Intro

Discover 5 ways Davo Sales Tax simplifies ecommerce tax management, automating sales tax collection, filing, and remittance, ensuring compliance and accuracy, while reducing audit risks and penalties, and streamlining online business operations.

The world of sales tax can be complex and overwhelming, especially for businesses that operate in multiple states or countries. However, with the right tools and strategies, managing sales tax can become a breeze. One such tool is Davo Sales Tax, a cutting-edge solution designed to simplify sales tax compliance for businesses of all sizes. In this article, we will explore five ways Davo Sales Tax can benefit your business and help you stay on top of your sales tax obligations.

Davo Sales Tax is a cloud-based platform that automates sales tax compliance, making it easier for businesses to collect, report, and remit sales tax. With its advanced technology and user-friendly interface, Davo Sales Tax is an ideal solution for businesses looking to streamline their sales tax processes and reduce the risk of errors and penalties. Whether you're a small online retailer or a large enterprise, Davo Sales Tax can help you navigate the complex world of sales tax with ease.

The importance of sales tax compliance cannot be overstated. Failure to comply with sales tax laws and regulations can result in significant fines and penalties, damage to your business reputation, and even loss of business licenses. Moreover, sales tax rates and rules are constantly changing, making it challenging for businesses to keep up with the latest developments. This is where Davo Sales Tax comes in – a reliable and efficient solution that helps businesses stay ahead of the sales tax curve.

Introduction to Davo Sales Tax

Davo Sales Tax is a comprehensive sales tax solution that offers a range of features and benefits to businesses. From automated sales tax collection to detailed reporting and analytics, Davo Sales Tax provides everything you need to manage your sales tax obligations with confidence. With its scalable and flexible design, Davo Sales Tax can be easily integrated into your existing accounting and e-commerce systems, ensuring seamless and efficient sales tax management.

Benefits of Using Davo Sales Tax

So, what are the benefits of using Davo Sales Tax? Here are five ways Davo Sales Tax can benefit your business:

- Automated Sales Tax Collection: Davo Sales Tax automates the sales tax collection process, ensuring that you collect the correct amount of sales tax from your customers. This reduces the risk of errors and penalties, and saves you time and resources.

- Accurate Sales Tax Reporting: Davo Sales Tax provides detailed and accurate sales tax reporting, making it easier for you to track and manage your sales tax obligations. With its advanced analytics and insights, you can gain a deeper understanding of your sales tax data and make informed decisions about your business.

- Streamlined Sales Tax Remittance: Davo Sales Tax streamlines the sales tax remittance process, ensuring that you remit the correct amount of sales tax to the relevant authorities on time. This reduces the risk of penalties and fines, and saves you time and resources.

- Real-Time Sales Tax Rates and Rules: Davo Sales Tax provides real-time sales tax rates and rules, ensuring that you stay up-to-date with the latest developments in sales tax laws and regulations. This reduces the risk of errors and penalties, and saves you time and resources.

- Scalable and Flexible Design: Davo Sales Tax has a scalable and flexible design, making it easy to integrate into your existing accounting and e-commerce systems. This ensures seamless and efficient sales tax management, and reduces the risk of errors and penalties.

How Davo Sales Tax Works

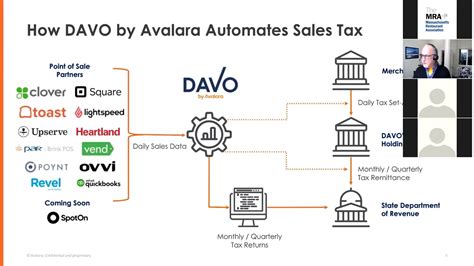

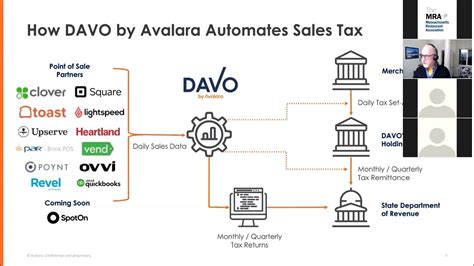

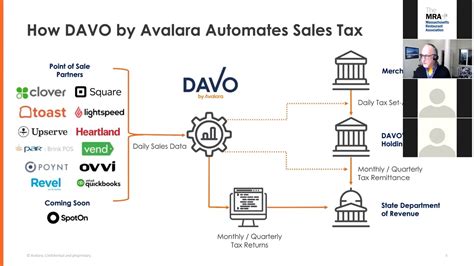

So, how does Davo Sales Tax work? Here's a step-by-step overview of the process:

- Integration: Davo Sales Tax is integrated into your existing accounting and e-commerce systems, ensuring seamless and efficient sales tax management.

- Automated Sales Tax Collection: Davo Sales Tax automates the sales tax collection process, ensuring that you collect the correct amount of sales tax from your customers.

- Real-Time Sales Tax Rates and Rules: Davo Sales Tax provides real-time sales tax rates and rules, ensuring that you stay up-to-date with the latest developments in sales tax laws and regulations.

- Accurate Sales Tax Reporting: Davo Sales Tax provides detailed and accurate sales tax reporting, making it easier for you to track and manage your sales tax obligations.

- Streamlined Sales Tax Remittance: Davo Sales Tax streamlines the sales tax remittance process, ensuring that you remit the correct amount of sales tax to the relevant authorities on time.

Features of Davo Sales Tax

Davo Sales Tax offers a range of features and benefits to businesses, including:

- Automated Sales Tax Collection: Davo Sales Tax automates the sales tax collection process, ensuring that you collect the correct amount of sales tax from your customers.

- Real-Time Sales Tax Rates and Rules: Davo Sales Tax provides real-time sales tax rates and rules, ensuring that you stay up-to-date with the latest developments in sales tax laws and regulations.

- Accurate Sales Tax Reporting: Davo Sales Tax provides detailed and accurate sales tax reporting, making it easier for you to track and manage your sales tax obligations.

- Streamlined Sales Tax Remittance: Davo Sales Tax streamlines the sales tax remittance process, ensuring that you remit the correct amount of sales tax to the relevant authorities on time.

- Scalable and Flexible Design: Davo Sales Tax has a scalable and flexible design, making it easy to integrate into your existing accounting and e-commerce systems.

Benefits for Businesses

Davo Sales Tax offers a range of benefits for businesses, including:

- Reduced Risk of Errors and Penalties: Davo Sales Tax automates the sales tax collection process, reducing the risk of errors and penalties.

- Increased Efficiency: Davo Sales Tax streamlines the sales tax remittance process, saving you time and resources.

- Improved Accuracy: Davo Sales Tax provides detailed and accurate sales tax reporting, making it easier for you to track and manage your sales tax obligations.

- Real-Time Sales Tax Rates and Rules: Davo Sales Tax provides real-time sales tax rates and rules, ensuring that you stay up-to-date with the latest developments in sales tax laws and regulations.

- Scalable and Flexible Design: Davo Sales Tax has a scalable and flexible design, making it easy to integrate into your existing accounting and e-commerce systems.

Gallery of Davo Sales Tax Images

Davo Sales Tax Image Gallery

What is Davo Sales Tax?

+Davo Sales Tax is a cloud-based platform that automates sales tax compliance, making it easier for businesses to collect, report, and remit sales tax.

How does Davo Sales Tax work?

+Davo Sales Tax automates the sales tax collection process, provides real-time sales tax rates and rules, and streamlines the sales tax remittance process.

What are the benefits of using Davo Sales Tax?

+The benefits of using Davo Sales Tax include reduced risk of errors and penalties, increased efficiency, improved accuracy, and real-time sales tax rates and rules.

Is Davo Sales Tax scalable and flexible?

+Yes, Davo Sales Tax has a scalable and flexible design, making it easy to integrate into your existing accounting and e-commerce systems.

How can I get started with Davo Sales Tax?

+You can get started with Davo Sales Tax by visiting their website and signing up for a free trial or contacting their sales team for more information.

In conclusion, Davo Sales Tax is a powerful tool that can help businesses simplify their sales tax compliance and reduce the risk of errors and penalties. With its automated sales tax collection, real-time sales tax rates and rules, and streamlined sales tax remittance, Davo Sales Tax is an ideal solution for businesses of all sizes. Whether you're a small online retailer or a large enterprise, Davo Sales Tax can help you navigate the complex world of sales tax with ease. So why wait? Sign up for a free trial today and see how Davo Sales Tax can benefit your business. Share this article with your friends and colleagues who may be struggling with sales tax compliance, and let's work together to make sales tax management easier and more efficient for everyone.