Intro

Discover the Break Even Formula Explained, a crucial business calculation for profitability, involving fixed costs, variable costs, and revenue to determine break-even points and margins, optimizing financial management and decision-making strategies.

The break-even formula is a fundamental concept in business and finance that helps entrepreneurs and managers determine the point at which their company, product, or service becomes profitable. Understanding the break-even formula is crucial for making informed decisions about pricing, production, and investment. In this article, we will delve into the world of break-even analysis, exploring its importance, components, and applications.

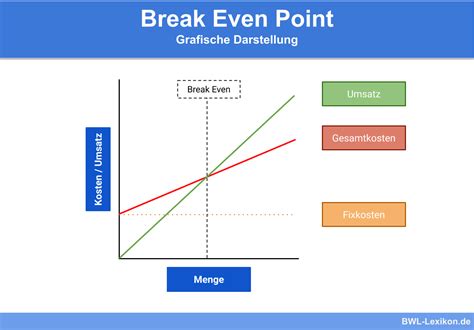

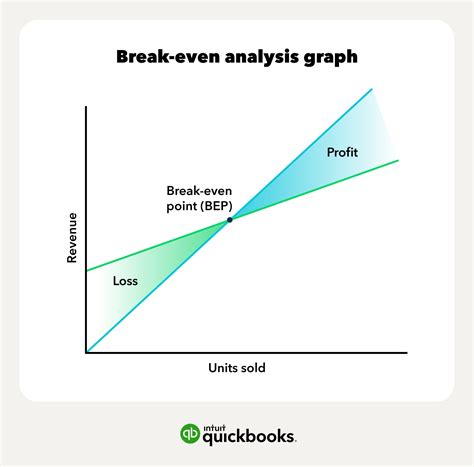

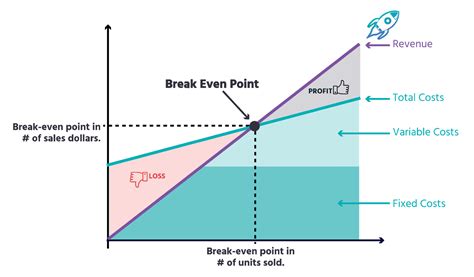

The break-even formula is a simple yet powerful tool that calculates the point at which total revenue equals total fixed and variable costs. It is a critical metric for businesses, as it helps them identify the minimum sales required to cover their expenses and generate a profit. The break-even formula is widely used in various industries, from manufacturing and retail to service-based businesses and non-profit organizations. Its importance cannot be overstated, as it provides a clear picture of a company's financial health and helps managers make strategic decisions.

The break-even formula is based on several key components, including fixed costs, variable costs, and revenue. Fixed costs are expenses that remain the same even if the company produces more or less, such as rent, salaries, and insurance. Variable costs, on the other hand, are expenses that change with the level of production, such as raw materials, labor, and marketing. Revenue is the total income generated by the sale of goods or services. By understanding these components and how they interact, businesses can use the break-even formula to make informed decisions about pricing, production, and investment.

Break-Even Analysis

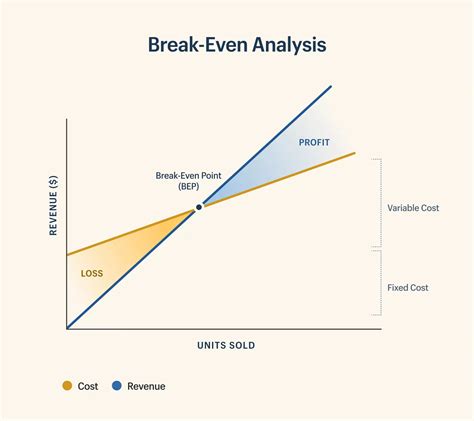

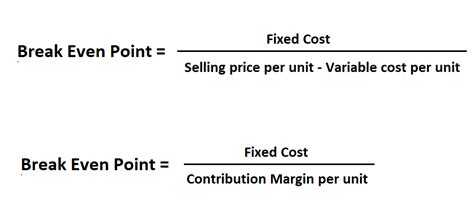

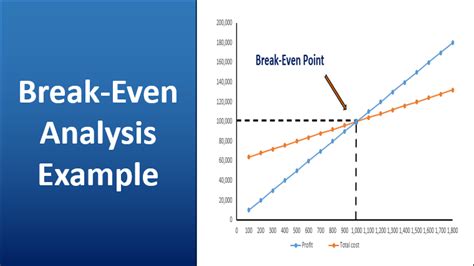

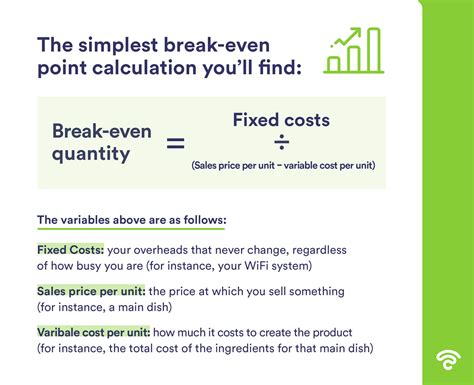

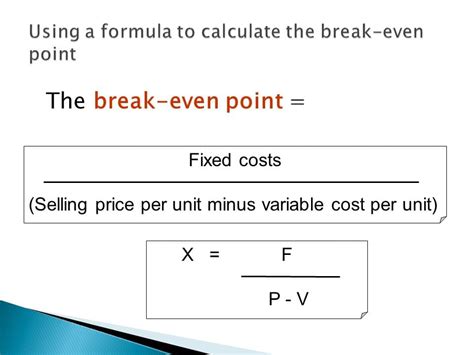

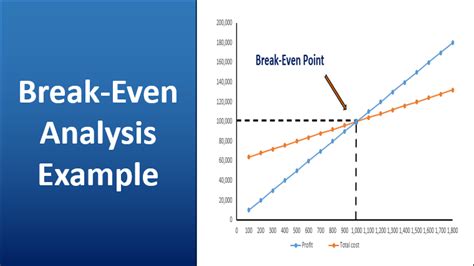

Break-even analysis is a comprehensive approach to understanding the break-even formula and its applications. It involves calculating the break-even point, which is the point at which total revenue equals total fixed and variable costs. The break-even point can be calculated using the following formula: Break-Even Point = Fixed Costs / (Selling Price - Variable Costs). This formula provides a clear picture of the minimum sales required to cover expenses and generate a profit.

Components of Break-Even Analysis

The components of break-even analysis include fixed costs, variable costs, and revenue. Fixed costs are expenses that remain the same even if the company produces more or less. Variable costs, on the other hand, are expenses that change with the level of production. Revenue is the total income generated by the sale of goods or services. Understanding these components is crucial for calculating the break-even point and making informed decisions about pricing, production, and investment.Calculating the Break-Even Point

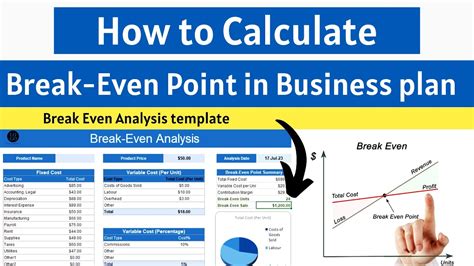

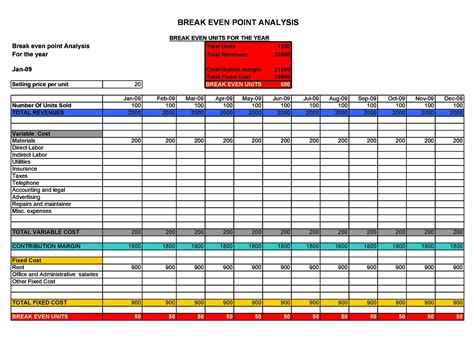

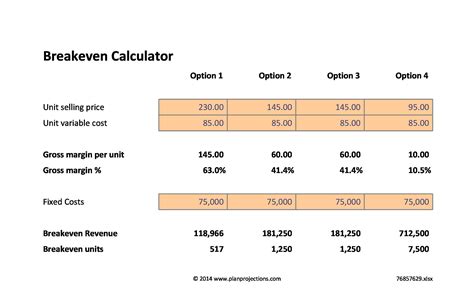

Calculating the break-even point involves using the break-even formula: Break-Even Point = Fixed Costs / (Selling Price - Variable Costs). This formula provides a clear picture of the minimum sales required to cover expenses and generate a profit. To calculate the break-even point, businesses need to determine their fixed costs, variable costs, and selling price. Fixed costs are expenses that remain the same even if the company produces more or less. Variable costs are expenses that change with the level of production. The selling price is the price at which goods or services are sold.

Example of Calculating the Break-Even Point

For example, let's say a company has fixed costs of $10,000, variable costs of $5 per unit, and a selling price of $10 per unit. To calculate the break-even point, we can use the break-even formula: Break-Even Point = Fixed Costs / (Selling Price - Variable Costs). Plugging in the numbers, we get: Break-Even Point = $10,000 / ($10 - $5) = $10,000 / $5 = 2,000 units. This means that the company needs to sell at least 2,000 units to cover its expenses and generate a profit.Applications of Break-Even Analysis

Break-even analysis has numerous applications in business and finance. It helps entrepreneurs and managers make informed decisions about pricing, production, and investment. By calculating the break-even point, businesses can determine the minimum sales required to cover expenses and generate a profit. This information can be used to adjust pricing, production levels, and marketing strategies to achieve profitability.

Benefits of Break-Even Analysis

The benefits of break-even analysis include: * Helping businesses determine the minimum sales required to cover expenses and generate a profit * Providing a clear picture of a company's financial health * Informing decisions about pricing, production, and investment * Helping businesses adjust to changes in the market or industry * Providing a benchmark for evaluating performance and making adjustmentsLimitations of Break-Even Analysis

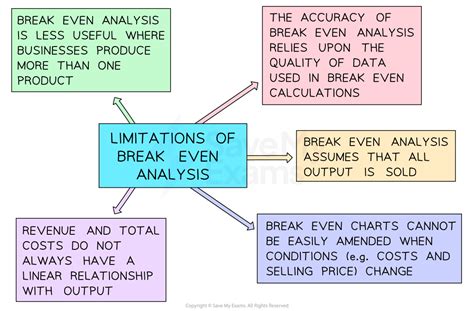

While break-even analysis is a powerful tool, it has several limitations. It assumes that fixed and variable costs remain constant, which may not always be the case. It also assumes that the selling price remains constant, which may not be realistic in a competitive market. Additionally, break-even analysis does not take into account other factors that may affect profitability, such as changes in the market or industry.

Overcoming the Limitations of Break-Even Analysis

To overcome the limitations of break-even analysis, businesses can use other tools and techniques, such as sensitivity analysis and scenario planning. Sensitivity analysis involves analyzing how changes in assumptions affect the break-even point. Scenario planning involves creating different scenarios to anticipate and prepare for potential changes in the market or industry.Conclusion and Future Directions

In conclusion, break-even analysis is a powerful tool for businesses and entrepreneurs. It provides a clear picture of a company's financial health and helps managers make informed decisions about pricing, production, and investment. While it has several limitations, these can be overcome by using other tools and techniques. As businesses continue to evolve and adapt to changes in the market and industry, break-even analysis will remain an essential tool for achieving profitability and success.

Final Thoughts

In final thoughts, break-even analysis is a fundamental concept in business and finance that helps entrepreneurs and managers determine the point at which their company, product, or service becomes profitable. By understanding the break-even formula and its applications, businesses can make informed decisions about pricing, production, and investment. As the business landscape continues to evolve, break-even analysis will remain a critical tool for achieving profitability and success.Break-Even Analysis Image Gallery

What is the break-even formula?

+The break-even formula is a calculation used to determine the point at which a company's total revenue equals its total fixed and variable costs.

How do I calculate the break-even point?

+To calculate the break-even point, you need to determine your fixed costs, variable costs, and selling price. Then, use the break-even formula: Break-Even Point = Fixed Costs / (Selling Price - Variable Costs).

What are the benefits of break-even analysis?

+The benefits of break-even analysis include helping businesses determine the minimum sales required to cover expenses and generate a profit, providing a clear picture of a company's financial health, and informing decisions about pricing, production, and investment.

What are the limitations of break-even analysis?

+The limitations of break-even analysis include assuming that fixed and variable costs remain constant, assuming that the selling price remains constant, and not taking into account other factors that may affect profitability.

How can I overcome the limitations of break-even analysis?

+To overcome the limitations of break-even analysis, you can use other tools and techniques, such as sensitivity analysis and scenario planning. These tools can help you analyze how changes in assumptions affect the break-even point and prepare for potential changes in the market or industry.

We hope this article has provided you with a comprehensive understanding of the break-even formula and its applications. Whether you're an entrepreneur, manager, or student, break-even analysis is a critical tool for achieving profitability and success. We encourage you to share your thoughts and experiences with break-even analysis in the comments below. If you have any questions or need further clarification, please don't hesitate to ask. Thank you for reading, and we look forward to hearing from you!