Intro

Discover what is ledger balance, including account balance, transaction history, and statement balance, to manage finances effectively.

The concept of ledger balance is crucial in the realm of accounting and finance, serving as a fundamental tool for businesses and individuals to manage their financial transactions and maintain a clear picture of their financial health. At its core, a ledger balance represents the total amount of money in an account at any given time, reflecting all transactions, including deposits, withdrawals, and any adjustments. Understanding ledger balances is essential for making informed financial decisions, whether for personal budgeting or for managing the financial affairs of a business.

In the context of banking, the ledger balance is often contrasted with the available balance. While the ledger balance shows the total balance in the account, including any pending transactions that have not yet been processed, the available balance reflects the amount of money that is immediately accessible for use, taking into account any holds or pending transactions that may temporarily restrict the use of certain funds. This distinction is vital for avoiding overdrafts and ensuring that financial obligations can be met.

The importance of accurately tracking ledger balances cannot be overstated. For businesses, it is a critical component of financial management, influencing everything from cash flow management to investment decisions. By closely monitoring ledger balances, companies can identify trends, anticipate potential cash flow issues, and make strategic decisions about investments and funding. Similarly, for individuals, keeping track of personal ledger balances is key to maintaining financial stability, planning for the future, and achieving long-term financial goals.

Understanding Ledger Balance

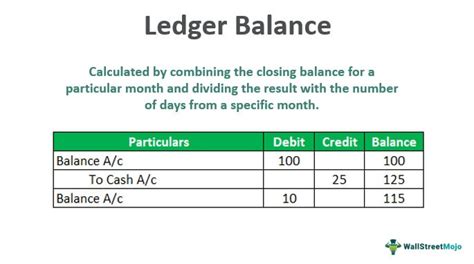

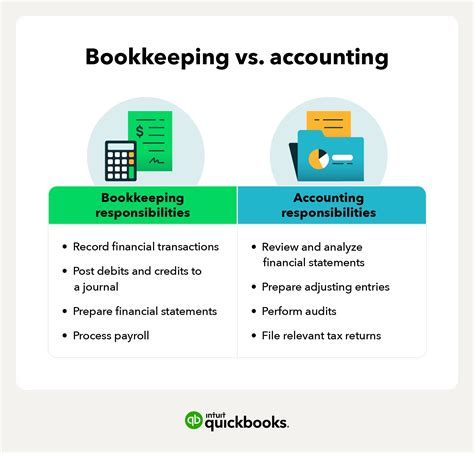

To grasp the concept of ledger balance fully, it's essential to delve into its components and how it is calculated. The ledger balance at any point is the result of all credits and debits to the account since its opening. Credits increase the balance (such as deposits), while debits decrease it (such as withdrawals or payments). In addition to these basic transactions, other factors can influence the ledger balance, including interest earned on the account, fees charged by the bank, and corrections or adjustments made by the financial institution.

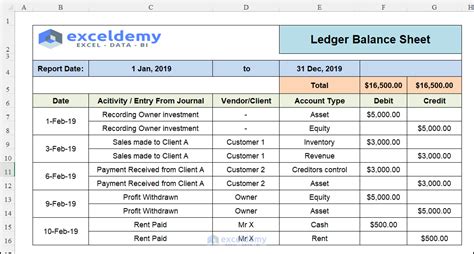

In practical terms, maintaining an accurate ledger balance involves regularly updating the account records to reflect all transactions. This can be done manually through ledger books or, more commonly today, through digital banking systems that automatically update balances in real-time. The advent of online banking and mobile banking apps has made it easier than ever for individuals and businesses to monitor their ledger balances, receive alerts for significant transactions, and manage their finances more effectively.

Benefits of Ledger Balance

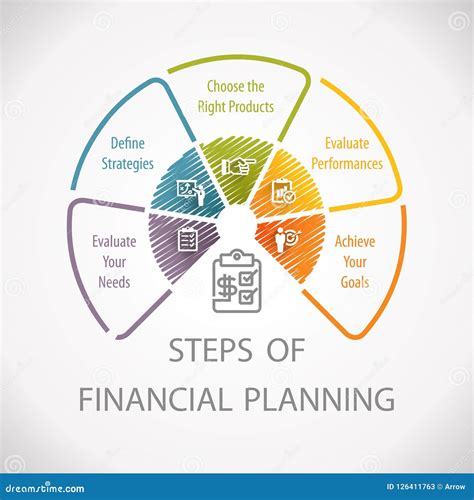

The benefits of closely monitoring and understanding ledger balances are multifaceted. For one, it enables better financial planning. By knowing exactly how much money is available, individuals and businesses can make informed decisions about spending, saving, and investing. This, in turn, can lead to improved financial stability and reduced risk of overdrafts or missed payments.

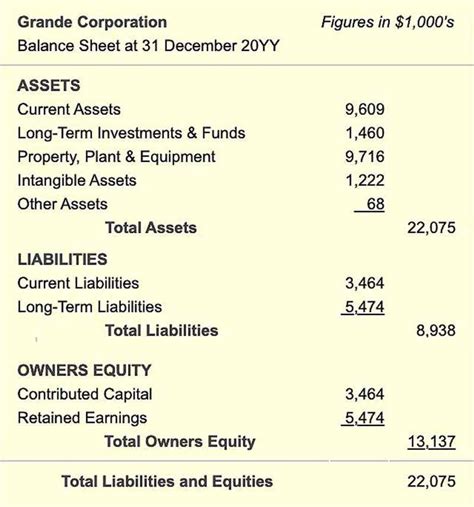

Moreover, an accurate ledger balance is essential for preparing financial statements, such as balance sheets and income statements, which are critical for assessing the financial health and performance of a business. These statements are used not only internally for strategic planning but also externally by investors, creditors, and regulatory bodies to evaluate the company's financial position and potential for future growth.

How to Manage Ledger Balance

Effective management of ledger balances involves several key steps. First, it's crucial to ensure that all transactions are recorded accurately and in a timely manner. This includes not just deposits and withdrawals but also any fees, interest, or adjustments. Utilizing digital banking tools can significantly streamline this process, providing real-time updates and reducing the likelihood of errors.

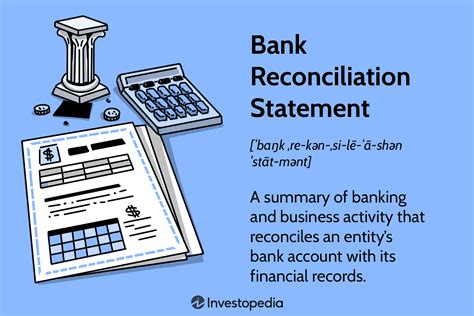

Second, regular reconciliation of the ledger balance with bank statements is essential. This process involves comparing the internal records of transactions and balances with those reported by the bank to identify any discrepancies or errors. Reconciliation helps in detecting fraud, correcting mistakes, and ensuring that the ledger balance accurately reflects the true financial position.

Third, implementing a system of controls and checks can prevent unauthorized transactions and protect against fraud. This might include setting up alerts for large or unusual transactions, requiring dual authorization for certain payments, or limiting access to account information and transaction capabilities.

Common Challenges with Ledger Balance

Despite its importance, managing ledger balances can present several challenges. One common issue is the timing difference between when a transaction is initiated and when it is actually processed. This can lead to temporary discrepancies between the ledger balance and the available balance, potentially causing overdrafts if not carefully managed.

Another challenge arises from errors or omissions in recording transactions. Whether due to human mistake, technical glitches, or fraud, inaccuracies in the ledger can lead to misleading financial information, poor decision-making, and potential legal or regulatory issues.

Furthermore, the increasing complexity of financial transactions, including international payments, currency conversions, and digital transactions, can complicate the management of ledger balances. Each of these factors introduces variables that must be carefully tracked and accounted for to maintain an accurate ledger balance.

Future of Ledger Balance Management

The future of ledger balance management is likely to be shaped by technological advancements, particularly in the areas of digital banking, artificial intelligence (AI), and blockchain technology. Digital banking has already revolutionized the way individuals and businesses manage their finances, offering real-time updates, automated transaction recording, and enhanced security features.

AI and machine learning algorithms can further improve the accuracy and efficiency of ledger balance management by automating reconciliation processes, detecting anomalies or potential fraud, and providing predictive insights into cash flow and financial trends. Additionally, blockchain technology, with its decentralized and immutable ledger system, promises to increase transparency, security, and efficiency in financial transactions, potentially transforming the way ledger balances are managed and verified.

Gallery of Ledger Balance Management

Ledger Balance Management Image Gallery

What is the importance of ledger balance in financial management?

+The ledger balance is crucial for making informed financial decisions, managing cash flow, and ensuring the financial stability of an individual or business.

How does digital banking impact ledger balance management?

+Digital banking offers real-time updates, automated transaction recording, and enhanced security features, making it easier and more efficient to manage ledger balances.

What are the common challenges in managing ledger balances?

+Common challenges include timing differences between transactions, errors or omissions in recording, and the complexity of financial transactions, which can lead to inaccuracies and potential fraud.

In conclusion, the concept of ledger balance is fundamental to financial management, offering a snapshot of an individual's or business's financial health at any given time. By understanding the importance of ledger balances, the benefits they provide, and the challenges associated with their management, individuals and businesses can better navigate the complexities of financial transactions and make informed decisions about their financial futures. As technology continues to evolve, the management of ledger balances is likely to become even more efficient and secure, further emphasizing the need for a deep understanding of this critical financial tool. We invite you to share your thoughts on the importance of ledger balance management and how you implement it in your personal or professional life. Your insights can help others better manage their finances and achieve their financial goals.