Intro

Learn 5 effective ways to win chargebacks, preventing revenue loss and minimizing dispute risks with expert tips on chargeback management, prevention, and rebuttal strategies.

The importance of understanding chargebacks cannot be overstated, especially for businesses that operate in the e-commerce space. Chargebacks are a consumer protection mechanism that allows customers to dispute transactions and reverse charges on their credit or debit cards. While chargebacks are intended to protect consumers from fraudulent transactions, they can also be used unfairly against merchants, resulting in significant financial losses. In recent years, the number of chargebacks has increased, and it's essential for businesses to know how to win chargebacks to minimize their financial impact.

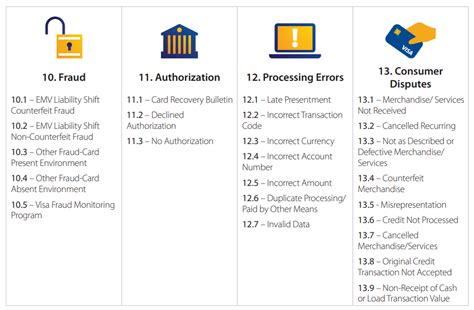

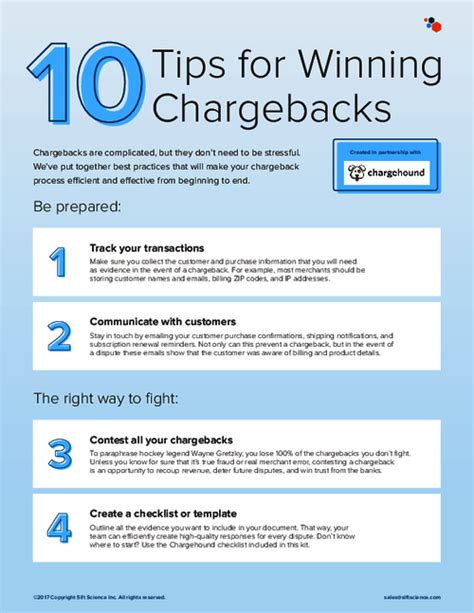

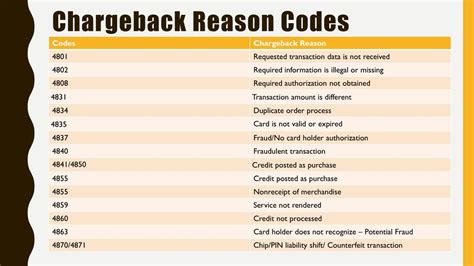

Chargebacks can be a major headache for businesses, and the process of resolving them can be time-consuming and costly. However, by understanding the chargeback process and taking proactive steps to prevent and dispute chargebacks, businesses can reduce their risk of financial losses. One of the most critical aspects of winning chargebacks is to have a thorough understanding of the chargeback reason codes, which are used by banks to categorize the reason for the dispute. By knowing the specific reason code associated with a chargeback, businesses can tailor their response to address the underlying issue and increase their chances of winning the dispute.

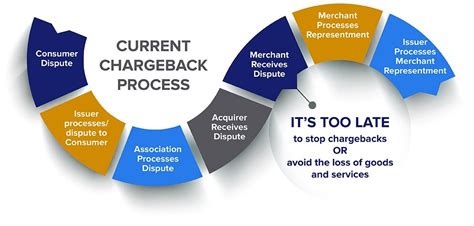

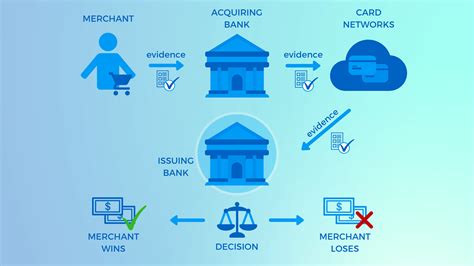

The chargeback process typically begins when a customer contacts their bank to dispute a transaction, and the bank then notifies the merchant's bank, which in turn notifies the merchant. The merchant is then given a limited time to respond to the dispute and provide evidence to support their claim. This is where having a solid understanding of the chargeback process and the necessary documentation to support a dispute is crucial. By providing compelling evidence and a well-structured response, businesses can increase their chances of winning chargebacks and reducing financial losses.

Understanding Chargeback Reason Codes

Providing Compelling Evidence

Responding to Chargebacks in a Timely Manner

Preventing Chargebacks

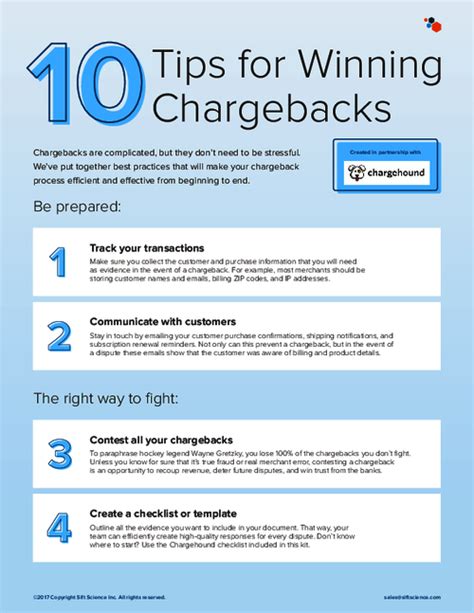

Best Practices for Winning Chargebacks

Some of the key benefits of winning chargebacks include:

- Reduced financial losses

- Improved customer satisfaction

- Increased revenue

- Enhanced reputation

- Better relationships with banks and financial institutions

To win chargebacks, businesses should:

- Understand the chargeback reason codes

- Provide compelling evidence

- Respond to chargebacks in a timely manner

- Prevent chargebacks by taking proactive steps

- Follow best practices for winning chargebacks

By following these steps and understanding the chargeback process, businesses can increase their chances of winning chargebacks and reducing financial losses.

Chargeback Image Gallery

What is a chargeback?

+A chargeback is a consumer protection mechanism that allows customers to dispute transactions and reverse charges on their credit or debit cards.

How do I prevent chargebacks?

+To prevent chargebacks, businesses can implement robust fraud detection measures, provide clear and concise product descriptions, and ensure that customers are aware of the terms and conditions of a transaction.

How do I respond to a chargeback?

+To respond to a chargeback, businesses should provide compelling evidence that addresses the underlying issue, such as proof of delivery or a signed receipt. It's also essential to respond quickly and ensure that all evidence is properly formatted and easily accessible.

What are the benefits of winning chargebacks?

+The benefits of winning chargebacks include reduced financial losses, improved customer satisfaction, increased revenue, enhanced reputation, and better relationships with banks and financial institutions.

How can I improve my chargeback win rate?

+To improve your chargeback win rate, businesses should understand the chargeback reason codes, provide compelling evidence, respond to chargebacks in a timely manner, prevent chargebacks by taking proactive steps, and follow best practices for winning chargebacks.

In summary, winning chargebacks requires a thorough understanding of the chargeback process, providing compelling evidence, responding to chargebacks in a timely manner, preventing chargebacks, and following best practices. By taking a proactive approach to chargeback prevention and dispute resolution, businesses can reduce their risk of financial losses and improve their overall customer satisfaction. We invite you to share your thoughts and experiences on chargebacks in the comments below. If you found this article helpful, please share it with others who may benefit from this information.