Intro

Discover how cost of customer acquisition impacts business growth, affecting marketing ROI, customer lifetime value, and retention strategies, making it crucial for companies to optimize acquisition costs.

The cost of customer acquisition is a crucial aspect of any business, as it directly impacts the company's revenue and profitability. In today's competitive market, acquiring new customers is more challenging than ever, and companies are willing to spend a significant amount of money to attract and retain them. However, the cost of customer acquisition can vary greatly depending on the industry, marketing strategies, and target audience. Understanding the cost of customer acquisition and how to optimize it is essential for businesses to succeed in the long run.

The cost of customer acquisition is not just about the money spent on marketing and advertising; it also includes the time and resources invested in converting leads into paying customers. Companies need to consider the cost of sales, customer support, and retention when calculating the total cost of customer acquisition. Moreover, the cost of customer acquisition can be affected by various factors such as the quality of leads, the effectiveness of marketing campaigns, and the overall customer experience.

As businesses continue to navigate the ever-changing landscape of customer acquisition, it is essential to stay focused on the metrics that matter most. The cost of customer acquisition is a critical metric that can make or break a business, and companies must be willing to adapt and evolve their strategies to stay ahead of the competition. By understanding the cost of customer acquisition and how to optimize it, businesses can make informed decisions about their marketing budgets, resource allocation, and customer retention strategies.

Understanding Customer Acquisition Cost

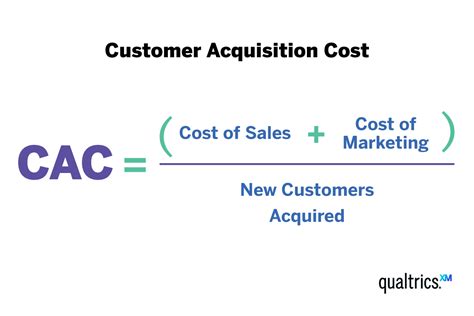

To calculate the CAC, businesses need to add up all the costs associated with acquiring new customers and divide that number by the total number of new customers acquired during a specific period. The formula for calculating CAC is:

CAC = (Total marketing expenses + Total sales expenses + Total customer support expenses) / Total number of new customers acquired

For example, if a company spends $1,000 on marketing, $500 on sales, and $200 on customer support, and acquires 100 new customers during a month, the CAC would be:

CAC = ($1,000 + $500 + $200) / 100 = $17.00 per customer

Benefits of Understanding Customer Acquisition Cost

Understanding the CAC is essential for businesses to evaluate the effectiveness of their customer acquisition strategies and make informed decisions about their marketing budgets. Here are some benefits of understanding the CAC:- Helps businesses evaluate the return on investment (ROI) of their marketing campaigns

- Enables companies to compare the effectiveness of different marketing channels and strategies

- Provides insights into the customer lifetime value (CLV) and helps businesses make informed decisions about customer retention

- Helps companies optimize their marketing budgets and allocate resources more efficiently

Factors Affecting Customer Acquisition Cost

- Quality of leads: The quality of leads can significantly impact the CAC. High-quality leads are more likely to convert into paying customers, reducing the CAC.

- Effectiveness of marketing campaigns: The effectiveness of marketing campaigns can also impact the CAC. Well-designed marketing campaigns can attract more leads and convert them into paying customers, reducing the CAC.

- Customer experience: The overall customer experience can also impact the CAC. Companies that provide a positive customer experience are more likely to retain customers and reduce the CAC.

- Industry and competition: The industry and competition can also impact the CAC. Companies operating in highly competitive industries may need to spend more on marketing and advertising to acquire new customers, increasing the CAC.

Strategies to Optimize Customer Acquisition Cost

To optimize the CAC, businesses need to focus on strategies that attract high-quality leads, improve the effectiveness of marketing campaigns, and provide a positive customer experience. Here are some strategies to optimize the CAC:- Use data and analytics to optimize marketing campaigns

- Focus on high-quality lead generation

- Improve the customer experience through personalized marketing and customer support

- Use retention strategies to reduce customer churn and improve customer lifetime value

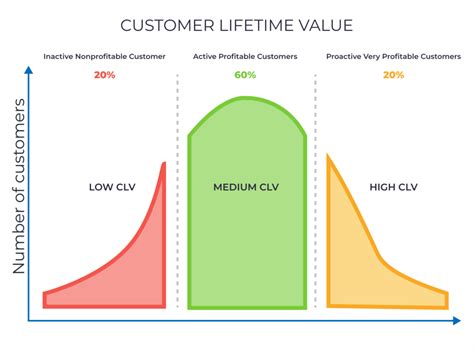

Calculating Customer Lifetime Value

The formula for calculating CLV is:

CLV = Average order value x Purchase frequency x Customer lifespan

For example, if a company's average order value is $100, purchase frequency is 5 times per year, and customer lifespan is 5 years, the CLV would be:

CLV = $100 x 5 x 5 = $2,500

Benefits of Understanding Customer Lifetime Value

Understanding the CLV is essential for businesses to evaluate the effectiveness of their customer acquisition and retention strategies. Here are some benefits of understanding the CLV:- Helps businesses evaluate the return on investment (ROI) of their marketing campaigns

- Enables companies to compare the effectiveness of different marketing channels and strategies

- Provides insights into the customer acquisition cost and helps businesses make informed decisions about customer retention

- Helps companies optimize their marketing budgets and allocate resources more efficiently

Strategies to Improve Customer Lifetime Value

- Use personalized marketing and customer support to improve the customer experience

- Offer loyalty programs and rewards to incentivize customers to make repeat purchases

- Use data and analytics to optimize marketing campaigns and improve customer engagement

- Focus on building strong relationships with customers through social media and community engagement

Measuring and Tracking Customer Acquisition Cost and Lifetime Value

Measuring and tracking the CAC and CLV is essential for businesses to evaluate the effectiveness of their customer acquisition and retention strategies. Here are some metrics to measure and track:- CAC: Track the CAC over time to evaluate the effectiveness of marketing campaigns and customer acquisition strategies.

- CLV: Track the CLV over time to evaluate the effectiveness of customer retention strategies and customer lifetime value.

- Customer retention rate: Track the customer retention rate to evaluate the effectiveness of customer retention strategies.

- Customer satisfaction: Track customer satisfaction to evaluate the effectiveness of customer support and customer experience strategies.

Customer Acquisition Cost Image Gallery

What is customer acquisition cost?

+Customer acquisition cost (CAC) is the cost of acquiring a new customer, including all the expenses related to marketing, sales, and customer support.

How do I calculate customer acquisition cost?

+To calculate the CAC, businesses need to add up all the costs associated with acquiring new customers and divide that number by the total number of new customers acquired during a specific period.

What is customer lifetime value?

+Customer lifetime value (CLV) is the total value of a customer to a business over their lifetime.

How do I calculate customer lifetime value?

+To calculate the CLV, businesses need to estimate the average order value, purchase frequency, and customer lifespan.

What are some strategies to optimize customer acquisition cost and lifetime value?

+Some strategies to optimize the CAC and CLV include using data and analytics to optimize marketing campaigns, focusing on high-quality lead generation, improving the customer experience, and using retention strategies to reduce customer churn.

In conclusion, understanding the cost of customer acquisition and lifetime value is essential for businesses to succeed in today's competitive market. By calculating and tracking these metrics, companies can evaluate the effectiveness of their customer acquisition and retention strategies, make informed decisions about their marketing budgets, and optimize their resource allocation. We hope this article has provided you with valuable insights into the world of customer acquisition and retention. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and colleagues, and let's continue the conversation on social media.