Intro

Discover 5 ways to define a ledger, including its role in accounting, financial tracking, and bookkeeping, with related terms like journal entries, assets, and liabilities.

In the world of accounting and finance, a ledger is a crucial tool that helps individuals and businesses keep track of their financial transactions. A ledger is essentially a book or digital file that contains a record of all financial transactions, including income, expenses, assets, liabilities, and equity. In this article, we will explore the concept of a ledger and its various definitions.

The importance of a ledger cannot be overstated, as it provides a clear and accurate picture of a company's financial health. By keeping track of all financial transactions, a ledger helps businesses make informed decisions about investments, budgeting, and resource allocation. Moreover, a ledger is also essential for preparing financial statements, such as balance sheets and income statements, which are used to report a company's financial performance to stakeholders.

A ledger is not just limited to businesses; individuals can also benefit from using a ledger to manage their personal finances. By tracking income and expenses, individuals can create a budget, set financial goals, and make smart investment decisions. In addition, a ledger can also help individuals identify areas where they can cut back on unnecessary expenses and optimize their financial resources.

Definition of a Ledger

A ledger is a systematic and chronological record of all financial transactions, including receipts, payments, and transfers. It is a critical component of the accounting system, as it provides a permanent and detailed record of all financial activities. A ledger can be maintained manually or electronically, using accounting software or spreadsheets.

Key Characteristics of a Ledger

The key characteristics of a ledger include: * A chronological record of all financial transactions * A detailed and systematic record of all financial activities * A permanent record of all financial transactions * A tool for preparing financial statements, such as balance sheets and income statements * A means of tracking income, expenses, assets, liabilities, and equityTypes of Ledgers

There are several types of ledgers, including:

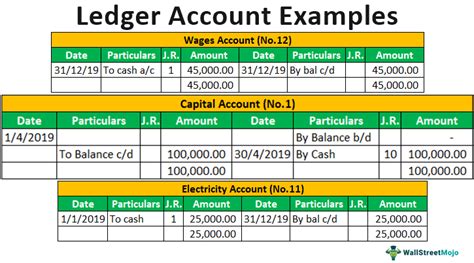

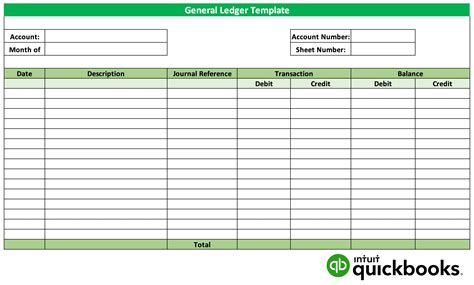

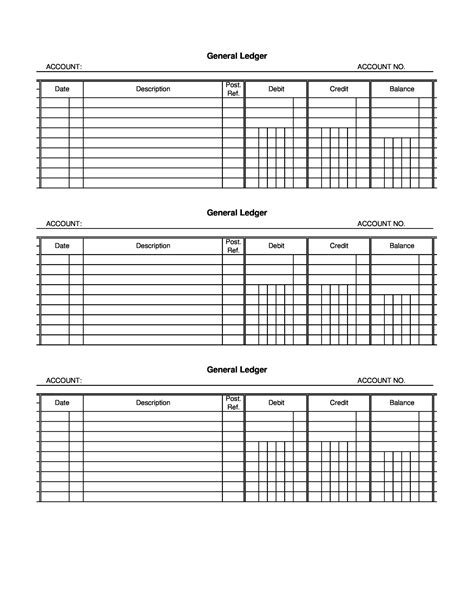

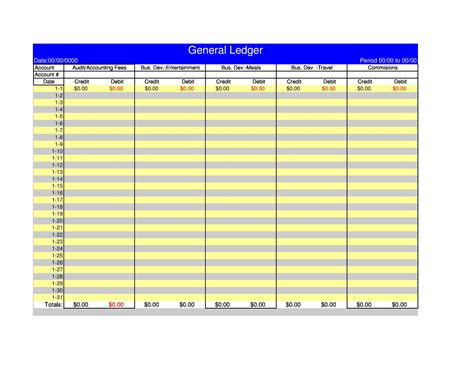

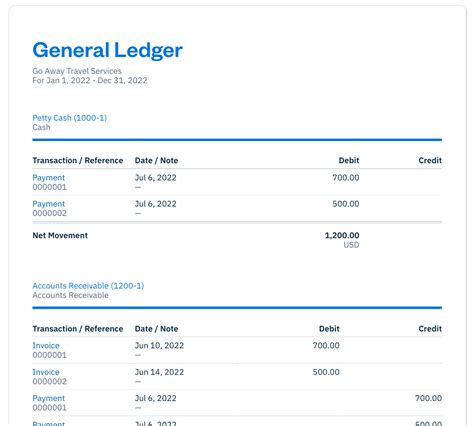

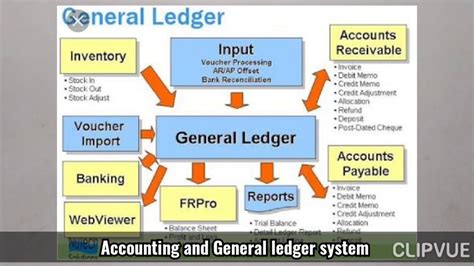

- General ledger: a comprehensive record of all financial transactions

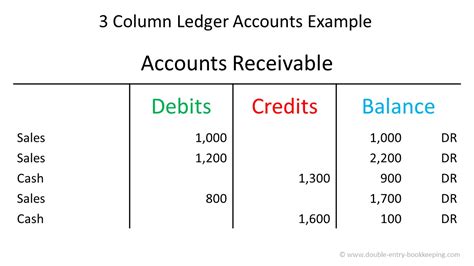

- Subsidiary ledger: a detailed record of specific transactions, such as accounts payable or accounts receivable

- Special ledger: a record of specific transactions, such as payroll or inventory

- Ledger account: a individual account within a ledger, used to track specific transactions

Benefits of Using a Ledger

The benefits of using a ledger include: * Improved financial management and control * Enhanced decision-making capabilities * Increased accuracy and reliability of financial data * Simplified preparation of financial statements * Better tracking of income, expenses, assets, liabilities, and equityHow to Create a Ledger

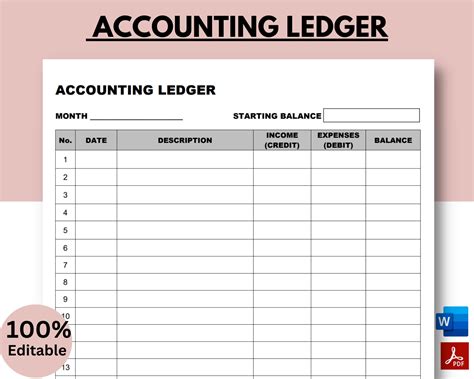

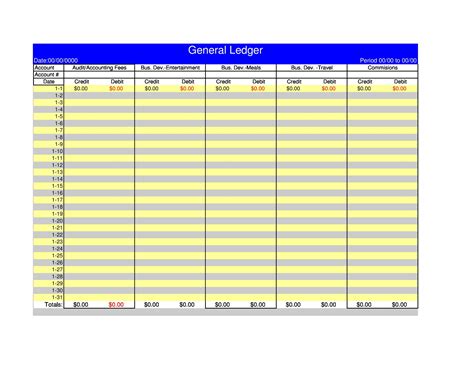

Creating a ledger involves several steps, including:

- Determine the type of ledger needed

- Set up the ledger account structure

- Record all financial transactions

- Post transactions to the ledger accounts

- Reconcile the ledger accounts regularly

Best Practices for Maintaining a Ledger

The best practices for maintaining a ledger include: * Regularly reviewing and reconciling the ledger accounts * Ensuring accuracy and completeness of all financial transactions * Using a consistent accounting method and system * Providing adequate security and access controls * Regularly backing up the ledger dataCommon Ledger Accounts

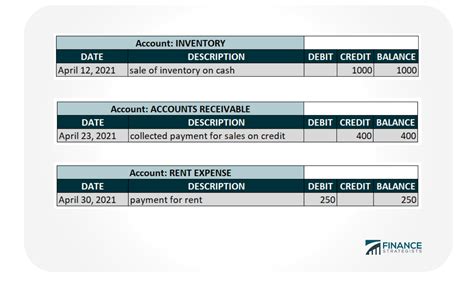

Common ledger accounts include:

- Cash account

- Accounts payable account

- Accounts receivable account

- Inventory account

- Payroll account

- Asset account

- Liability account

- Equity account

Challenges and Limitations of Using a Ledger

The challenges and limitations of using a ledger include: * Ensuring accuracy and completeness of all financial transactions * Maintaining the security and integrity of the ledger data * Providing adequate access controls and user permissions * Managing the complexity and volume of financial transactions * Ensuring compliance with accounting standards and regulationsFuture of Ledgers

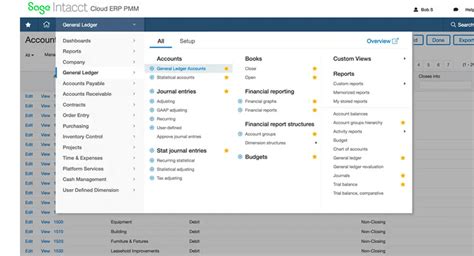

The future of ledgers is likely to involve increased use of technology and automation, such as:

- Cloud-based ledger systems

- Artificial intelligence and machine learning

- Blockchain and distributed ledger technology

- Real-time reporting and analytics

- Enhanced security and access controls

Conclusion and Next Steps

In conclusion, a ledger is a critical tool for managing financial transactions and making informed decisions. By understanding the definition, types, and benefits of a ledger, individuals and businesses can improve their financial management and control. The next steps involve creating a ledger, maintaining it regularly, and staying up-to-date with the latest technologies and best practices.Ledger Image Gallery

What is a ledger in accounting?

+A ledger is a systematic and chronological record of all financial transactions, including receipts, payments, and transfers.

What are the types of ledgers?

+The types of ledgers include general ledger, subsidiary ledger, special ledger, and ledger account.

How do I create a ledger?

+Creating a ledger involves determining the type of ledger needed, setting up the ledger account structure, recording all financial transactions, posting transactions to the ledger accounts, and reconciling the ledger accounts regularly.

What are the benefits of using a ledger?

+The benefits of using a ledger include improved financial management and control, enhanced decision-making capabilities, increased accuracy and reliability of financial data, simplified preparation of financial statements, and better tracking of income, expenses, assets, liabilities, and equity.

What is the future of ledgers?

+The future of ledgers is likely to involve increased use of technology and automation, such as cloud-based ledger systems, artificial intelligence and machine learning, blockchain and distributed ledger technology, real-time reporting and analytics, and enhanced security and access controls.

We hope this article has provided you with a comprehensive understanding of the concept of a ledger and its importance in accounting and finance. Whether you are an individual or a business, using a ledger can help you manage your financial transactions effectively and make informed decisions. If you have any further questions or would like to share your experiences with using a ledger, please comment below. Additionally, feel free to share this article with others who may benefit from this information.