Intro

Calculate break-even point easily with our guide, covering cost analysis, revenue projection, and financial planning to determine profitability and make informed business decisions.

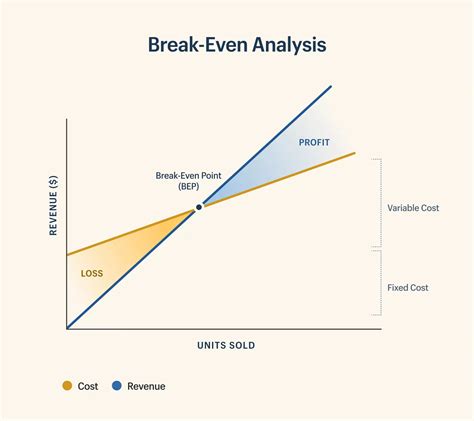

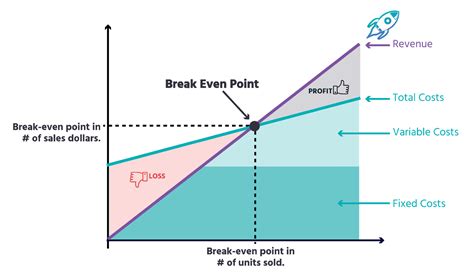

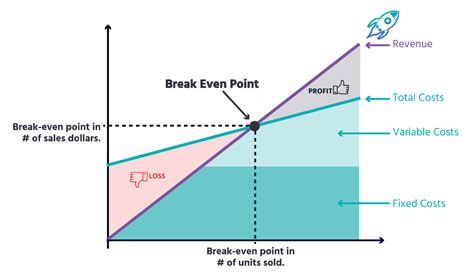

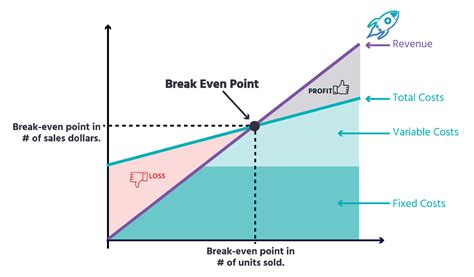

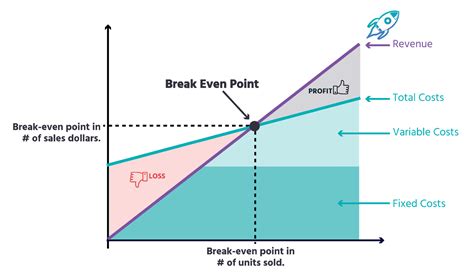

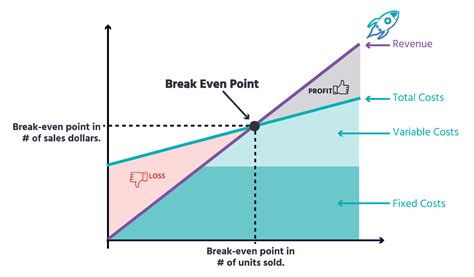

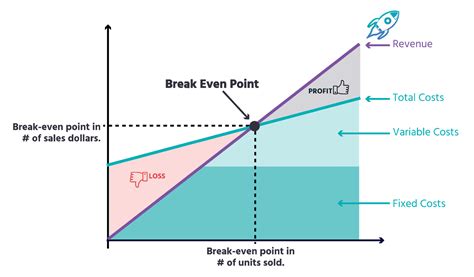

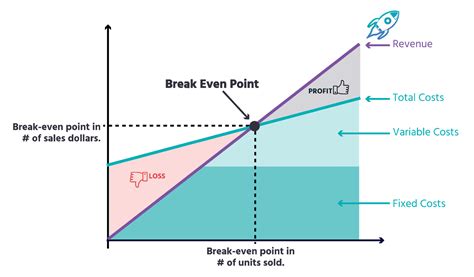

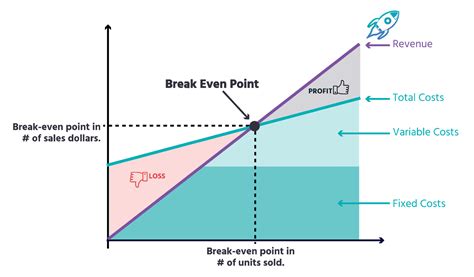

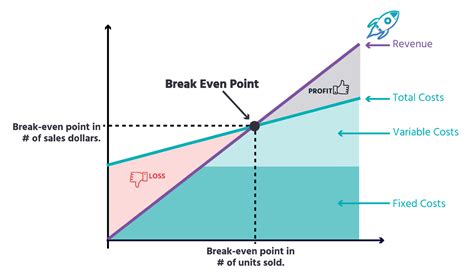

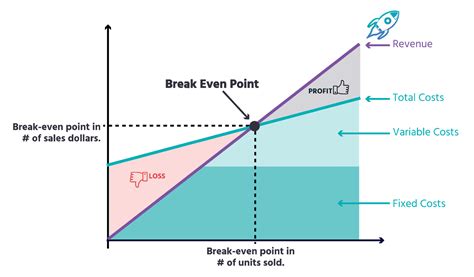

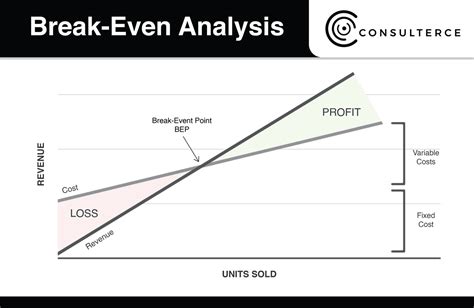

Calculating the break-even point is a crucial step for any business, as it helps determine when a company will start generating profits. The break-even point is the point at which the total revenue equals the total fixed and variable costs. In this article, we will explore the importance of calculating the break-even point and provide a step-by-step guide on how to do it easily.

The break-even point is essential for businesses because it helps them understand their financial situation and make informed decisions. By calculating the break-even point, businesses can determine how many units they need to sell, the price they need to charge, and the costs they need to incur to start generating profits. This information can be used to create a business plan, secure funding, and make strategic decisions.

To calculate the break-even point, businesses need to understand their fixed and variable costs. Fixed costs are expenses that remain the same even if the business produces more or less, such as rent, salaries, and insurance. Variable costs, on the other hand, are expenses that change depending on the production level, such as raw materials, labor, and marketing expenses.

Understanding Break-Even Analysis

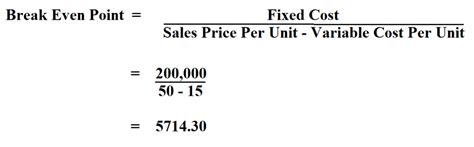

Break-even analysis is a financial calculation that determines the point at which a business will break even. It takes into account the fixed and variable costs, as well as the selling price and the number of units sold. The break-even point can be calculated using the following formula: Break-Even Point = Fixed Costs / (Selling Price - Variable Costs).

For example, let's say a business has fixed costs of $10,000, variable costs of $5 per unit, and a selling price of $10 per unit. To calculate the break-even point, we would use the following formula: Break-Even Point = $10,000 / ($10 - $5) = $10,000 / $5 = 2,000 units. This means that the business needs to sell 2,000 units to break even.

Benefits of Calculating Break-Even Point

Calculating the break-even point has several benefits for businesses. It helps them understand their financial situation, make informed decisions, and create a business plan. By knowing the break-even point, businesses can determine how many units they need to sell, the price they need to charge, and the costs they need to incur to start generating profits.

Additionally, calculating the break-even point helps businesses to identify areas where they can improve their financial performance. For example, if a business has a high break-even point, it may need to reduce its fixed costs or variable costs to become more competitive. On the other hand, if a business has a low break-even point, it may be able to increase its prices or sell more units to increase its profits.

Steps to Calculate Break-Even Point

Calculating the break-even point is a straightforward process that involves the following steps:

- Determine the fixed costs: Identify all the fixed costs associated with the business, such as rent, salaries, and insurance.

- Determine the variable costs: Identify all the variable costs associated with the business, such as raw materials, labor, and marketing expenses.

- Determine the selling price: Determine the selling price of the product or service.

- Calculate the contribution margin: Calculate the contribution margin by subtracting the variable costs from the selling price.

- Calculate the break-even point: Calculate the break-even point by dividing the fixed costs by the contribution margin.

For example, let's say a business has fixed costs of $10,000, variable costs of $5 per unit, and a selling price of $10 per unit. The contribution margin would be $10 - $5 = $5. The break-even point would be $10,000 / $5 = 2,000 units.

Common Mistakes to Avoid

When calculating the break-even point, businesses should avoid the following common mistakes:

- Failing to include all fixed and variable costs

- Using incorrect selling prices or contribution margins

- Failing to consider changes in costs or prices over time

- Using the break-even point as the only metric to evaluate business performance

By avoiding these mistakes, businesses can ensure that their break-even analysis is accurate and reliable.

Break-Even Point in Different Industries

The break-even point can vary significantly depending on the industry and business model. For example, a business in the retail industry may have a lower break-even point than a business in the manufacturing industry, due to the higher fixed costs associated with manufacturing.

In the service industry, the break-even point may be lower due to the lower variable costs associated with providing services. However, the break-even point can still be influenced by factors such as labor costs, marketing expenses, and competition.

Using Break-Even Point to Make Business Decisions

The break-even point can be used to make informed business decisions, such as:

- Determining pricing strategies: By knowing the break-even point, businesses can determine the minimum price they need to charge to break even.

- Evaluating cost structure: By analyzing the break-even point, businesses can identify areas where they can reduce costs to become more competitive.

- Assessing business performance: By comparing actual sales to the break-even point, businesses can evaluate their financial performance and make adjustments as needed.

Gallery of Break Even Point Examples

Break Even Point Image Gallery

What is the break-even point?

+The break-even point is the point at which the total revenue equals the total fixed and variable costs.

How do I calculate the break-even point?

+To calculate the break-even point, use the formula: Break-Even Point = Fixed Costs / (Selling Price - Variable Costs).

What are the benefits of calculating the break-even point?

+Calculating the break-even point helps businesses understand their financial situation, make informed decisions, and create a business plan.

In conclusion, calculating the break-even point is a crucial step for any business. By understanding the break-even point, businesses can make informed decisions, create a business plan, and evaluate their financial performance. We hope this article has provided you with a comprehensive guide on how to calculate the break-even point easily. If you have any questions or comments, please feel free to share them below. Additionally, if you found this article helpful, please share it with your friends and colleagues.