Intro

Pay off debt quickly with a Debt Snowball Printable, a strategy using debt consolidation, budgeting tools, and financial planning to achieve debt freedom.

Debt can be overwhelming, especially when you have multiple debts with different interest rates and payment due dates. It's easy to feel like you're drowning in a sea of debt, with no clear way to escape. However, there is a strategy that can help you pay off your debts quickly and efficiently: the debt snowball method. In this article, we'll explore the debt snowball method, its benefits, and how you can use a debt snowball printable to get started.

The debt snowball method was popularized by financial expert Dave Ramsey, who argues that paying off debts in a specific order can help you build momentum and stay motivated. The basic idea is to list all of your debts, from the smallest balance to the largest, and then focus on paying off the smallest debt first. Once you've paid off the smallest debt, you'll use the money you were paying on that debt to attack the next smallest debt, and so on. This approach can help you quickly eliminate smaller debts and free up more money in your budget to tackle larger debts.

One of the key benefits of the debt snowball method is that it provides a clear plan of action. When you're facing a large amount of debt, it can be hard to know where to start. The debt snowball method gives you a simple, step-by-step approach to paying off your debts, which can help you feel more in control and confident. Additionally, the debt snowball method can help you build momentum and celebrate small victories along the way. Paying off a debt, no matter how small, can be a powerful motivator, and the debt snowball method allows you to experience the thrill of paying off a debt quickly.

Understanding the Debt Snowball Method

To understand the debt snowball method, let's consider an example. Suppose you have three debts: a credit card balance of $500, a car loan of $10,000, and a student loan of $30,000. Using the debt snowball method, you would focus on paying off the credit card balance first, since it has the smallest balance. Once you've paid off the credit card, you'll use the money you were paying on that debt to attack the car loan, and then finally the student loan.

Benefits of the Debt Snowball Method

The debt snowball method has several benefits, including: * Provides a clear plan of action * Helps build momentum and motivation * Allows you to celebrate small victories along the way * Can help you pay off debts quickly and efficientlyCreating a Debt Snowball Printable

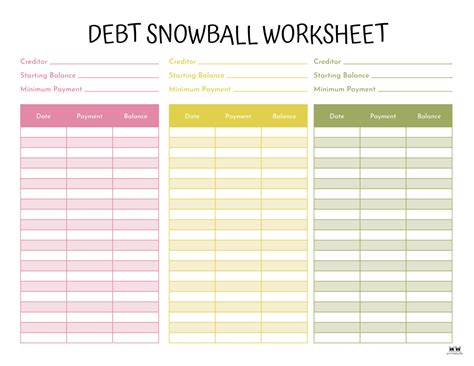

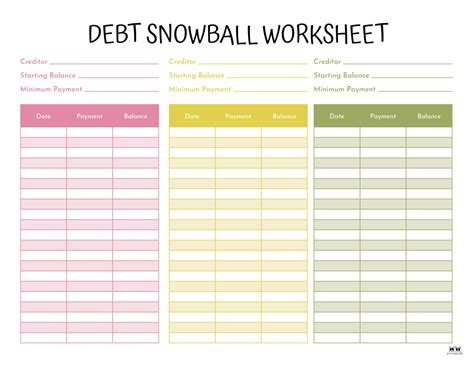

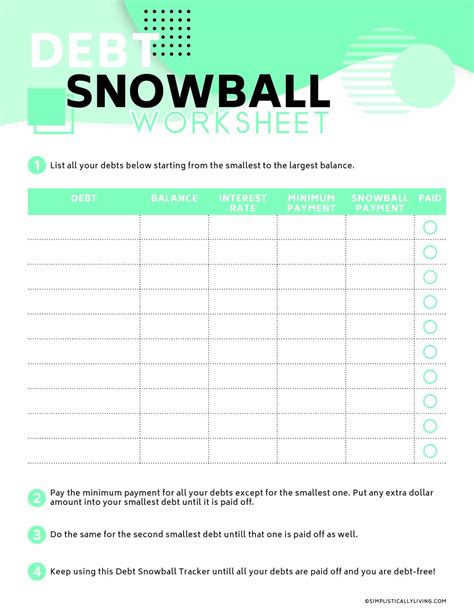

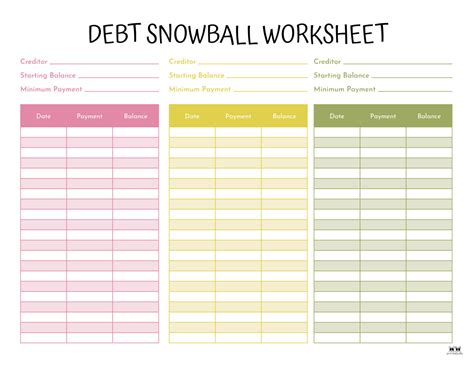

A debt snowball printable can be a powerful tool to help you get started with the debt snowball method. A debt snowball printable is a worksheet that allows you to list all of your debts, calculate your total debt, and create a plan to pay off your debts. To create a debt snowball printable, you'll need to gather some information, including:

- A list of all of your debts, including credit cards, loans, and other debts

- The balance and interest rate for each debt

- The minimum payment for each debt

- Your total monthly income and expenses

Steps to Create a Debt Snowball Printable

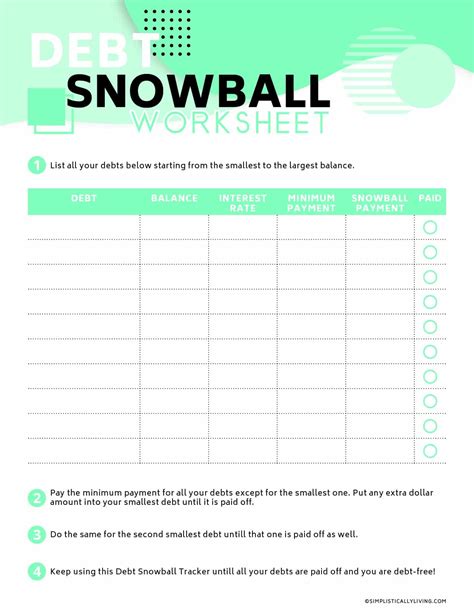

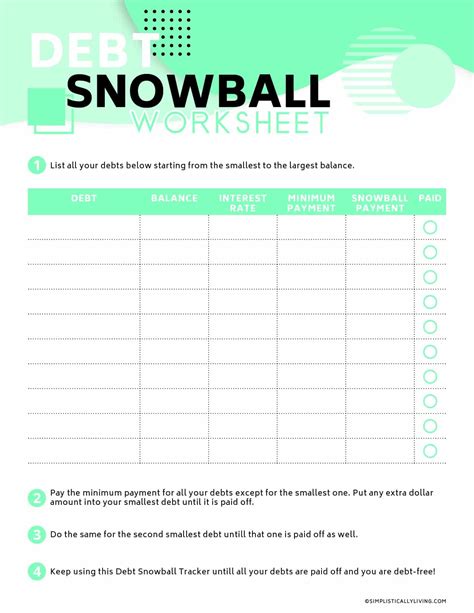

Here are the steps to create a debt snowball printable: 1. List all of your debts, from the smallest balance to the largest. 2. Calculate the total debt and the total minimum payment for all debts. 3. Determine how much money you can afford to pay each month towards your debts. 4. Create a plan to pay off your debts, one by one, using the debt snowball method.Using a Debt Snowball Printable to Pay Off Debt

Once you have a debt snowball printable, you can use it to pay off your debts. Here are some tips to keep in mind:

- Make sure to pay the minimum payment on all debts except the smallest one.

- Put as much money as possible towards the smallest debt.

- Once you've paid off the smallest debt, use the money you were paying on that debt to attack the next smallest debt.

- Continue this process until you've paid off all of your debts.

Tips for Success

Here are some additional tips to help you succeed with the debt snowball method: * Make sure to track your progress and celebrate your successes along the way. * Consider using a budgeting app or spreadsheet to help you stay on track. * Don't be afraid to seek help if you're struggling to pay off your debts.Common Mistakes to Avoid

While the debt snowball method can be an effective way to pay off debt, there are some common mistakes to avoid. Here are a few:

- Not having a clear plan: Without a clear plan, it's easy to get off track and lose momentum.

- Not tracking progress: Failing to track your progress can make it difficult to stay motivated and see the results of your efforts.

- Not being consistent: Consistency is key when it comes to paying off debt. Make sure to stick to your plan and avoid getting sidetracked.

Overcoming Obstacles

Here are some tips for overcoming common obstacles: * Don't be too hard on yourself if you slip up - simply get back on track and keep moving forward. * Consider seeking help from a financial advisor or credit counselor if you're struggling to pay off your debts. * Remember that paying off debt takes time and effort, but the end result is worth it.Conclusion and Next Steps

In conclusion, the debt snowball method can be a powerful tool to help you pay off your debts quickly and efficiently. By creating a debt snowball printable and following the steps outlined in this article, you can take control of your debt and start building a brighter financial future. Remember to stay consistent, track your progress, and celebrate your successes along the way.

Final Thoughts

Here are some final thoughts to keep in mind: * Paying off debt takes time and effort, but the end result is worth it. * Don't be afraid to seek help if you're struggling to pay off your debts. * Remember to stay positive and focused on your goals.Debt Snowball Image Gallery

What is the debt snowball method?

+The debt snowball method is a strategy for paying off debt that involves listing all of your debts, from the smallest balance to the largest, and then focusing on paying off the smallest debt first.

How do I create a debt snowball printable?

+To create a debt snowball printable, you'll need to gather some information, including a list of all of your debts, the balance and interest rate for each debt, and your total monthly income and expenses.

What are some common mistakes to avoid when using the debt snowball method?

+Some common mistakes to avoid when using the debt snowball method include not having a clear plan, not tracking progress, and not being consistent.

How long does it take to pay off debt using the debt snowball method?

+The amount of time it takes to pay off debt using the debt snowball method will vary depending on the amount of debt you have and the amount of money you can afford to pay each month.

Is the debt snowball method the best way to pay off debt?

+The debt snowball method is one of several strategies for paying off debt, and whether it is the best method for you will depend on your individual circumstances and financial goals.

We hope this article has been helpful in explaining the debt snowball method and how to use a debt snowball printable to pay off your debts. Remember to stay consistent, track your progress, and celebrate your successes along the way. If you have any questions or comments, please don't hesitate to reach out. We'd love to hear from you and help you on your journey to becoming debt-free. Share this article with your friends and family who may be struggling with debt, and let's work together to build a brighter financial future.