Intro

Discover 5 ways business cash advance options can boost working capital, improve cash flow, and support small business growth with alternative funding solutions.

The concept of a business cash advance has become increasingly popular among entrepreneurs and small business owners in recent years. This is largely due to the fact that traditional lending institutions have made it more difficult for businesses to secure funding. A business cash advance provides an alternative solution for companies that need quick access to capital. In this article, we will delve into the world of business cash advances, exploring what they are, how they work, and the benefits they offer to businesses.

A business cash advance is a type of financing that allows businesses to receive a lump sum of money in exchange for a percentage of their future sales. This type of financing is often used by businesses that have a high volume of credit card sales, such as restaurants, retail stores, and service-based businesses. The cash advance is typically repaid through a daily or weekly deduction from the business's credit card sales, making it a flexible and manageable way to access capital.

The importance of business cash advances cannot be overstated. They provide businesses with the funding they need to grow, expand, and thrive in a competitive market. Without access to capital, many businesses would be unable to invest in new equipment, hire additional staff, or pursue new marketing initiatives. Business cash advances fill this gap, providing businesses with a quick and easy way to access the funding they need.

What is a Business Cash Advance?

How Does a Business Cash Advance Work?

The process of obtaining a business cash advance is relatively straightforward. Businesses can apply for a cash advance through a lender or financing company, providing basic information about their business, including their credit card sales history and financial statements. The lender will then review the application and determine the amount of funding the business is eligible for, based on their credit card sales and other factors.Once the application is approved, the business will receive the cash advance, which can be used for any business purpose, such as purchasing new equipment, hiring additional staff, or pursuing new marketing initiatives. The cash advance is then repaid through a daily or weekly deduction from the business's credit card sales, making it a flexible and manageable way to access capital.

Benefits of a Business Cash Advance

- Quick access to capital: Business cash advances provide businesses with quick access to capital, allowing them to take advantage of new opportunities and respond to changing market conditions.

- Flexible repayment terms: The repayment terms for a business cash advance are typically flexible, with the cash advance being repaid through a daily or weekly deduction from the business's credit card sales.

- No collateral required: Unlike traditional loans, business cash advances do not require collateral, making them a more accessible option for businesses that do not have assets to secure a loan.

- Easy application process: The application process for a business cash advance is relatively straightforward, with businesses able to apply online or through a lender or financing company.

Types of Business Cash Advances

There are several types of business cash advances available, including:- Merchant cash advance: This type of cash advance is specifically designed for businesses that have a high volume of credit card sales, such as restaurants and retail stores.

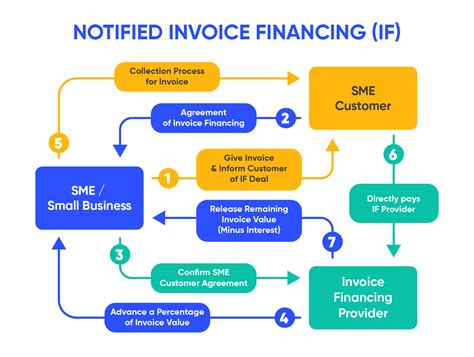

- Invoice financing: This type of cash advance allows businesses to receive funding based on outstanding invoices, providing them with quick access to capital.

- Line of credit: This type of cash advance provides businesses with a revolving line of credit, allowing them to draw down funds as needed.

How to Apply for a Business Cash Advance

To apply for a business cash advance, businesses will typically need to provide the following information:

- Business name and address

- Credit card sales history

- Financial statements

- Business tax returns

- Personal guarantee

Tips for Getting Approved for a Business Cash Advance

There are several tips that businesses can follow to increase their chances of getting approved for a business cash advance, including:- Having a strong credit card sales history

- Providing accurate and complete financial information

- Having a clear business plan and budget

- Being prepared to provide additional information or documentation as needed

Risks and Challenges of Business Cash Advances

- High interest rates: Business cash advances can have high interest rates, making them a more expensive option than traditional loans.

- Fees and charges: Business cash advances can also come with fees and charges, such as origination fees and late payment fees.

- Repayment terms: The repayment terms for a business cash advance can be inflexible, making it difficult for businesses to manage their cash flow.

Alternatives to Business Cash Advances

There are several alternatives to business cash advances, including:- Traditional loans: Traditional loans can provide businesses with access to capital at a lower interest rate than business cash advances.

- Invoice financing: Invoice financing allows businesses to receive funding based on outstanding invoices, providing them with quick access to capital.

- Line of credit: A line of credit provides businesses with a revolving line of credit, allowing them to draw down funds as needed.

Conclusion and Next Steps

If you are considering a business cash advance, it is essential to do your research and compare different lenders and financing options. You should also carefully review the terms and conditions of the cash advance, including the interest rate, fees, and repayment terms. By taking the time to understand your options and make an informed decision, you can ensure that you are getting the best possible deal for your business.

Business Cash Advance Image Gallery

What is a business cash advance?

+A business cash advance is a type of financing that allows businesses to receive a lump sum of money in exchange for a percentage of their future sales.

How does a business cash advance work?

+The process of obtaining a business cash advance is relatively straightforward. Businesses can apply for a cash advance through a lender or financing company, providing basic information about their business, including their credit card sales history and financial statements.

What are the benefits of a business cash advance?

+There are several benefits to using a business cash advance, including quick access to capital, flexible repayment terms, and no collateral required.

What are the risks and challenges of business cash advances?

+While business cash advances can provide businesses with quick access to capital, there are also several risks and challenges associated with this type of financing, including high interest rates and fees.

What are the alternatives to business cash advances?

+There are several alternatives to business cash advances, including traditional loans, invoice financing, and lines of credit.

We hope this article has provided you with a comprehensive understanding of business cash advances and how they can help your business grow and thrive. If you have any further questions or would like to learn more about this topic, please do not hesitate to contact us. We would be happy to hear from you and provide you with any additional information or guidance you may need.