Intro

Optimize cash till drawer management with efficient cash handling, point of sale integration, and secure storage solutions to minimize losses and maximize profitability.

Effective cash till drawer management is crucial for any business that handles cash transactions. It's a process that involves tracking, managing, and securing the cash in a till drawer to prevent losses, ensure accuracy, and maintain a smooth operation. In today's fast-paced retail environment, having a well-organized cash till drawer management system in place can make all the difference in preventing errors, reducing theft, and improving customer satisfaction.

A cash till drawer is a critical component of any point-of-sale (POS) system, and its management is essential for maintaining the financial integrity of a business. A well-managed cash till drawer can help prevent cash discrepancies, reduce the risk of theft and fraud, and ensure that transactions are accurately recorded. Moreover, it can also help businesses to identify areas where they can improve their operations, such as reducing wait times, improving customer service, and increasing sales.

In recent years, cash till drawer management has become more complex due to the increasing use of digital payment methods, such as credit cards, mobile payments, and contactless transactions. While these payment methods offer convenience and flexibility, they also introduce new challenges for businesses, such as managing multiple payment streams, handling refunds and exchanges, and preventing cyber threats. As a result, businesses need to adapt their cash till drawer management systems to accommodate these changes and ensure that they remain secure, efficient, and effective.

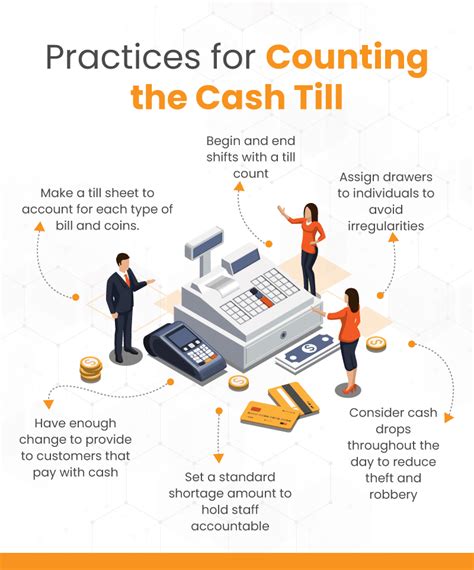

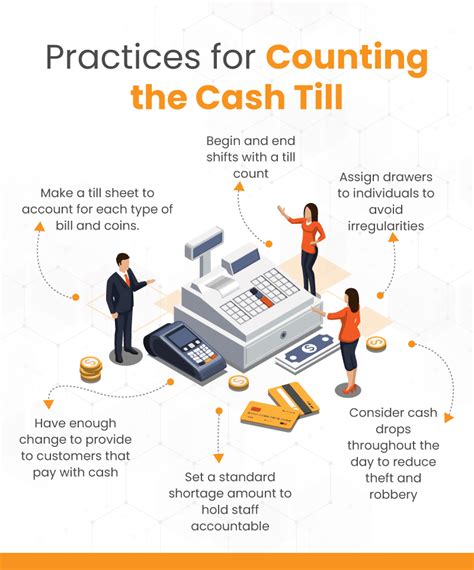

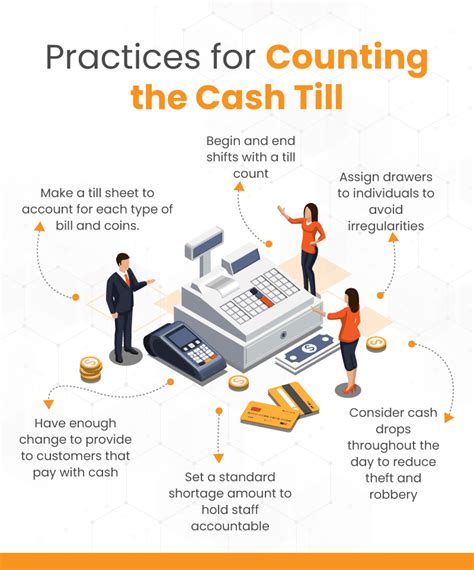

Cash Till Drawer Management Best Practices

Implementing best practices in cash till drawer management is essential for businesses that want to minimize errors, prevent losses, and improve their overall operations. Some of the best practices include:

- Counting and reconciling cash at the start and end of each shift to prevent discrepancies

- Using a secure and tamper-evident cash till drawer to prevent theft and tampering

- Implementing a cash handling policy that outlines procedures for handling cash, credit card transactions, and other payment methods

- Training staff on cash handling procedures and providing ongoing support and guidance

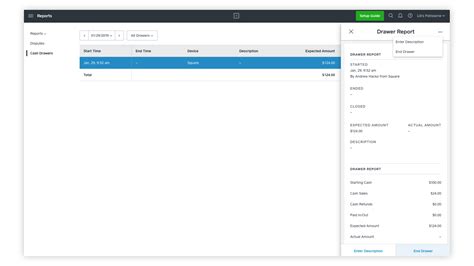

- Regularly reviewing and analyzing cash till drawer reports to identify areas for improvement

By implementing these best practices, businesses can reduce the risk of cash discrepancies, prevent theft and fraud, and improve their overall cash till drawer management.

Benefits of Effective Cash Till Drawer Management

Effective cash till drawer management offers numerous benefits for businesses, including:

- Reduced risk of cash discrepancies and theft

- Improved accuracy and efficiency in cash handling

- Enhanced customer satisfaction due to faster and more accurate transactions

- Better management of cash flow and improved financial reporting

- Reduced risk of cyber threats and data breaches

- Improved staff training and development through regular cash handling procedures

By implementing an effective cash till drawer management system, businesses can enjoy these benefits and improve their overall operations.

Cash Till Drawer Management Tools and Technologies

There are various tools and technologies available to help businesses manage their cash till drawers effectively. Some of these include:

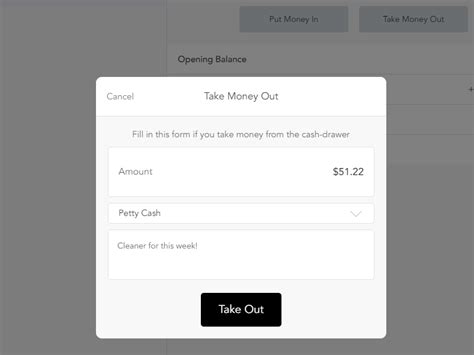

- Point-of-sale (POS) systems that integrate with cash till drawers

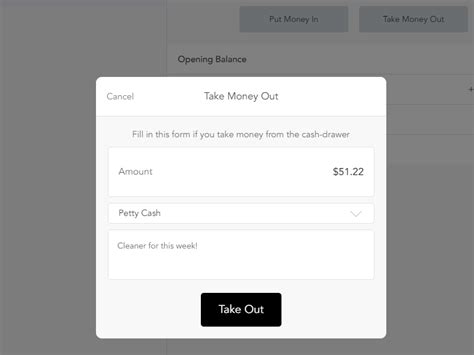

- Cash till drawer software that tracks and analyzes cash transactions

- Secure and tamper-evident cash till drawers that prevent theft and tampering

- Mobile payment solutions that allow customers to make payments using their mobile devices

- Cloud-based cash management systems that provide real-time reporting and analytics

By leveraging these tools and technologies, businesses can streamline their cash till drawer management, reduce errors, and improve their overall operations.

Cash Till Drawer Security Measures

Cash till drawer security is a critical aspect of cash till drawer management. Some of the security measures that businesses can implement include:

- Using secure and tamper-evident cash till drawers

- Implementing access controls and restrictions on who can access the cash till drawer

- Using alarms and sensors to detect and prevent theft

- Regularly reviewing and analyzing cash till drawer reports to identify suspicious activity

- Training staff on cash handling procedures and providing ongoing support and guidance

By implementing these security measures, businesses can reduce the risk of theft and fraud, and protect their cash till drawers from unauthorized access.

Cash Till Drawer Management Challenges

Despite the importance of cash till drawer management, businesses often face challenges in implementing and maintaining effective cash till drawer management systems. Some of these challenges include:

- Managing multiple payment streams and handling refunds and exchanges

- Preventing cyber threats and data breaches

- Training staff on cash handling procedures and providing ongoing support and guidance

- Managing cash flow and maintaining accurate financial reporting

- Implementing and maintaining secure and tamper-evident cash till drawers

By understanding these challenges, businesses can develop strategies to overcome them and improve their cash till drawer management.

Cash Till Drawer Management Solutions

There are various solutions available to help businesses overcome the challenges of cash till drawer management. Some of these solutions include:

- Implementing a cloud-based cash management system that provides real-time reporting and analytics

- Using a secure and tamper-evident cash till drawer that prevents theft and tampering

- Training staff on cash handling procedures and providing ongoing support and guidance

- Implementing access controls and restrictions on who can access the cash till drawer

- Regularly reviewing and analyzing cash till drawer reports to identify areas for improvement

By implementing these solutions, businesses can improve their cash till drawer management, reduce errors, and enhance customer satisfaction.

Cash Till Drawer Management Trends

The cash till drawer management landscape is constantly evolving, with new trends and technologies emerging all the time. Some of the current trends include:

- The increasing use of digital payment methods, such as mobile payments and contactless transactions

- The adoption of cloud-based cash management systems that provide real-time reporting and analytics

- The use of artificial intelligence and machine learning to improve cash till drawer management

- The implementation of secure and tamper-evident cash till drawers that prevent theft and tampering

- The training of staff on cash handling procedures and providing ongoing support and guidance

By staying up-to-date with these trends, businesses can improve their cash till drawer management, reduce errors, and enhance customer satisfaction.

Cash Till Drawer Management Image Gallery

What is cash till drawer management?

+Cash till drawer management refers to the process of tracking, managing, and securing the cash in a till drawer to prevent losses, ensure accuracy, and maintain a smooth operation.

Why is cash till drawer management important?

+Cash till drawer management is important because it helps prevent cash discrepancies, reduces the risk of theft and fraud, and ensures that transactions are accurately recorded.

What are some best practices for cash till drawer management?

+Some best practices for cash till drawer management include counting and reconciling cash at the start and end of each shift, using a secure and tamper-evident cash till drawer, and implementing a cash handling policy that outlines procedures for handling cash, credit card transactions, and other payment methods.

What are some common challenges of cash till drawer management?

+Some common challenges of cash till drawer management include managing multiple payment streams, preventing cyber threats and data breaches, training staff on cash handling procedures, and maintaining accurate financial reporting.

What are some solutions for cash till drawer management?

+Some solutions for cash till drawer management include implementing a cloud-based cash management system, using a secure and tamper-evident cash till drawer, training staff on cash handling procedures, and implementing access controls and restrictions on who can access the cash till drawer.

We hope this article has provided you with a comprehensive overview of cash till drawer management, including its importance, best practices, benefits, challenges, and solutions. By implementing effective cash till drawer management systems, businesses can reduce errors, prevent losses, and improve their overall operations. If you have any questions or comments, please don't hesitate to reach out to us. We'd love to hear from you and help you improve your cash till drawer management. Share this article with your colleagues and friends, and let's work together to improve cash till drawer management practices.