Intro

Discover how chargeback works with 5 key methods, including dispute resolution, refund processing, and transaction reversal, to protect consumers from fraudulent transactions and unauthorized payments.

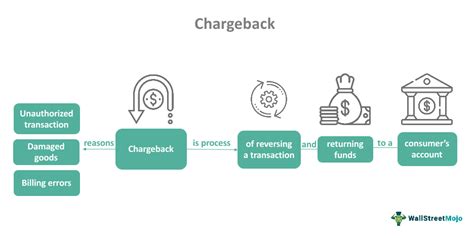

The world of e-commerce and online transactions has become increasingly complex, with various rules and regulations in place to protect both consumers and merchants. One important concept that plays a crucial role in this ecosystem is the chargeback. A chargeback is a process where a consumer disputes a transaction with their bank, resulting in the reversal of the transaction and the return of funds to the consumer. In this article, we will delve into the world of chargebacks, exploring how they work, their benefits, and their potential drawbacks.

Chargebacks have become a vital tool for consumers to protect themselves against fraudulent transactions, incorrect charges, and unsatisfactory products or services. With the rise of online shopping, chargebacks have become more prevalent, and merchants must be aware of the chargeback process to avoid potential losses. In the following sections, we will examine the chargeback process in detail, discussing its benefits, working mechanisms, and potential consequences for merchants.

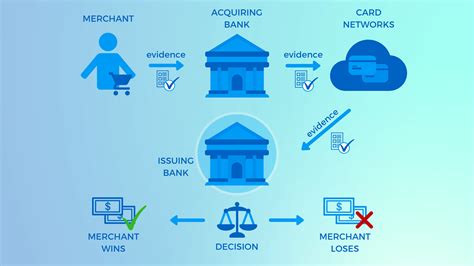

The chargeback process is designed to be fair and efficient, allowing consumers to resolve disputes quickly and easily. However, the process can be complex, and merchants must be aware of the rules and regulations surrounding chargebacks to avoid potential pitfalls. By understanding how chargebacks work, merchants can take steps to prevent them, reducing the risk of financial losses and damage to their reputation.

What is a Chargeback?

Types of Chargebacks

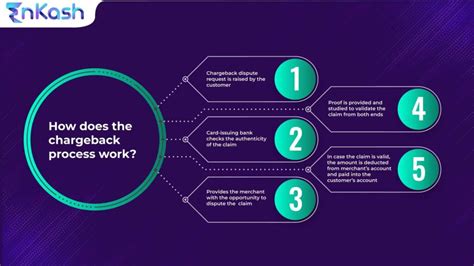

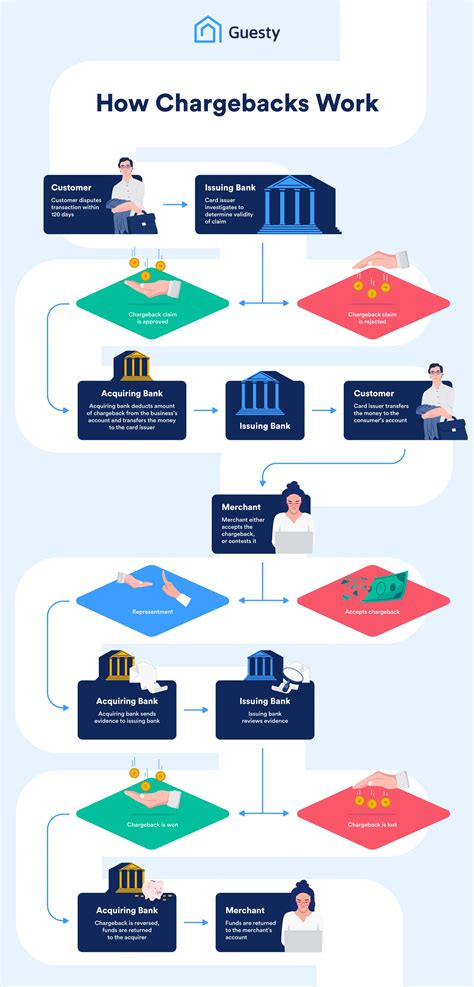

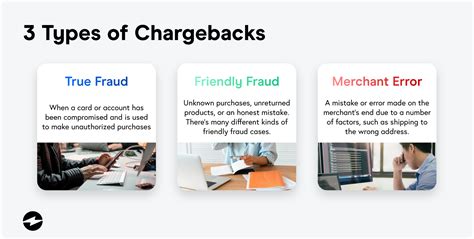

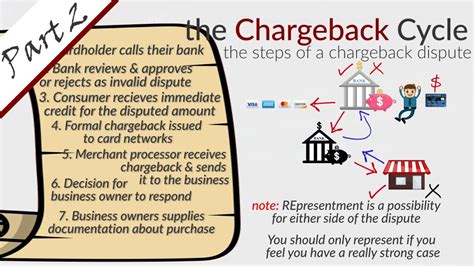

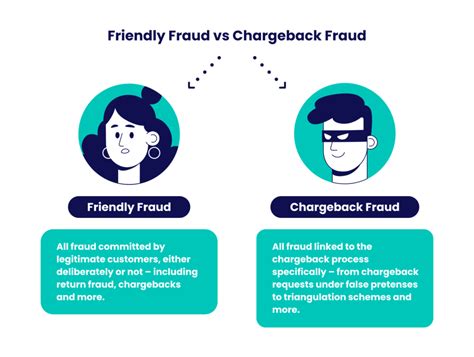

There are several types of chargebacks, each with its own set of rules and regulations. The most common types of chargebacks include: * Fraudulent transactions: These occur when a consumer's credit card information is stolen or used without their knowledge or consent. * Incorrect charges: These occur when a merchant charges a consumer incorrectly, either by charging the wrong amount or by charging for a product or service that was not received. * Unsatisfactory products or services: These occur when a consumer is not satisfied with a product or service and requests a refund.How Chargebacks Work

Benefits of Chargebacks

Chargebacks provide several benefits to consumers, including: * Protection against fraudulent transactions: Chargebacks allow consumers to dispute unauthorized transactions, protecting them from financial losses. * Resolution of disputes: Chargebacks provide a mechanism for consumers to resolve disputes with merchants, ensuring that they receive fair treatment. * Confidence in online transactions: Chargebacks provide consumers with confidence in online transactions, knowing that they have a mechanism to protect themselves against unfair or unauthorized transactions.5 Ways Chargeback Works

Consequences of Chargebacks for Merchants

Chargebacks can have significant consequences for merchants, including: * Financial losses: Chargebacks can result in financial losses for merchants, as they are required to refund the consumer and pay a fee to the bank or credit card company. * Damage to reputation: Chargebacks can damage a merchant's reputation, as consumers may view the merchant as untrustworthy or unreliable. * Increased fees: Merchants may be required to pay higher fees to the bank or credit card company as a result of chargebacks.Preventing Chargebacks

Best Practices for Merchants

Merchants can follow several best practices to minimize the risk of chargebacks, including: * Implementing robust security measures to prevent fraudulent transactions * Providing excellent customer service to resolve disputes and issues quickly * Clearly disclosing transaction terms and conditions * Obtaining explicit consent from consumers for recurring transactions * Maintaining accurate and detailed records of transactionsChargeback Image Gallery

What is a chargeback?

+A chargeback is a transaction that is reversed by a bank or credit card company, returning funds to the consumer.

How do chargebacks work?

+Chargebacks work by allowing consumers to initiate a dispute with their bank or credit card company, claiming that a transaction was unauthorized, incorrect, or unsatisfactory.

What are the benefits of chargebacks?

+Chargebacks provide several benefits to consumers, including protection against fraudulent transactions, resolution of disputes, and confidence in online transactions.

How can merchants prevent chargebacks?

+Merchants can prevent chargebacks by clearly disclosing transaction terms and conditions, providing accurate and detailed descriptions of products or services, and responding promptly to consumer disputes.

What are the consequences of chargebacks for merchants?

+Chargebacks can have significant consequences for merchants, including financial losses, damage to reputation, and increased fees.

In conclusion, chargebacks play a crucial role in protecting consumers from unfair or unauthorized transactions. By understanding how chargebacks work and following best practices, merchants can minimize the risk of chargebacks and maintain a positive reputation. We hope this article has provided you with a comprehensive understanding of chargebacks and their importance in the world of e-commerce. If you have any further questions or would like to share your experiences with chargebacks, please don't hesitate to comment below.