Intro

Discover the impact of Chicagos restaurant tax on dining costs, food prices, and eateries, exploring 5 key ways it affects consumers, local businesses, and the food industry economy.

The city of Chicago is known for its vibrant food scene, with a wide variety of restaurants serving everything from classic deep-dish pizza to modern fine dining. However, eating out in Chicago can come with a hefty price tag, thanks in part to the city's restaurant tax. In this article, we'll explore the 5 ways that the Chicago restaurant tax affects diners and restaurant owners alike.

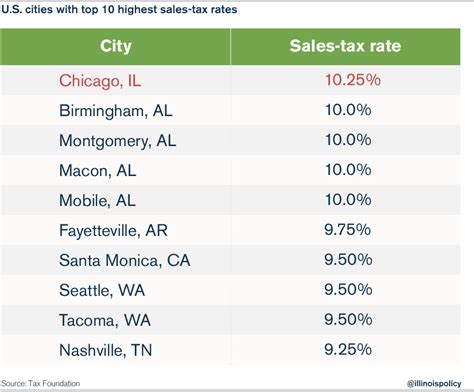

Chicago's restaurant tax is a combined state and local tax that totals 10.25%. This tax is applied to all food and beverages sold in restaurants, bars, and other establishments that serve prepared meals. The tax is made up of a 5% state tax, a 3.75% county tax, and a 1.5% city tax. For diners, this means that a $20 meal can end up costing over $22, once tax is added.

Understanding the Chicago Restaurant Tax

To understand the impact of the Chicago restaurant tax, it's helpful to look at how it compares to other cities. According to a report by the Tax Foundation, Chicago has one of the highest combined state and local sales tax rates in the country. This can make it difficult for restaurants to attract price-sensitive customers, who may be tempted to dine in neighboring cities with lower tax rates.

How the Tax Affects Restaurant Owners

For restaurant owners, the Chicago restaurant tax can be a significant burden. Not only do they have to collect and remit the tax to the government, but they also have to absorb the cost of processing and administering the tax. This can be especially challenging for small, independent restaurants that may not have the resources or infrastructure to handle complex tax laws.

Administrative Burden

One of the biggest challenges that restaurant owners face is the administrative burden of complying with the tax law. This includes tasks such as tracking sales, calculating tax liability, and filing tax returns. For small restaurants, this can be a time-consuming and costly process, taking away from time that could be spent on more important tasks, such as serving customers and managing the business.Impact on Profit Margins

The Chicago restaurant tax can also have a significant impact on profit margins. With a tax rate of 10.25%, restaurants have to factor the tax into their pricing, which can make it difficult to remain competitive. This can be especially challenging in a city like Chicago, where there are many dining options and customers are often looking for the best value.5 Ways to Minimize the Impact of the Tax

While the Chicago restaurant tax may seem like a fixed cost, there are several ways that restaurants can minimize its impact. Here are 5 strategies that restaurants can use to reduce the burden of the tax:

- Offer tax-free specials or promotions to attract price-sensitive customers

- Implement a service charge to offset the cost of the tax

- Raise menu prices to factor in the tax, but do so in a way that is transparent and fair to customers

- Consider offering a discount to customers who pay with cash, which can help to reduce the administrative burden of processing credit card transactions

- Look for ways to reduce waste and inefficiency in the restaurant, which can help to offset the cost of the tax

Benefits of the Tax

While the Chicago restaurant tax may seem like a burden, it also has several benefits. The tax generates significant revenue for the city and state, which can be used to fund important public services and infrastructure projects. Additionally, the tax can help to promote fairness and equity in the restaurant industry, by ensuring that all restaurants are subject to the same tax rate and rules.Gallery of Chicago Restaurant Tax

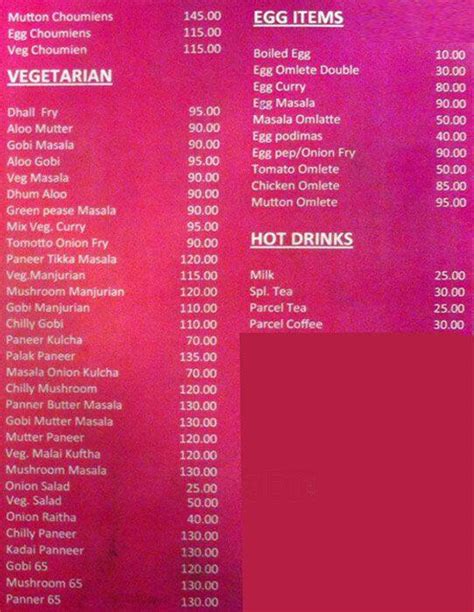

Chicago Restaurant Tax Image Gallery

Frequently Asked Questions

What is the Chicago restaurant tax rate?

+The Chicago restaurant tax rate is 10.25%, which includes a 5% state tax, a 3.75% county tax, and a 1.5% city tax.

How does the tax affect restaurant owners?

+The tax can be a significant burden for restaurant owners, who have to collect and remit the tax to the government, as well as absorb the cost of processing and administering the tax.

Are there any ways to minimize the impact of the tax?

+Yes, there are several ways to minimize the impact of the tax, including offering tax-free specials or promotions, implementing a service charge, and raising menu prices to factor in the tax.

What are the benefits of the tax?

+The tax generates significant revenue for the city and state, which can be used to fund important public services and infrastructure projects. It also promotes fairness and equity in the restaurant industry.

How can I learn more about the Chicago restaurant tax?

+You can learn more about the Chicago restaurant tax by visiting the city's website or contacting a tax professional. You can also reach out to your local restaurant association for more information and resources.

In

Final Thoughts