Intro

Discover Fifo Lifo accounting methods, including inventory valuation, cost flow assumptions, and financial reporting impacts, to optimize accounting practices and improve financial analysis with First-In-First-Out and Last-In-First-Out techniques.

The world of accounting is filled with various methods and techniques that help businesses and organizations manage their finances effectively. Two of the most commonly used accounting methods are the First-In-First-Out (FIFO) and Last-In-First-Out (LIFO) methods. These methods are used to value inventory and determine the cost of goods sold, which is a critical component of a company's financial statements. In this article, we will delve into the details of FIFO and LIFO accounting methods, their benefits, and their drawbacks.

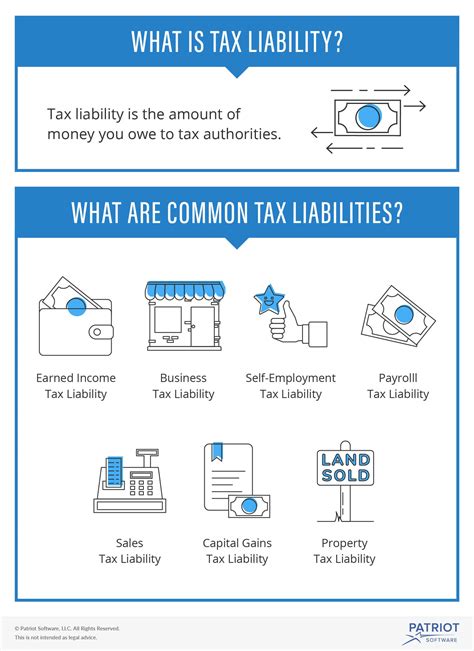

The importance of choosing the right accounting method cannot be overstated. It can have a significant impact on a company's financial statements, tax liabilities, and ultimately, its bottom line. The FIFO and LIFO methods are two of the most widely used accounting methods, and understanding their differences is crucial for businesses to make informed decisions. Whether you are a business owner, accountant, or financial analyst, this article will provide you with a comprehensive understanding of FIFO and LIFO accounting methods.

The FIFO and LIFO methods are used to determine the cost of goods sold, which is the direct cost of producing and selling a company's products or services. The cost of goods sold includes the cost of raw materials, labor, and overhead. The method used to value inventory can significantly impact the cost of goods sold, which in turn affects a company's gross profit, net income, and tax liabilities. In the next section, we will explore the FIFO accounting method in more detail.

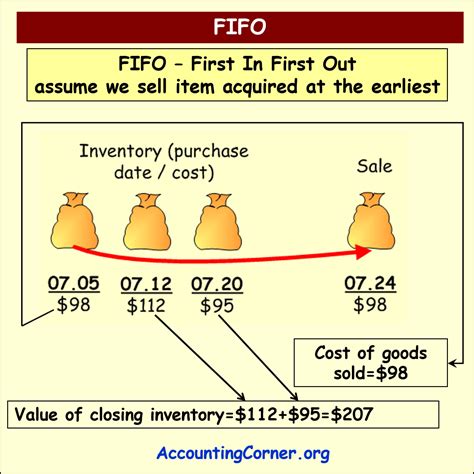

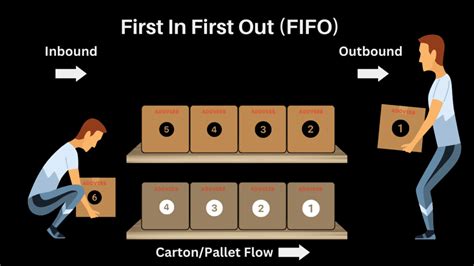

FIFO Accounting Method

The FIFO method is simple to implement and understand, making it a popular choice among businesses. It is also consistent with the way many businesses operate, where older inventory is sold or used before newer inventory. However, the FIFO method can be affected by inflation, where the cost of goods sold may not reflect the current market price of the items. This can result in a higher gross profit and net income, which may not accurately reflect the company's financial performance.

Benefits of FIFO Accounting Method

The FIFO accounting method has several benefits, including: * Simple to implement and understand * Consistent with the way many businesses operate * Reflects the cost of the oldest items in inventory * Easy to track and record inventoryHowever, the FIFO method also has some drawbacks, such as:

- Can be affected by inflation, resulting in a higher gross profit and net income

- May not reflect the current market price of the items

- Can result in a higher tax liability

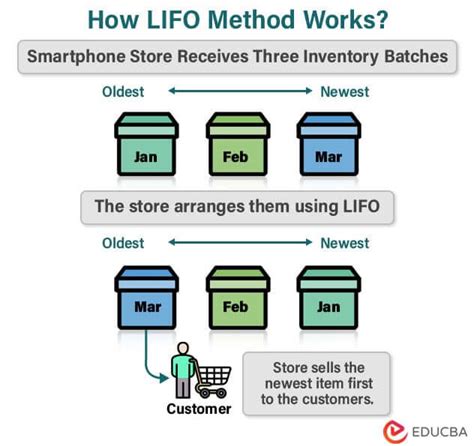

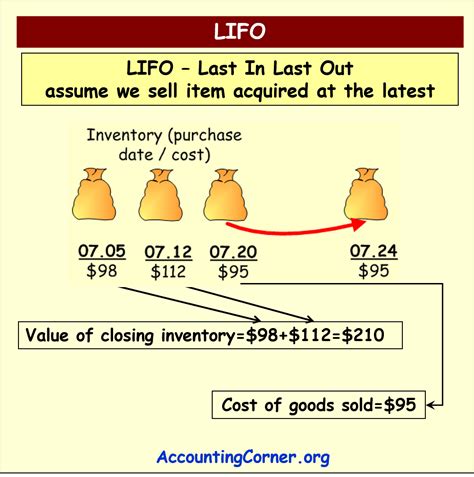

LIFO Accounting Method

The LIFO method is more complex to implement and understand than the FIFO method, but it can provide a more accurate reflection of the cost of goods sold. The LIFO method is also less affected by inflation, as the cost of goods sold reflects the current market price of the items. However, the LIFO method can result in a lower gross profit and net income, which may not accurately reflect the company's financial performance.

Benefits of LIFO Accounting Method

The LIFO accounting method has several benefits, including: * Provides a more accurate reflection of the cost of goods sold * Less affected by inflation * Reflects the current market price of the items * Can result in a lower tax liabilityHowever, the LIFO method also has some drawbacks, such as:

- More complex to implement and understand

- May not be consistent with the way many businesses operate

- Can result in a lower gross profit and net income

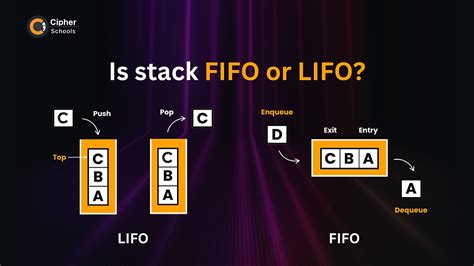

Comparison of FIFO and LIFO Accounting Methods

In general, the FIFO method is preferred in industries where inventory is sold or used in the order it is received, while the LIFO method is preferred in industries where inventory is perishable or has a limited shelf life. The FIFO method is also preferred in companies where the cost of goods sold is a significant component of the financial statements.

Steps to Choose the Right Accounting Method

Choosing the right accounting method depends on several factors, including: * Industry and business model * Financial goals and objectives * Type of inventory and its shelf life * Inflation and market trendsThe following steps can help companies choose the right accounting method:

- Determine the type of inventory and its shelf life

- Consider the industry and business model

- Evaluate the financial goals and objectives

- Analyze the impact of inflation and market trends

- Consult with accounting professionals and financial experts

Gallery of FIFO LIFO Accounting Methods

FIFO LIFO Accounting Methods Image Gallery

What is the main difference between FIFO and LIFO accounting methods?

+The main difference between FIFO and LIFO accounting methods is the assumption about the order in which inventory is sold or used. FIFO assumes that the first items purchased or produced are the first ones to be sold or used, while LIFO assumes that the last items purchased or produced are the first ones to be sold or used.

Which accounting method is more suitable for industries with perishable inventory?

+The LIFO accounting method is more suitable for industries with perishable inventory, as it assumes that the newest items in inventory are sold or used before the older items.

How does inflation affect the FIFO and LIFO accounting methods?

+Inflation can affect the FIFO and LIFO accounting methods differently. The FIFO method can result in a higher gross profit and net income during periods of inflation, while the LIFO method can result in a lower gross profit and net income.

What are the steps to choose the right accounting method for a company?

+The steps to choose the right accounting method for a company include determining the type of inventory and its shelf life, considering the industry and business model, evaluating the financial goals and objectives, analyzing the impact of inflation and market trends, and consulting with accounting professionals and financial experts.

Why is it important to choose the right accounting method for a company?

+Choosing the right accounting method is important because it can significantly impact a company's financial statements, tax liabilities, and ultimately, its bottom line. The right accounting method can provide a more accurate reflection of a company's financial performance and help management make informed decisions.

In conclusion, the FIFO and LIFO accounting methods are two of the most widely used accounting methods in the world. Each method has its benefits and drawbacks, and the choice of method depends on the company's industry, business model, and financial goals. By understanding the differences between FIFO and LIFO, companies can make informed decisions about their accounting methods and ensure that their financial statements accurately reflect their financial performance. We hope that this article has provided you with a comprehensive understanding of FIFO and LIFO accounting methods and has helped you to make informed decisions about your company's accounting methods. If you have any further questions or comments, please do not hesitate to contact us.