Intro

Manage finances with an expense tracker printable template, featuring budgeting tools, financial planners, and spending logs to monitor expenses, income, and savings, promoting fiscal responsibility and money management.

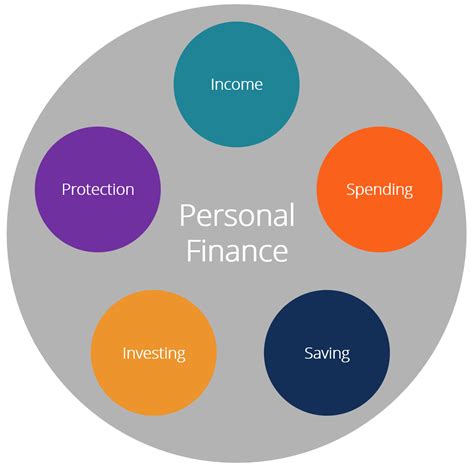

Managing personal finances effectively is crucial for achieving financial stability and security. One of the most effective ways to keep track of your expenses is by using an expense tracker printable template. This tool allows you to monitor and record every transaction, providing a clear picture of where your money is going. In today's digital age, while there are numerous apps and software available for tracking expenses, printable templates offer a tangible and straightforward approach that many people find appealing.

The importance of tracking expenses cannot be overstated. It helps in identifying areas where you can cut back on unnecessary spending, make informed financial decisions, and work towards your long-term financial goals. Whether you're trying to save for a big purchase, pay off debt, or simply understand your spending habits better, an expense tracker is an indispensable tool. Moreover, using a printable template can be particularly beneficial for those who prefer a hands-on approach or need a method that doesn't rely on digital devices.

For individuals and families alike, maintaining a balanced budget is key to financial health. An expense tracker printable template is a simple yet powerful tool that can be adapted to fit any financial situation. It's about creating a habit of regularly monitoring your expenses, which in turn helps in making conscious spending decisions. This practice not only leads to better financial management but also reduces financial stress and anxiety. By having a clear overview of your income and expenses, you can plan for the future with more confidence.

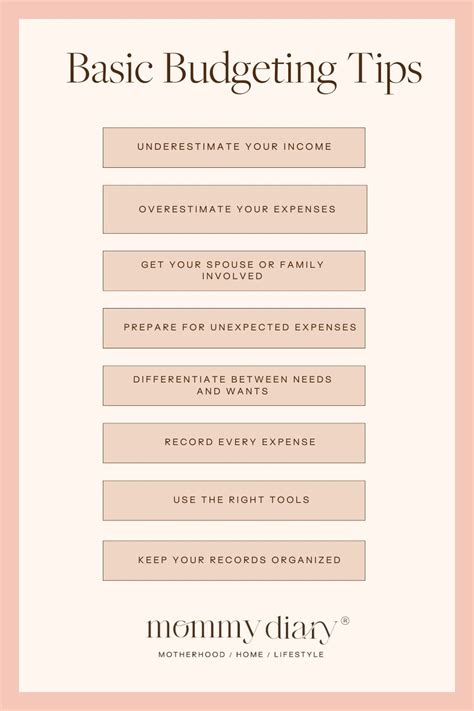

Benefits of Using an Expense Tracker Printable Template

The benefits of using an expense tracker printable template are numerous. Firstly, it provides a hands-on approach to managing finances, which can be very satisfying for those who prefer tangible methods over digital apps. Secondly, it helps in creating a budget and sticking to it, as you have a clear visual representation of your income and expenses. This transparency is crucial for identifying patterns of unnecessary spending and making the necessary adjustments. Additionally, using a printable template can be a cost-effective method, as it eliminates the need for subscription-based financial management apps or software.

Key Features of an Effective Expense Tracker

An effective expense tracker should have certain key features to make it useful and easy to use. These include: - A section for recording income - A detailed breakdown of fixed expenses (rent, utilities, etc.) - A category for variable expenses (groceries, entertainment, etc.) - Space for noting any savings or debt payments - A summary section to review monthly expenses and compare them with incomeHow to Use an Expense Tracker Printable Template

Using an expense tracker printable template is straightforward. First, download and print the template. Ensure it has all the necessary categories for your expenses. At the beginning of each month, fill in your projected income and fixed expenses. Throughout the month, record every transaction, no matter how small, in the appropriate category. This includes groceries, fuel for your car, dining out, and any miscellaneous purchases. At the end of the month, tally up your expenses and compare them with your income. This final step is crucial for understanding where your money is going and making adjustments for the next month.

Tips for Maximizing the Use of Your Expense Tracker

To get the most out of your expense tracker printable template, consider the following tips: - Be diligent about recording every transaction. Consistency is key to accurate financial tracking. - Review your tracker regularly, ideally weekly, to stay on top of your spending. - Use different colors or symbols to categorize your expenses visually, making it easier to identify patterns. - Don't forget to include any debt payments or savings contributions in your tracker.Customizing Your Expense Tracker Printable Template

One of the advantages of using a printable template is the ease with which it can be customized to fit your specific financial needs. Whether you're single, married, or have a large family, you can tailor your expense tracker to include categories that are relevant to your situation. For example, if you have children, you might include a category for childcare expenses or education costs. If you're a homeowner, you'll want to include categories for mortgage payments, property taxes, and maintenance costs. The key is to ensure that your template is comprehensive and covers all aspects of your financial life.

Examples of Customizable Categories

Some examples of customizable categories include: - Housing expenses (rent/mortgage, utilities, insurance) - Transportation costs (car loan/lease, gas, insurance, maintenance) - Food expenses (groceries, dining out) - Entertainment (movies, concerts, hobbies) - Health and wellness (medical expenses, gym membership, health insurance)Overcoming Challenges with Expense Tracking

Despite the benefits, some individuals may face challenges when starting to use an expense tracker printable template. One common obstacle is the discipline required to record every transaction faithfully. To overcome this, it might be helpful to set reminders or place your tracker in a spot where you'll see it frequently, such as on the fridge or next to your wallet. Another challenge could be feeling overwhelmed by the complexity of your finances. In such cases, simplifying your categories or seeking the help of a financial advisor can provide clarity and direction.

Strategies for Staying Motivated

Staying motivated is crucial for successfully using an expense tracker. Consider the following strategies: - Set clear financial goals, whether it's saving for a vacation or paying off debt. - Share your goals with a friend or family member and ask them to hold you accountable. - Reward yourself periodically for sticking to your budget and reaching milestones.Integrating Expense Tracking into Your Daily Life

For expense tracking to be truly effective, it needs to become an integral part of your daily life. This means developing a routine of regularly updating your tracker and reviewing your financial progress. It could also involve discussing financial goals and strategies with your partner or family members to ensure everyone is on the same page. By making expense tracking a habit, you'll find it becomes second nature to monitor your spending and make conscious financial decisions.

Creating a Financial Routine

Creating a financial routine can help in making expense tracking a sustainable habit. This could involve: - Setting aside a specific time each week to update your tracker - Implementing automatic savings transfers from your checking account - Regularly reviewing and discussing financial progress with your familyConclusion and Next Steps

In conclusion, using an expense tracker printable template is a simple, effective, and customizable way to manage your finances. By understanding the benefits, customizing the template to fit your needs, and making expense tracking a habit, you can gain control over your financial life. Remember, the key to success lies in consistency and patience. As you embark on this journey of financial management, keep in mind that small steps today can lead to significant financial stability and security in the future.

Expense Tracker Image Gallery

What is the main purpose of an expense tracker printable template?

+The main purpose of an expense tracker printable template is to help individuals monitor and manage their expenses effectively, leading to better financial planning and decision-making.

How often should I update my expense tracker?

+It's recommended to update your expense tracker regularly, ideally daily or weekly, to ensure accuracy and to make it a habit.

Can I customize my expense tracker printable template?

+Yes, expense tracker printable templates can be customized to fit your specific financial needs and categories, making them more effective for personal use.

What are the benefits of using a printable expense tracker over a digital app?

+The benefits include a hands-on approach, cost-effectiveness, and the ability to customize without relying on digital devices, which some users find more appealing and effective for their financial management needs.

How can I stay motivated to continue using my expense tracker?

+Setting clear financial goals, sharing your progress with a friend, and rewarding yourself for milestones achieved can help in staying motivated to continue using your expense tracker.

We hope this comprehensive guide to using an expense tracker printable template has been informative and helpful. By implementing these strategies and making expense tracking a part of your daily routine, you'll be well on your way to achieving financial stability and security. Remember, the journey to financial freedom starts with small, consistent steps. Share your experiences, tips, and questions about using expense trackers in the comments below, and don't forget to share this article with anyone who might benefit from taking control of their finances.