Intro

Master the 5 Steps Credit Process with ease, including credit application, reporting, scoring, and approval, to achieve financial stability and creditworthiness through credit monitoring and management.

The credit process is a crucial aspect of personal and business finance, allowing individuals and organizations to access funds for various purposes. Understanding the steps involved in the credit process is essential for making informed decisions and managing debt effectively. In this article, we will delve into the 5 steps credit process, exploring each stage in detail and providing valuable insights for readers.

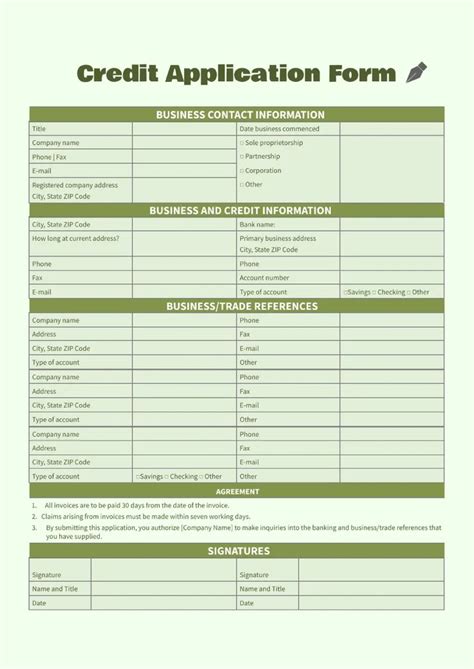

The credit process begins with a borrower's application, which sets the stage for the entire procedure. This initial step is critical, as it determines the borrower's eligibility for credit and the terms of the loan. The application process typically involves submitting personal and financial information, which is then reviewed by the lender. This review process helps lenders assess the borrower's creditworthiness and make informed decisions about the loan.

As we explore the 5 steps credit process, it becomes clear that each stage is interconnected and plays a vital role in the overall procedure. From the initial application to the final repayment, the credit process requires careful consideration and management. In the following sections, we will examine each step in detail, providing practical examples and statistical data to illustrate the concepts.

Introduction to the 5 Steps Credit Process

The 5 steps credit process is a comprehensive framework that guides lenders and borrowers through the credit application and approval procedure. This process is designed to ensure that credit is extended to eligible borrowers while minimizing the risk of default. By understanding the 5 steps credit process, borrowers can navigate the system more effectively, and lenders can make informed decisions about loan applications.

Step 1: Application and Pre-Qualification

The first step in the credit process involves the borrower submitting an application, which typically includes personal and financial information. This information is used to assess the borrower's creditworthiness and determine their eligibility for credit. The pre-qualification stage is an essential part of the application process, as it provides an initial assessment of the borrower's credit profile.

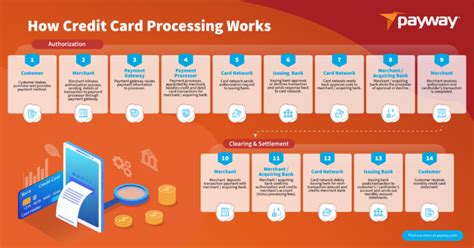

During this stage, lenders review the borrower's credit report, income, and other financial information to determine their credit score. The credit score is a critical factor in the credit process, as it helps lenders evaluate the borrower's creditworthiness and determine the terms of the loan. A good credit score can result in more favorable loan terms, including lower interest rates and higher credit limits.

Step 2: Credit Review and Analysis

The second step in the credit process involves a thorough review and analysis of the borrower's credit profile. This stage is critical, as it helps lenders assess the borrower's creditworthiness and determine the level of risk associated with the loan. The credit review process typically involves evaluating the borrower's credit history, income, and other financial information.

Lenders use various tools and techniques to analyze the borrower's credit profile, including credit scoring models and risk assessment frameworks. These tools help lenders identify potential risks and determine the likelihood of default. By carefully evaluating the borrower's credit profile, lenders can make informed decisions about loan applications and minimize the risk of default.

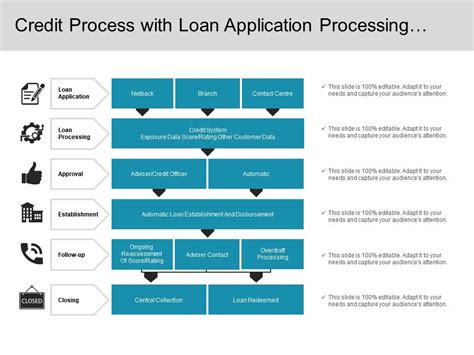

Step 3: Loan Approval and Terms

The third step in the credit process involves loan approval and the determination of loan terms. This stage is critical, as it sets the conditions for the loan and determines the borrower's repayment obligations. The loan approval process typically involves evaluating the borrower's credit profile, income, and other financial information to determine their eligibility for credit.

Once the loan is approved, the lender will outline the terms of the loan, including the interest rate, repayment schedule, and credit limit. The borrower must carefully review these terms to ensure they understand their repayment obligations and can manage the debt effectively. By understanding the loan terms, borrowers can avoid potential pitfalls and make informed decisions about their credit.

Step 4: Loan Disbursement and Repayment

The fourth step in the credit process involves loan disbursement and repayment. This stage is critical, as it sets the stage for the borrower's repayment obligations and determines the lender's risk exposure. The loan disbursement process typically involves transferring the loan funds to the borrower's account, which can be used for various purposes, such as purchasing a home or financing a business.

The repayment process involves the borrower making regular payments to the lender, which typically includes interest and principal payments. The repayment schedule is critical, as it determines the borrower's monthly payment obligations and the total cost of the loan. By understanding the repayment process, borrowers can manage their debt effectively and avoid potential pitfalls, such as late payments and default.

Step 5: Credit Monitoring and Maintenance

The final step in the credit process involves credit monitoring and maintenance. This stage is critical, as it helps lenders and borrowers manage the credit relationship and minimize the risk of default. The credit monitoring process typically involves tracking the borrower's credit profile, payment history, and other financial information to ensure they are managing their debt effectively.

By monitoring the borrower's credit profile, lenders can identify potential risks and take proactive steps to mitigate them. This may involve adjusting the loan terms, providing financial counseling, or taking other measures to ensure the borrower's creditworthiness. By maintaining a good credit profile, borrowers can enjoy more favorable loan terms, including lower interest rates and higher credit limits.

Gallery of Credit Process

Credit Process Image Gallery

What is the purpose of the credit process?

+The credit process is designed to evaluate an individual's or business's creditworthiness and determine their eligibility for credit. It helps lenders assess the risk of lending and make informed decisions about loan applications.

What are the key steps in the credit process?

+The key steps in the credit process include application and pre-qualification, credit review and analysis, loan approval and terms, loan disbursement and repayment, and credit monitoring and maintenance.

Why is credit monitoring important?

+Credit monitoring is essential for managing credit risk and ensuring that borrowers are managing their debt effectively. It helps lenders identify potential risks and take proactive steps to mitigate them, reducing the likelihood of default and maintaining a healthy credit relationship.

How can individuals improve their credit score?

+Individuals can improve their credit score by making timely payments, reducing debt, and maintaining a good credit history. They can also monitor their credit report and dispute any errors or inaccuracies to ensure their credit profile is accurate and up-to-date.

What are the benefits of understanding the credit process?

+Understanding the credit process can help individuals and businesses make informed decisions about credit and manage their debt effectively. It can also help them avoid potential pitfalls, such as late payments and default, and maintain a healthy credit relationship with lenders.

In conclusion, the 5 steps credit process is a critical framework for evaluating an individual's or business's creditworthiness and determining their eligibility for credit. By understanding each stage of the process, borrowers can navigate the system more effectively, and lenders can make informed decisions about loan applications. We invite readers to share their thoughts and experiences with the credit process, and we encourage them to ask questions and seek guidance from financial experts to ensure they are managing their credit effectively.