Intro

Discover 5 essential California restaurant tax tips, including sales tax, payroll tax, and property tax guidance, to optimize your eaterys finances and minimize liabilities, ensuring compliance with California tax laws and regulations.

The restaurant industry in California is a thriving and competitive market, with many establishments vying for the attention of hungry customers. However, navigating the complex world of taxes can be a daunting task for restaurant owners, especially in a state with as many regulations as California. In this article, we will explore five essential California restaurant tax tips to help you stay on top of your financial obligations and avoid any potential pitfalls.

Restaurant owners in California must contend with a multitude of taxes, including sales tax, payroll tax, and property tax, among others. Failure to comply with these tax requirements can result in severe penalties, fines, and even the loss of your business. Therefore, it is crucial to understand the tax landscape and take proactive steps to ensure your restaurant remains compliant. Whether you are a seasoned restaurateur or just starting out, these five California restaurant tax tips will provide you with the knowledge and expertise needed to succeed in this challenging but rewarding industry.

From understanding the nuances of sales tax to navigating the complexities of payroll tax, we will delve into the key tax considerations that every California restaurant owner should be aware of. By the end of this article, you will be equipped with the knowledge and confidence to tackle even the most complex tax challenges, allowing you to focus on what matters most - providing exceptional dining experiences for your customers. With that said, let's dive into the first of our five California restaurant tax tips.

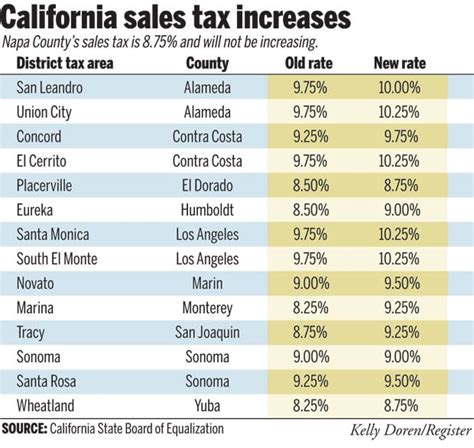

Understanding Sales Tax in California

To comply with sales tax requirements, you must obtain a seller's permit from the California Department of Tax and Fee Administration (CDTFA). This permit allows you to collect and remit sales tax on behalf of the state. You will also need to file regular sales tax returns, which can be done online or by mail. Failure to file or pay sales tax can result in penalties, fines, and even the loss of your seller's permit.

Key Sales Tax Considerations

When it comes to sales tax, there are several key considerations that California restaurant owners should be aware of. These include: * Understanding what items are subject to sales tax, such as food, beverages, and merchandise * Knowing the sales tax rate in your area and ensuring you are collecting and remitting the correct amount * Obtaining a seller's permit from the CDTFA * Filing regular sales tax returns and paying any outstanding balances * Maintaining accurate records of sales tax collections and paymentsBy understanding these key sales tax considerations, you can ensure that your restaurant remains compliant with California sales tax regulations and avoids any potential penalties or fines.

Payroll Tax Obligations in California

To comply with payroll tax requirements, you must register with the California Employment Development Department (EDD) and obtain an employer account number. You will also need to file regular payroll tax returns, which can be done online or by mail. Failure to file or pay payroll tax can result in penalties, fines, and even the loss of your business.

Key Payroll Tax Considerations

When it comes to payroll tax, there are several key considerations that California restaurant owners should be aware of. These include: * Understanding what taxes need to be withheld and paid, such as federal and state income taxes, Social Security, and Medicare taxes * Registering with the EDD and obtaining an employer account number * Filing regular payroll tax returns and paying any outstanding balances * Maintaining accurate records of payroll tax withholdings and payments * Complying with California-specific payroll tax requirements, such as SDI and ETTBy understanding these key payroll tax considerations, you can ensure that your restaurant remains compliant with California payroll tax regulations and avoids any potential penalties or fines.

Property Tax Considerations in California

To comply with property tax requirements, you must ensure that your property is properly assessed and that you are paying the correct amount of property tax. You can do this by reviewing your property tax bill and ensuring that it accurately reflects the value of your property. You can also consider hiring a property tax consultant to help you navigate the complex world of property tax.

Key Property Tax Considerations

When it comes to property tax, there are several key considerations that California restaurant owners should be aware of. These include: * Understanding how property tax is assessed and collected in California * Ensuring that your property is properly assessed and that you are paying the correct amount of property tax * Reviewing your property tax bill and ensuring it accurately reflects the value of your property * Considering hiring a property tax consultant to help you navigate the complex world of property tax * Exploring options for reducing your property tax liability, such as filing for a reduction in assessed valueBy understanding these key property tax considerations, you can ensure that your restaurant remains compliant with California property tax regulations and avoids any potential penalties or fines.

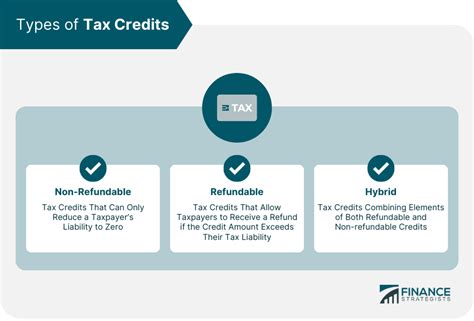

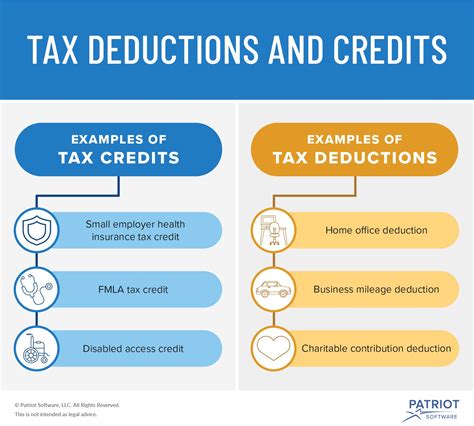

Tax Credits and Incentives in California

To take advantage of these tax credits and incentives, you must meet certain eligibility requirements and follow the application process. This can include filing paperwork, providing documentation, and meeting with state officials. It is essential to understand the various tax credits and incentives available and to consult with a tax professional to ensure you are taking advantage of all the credits and incentives you are eligible for.

Key Tax Credit and Incentive Considerations

When it comes to tax credits and incentives, there are several key considerations that California restaurant owners should be aware of. These include: * Understanding the various tax credits and incentives available, such as the California Competes Tax Credit and the New Employment Credit * Meeting the eligibility requirements for each credit and incentive * Following the application process and providing required documentation * Consulting with a tax professional to ensure you are taking advantage of all the credits and incentives you are eligible for * Exploring options for combining multiple credits and incentives to maximize your tax savingsBy understanding these key tax credit and incentive considerations, you can ensure that your restaurant is taking advantage of all the tax savings available and reducing your tax liability.

Record Keeping and Audit Preparation in California

To comply with record keeping and audit preparation requirements, you must implement a robust accounting system that can track and record all financial transactions. You should also establish a regular audit preparation process, which includes reviewing financial statements, reconciling accounts, and identifying any potential discrepancies.

Key Record Keeping and Audit Preparation Considerations

When it comes to record keeping and audit preparation, there are several key considerations that California restaurant owners should be aware of. These include: * Implementing a robust accounting system that can track and record all financial transactions * Establishing a regular audit preparation process, including reviewing financial statements and reconciling accounts * Maintaining accurate and detailed records of all financial transactions, including sales, payroll, and property tax * Keeping records for a minimum of three years and making them available for audit at any time * Consulting with a tax professional to ensure you are meeting all record keeping and audit preparation requirementsBy understanding these key record keeping and audit preparation considerations, you can ensure that your restaurant is meeting all tax obligations and is prepared for any potential audits.

California Restaurant Tax Tips Image Gallery

What is the sales tax rate in California?

+The sales tax rate in California varies depending on the location, with a base rate of 7.25% and additional local rates that can range from 0.1% to 3.25%.

How do I obtain a seller's permit in California?

+To obtain a seller's permit in California, you must register with the California Department of Tax and Fee Administration (CDTFA) and provide required documentation, such as a business license and tax identification number.

What is the deadline for filing payroll tax returns in California?

+The deadline for filing payroll tax returns in California varies depending on the type of return and the filing frequency, but generally, quarterly returns are due on the last day of the month following the end of the quarter.

In