Intro

Discover 5 ways to calculate total cost, including lifecycle, ownership, and operational costs, to optimize budgeting and reduce expenses with effective cost management strategies.

The concept of total cost is a crucial aspect of any business or organization, as it encompasses all the expenses incurred to produce and sell a product or service. Understanding the total cost is essential for companies to make informed decisions about pricing, production, and investment. In this article, we will delve into the world of total cost, exploring its different components, calculation methods, and importance in business decision-making.

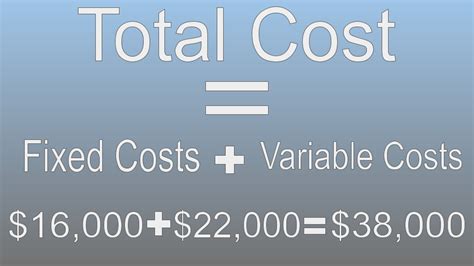

The total cost of a product or service includes both fixed and variable costs. Fixed costs remain the same even if the company produces more or less, such as rent, salaries, and insurance. On the other hand, variable costs change with the level of production, including costs like raw materials, labor, and marketing expenses. To calculate the total cost, businesses need to add up all these expenses and consider other factors like depreciation, amortization, and interest payments.

Introduction to Total Cost

The total cost includes both direct and indirect costs. Direct costs are expenses that can be directly attributed to the production of a product or service, such as labor, materials, and equipment. Indirect costs, on the other hand, are expenses that are not directly related to production, such as rent, utilities, and marketing expenses. To calculate the total cost, businesses need to add up all these expenses and consider other factors like depreciation, amortization, and interest payments.

Components of Total Cost

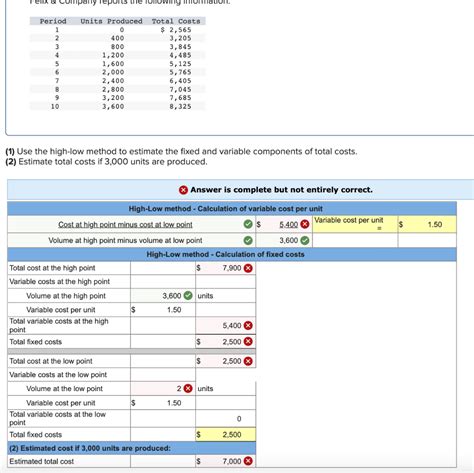

Calculation of Total Cost

Total Cost = Fixed Costs + Variable Costs + Semi-Variable Costs + Sunk Costs + Opportunity Costs

For example, let's say a company produces widgets and has the following expenses:

- Fixed costs: $100,000 (rent, salaries, insurance)

- Variable costs: $50,000 (raw materials, labor, marketing expenses)

- Semi-variable costs: $20,000 (utilities, maintenance costs)

- Sunk costs: $30,000 (equipment, machinery)

- Opportunity costs: $10,000 (investing in a new project instead of expanding an existing one)

Using the formula above, the total cost would be:

Total Cost = $100,000 + $50,000 + $20,000 + $30,000 + $10,000 = $210,000

Importance of Total Cost in Business Decision-Making

For example, let's say a company produces widgets and has a total cost of $210,000. If the company sells 10,000 widgets at $20 each, the total revenue would be $200,000. However, if the company sells 10,000 widgets at $25 each, the total revenue would be $250,000. In this case, the company would be more profitable if it sells the widgets at $25 each, as the total revenue would be higher than the total cost.

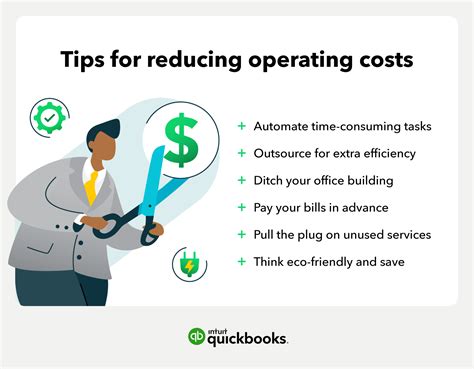

5 Ways to Reduce Total Cost

For example, let's say a company produces widgets and has a total cost of $210,000. If the company implements cost-saving measures, such as reducing energy consumption, and improves efficiency, such as streamlining production processes, the total cost could be reduced to $180,000. This would result in increased profitability and competitiveness for the company.

Gallery of Total Cost

Total Cost Image Gallery

What is total cost?

+Total cost refers to the total amount of expenses incurred by a business to produce and sell a product or service.

What are the components of total cost?

+The components of total cost include fixed costs, variable costs, semi-variable costs, sunk costs, and opportunity costs.

How is total cost calculated?

+Total cost is calculated by adding up all the expenses incurred to produce and sell a product or service, including fixed costs, variable costs, semi-variable costs, sunk costs, and opportunity costs.

Why is total cost important in business decision-making?

+Total cost is important in business decision-making because it helps companies determine their profitability and identify areas where they can cut costs, improve efficiency, and increase profitability.

What are some ways to reduce total cost?

+Some ways to reduce total cost include implementing cost-saving measures, improving efficiency, outsourcing certain functions, investing in new technology, and renegotiating contracts with suppliers or vendors.

We hope this article has provided you with a comprehensive understanding of total cost and its importance in business decision-making. By understanding the components of total cost and how to calculate it, businesses can make informed decisions about pricing, production, and investment. Additionally, by implementing cost-saving measures and improving efficiency, companies can reduce their total cost and increase their profitability. If you have any questions or comments, please feel free to share them below.