Intro

Discover 5 ways to accept payments online, including digital wallets, credit cards, and invoicing, to streamline transactions and boost sales with secure payment gateways and online payment processing solutions.

The ability to accept payments is a crucial aspect of any business, whether it's a small startup or a large corporation. With the rise of digital technologies, there are now more ways than ever to accept payments from customers. In this article, we will explore five ways to accept payments, including online payment gateways, mobile payments, credit card machines, bank transfers, and cash payments.

Accepting payments is essential for businesses to operate efficiently and effectively. It allows companies to receive funds from customers, which can then be used to invest in growth, pay employees, and cover expenses. Without a reliable payment system, businesses would struggle to survive, let alone thrive. In today's digital age, customers expect to have a variety of payment options available to them, and businesses that fail to deliver may lose out on sales and revenue.

The importance of accepting payments cannot be overstated. It's not just about receiving funds; it's also about providing a convenient and seamless experience for customers. When customers can easily pay for goods and services, they are more likely to return to a business and recommend it to others. On the other hand, a cumbersome or limited payment system can lead to frustration, cart abandonment, and a loss of customer loyalty. As such, businesses must prioritize payment acceptance and ensure that they have a robust and flexible system in place.

Online Payment Gateways

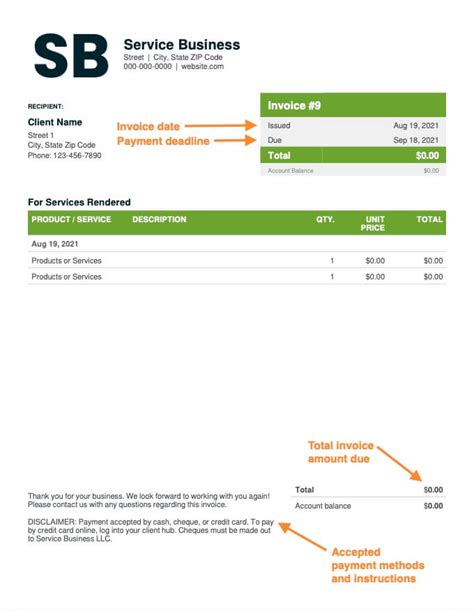

Online payment gateways offer a range of benefits for businesses, including increased convenience, improved security, and reduced costs. With an online payment gateway, businesses can accept payments from customers all over the world, without the need for physical infrastructure or manual processing. This makes it easier for businesses to expand their customer base and increase sales. Additionally, online payment gateways often provide robust security features, such as encryption and tokenization, to protect sensitive customer data.

Benefits of Online Payment Gateways

Some of the benefits of online payment gateways include: * Increased convenience for customers * Improved security for sensitive customer data * Reduced costs for businesses * Increased sales and revenue * Easy integration with e-commerce platformsMobile Payments

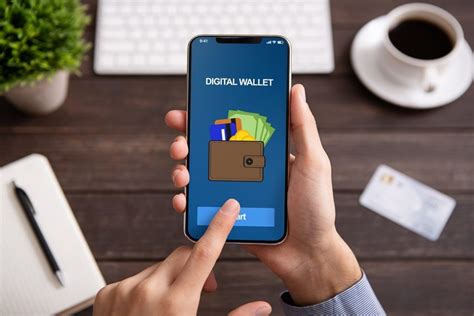

Mobile payments offer a range of benefits for businesses, including increased convenience, improved customer experience, and reduced costs. With mobile payments, businesses can accept payments from customers anywhere, at any time, without the need for physical infrastructure or manual processing. This makes it easier for businesses to increase sales and revenue, while also improving customer satisfaction.

Benefits of Mobile Payments

Some of the benefits of mobile payments include: * Increased convenience for customers * Improved customer experience * Reduced costs for businesses * Increased sales and revenue * Easy integration with mobile apps and websitesCredit Card Machines

Credit card machines offer a range of benefits for businesses, including increased sales, improved customer experience, and reduced costs. With credit card machines, businesses can accept payments from customers in person, without the need for manual processing or online payment gateways. This makes it easier for businesses to increase sales and revenue, while also improving customer satisfaction.

Benefits of Credit Card Machines

Some of the benefits of credit card machines include: * Increased sales and revenue * Improved customer experience * Reduced costs for businesses * Widely accepted payment method * Easy to use and integrate with point-of-sale systemsBank Transfers

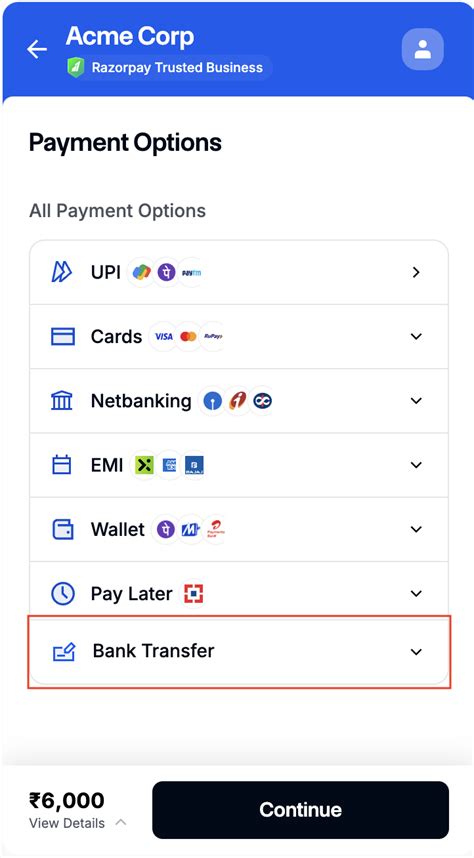

Bank transfers offer a range of benefits for businesses, including increased security, improved customer experience, and reduced costs. With bank transfers, businesses can accept payments from customers without the need for physical infrastructure or manual processing. This makes it easier for businesses to increase sales and revenue, while also improving customer satisfaction.

Benefits of Bank Transfers

Some of the benefits of bank transfers include: * Increased security for sensitive customer data * Improved customer experience * Reduced costs for businesses * Convenient and easy to use * Widely accepted payment methodCash Payments

Cash payments offer a range of benefits for businesses, including increased sales, improved customer experience, and reduced costs. With cash payments, businesses can accept payments from customers in person, without the need for manual processing or online payment gateways. This makes it easier for businesses to increase sales and revenue, while also improving customer satisfaction.

Benefits of Cash Payments

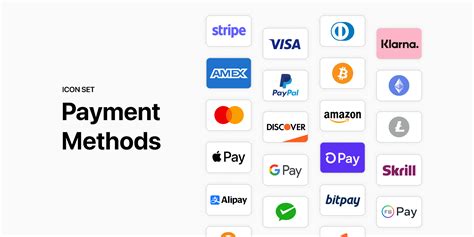

Some of the benefits of cash payments include: * Increased sales and revenue * Improved customer experience * Reduced costs for businesses * Widely accepted payment method * Easy to use and integrate with point-of-sale systemsPayment Methods Image Gallery

What are the benefits of online payment gateways?

+Online payment gateways offer increased convenience, improved security, and reduced costs for businesses. They also provide a seamless experience for customers, making it easier for them to pay for goods and services.

How do mobile payments work?

+Mobile payments allow customers to pay for goods and services using their mobile devices. They work by using a mobile app or wallet to store payment information, which is then used to make payments.

What are the benefits of credit card machines?

+Credit card machines offer increased sales, improved customer experience, and reduced costs for businesses. They also provide a secure way for customers to pay, using encryption and tokenization to protect sensitive data.

How do bank transfers work?

+Bank transfers allow customers to pay for goods and services by transferring funds directly from their bank account to the business's bank account. They work by using online banking or mobile banking apps to initiate the transfer.

What are the benefits of cash payments?

+Cash payments offer increased sales, improved customer experience, and reduced costs for businesses. They also provide a secure way for customers to pay, without the need for sensitive data or online processing.

In conclusion, accepting payments is a crucial aspect of any business, and there are many ways to do so. From online payment gateways to mobile payments, credit card machines, bank transfers, and cash payments, each method has its own benefits and drawbacks. By understanding the different payment methods available, businesses can choose the best options for their needs and provide a seamless experience for their customers. We invite you to share your thoughts on the different payment methods and how they can be used to improve the customer experience. Please comment below and let us know your opinions on this topic.