Intro

Boost payment efficiency with 5 expert credit card reader tips, covering mobile readers, chip technology, and contactless transactions, to enhance security and streamline POS systems for businesses.

The world of payment processing has undergone a significant transformation in recent years, with the rise of mobile payments and contactless transactions. For businesses, especially small and medium-sized enterprises, having a reliable credit card reader is crucial for accepting payments from customers. In this article, we will delve into the importance of credit card readers and provide valuable tips for businesses to make the most out of these devices.

Credit card readers have become an essential tool for businesses, allowing them to process transactions efficiently and securely. With the increasing demand for cashless payments, having a credit card reader can help businesses to stay competitive and attract more customers. Moreover, credit card readers can help businesses to reduce the risk of cash handling errors and minimize the need for manual transactions.

In today's fast-paced business environment, credit card readers play a vital role in streamlining payment processes and improving customer experience. With the advancement of technology, credit card readers have become more sophisticated, offering features such as contactless payments, mobile payments, and real-time transaction tracking. By leveraging these features, businesses can enhance their payment processes, reduce costs, and increase customer satisfaction.

Introduction to Credit Card Readers

A credit card reader is a device that enables businesses to accept credit and debit card payments from customers. These devices can be connected to a point-of-sale (POS) system or used as a standalone device. Credit card readers use encryption and tokenization to secure transactions, ensuring that sensitive customer information is protected.

Benefits of Using Credit Card Readers

The benefits of using credit card readers are numerous. Some of the key advantages include:

- Increased sales: By accepting credit and debit card payments, businesses can attract more customers and increase sales.

- Improved customer experience: Credit card readers enable businesses to process transactions quickly and efficiently, reducing wait times and improving customer satisfaction.

- Reduced cash handling errors: Credit card readers minimize the need for manual transactions, reducing the risk of cash handling errors and discrepancies.

- Enhanced security: Credit card readers use advanced security features such as encryption and tokenization to protect sensitive customer information.

Types of Credit Card Readers

There are several types of credit card readers available, including:

- Traditional credit card readers: These devices use a magnetic stripe to read credit and debit card information.

- Contactless credit card readers: These devices use near-field communication (NFC) technology to enable contactless payments.

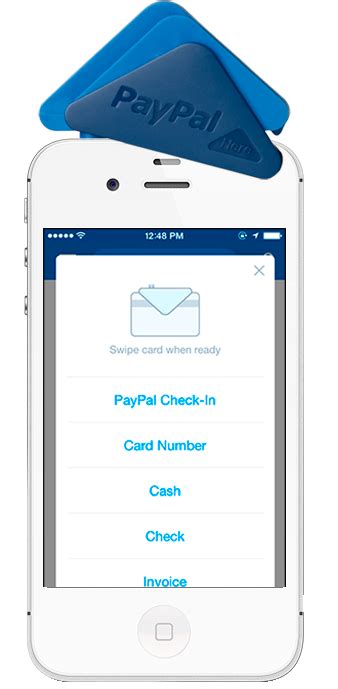

- Mobile credit card readers: These devices connect to a mobile device, such as a smartphone or tablet, and enable businesses to accept payments on-the-go.

- Online credit card readers: These devices enable businesses to accept payments online, through an e-commerce website or mobile app.

5 Credit Card Reader Tips

Here are five valuable tips for businesses to get the most out of their credit card readers:

- Choose the right credit card reader: With so many options available, it's essential to choose a credit card reader that meets your business needs. Consider factors such as transaction volume, security features, and compatibility with your POS system.

- Ensure security and compliance: Credit card readers must comply with industry security standards, such as PCI-DSS. Ensure that your credit card reader is secure and compliant to protect sensitive customer information.

- Train staff on credit card reader usage: Proper training is essential to ensure that staff can use the credit card reader effectively and efficiently. Provide ongoing training and support to ensure that staff are confident and competent in using the device.

- Monitor transaction activity: Regularly monitor transaction activity to detect any suspicious or fraudulent activity. This can help to prevent losses and protect your business from financial risk.

- Keep software and firmware up-to-date: Regularly update software and firmware to ensure that your credit card reader is running the latest security patches and features. This can help to prevent vulnerabilities and ensure that your device remains secure and compliant.

Best Practices for Credit Card Reader Maintenance

Regular maintenance is essential to ensure that your credit card reader is functioning correctly and securely. Here are some best practices for credit card reader maintenance:

- Clean the device regularly to prevent dust and debris from accumulating.

- Check for software and firmware updates regularly.

- Perform routine testing to ensure that the device is functioning correctly.

- Store the device in a secure location when not in use.

- Limit access to the device to authorized personnel only.

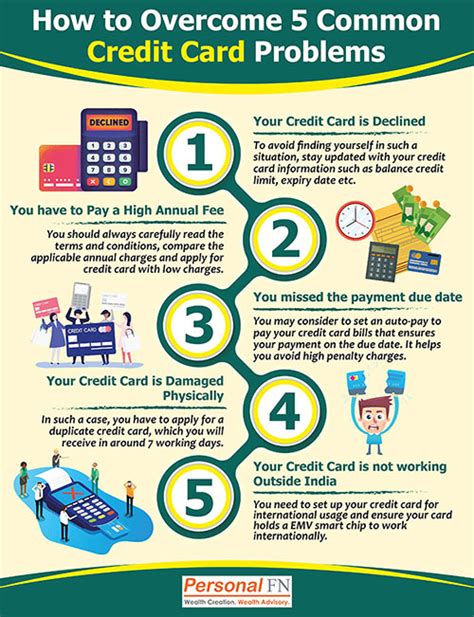

Common Credit Card Reader Issues and Troubleshooting Tips

Like any device, credit card readers can experience issues and errors. Here are some common issues and troubleshooting tips:

- Connection issues: Check that the device is properly connected to the POS system or mobile device.

- Transaction errors: Check that the customer's credit or debit card is valid and that the transaction amount is correct.

- Device malfunction: Check that the device is properly calibrated and that the software and firmware are up-to-date.

Gallery of Credit Card Readers

Credit Card Reader Image Gallery

What is a credit card reader?

+A credit card reader is a device that enables businesses to accept credit and debit card payments from customers.

What are the benefits of using a credit card reader?

+The benefits of using a credit card reader include increased sales, improved customer experience, reduced cash handling errors, and enhanced security.

How do I choose the right credit card reader for my business?

+Consider factors such as transaction volume, security features, and compatibility with your POS system when choosing a credit card reader.

How do I ensure the security and compliance of my credit card reader?

+Ensure that your credit card reader is secure and compliant by regularly updating software and firmware, using encryption and tokenization, and following industry security standards.

What are some common issues with credit card readers and how can I troubleshoot them?

+Common issues with credit card readers include connection issues, transaction errors, and device malfunctions. Troubleshoot these issues by checking connections, verifying transaction information, and updating software and firmware.

In conclusion, credit card readers are an essential tool for businesses to accept payments from customers. By following the tips and best practices outlined in this article, businesses can ensure that their credit card readers are functioning correctly and securely, and that they are providing a positive customer experience. Whether you're a small business owner or a large enterprise, investing in a reliable credit card reader can help to increase sales, improve customer satisfaction, and reduce the risk of financial loss. We hope that this article has provided you with valuable insights and information on credit card readers, and we invite you to share your thoughts and experiences in the comments below.