Intro

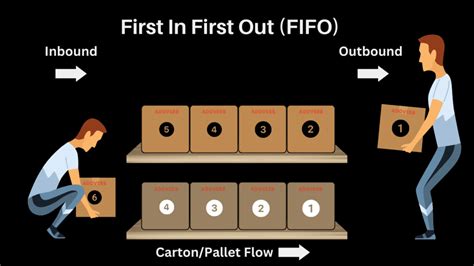

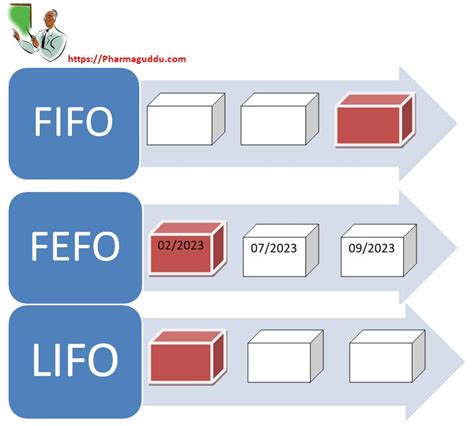

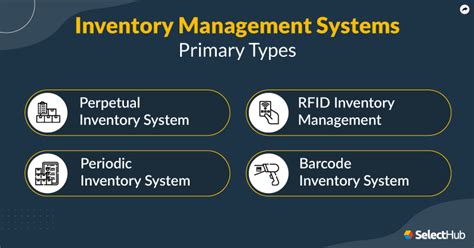

Discover 5 Lifo and Fifo methods for inventory management, including perpetual, periodic, and weighted average cost methods, to optimize stock control and minimize costs with First-In-First-Out and Last-In-First-Out techniques.

The LIFO (Last-In, First-Out) and FIFO (First-In, First-Out) methods are two fundamental concepts in accounting and inventory management. Understanding the differences between these methods is crucial for businesses to accurately value their inventory, manage stock levels, and make informed decisions. In this article, we will delve into the world of LIFO and FIFO methods, exploring their definitions, advantages, disadvantages, and applications.

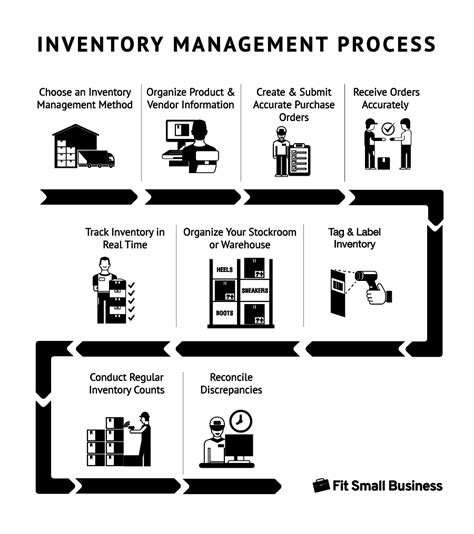

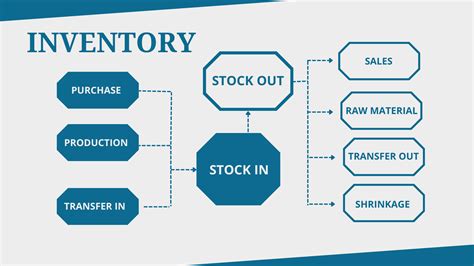

The importance of inventory management cannot be overstated. It is a critical component of a company's overall strategy, as it directly affects profitability, cash flow, and customer satisfaction. Effective inventory management enables businesses to respond quickly to changes in demand, reduce waste, and optimize their supply chain. The LIFO and FIFO methods are two popular techniques used to manage inventory, each with its own strengths and weaknesses. By understanding these methods, businesses can choose the best approach for their specific needs and improve their bottom line.

In today's fast-paced business environment, companies must be agile and adaptable to stay competitive. The LIFO and FIFO methods offer distinct advantages in terms of inventory valuation, tax benefits, and operational efficiency. For instance, the LIFO method can provide tax benefits during periods of inflation, while the FIFO method can help businesses maintain a more accurate picture of their inventory costs. By exploring the intricacies of these methods, businesses can make informed decisions about their inventory management strategy and stay ahead of the competition.

Introduction to LIFO Method

Advantages of LIFO Method

The LIFO method offers several advantages, including: * Tax benefits: By matching the higher cost of newer items against revenue, businesses can reduce their taxable income. * Improved cash flow: The LIFO method can help businesses conserve cash by reducing the amount of taxes owed. * Simplified inventory management: The LIFO method can be easier to implement and manage, especially for businesses with a high volume of inventory turnover.Disadvantages of LIFO Method

However, the LIFO method also has some disadvantages, including: * Inaccurate inventory valuation: The LIFO method can result in an inaccurate picture of inventory costs, as the older items are retained in inventory at their original cost. * Complexity: The LIFO method can be complex to implement and manage, especially for businesses with a large and diverse inventory.Introduction to FIFO Method

Advantages of FIFO Method

The FIFO method offers several advantages, including: * Accurate inventory valuation: The FIFO method provides a more accurate picture of inventory costs, as the older items are matched against revenue. * Improved inventory management: The FIFO method can help businesses manage their inventory more effectively, by ensuring that older items are sold or used before they expire or become obsolete. * Simplified financial reporting: The FIFO method can simplify financial reporting, as the cost of goods sold is more accurately reflected.Disadvantages of FIFO Method

However, the FIFO method also has some disadvantages, including: * Higher tax liability: The FIFO method can result in a higher tax liability, as the lower cost of older items is matched against revenue, increasing taxable income. * Complexity: The FIFO method can be complex to implement and manage, especially for businesses with a large and diverse inventory.Comparison of LIFO and FIFO Methods

Key Differences

The key differences between the LIFO and FIFO methods include: * Inventory valuation: The LIFO method can result in an inaccurate picture of inventory costs, while the FIFO method provides a more accurate picture. * Tax benefits: The LIFO method can provide tax benefits during periods of inflation, while the FIFO method can result in a higher tax liability. * Complexity: Both methods can be complex to implement and manage, especially for businesses with a large and diverse inventory.Applications of LIFO and FIFO Methods

Best Practices

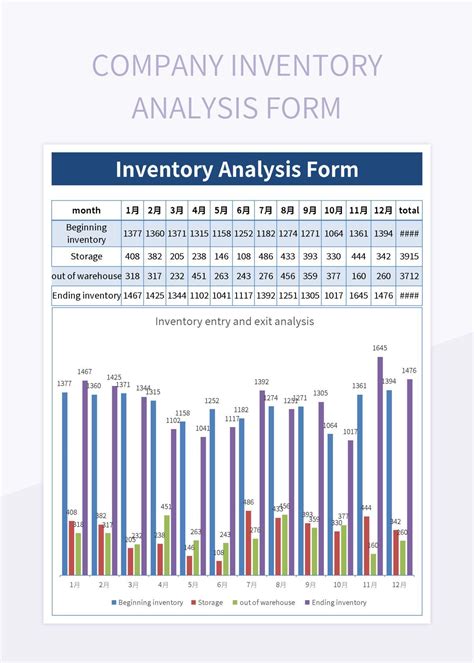

To get the most out of the LIFO and FIFO methods, businesses should follow best practices, including: * Regular inventory audits: Regular inventory audits can help businesses ensure that their inventory is accurate and up-to-date. * Effective inventory management: Effective inventory management can help businesses manage their inventory more efficiently, reducing waste and improving profitability. * Financial reporting: Accurate financial reporting can help businesses make informed decisions about their inventory management strategy.Gallery of Inventory Management

Inventory Management Image Gallery

Frequently Asked Questions

What is the main difference between LIFO and FIFO methods?

+The main difference between LIFO and FIFO methods is the way they value inventory. LIFO assumes that the most recently acquired items are the first ones to be sold or used, while FIFO assumes that the oldest items are the first ones to be sold or used.

Which method is more accurate for inventory valuation?

+The FIFO method is generally more accurate for inventory valuation, as it matches the older items against revenue, reflecting the actual cost of goods sold.

What are the tax benefits of using the LIFO method?

+The LIFO method can provide tax benefits during periods of inflation, as the higher cost of newer items is matched against revenue, reducing taxable income.

How do I choose between LIFO and FIFO methods for my business?

+The choice between LIFO and FIFO methods depends on the specific needs and goals of your business. Consider factors such as inventory turnover, inflation, and tax benefits when making your decision.

Can I use both LIFO and FIFO methods for my business?

+Yes, you can use both LIFO and FIFO methods for your business, depending on the specific products or inventory you are managing. However, it's essential to consistently apply the chosen method to avoid confusion and ensure accurate financial reporting.

In conclusion, the LIFO and FIFO methods are two fundamental concepts in accounting and inventory management. By understanding the differences between these methods, businesses can choose the best approach for their inventory management strategy and improve their bottom line. Whether you're a small business owner or a large corporation, effective inventory management is crucial for success. We encourage you to share your thoughts and experiences with inventory management in the comments below. What methods have you used, and what challenges have you faced? Your input can help others make informed decisions about their inventory management strategy.