Intro

Discover the 5 essential insurance claim forms, including accident reports and proof of loss, to navigate the claims process smoothly with insurance adjusters and maximize your settlement with effective claim filing and documentation techniques.

The process of filing an insurance claim can be overwhelming, especially when it comes to navigating the various forms and documentation required. Insurance claim forms are a crucial part of the claims process, as they provide the necessary information for insurance companies to assess and settle claims. In this article, we will delve into the world of insurance claim forms, exploring their importance, types, and the information they typically require.

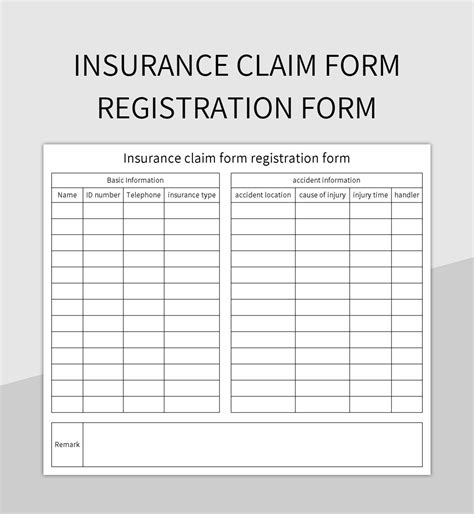

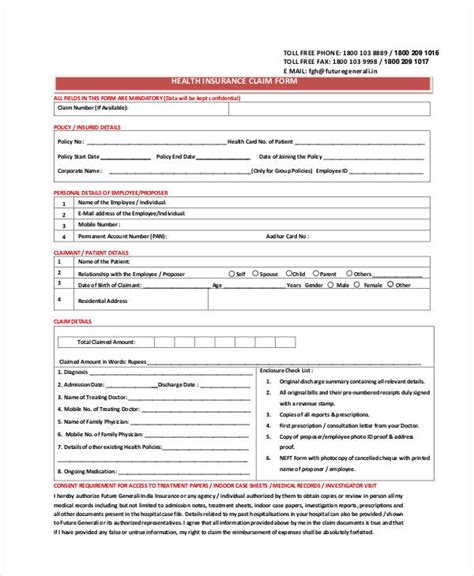

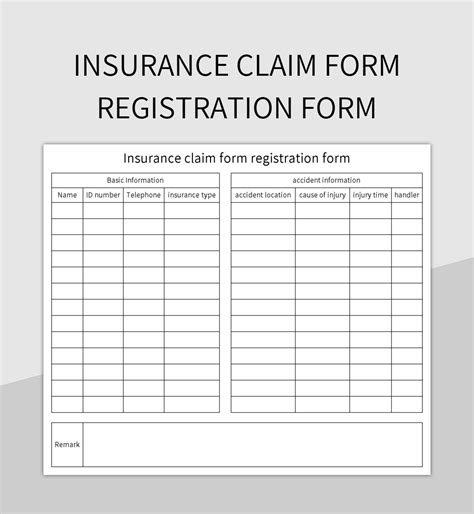

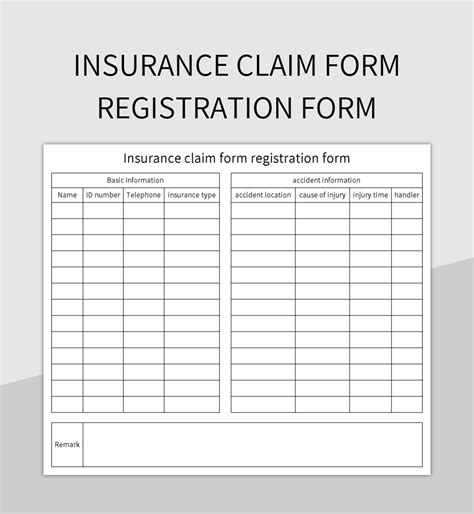

Insurance claim forms are designed to gather specific details about the incident or event that led to the claim, such as the date, time, location, and extent of the damage or loss. These forms also require policyholders to provide personal and contact information, as well as details about their policy, including the policy number and coverage limits. The information collected on these forms helps insurance companies to verify the claim, determine the extent of the damage or loss, and make informed decisions about coverage and compensation.

Types of Insurance Claim Forms

There are various types of insurance claim forms, each designed for specific types of claims. Some common types of insurance claim forms include:

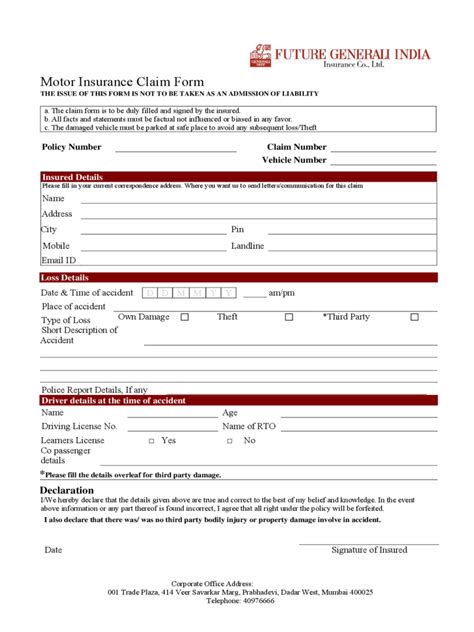

- Auto insurance claim forms: These forms are used to report accidents, theft, or damage to vehicles.

- Homeowners insurance claim forms: These forms are used to report damage or loss to homes, including damage caused by natural disasters, fires, or theft.

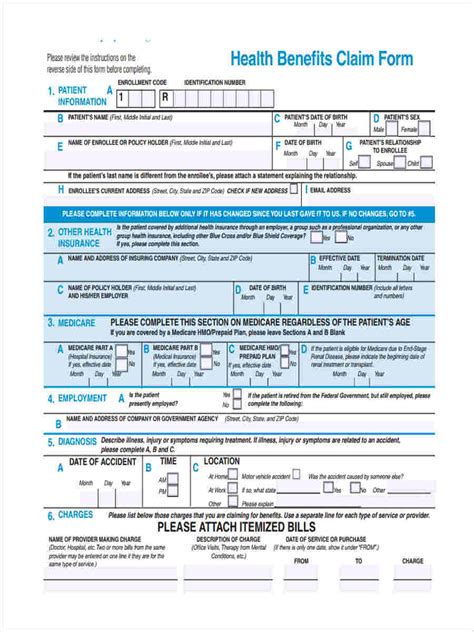

- Health insurance claim forms: These forms are used to report medical expenses, including doctor visits, hospital stays, and prescriptions.

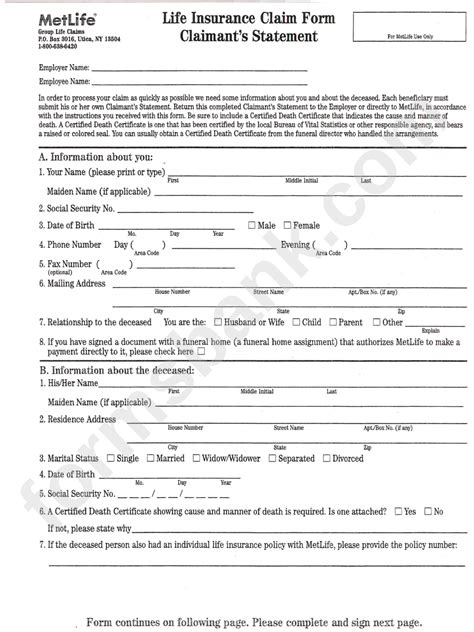

- Life insurance claim forms: These forms are used to report the death of a policyholder and to initiate the claims process.

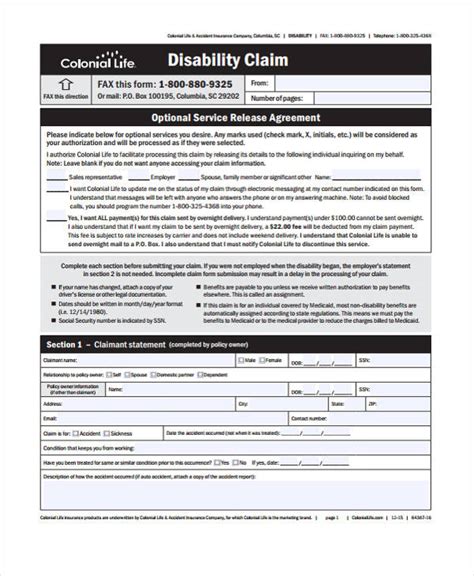

- Disability insurance claim forms: These forms are used to report injuries or illnesses that prevent policyholders from working.

Importance of Insurance Claim Forms

Insurance claim forms play a critical role in the claims process, as they provide the necessary information for insurance companies to assess and settle claims. The importance of insurance claim forms can be seen in the following ways:

- They help to establish the validity of a claim: Insurance claim forms require policyholders to provide detailed information about the incident or event that led to the claim, which helps insurance companies to verify the claim and determine the extent of the damage or loss.

- They facilitate the claims process: Insurance claim forms help to streamline the claims process by providing a standardized format for reporting claims, which enables insurance companies to process claims more efficiently.

- They protect policyholders' rights: Insurance claim forms help to ensure that policyholders' rights are protected by providing a clear and transparent process for reporting and settling claims.

Information Required on Insurance Claim Forms

Insurance claim forms typically require policyholders to provide a range of information, including:

- Personal and contact information: Policyholders are required to provide their name, address, phone number, and email address.

- Policy information: Policyholders are required to provide their policy number, coverage limits, and details about their policy, including the type of coverage and the deductible.

- Incident or event details: Policyholders are required to provide details about the incident or event that led to the claim, including the date, time, location, and extent of the damage or loss.

- Supporting documentation: Policyholders may be required to provide supporting documentation, such as police reports, medical records, or receipts, to support their claim.

Steps to Complete an Insurance Claim Form

Completing an insurance claim form can be a straightforward process if policyholders follow these steps:

- Read and understand the form: Policyholders should carefully read and understand the insurance claim form before completing it.

- Gather required information: Policyholders should gather all the required information, including personal and contact information, policy information, and incident or event details.

- Complete the form accurately: Policyholders should complete the form accurately and thoroughly, ensuring that all required fields are filled in.

- Attach supporting documentation: Policyholders should attach any supporting documentation, such as police reports or medical records, to the claim form.

- Submit the form: Policyholders should submit the completed claim form to their insurance company, either online or by mail.

Tips for Filing an Insurance Claim

Filing an insurance claim can be a complex and time-consuming process, but there are several tips that policyholders can follow to make the process smoother:

- Act quickly: Policyholders should act quickly to report their claim, as delays can lead to complications and disputes.

- Keep detailed records: Policyholders should keep detailed records of their claim, including correspondence with their insurance company and supporting documentation.

- Be honest and transparent: Policyholders should be honest and transparent when completing their claim form, as inaccuracies or omissions can lead to delays or disputes.

- Seek professional advice: Policyholders may want to consider seeking professional advice from a lawyer or insurance adjuster to help them navigate the claims process.

Common Mistakes to Avoid When Filing an Insurance Claim

There are several common mistakes that policyholders can make when filing an insurance claim, including:

- Failing to read and understand the policy: Policyholders should carefully read and understand their policy before filing a claim, as this can help them to avoid misunderstandings and disputes.

- Failing to keep detailed records: Policyholders should keep detailed records of their claim, including correspondence with their insurance company and supporting documentation.

- Failing to act quickly: Policyholders should act quickly to report their claim, as delays can lead to complications and disputes.

- Failing to be honest and transparent: Policyholders should be honest and transparent when completing their claim form, as inaccuracies or omissions can lead to delays or disputes.

Insurance Claim Forms Image Gallery

What is an insurance claim form?

+An insurance claim form is a document used to report a claim to an insurance company. It provides the necessary information for the insurance company to assess and settle the claim.

What information is required on an insurance claim form?

+Insurance claim forms typically require policyholders to provide personal and contact information, policy information, incident or event details, and supporting documentation.

How do I complete an insurance claim form?

+To complete an insurance claim form, policyholders should read and understand the form, gather required information, complete the form accurately, attach supporting documentation, and submit the form to their insurance company.

What are some common mistakes to avoid when filing an insurance claim?

+Common mistakes to avoid when filing an insurance claim include failing to read and understand the policy, failing to keep detailed records, failing to act quickly, and failing to be honest and transparent.

How can I ensure a smooth insurance claims process?

+To ensure a smooth insurance claims process, policyholders should act quickly, keep detailed records, be honest and transparent, and seek professional advice if necessary.

In conclusion, insurance claim forms are a critical part of the claims process, providing the necessary information for insurance companies to assess and settle claims. By understanding the importance of insurance claim forms, the types of forms available, and the information required, policyholders can navigate the claims process with confidence. Remember to act quickly, keep detailed records, be honest and transparent, and seek professional advice if necessary to ensure a smooth insurance claims process. If you have any questions or concerns about insurance claim forms, feel free to comment below or share this article with others who may find it helpful.