Intro

Debt can be overwhelming, especially when you have multiple debts with different interest rates and payment due dates. However, with the right strategy, you can pay off your debts and achieve financial freedom. One popular method for paying off debt is the debt snowball approach, which involves paying off debts in a specific order to build momentum and motivation. A debt snowball worksheet printable can be a useful tool to help you get started with this approach.

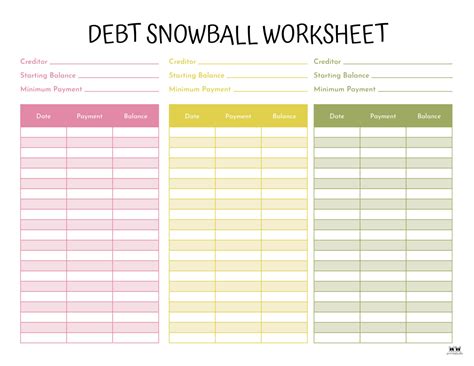

The debt snowball method was popularized by financial expert Dave Ramsey, who recommends paying off debts in the order of smallest balance to largest. This approach can be effective because it allows you to quickly pay off smaller debts and see progress, which can be motivating and help you stay on track. To use the debt snowball method, you will need to make a list of all your debts, including the balance, interest rate, and minimum payment for each debt. You can then use a debt snowball worksheet printable to help you organize your debts and create a plan for paying them off.

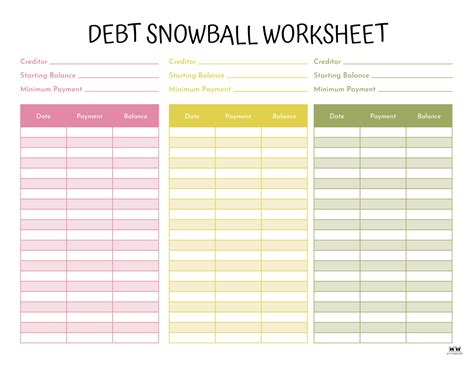

How to Use a Debt Snowball Worksheet Printable

Using a debt snowball worksheet printable is a simple process that can help you take control of your debt and create a plan for paying it off. Here are the steps to follow:

- List all your debts, including credit cards, loans, and other debts.

- Include the balance, interest rate, and minimum payment for each debt.

- Sort your debts in order from smallest balance to largest.

- Determine how much you can afford to pay each month towards your debt.

- Use the debt snowball worksheet printable to create a plan for paying off your debts, one by one.

Benefits of Using a Debt Snowball Worksheet Printable

Using a debt snowball worksheet printable can have several benefits, including:- Helping you stay organized and focused on your debt repayment goals.

- Allowing you to see progress and celebrate small victories along the way.

- Providing a clear plan for paying off your debts, which can be motivating and help you stay on track.

- Helping you avoid debt pitfalls, such as late fees and interest charges.

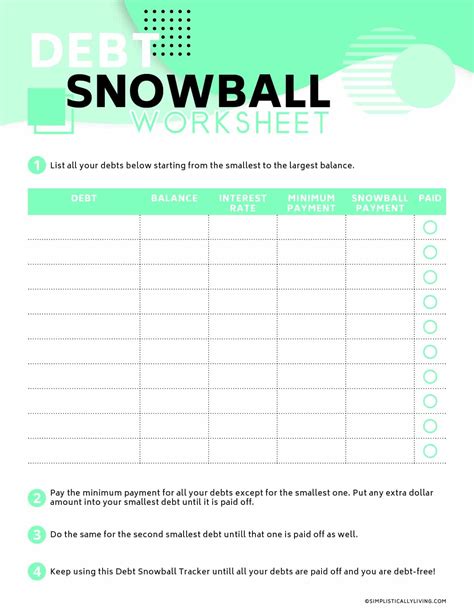

Creating a Debt Snowball Plan

To create a debt snowball plan, you will need to follow these steps:

- List all your debts, including the balance, interest rate, and minimum payment for each debt.

- Sort your debts in order from smallest balance to largest.

- Determine how much you can afford to pay each month towards your debt.

- Use the debt snowball worksheet printable to create a plan for paying off your debts, one by one.

- Start by paying the minimum payment on all debts except the smallest one, which you will pay off as aggressively as possible.

- Once you have paid off the smallest debt, use the money you were paying on it to attack the next debt, and so on.

Tips for Success with the Debt Snowball Method

Here are some tips for success with the debt snowball method:- Make sure to pay the minimum payment on all debts except the smallest one, which you will pay off as aggressively as possible.

- Use any extra money you can find to pay off your debts, such as by cutting back on expenses or selling items you no longer need.

- Avoid new debt while you are paying off your existing debts.

- Consider consolidating your debt into a single loan with a lower interest rate, if possible.

Debt Snowball Worksheet Printable Template

Here is a debt snowball worksheet printable template you can use to get started:

| Debt | Balance | Interest Rate | Minimum Payment |

|---|---|---|---|

| Credit Card | $1,000 | 18% | $50 |

| Car Loan | $10,000 | 6% | $200 |

| Student Loan | $30,000 | 4% | $100 |

| Mortgage | $100,000 | 5% | $500 |

Using this template, you can list all your debts and sort them in order from smallest balance to largest. You can then use the debt snowball worksheet printable to create a plan for paying off your debts, one by one.

Common Mistakes to Avoid with the Debt Snowball Method

Here are some common mistakes to avoid with the debt snowball method:- Not making a budget and tracking your expenses, which can make it difficult to stick to your debt repayment plan.

- Not paying the minimum payment on all debts except the smallest one, which can lead to late fees and interest charges.

- Using the debt snowball method without also addressing the underlying issues that led to your debt, such as overspending or lack of savings.

Debt Snowball Success Stories

There are many debt snowball success stories out there, from people who have paid off thousands of dollars in debt using this method. Here are a few examples:

- A couple who paid off $20,000 in credit card debt in just 12 months using the debt snowball method.

- A single mother who paid off $10,000 in student loan debt in 2 years using the debt snowball method.

- A family who paid off $50,000 in debt, including credit cards, loans, and a mortgage, in 5 years using the debt snowball method.

Conclusion and Next Steps

Paying off debt can be a challenging and overwhelming process, but with the right strategy and tools, you can achieve financial freedom. The debt snowball method is a popular approach that involves paying off debts in a specific order to build momentum and motivation. A debt snowball worksheet printable can be a useful tool to help you get started with this approach. By following the steps outlined in this article and using the debt snowball worksheet printable template, you can create a plan for paying off your debts and achieving financial freedom.Debt Snowball Image Gallery

What is the debt snowball method?

+The debt snowball method is a debt reduction strategy that involves paying off debts in a specific order, typically from smallest balance to largest.

How do I create a debt snowball plan?

+To create a debt snowball plan, list all your debts, including the balance, interest rate, and minimum payment for each debt. Sort your debts in order from smallest balance to largest, and then use the debt snowball worksheet printable to create a plan for paying off your debts, one by one.

What are the benefits of using a debt snowball worksheet printable?

+Using a debt snowball worksheet printable can help you stay organized and focused on your debt repayment goals, allow you to see progress and celebrate small victories along the way, and provide a clear plan for paying off your debts.

How long does it take to pay off debt using the debt snowball method?

+The length of time it takes to pay off debt using the debt snowball method will depend on the amount of debt you have, the interest rates on your debts, and the amount you can afford to pay each month towards your debt.

Is the debt snowball method the best way to pay off debt?

+The debt snowball method is just one approach to paying off debt, and it may not be the best method for everyone. Other methods, such as the debt avalanche method, may be more effective for some people.

We hope this article has provided you with a comprehensive understanding of the debt snowball method and how to use a debt snowball worksheet printable to pay off your debts. Remember to stay focused, motivated, and patient, and you will be on your way to achieving financial freedom. If you have any further questions or need additional guidance, please don't hesitate to reach out. Share your thoughts and experiences with the debt snowball method in the comments below, and help others who may be struggling with debt.