Intro

Understanding and managing credit limits is crucial for maintaining a healthy financial profile. A credit limit worksheet can be an invaluable tool in this endeavor, helping individuals track their credit utilization ratio, plan expenses, and make informed decisions about their financial resources. The importance of effectively managing credit limits cannot be overstated, as it directly impacts credit scores, which in turn influence interest rates on loans, credit card approvals, and even employment opportunities in some cases.

Effective credit management is about striking a balance between available credit and actual usage. It's not just about having a high credit limit, but also about keeping credit utilization low to demonstrate responsible financial behavior. A well-structured credit limit worksheet can help in achieving this balance by providing a clear overview of all credit accounts, their respective limits, current balances, and the percentage of the limit being used.

For those looking to improve their financial literacy and manage their credit more effectively, there are several strategies and tools available. One of the most straightforward and effective methods is using a credit limit worksheet. This tool allows individuals to monitor their credit card balances, credit limits, and utilization rates across all their accounts. By doing so, it helps in identifying areas where adjustments can be made to optimize credit usage and improve overall financial health.

Introduction to Credit Limit Worksheets

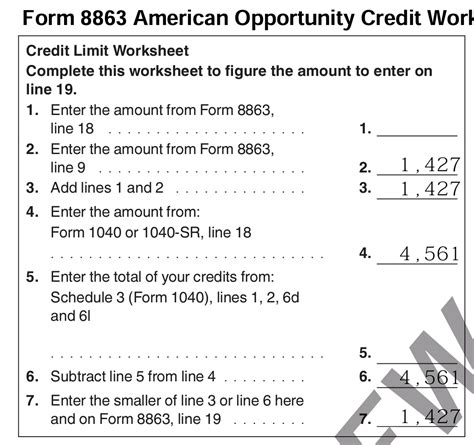

A credit limit worksheet is essentially a personalized document or spreadsheet designed to help individuals track and manage their credit limits across various credit accounts. It's a simple yet powerful tool that can be customized to fit individual needs, providing a snapshot of credit health at any given time. By regularly updating and reviewing this worksheet, individuals can gain insights into their spending habits, identify potential issues before they escalate, and make proactive decisions to maintain or improve their credit standing.

Benefits of Using a Credit Limit Worksheet

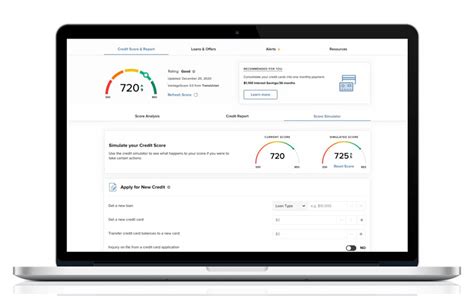

The benefits of incorporating a credit limit worksheet into one's financial management routine are multifaceted. Firstly, it enhances awareness of credit utilization, which is a critical component of credit scoring models. By keeping track of how much credit is being used versus the amount available, individuals can ensure they are not overextending themselves and can make adjustments as necessary to keep their credit utilization ratio in check. This proactive approach can lead to significant improvements in credit scores over time, opening up better financial opportunities.

Moreover, a credit limit worksheet can serve as a budgeting tool, helping individuals allocate their financial resources more efficiently. By having a clear picture of their credit limits and current balances, people can plan their expenses more effectively, avoid overspending, and make timely payments to avoid interest charges and late fees. This level of financial organization can also reduce stress related to debt management, providing peace of mind and a sense of control over one's financial situation.

Steps to Create a Credit Limit Worksheet

Creating a credit limit worksheet is a straightforward process that can be tailored to individual preferences and needs. The basic steps involve:

- Listing All Credit Accounts: Start by making a list of all credit accounts, including credit cards, lines of credit, and loans. Ensure that every account is included to get an accurate picture of your credit situation.

- Gathering Credit Limit Information: For each account, note down the credit limit. This information can usually be found on the credit card statement, by logging into the account online, or by contacting the credit issuer directly.

- Recording Current Balances: Update the worksheet with the current balance of each account. This will help in calculating the credit utilization ratio for each account and overall.

- Calculating Credit Utilization: Calculate the credit utilization ratio for each account by dividing the current balance by the credit limit and then multiplying by 100 to get the percentage. Also, calculate the overall credit utilization by summing all balances and dividing by the total of all credit limits.

- Reviewing and Adjusting: Regularly review the worksheet to monitor progress, identify areas for improvement, and make necessary adjustments to spending habits or payment strategies.

Practical Applications of Credit Limit Worksheets

In practical terms, a credit limit worksheet can be a highly effective tool for achieving specific financial goals. For instance, individuals looking to improve their credit scores can use the worksheet to ensure they are keeping their credit utilization ratios below the recommended 30%. This can involve strategies such as reducing spending on certain credit cards, making extra payments to lower balances, or even requesting credit limit increases on accounts with high utilization rates, provided the individual is confident in their ability to manage the increased credit responsibly.

Moreover, for those dealing with debt, a credit limit worksheet can be instrumental in devising a debt reduction plan. By prioritizing accounts with the highest interest rates or the smallest balances, individuals can focus their payments effectively, saving money on interest over time and becoming debt-free sooner.

Tips for Maximizing the Use of a Credit Limit Worksheet

To get the most out of a credit limit worksheet, consider the following tips:

- Regular Updates: Ensure the worksheet is updated regularly, ideally every month, to reflect changes in credit limits, balances, and utilization ratios.

- Automate Payments: Set up automatic payments for credit accounts to avoid late fees and negative impacts on credit scores.

- Monitor Credit Reports: Periodically review credit reports to ensure they are accurate and up-to-date, as errors can affect credit scores and the effectiveness of the credit limit worksheet.

- Adjust Spending Habits: Use insights from the worksheet to adjust spending habits, aiming to keep credit utilization low and make timely payments.

Gallery of Credit Management Tools

Credit Management Tools Image Gallery

What is the purpose of a credit limit worksheet?

+The purpose of a credit limit worksheet is to help individuals track and manage their credit limits across various credit accounts, providing insights into credit utilization and aiding in financial planning and decision-making.

How often should I update my credit limit worksheet?

+It's recommended to update your credit limit worksheet regularly, ideally every month, to reflect changes in credit limits, balances, and utilization ratios, ensuring you have an accurate and up-to-date picture of your credit situation.

Can a credit limit worksheet help improve my credit score?

+Yes, a credit limit worksheet can help improve your credit score by enabling you to monitor and manage your credit utilization ratio effectively, make timely payments, and avoid overspending, all of which are critical factors in determining credit scores.

In conclusion, a credit limit worksheet is a versatile and essential tool for anyone seeking to manage their credit effectively, improve their financial literacy, and achieve long-term financial stability. By understanding the importance of credit management, creating a personalized credit limit worksheet, and using it regularly to guide financial decisions, individuals can navigate the complexities of credit with confidence and precision. Whether you're looking to rebuild credit, avoid debt, or simply maintain a healthy financial profile, incorporating a credit limit worksheet into your financial routine can be a pivotal step towards securing a brighter financial future. So, take the first step today, and start building the financial foundation you deserve.