Intro

Boost credit scores with our 5 Ways Credit Tracker guide, featuring credit monitoring, report analysis, and score improvement strategies, including credit repair, debt management, and financial planning tips.

Credit tracking is an essential aspect of personal finance management, allowing individuals to monitor their credit scores, detect potential errors, and make informed decisions about their financial health. With the increasing importance of credit scores in determining loan eligibility, interest rates, and even employment opportunities, it's crucial to stay on top of your credit report. In this article, we'll explore five ways to track your credit, providing you with the tools and knowledge to take control of your financial well-being.

The significance of credit tracking cannot be overstated. Your credit score is a three-digit number that represents your creditworthiness, ranging from 300 to 850. A good credit score can open doors to better loan terms, lower interest rates, and even improved credit card offers. On the other hand, a poor credit score can lead to higher interest rates, reduced credit limits, and even loan rejections. By monitoring your credit report, you can identify areas for improvement, dispute errors, and work towards achieving a healthier credit profile.

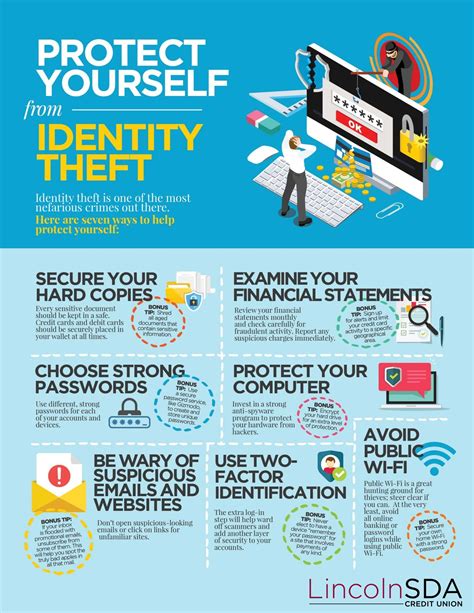

Moreover, credit tracking is not just about monitoring your credit score; it's also about protecting yourself from identity theft and credit fraud. By regularly checking your credit report, you can detect suspicious activity, such as unauthorized accounts or inquiries, and take prompt action to prevent further damage. With the rise of online transactions and digital payments, the risk of identity theft has increased, making credit tracking more crucial than ever.

In addition to the benefits mentioned above, credit tracking can also help you make informed decisions about your financial goals. Whether you're planning to buy a house, finance a car, or apply for a credit card, your credit score plays a significant role in determining the interest rates and terms you'll qualify for. By tracking your credit, you can identify areas for improvement, work on building a stronger credit profile, and ultimately achieve your financial objectives.

Understanding Credit Scores

Before we dive into the five ways to track your credit, it's essential to understand how credit scores work. Credit scores are calculated based on information in your credit report, which includes your payment history, credit utilization, credit age, credit mix, and new credit inquiries. The most widely used credit score is the FICO score, which ranges from 300 to 850. A good credit score is generally considered to be 700 or above, while a poor credit score is below 600.

Factors Affecting Credit Scores

The following factors can affect your credit score: * Payment history (35%): Late payments, accounts sent to collections, and bankruptcies can negatively impact your credit score. * Credit utilization (30%): High credit utilization can indicate a higher risk of default, while low credit utilization can improve your credit score. * Credit age (15%): A longer credit history can positively impact your credit score, while a shorter credit history may negatively affect it. * Credit mix (10%): A diverse mix of credit types, such as credit cards, loans, and mortgages, can improve your credit score. * New credit inquiries (10%): Applying for multiple credit cards or loans in a short period can negatively impact your credit score.5 Ways to Track Your Credit

Now that we've covered the basics of credit scores, let's explore the five ways to track your credit:

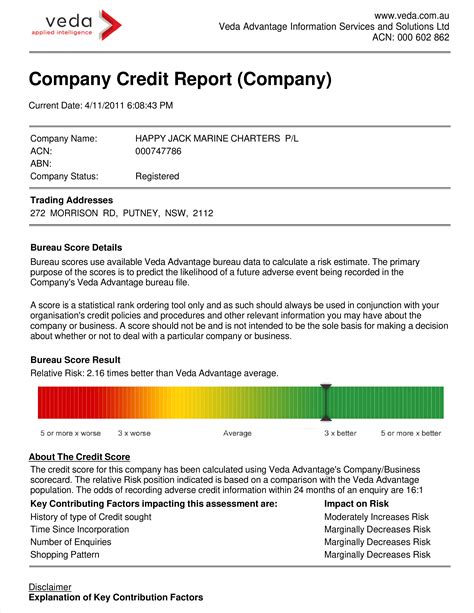

- Credit Reporting Agencies: You can request a free credit report from each of the three major credit reporting agencies (Experian, TransUnion, and Equifax) once a year. This will provide you with a comprehensive overview of your credit history, including any errors or inaccuracies.

- Credit Monitoring Services: Companies like Credit Karma, Credit Sesame, and IdentityForce offer free or paid credit monitoring services. These services provide you with access to your credit report, credit score, and alerts for any changes or suspicious activity.

- Credit Card Issuers: Many credit card issuers, such as Discover and Capital One, offer free credit scores and credit monitoring services to their cardholders. This can be a convenient way to track your credit without having to sign up for a separate service.

- Mobile Apps: Apps like Credit Karma, Mint, and Personal Capital allow you to track your credit score, credit report, and financial accounts in one place. These apps often provide personalized recommendations and alerts to help you improve your credit.

- DIY Credit Tracking: You can also track your credit manually by requesting your credit report, reviewing it for errors, and monitoring your credit score over time. This method requires more effort, but it can be a cost-effective way to stay on top of your credit.

Benefits of Credit Tracking

The benefits of credit tracking include: * Improved credit score: By monitoring your credit report and score, you can identify areas for improvement and work towards achieving a healthier credit profile. * Reduced risk of identity theft: Regularly checking your credit report can help you detect suspicious activity and prevent further damage. * Better loan terms: A good credit score can qualify you for better loan terms, including lower interest rates and more favorable repayment terms. * Increased financial awareness: Credit tracking can help you understand your financial situation and make informed decisions about your money.Best Practices for Credit Tracking

To get the most out of credit tracking, follow these best practices:

- Check your credit report regularly: Request your credit report from each of the three major credit reporting agencies once a year, and review it for errors or inaccuracies.

- Monitor your credit score: Keep track of your credit score over time, and work towards achieving a healthier credit profile.

- Set up alerts: Set up alerts for any changes or suspicious activity on your credit report, and take prompt action to prevent further damage.

- Avoid applying for too much credit: Applying for multiple credit cards or loans in a short period can negatively impact your credit score.

- Pay your bills on time: Late payments can negatively impact your credit score, so make sure to pay your bills on time, every time.

Common Credit Tracking Mistakes

Common mistakes to avoid when tracking your credit include: * Not checking your credit report regularly: Failing to review your credit report can lead to errors or inaccuracies going undetected. * Not monitoring your credit score: Not keeping track of your credit score can make it difficult to identify areas for improvement. * Applying for too much credit: Applying for multiple credit cards or loans in a short period can negatively impact your credit score. * Not paying your bills on time: Late payments can negatively impact your credit score, so make sure to pay your bills on time, every time.Conclusion and Next Steps

In conclusion, credit tracking is a crucial aspect of personal finance management. By monitoring your credit report and score, you can identify areas for improvement, detect potential errors, and make informed decisions about your financial health. Remember to check your credit report regularly, monitor your credit score, set up alerts, avoid applying for too much credit, and pay your bills on time. By following these best practices and avoiding common mistakes, you can achieve a healthier credit profile and improve your overall financial well-being.

Credit Tracking Image Gallery

What is credit tracking?

+Credit tracking is the process of monitoring your credit report and score to identify areas for improvement, detect potential errors, and make informed decisions about your financial health.

Why is credit tracking important?

+Credit tracking is important because it allows you to monitor your credit report and score, detect potential errors, and make informed decisions about your financial health. It can also help you identify areas for improvement and work towards achieving a healthier credit profile.

How can I track my credit?

+You can track your credit by requesting your credit report from each of the three major credit reporting agencies, monitoring your credit score, setting up alerts, and using credit monitoring services or mobile apps.

What are the benefits of credit tracking?

+The benefits of credit tracking include improved credit score, reduced risk of identity theft, better loan terms, and increased financial awareness.

How often should I check my credit report?

+You should check your credit report at least once a year, and more often if you're actively working to improve your credit score or detect potential errors.

We hope this article has provided you with a comprehensive understanding of credit tracking and its importance in personal finance management. By following the best practices and tips outlined above, you can take control of your credit and achieve a healthier financial profile. Remember to share your thoughts and experiences with credit tracking in the comments below, and don't forget to share this article with your friends and family who may benefit from this information.