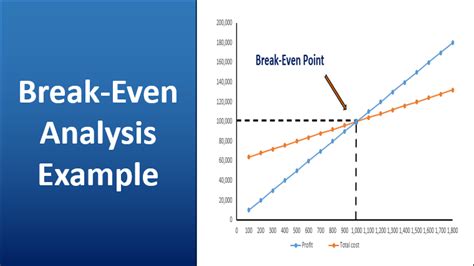

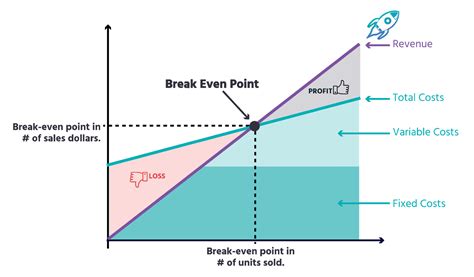

The break-even point is the point at which a company's total revenue equals its total fixed and variable costs. At this point, the company is neither making a profit nor incurring a loss. The break-even analysis is essential for businesses, as it helps them identify the sales volume required to cover their costs and start generating profits. By understanding the break-even point, companies can develop strategies to increase sales, reduce costs, and improve their overall profitability.

The break-even analysis is also useful for evaluating the feasibility of new projects or investments. By calculating the break-even point, businesses can determine whether a project is likely to generate sufficient returns to justify the investment. This analysis can also help companies identify potential risks and develop contingency plans to mitigate them. In addition, the break-even analysis can be used to evaluate the impact of changes in pricing, production costs, or market conditions on a company's profitability.

Introduction to Break Even Analysis Formulas

To calculate the break-even point, businesses use several formulas, each with its own unique characteristics and applications. The most common break-even analysis formulas include the basic break-even formula, the contribution margin formula, the margin of safety formula, the degree of operating leverage formula, and the cash break-even formula. These formulas provide valuable insights into a company's financial performance and help managers make informed decisions about their operations.

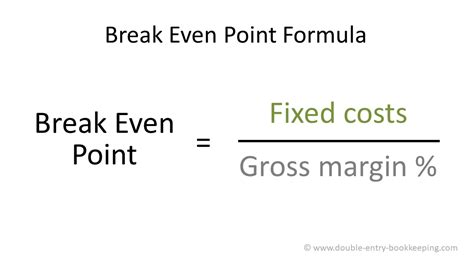

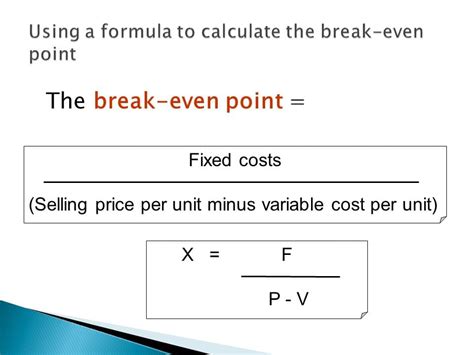

Break Even Analysis Formula 1: Basic Break-Even Formula

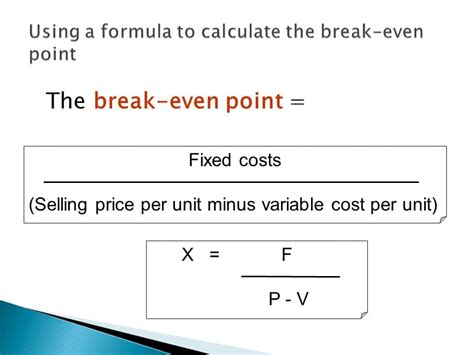

The basic break-even formula is the most widely used formula in break-even analysis. It's calculated by dividing the fixed costs by the contribution margin per unit. The contribution margin per unit is the selling price per unit minus the variable cost per unit. The formula is as follows:

Break-Even Point (BEP) = Fixed Costs / Contribution Margin per Unit

For example, let's say a company has fixed costs of $10,000, a selling price of $100 per unit, and variable costs of $60 per unit. The contribution margin per unit would be $40 ($100 - $60), and the break-even point would be 250 units ($10,000 / $40).

Benefits of the Basic Break-Even Formula

The basic break-even formula provides several benefits, including:

- Helping businesses determine the sales volume required to cover their costs and start generating profits

- Evaluating the feasibility of new projects or investments

- Identifying potential risks and developing contingency plans to mitigate them

- Evaluating the impact of changes in pricing, production costs, or market conditions on a company's profitability

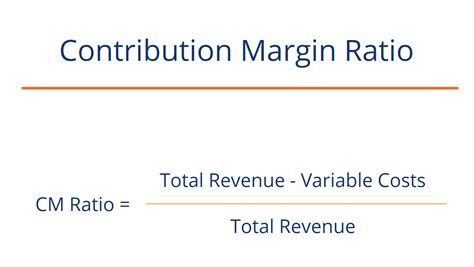

Break Even Analysis Formula 2: Contribution Margin Formula

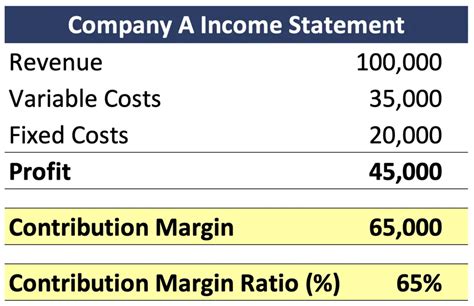

The contribution margin formula is used to calculate the contribution margin per unit, which is a critical component of the break-even analysis. The formula is as follows:

Contribution Margin per Unit = Selling Price per Unit - Variable Cost per Unit

For example, let's say a company has a selling price of $100 per unit and variable costs of $60 per unit. The contribution margin per unit would be $40 ($100 - $60).

Benefits of the Contribution Margin Formula

The contribution margin formula provides several benefits, including:

- Helping businesses determine the amount of money available to cover fixed costs and generate profits

- Evaluating the profitability of different products or services

- Identifying areas for cost reduction and improvement

- Developing pricing strategies to maximize profitability

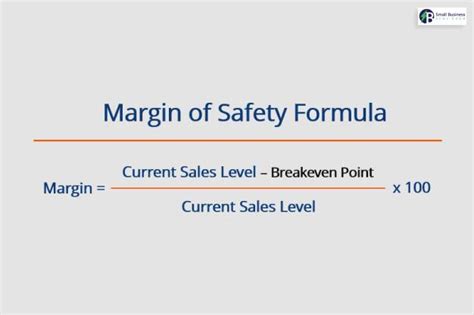

Break Even Analysis Formula 3: Margin of Safety Formula

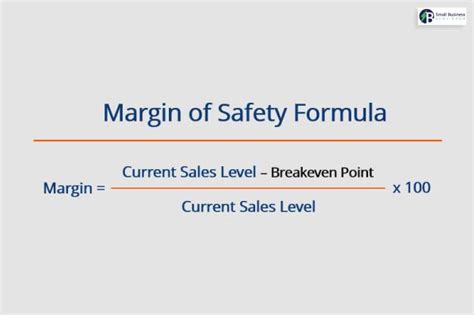

The margin of safety formula is used to calculate the amount of sales revenue that a company can lose before it reaches the break-even point. The formula is as follows:

Margin of Safety = (Total Sales - Break-Even Sales) / Total Sales

For example, let's say a company has total sales of $100,000 and break-even sales of $80,000. The margin of safety would be 20% (($100,000 - $80,000) / $100,000).

Benefits of the Margin of Safety Formula

The margin of safety formula provides several benefits, including:

- Helping businesses evaluate the risk of not meeting their sales targets

- Identifying areas for cost reduction and improvement

- Developing strategies to increase sales and reduce costs

- Evaluating the impact of changes in market conditions on a company's profitability

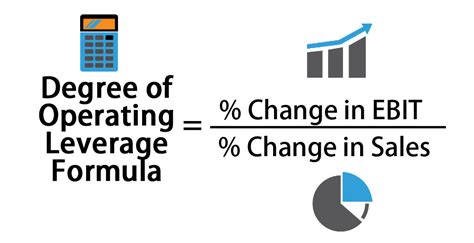

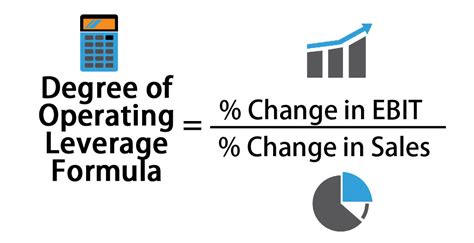

Break Even Analysis Formula 4: Degree of Operating Leverage Formula

The degree of operating leverage formula is used to calculate the percentage change in earnings before interest and taxes (EBIT) resulting from a percentage change in sales. The formula is as follows:

Degree of Operating Leverage = (Contribution Margin / EBIT)

For example, let's say a company has a contribution margin of $40,000 and EBIT of $20,000. The degree of operating leverage would be 2 ($40,000 / $20,000).

Benefits of the Degree of Operating Leverage Formula

The degree of operating leverage formula provides several benefits, including:

- Helping businesses evaluate the impact of changes in sales on their profitability

- Identifying areas for cost reduction and improvement

- Developing strategies to increase sales and reduce costs

- Evaluating the risk of not meeting their sales targets

Break Even Analysis Formula 5: Cash Break-Even Formula

The cash break-even formula is used to calculate the point at which a company's cash inflows equal its cash outflows. The formula is as follows:

Cash Break-Even Point = (Initial Investment / Cash Flow per Unit)

For example, let's say a company has an initial investment of $10,000 and cash flow per unit of $50. The cash break-even point would be 200 units ($10,000 / $50).

Benefits of the Cash Break-Even Formula

The cash break-even formula provides several benefits, including:

- Helping businesses evaluate the cash flow requirements of their operations

- Identifying areas for cost reduction and improvement

- Developing strategies to increase cash flow and reduce costs

- Evaluating the risk of not meeting their cash flow targets

Break Even Analysis Image Gallery

What is the break-even point?

+The break-even point is the point at which a company's total revenue equals its total fixed and variable costs.

Why is the break-even analysis important?

+The break-even analysis is important because it helps businesses evaluate the viability of their operations and make informed decisions about pricing, production, and investment.

What are the different types of break-even analysis formulas?

+The different types of break-even analysis formulas include the basic break-even formula, the contribution margin formula, the margin of safety formula, the degree of operating leverage formula, and the cash break-even formula.

How do I calculate the break-even point using the basic break-even formula?

+To calculate the break-even point using the basic break-even formula, you need to divide the fixed costs by the contribution margin per unit.

What is the contribution margin formula?

+The contribution margin formula is used to calculate the contribution margin per unit, which is the selling price per unit minus the variable cost per unit.

In conclusion, the break-even analysis is a powerful tool for businesses to evaluate their financial performance and make informed decisions about their operations. By understanding the different types of break-even analysis formulas and how to apply them, businesses can gain valuable insights into their profitability and develop strategies to increase sales, reduce costs, and improve their overall financial performance. We hope this article has provided you with a comprehensive understanding of the break-even analysis and its applications. If you have any further questions or would like to share your experiences with break-even analysis, please don't hesitate to comment below. Additionally, if you found this article helpful, please share it with your friends and colleagues who may benefit from this information.