Intro

Discover cash advance loans, including payday loans, short-term lending, and emergency funding options, to help manage financial crises with instant approval and quick disbursal.

The concept of cash advance loans has become increasingly popular in recent years, especially among individuals who face unexpected financial emergencies. These loans provide a quick and easy way to access cash when needed, but they also come with certain terms and conditions that borrowers should be aware of. In this article, we will delve into the world of cash advance loans, exploring their benefits, drawbacks, and everything in between.

Cash advance loans are designed to provide individuals with a short-term solution to their financial problems. They are typically offered by lenders who specialize in providing quick and easy access to cash, often with minimal paperwork and credit checks. This makes them an attractive option for people who need money urgently, such as to pay for car repairs, medical bills, or other unexpected expenses. However, it's essential to understand that cash advance loans are not a long-term solution to financial problems and should be used responsibly.

The importance of understanding cash advance loans cannot be overstated. With the rise of online lending, it's easier than ever to access these loans, but this also means that borrowers need to be more vigilant than ever. By educating themselves on the ins and outs of cash advance loans, individuals can make informed decisions about their financial health and avoid potential pitfalls. Whether you're facing a financial emergency or simply want to learn more about these loans, this article aims to provide you with a comprehensive guide to cash advance loans.

What are Cash Advance Loans?

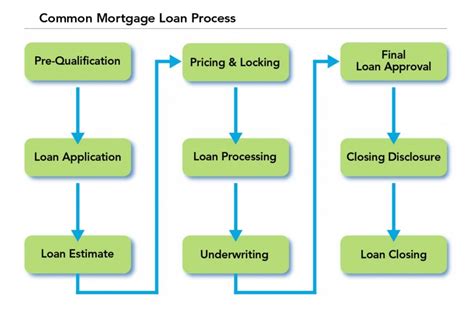

The application process for cash advance loans is usually straightforward and can be completed online or in-person. Borrowers are required to provide some basic information, such as their name, address, and employment details, as well as their bank account information. Once the application is approved, the loan amount is deposited into the borrower's bank account, and they are expected to repay the loan on their next payday.

Types of Cash Advance Loans

There are several types of cash advance loans available, each with its own set of terms and conditions. Some of the most common types of cash advance loans include: * Payday loans: These loans are designed to provide individuals with a short-term solution to their financial problems. They are typically due on the borrower's next payday and come with high interest rates and fees. * Installment loans: These loans are similar to payday loans but are repaid in installments over a set period. They often come with lower interest rates and fees than payday loans. * Title loans: These loans require borrowers to use their vehicle title as collateral. They are often more expensive than payday loans and can result in the borrower losing their vehicle if they fail to repay the loan. * Cash advance apps: These apps provide individuals with a short-term loan or cash advance, often with lower interest rates and fees than traditional cash advance loans.How do Cash Advance Loans Work?

The repayment terms for cash advance loans vary depending on the lender and the type of loan. Some lenders may offer a rollover option, which allows borrowers to extend the repayment period, while others may require borrowers to repay the loan in full on their next payday. It's essential to read and understand the repayment terms before applying for a cash advance loan.

Benefits of Cash Advance Loans

Cash advance loans offer several benefits, including: * Quick and easy access to cash: Cash advance loans provide individuals with a fast and convenient way to access cash when needed. * Minimal paperwork: The application process for cash advance loans is often straightforward and requires minimal paperwork. * No credit checks: Many lenders do not perform credit checks, making it easier for individuals with poor credit to obtain a loan. * Flexibility: Cash advance loans can be used for a variety of purposes, such as paying bills, covering unexpected expenses, or financing a vacation.Drawbacks of Cash Advance Loans

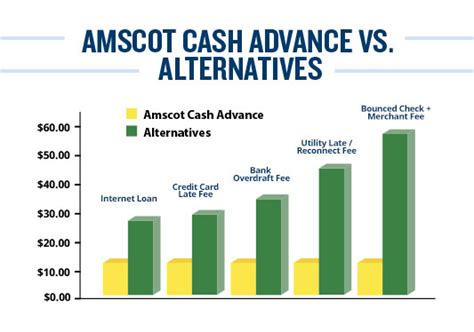

Alternatives to Cash Advance Loans

There are several alternatives to cash advance loans, including: * Personal loans: These loans offer a longer repayment period and lower interest rates than cash advance loans. * Credit cards: Credit cards can provide individuals with a line of credit that can be used to cover unexpected expenses. * Savings: Building an emergency savings fund can provide individuals with a cushion against unexpected expenses. * Borrowing from friends or family: Borrowing from friends or family can be a more affordable and flexible option than cash advance loans.How to Apply for a Cash Advance Loan

Once the application is approved, the loan amount is deposited into the borrower's bank account, and they are expected to repay the loan on their next payday. It's essential to read and understand the repayment terms before applying for a cash advance loan.

Tips for Repaying Cash Advance Loans

Repaying cash advance loans can be challenging, but there are several tips that can help. Some of the most effective tips include: * Creating a budget: Creating a budget can help borrowers understand their income and expenses, making it easier to repay the loan. * Cutting expenses: Cutting expenses can help borrowers free up more money in their budget to repay the loan. * Increasing income: Increasing income can provide borrowers with more money to repay the loan. * Communicating with the lender: Communicating with the lender can help borrowers understand the repayment terms and avoid any potential pitfalls.Conclusion and Final Thoughts

It's essential to approach cash advance loans with caution and to carefully consider the repayment terms before applying. By doing so, individuals can avoid the potential pitfalls associated with these loans and use them as a useful tool for managing their finances.

Cash Advance Loan Image Gallery

What is a cash advance loan?

+A cash advance loan is a type of short-term loan that provides individuals with a lump sum of money, which must be repaid on their next payday.

How do I apply for a cash advance loan?

+To apply for a cash advance loan, borrowers can apply online or in-person, and the application is typically reviewed and approved within minutes.

What are the benefits of cash advance loans?

+Cash advance loans offer several benefits, including quick and easy access to cash, minimal paperwork, and no credit checks.

What are the drawbacks of cash advance loans?

+Cash advance loans come with some significant drawbacks, including high interest rates and fees, a short repayment period, and the risk of debt cycle.

Are there any alternatives to cash advance loans?

+Yes, there are several alternatives to cash advance loans, including personal loans, credit cards, savings, and borrowing from friends or family.

We hope this article has provided you with a comprehensive guide to cash advance loans. If you have any further questions or comments, please don't hesitate to reach out. Share this article with your friends and family to help them understand the benefits and drawbacks of cash advance loans. By educating ourselves on the ins and outs of these loans, we can make informed decisions about our financial health and avoid potential pitfalls.