Intro

Calculate profitability with the Break Even Sales Formula, a crucial tool for businesses to determine revenue, fixed costs, and variable expenses, ensuring a balanced financial strategy and informed decision-making.

The break-even sales formula is a crucial tool for businesses to determine the point at which their total revenue equals their total fixed and variable costs. Understanding this concept is essential for entrepreneurs, managers, and executives to make informed decisions about pricing, production, and investment. In this article, we will delve into the importance of the break-even sales formula, its components, and how to calculate it.

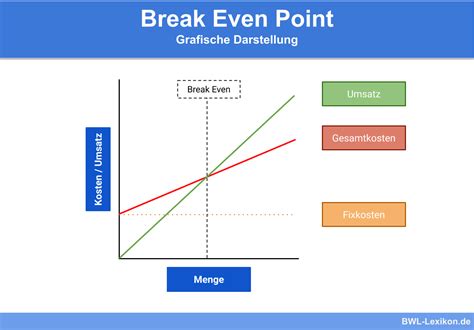

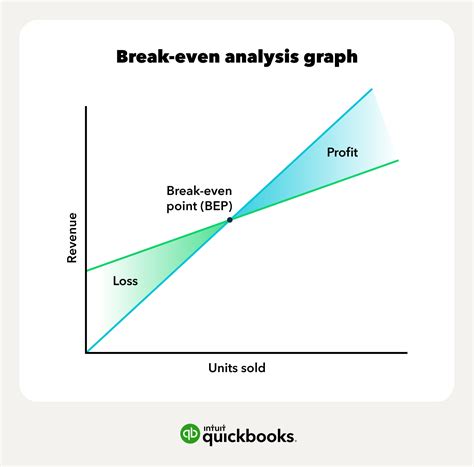

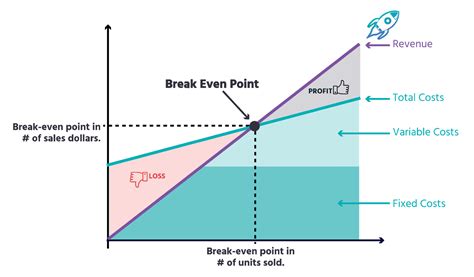

The break-even point is a critical milestone for any business, as it marks the transition from operating at a loss to generating profits. By knowing the break-even point, companies can set realistic targets, allocate resources effectively, and develop strategies to increase sales and revenue. Moreover, the break-even sales formula helps businesses to identify areas for cost reduction, optimize pricing, and improve their overall financial performance.

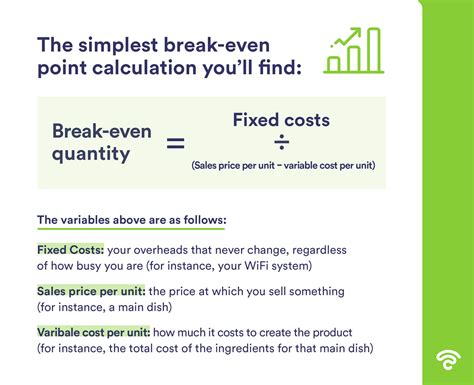

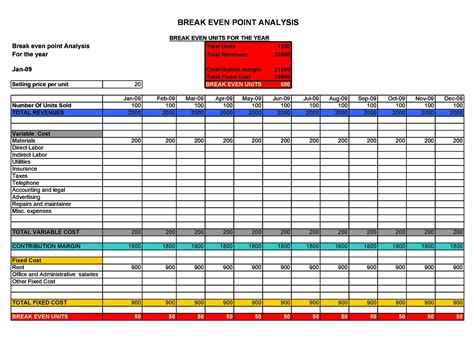

To calculate the break-even point, businesses need to understand the different types of costs involved in their operations. Fixed costs are expenses that remain constant regardless of the level of production or sales, such as rent, salaries, and insurance. Variable costs, on the other hand, are expenses that vary directly with the level of production or sales, such as raw materials, labor, and marketing expenses. The break-even sales formula takes into account both fixed and variable costs to determine the point at which a business becomes profitable.

Understanding the Break-Even Sales Formula

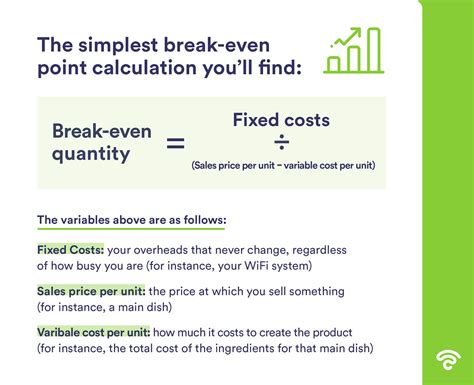

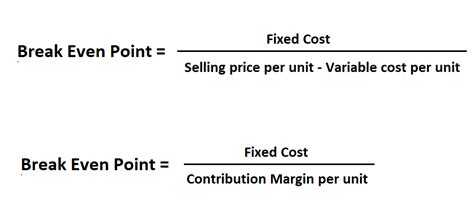

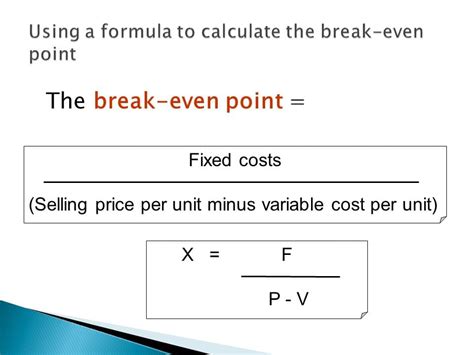

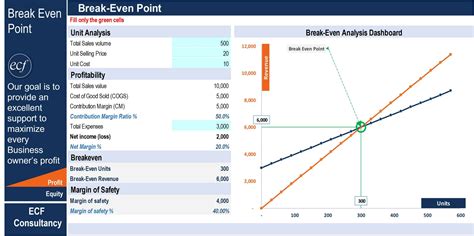

The break-even sales formula is calculated as follows: Break-Even Point (BEP) = Fixed Costs / (Selling Price - Variable Costs). This formula provides a simple and effective way to determine the break-even point, which can be expressed in terms of units sold or revenue. By understanding the break-even sales formula, businesses can make informed decisions about pricing, production, and investment, and develop strategies to increase sales and revenue.

Components of the Break-Even Sales Formula

The break-even sales formula consists of three main components: fixed costs, variable costs, and selling price. Fixed costs are expenses that remain constant regardless of the level of production or sales, while variable costs are expenses that vary directly with the level of production or sales. The selling price is the amount at which a product or service is sold to customers. By understanding these components, businesses can calculate the break-even point and make informed decisions about their operations.Calculating the Break-Even Point

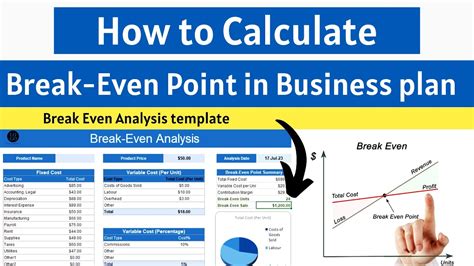

To calculate the break-even point, businesses need to follow these steps:

- Identify the fixed costs: Determine the total fixed costs, including rent, salaries, insurance, and other expenses that remain constant.

- Identify the variable costs: Determine the total variable costs, including raw materials, labor, marketing expenses, and other expenses that vary directly with the level of production or sales.

- Determine the selling price: Determine the selling price of the product or service, taking into account the target market, competition, and pricing strategy.

- Calculate the contribution margin: Calculate the contribution margin by subtracting the variable costs from the selling price.

- Calculate the break-even point: Calculate the break-even point by dividing the fixed costs by the contribution margin.

Example of Calculating the Break-Even Point

For example, let's say a company has fixed costs of $100,000, variable costs of $50 per unit, and a selling price of $100 per unit. To calculate the break-even point, we need to follow these steps: * Calculate the contribution margin: $100 (selling price) - $50 (variable costs) = $50 (contribution margin) * Calculate the break-even point: $100,000 (fixed costs) / $50 (contribution margin) = 2,000 unitsImportance of the Break-Even Sales Formula

The break-even sales formula is essential for businesses to determine the point at which they become profitable. By understanding the break-even point, companies can:

- Set realistic targets: By knowing the break-even point, businesses can set realistic targets for sales and revenue.

- Allocate resources effectively: By understanding the break-even point, businesses can allocate resources effectively, such as investing in marketing and sales efforts.

- Develop strategies to increase sales and revenue: By understanding the break-even point, businesses can develop strategies to increase sales and revenue, such as pricing strategies and product development.

Benefits of Using the Break-Even Sales Formula

The break-even sales formula provides several benefits to businesses, including: * Helps to identify areas for cost reduction: By understanding the break-even point, businesses can identify areas for cost reduction and optimize their operations. * Provides a basis for pricing: The break-even sales formula provides a basis for pricing, helping businesses to determine the optimal price for their products or services. * Helps to evaluate investment opportunities: By understanding the break-even point, businesses can evaluate investment opportunities and make informed decisions about their operations.Common Mistakes to Avoid When Using the Break-Even Sales Formula

When using the break-even sales formula, businesses should avoid the following common mistakes:

- Failing to account for all costs: Businesses should ensure that they account for all costs, including fixed and variable costs, when calculating the break-even point.

- Using inaccurate data: Businesses should ensure that they use accurate data when calculating the break-even point, including up-to-date information on costs and sales.

- Failing to review and update the break-even point: Businesses should regularly review and update the break-even point to reflect changes in their operations and market conditions.

Best Practices for Using the Break-Even Sales Formula

To get the most out of the break-even sales formula, businesses should follow these best practices: * Regularly review and update the break-even point: Businesses should regularly review and update the break-even point to reflect changes in their operations and market conditions. * Use accurate data: Businesses should ensure that they use accurate data when calculating the break-even point, including up-to-date information on costs and sales. * Consider multiple scenarios: Businesses should consider multiple scenarios when using the break-even sales formula, including different pricing strategies and market conditions.Break-Even Sales Formula Image Gallery

What is the break-even sales formula?

+The break-even sales formula is a calculation used to determine the point at which a business becomes profitable. It is calculated by dividing the fixed costs by the contribution margin.

How do I calculate the break-even point?

+To calculate the break-even point, you need to identify the fixed costs, variable costs, and selling price. Then, calculate the contribution margin by subtracting the variable costs from the selling price. Finally, divide the fixed costs by the contribution margin to get the break-even point.

What are the benefits of using the break-even sales formula?

+The break-even sales formula provides several benefits, including helping to identify areas for cost reduction, providing a basis for pricing, and evaluating investment opportunities. It also helps businesses to set realistic targets, allocate resources effectively, and develop strategies to increase sales and revenue.

How often should I review and update the break-even point?

+You should regularly review and update the break-even point to reflect changes in your operations and market conditions. This will help you to ensure that your business remains profitable and competitive.

What are the common mistakes to avoid when using the break-even sales formula?

+Common mistakes to avoid when using the break-even sales formula include failing to account for all costs, using inaccurate data, and failing to review and update the break-even point. You should also consider multiple scenarios and use accurate data when calculating the break-even point.

In conclusion, the break-even sales formula is a powerful tool for businesses to determine the point at which they become profitable. By understanding the break-even point, companies can set realistic targets, allocate resources effectively, and develop strategies to increase sales and revenue. We hope that this article has provided you with a comprehensive understanding of the break-even sales formula and its importance in business decision-making. If you have any questions or comments, please feel free to share them with us. We would love to hear your thoughts and provide further guidance on how to apply the break-even sales formula in your business.