Intro

Learn about Fifo and Lifo accounting methods, including inventory valuation, cost flow assumptions, and financial reporting implications, to optimize your accounting practices and improve financial analysis with these inventory management techniques.

The choice of accounting method can significantly impact a company's financial statements and tax liabilities. Two of the most commonly used accounting methods are the First-In, First-Out (FIFO) and Last-In, First-Out (LIFO) methods. Understanding the differences between these two methods is crucial for businesses to make informed decisions about their inventory management and financial reporting.

In today's fast-paced business environment, companies need to be aware of the implications of their accounting choices. The FIFO and LIFO methods have distinct effects on a company's financial statements, including the balance sheet and income statement. The choice of method can also impact a company's tax liabilities, which can have a significant impact on its bottom line. As a result, it is essential for businesses to carefully consider their accounting options and choose the method that best suits their needs.

The FIFO and LIFO methods are used to value inventory and determine the cost of goods sold. The main difference between the two methods is the order in which inventory items are sold. Under the FIFO method, the oldest items in inventory are sold first, while under the LIFO method, the most recent items are sold first. This difference in approach can have significant implications for a company's financial statements and tax liabilities.

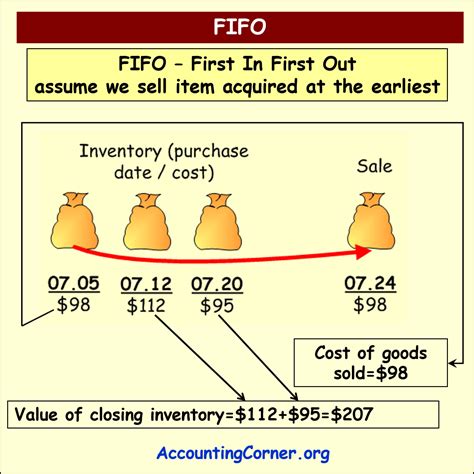

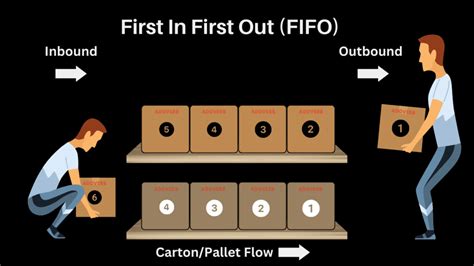

FIFO Accounting Method

The FIFO accounting method is the most commonly used method for valuing inventory. Under this method, the oldest items in inventory are sold first, and the cost of these items is used to determine the cost of goods sold. The FIFO method is based on the assumption that the first items purchased or produced are the first items sold. This method is often used in industries where inventory is sold in the order it is received, such as retail or manufacturing.

The FIFO method has several advantages, including its simplicity and ease of use. It is also the most intuitive method, as it assumes that the oldest items are sold first. Additionally, the FIFO method provides a more accurate picture of a company's inventory costs, as it reflects the actual cost of the items sold.

Benefits of FIFO Accounting Method

The FIFO accounting method has several benefits, including: * Simplicity and ease of use * Provides a more accurate picture of inventory costs * Reflects the actual cost of items sold * Often used in industries where inventory is sold in the order it is receivedLIFO Accounting Method

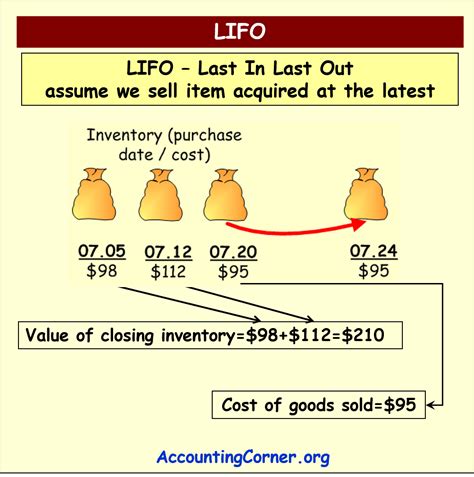

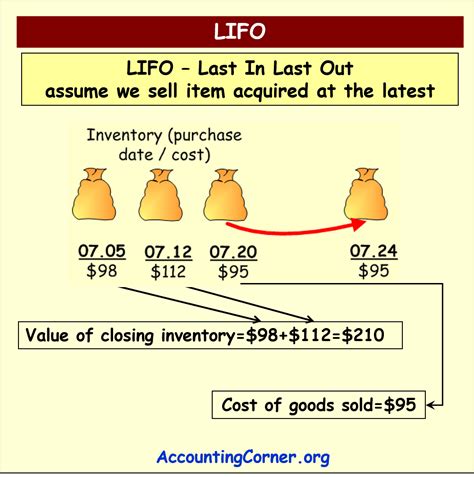

The LIFO accounting method is less commonly used than the FIFO method, but it is still widely used in certain industries. Under this method, the most recent items in inventory are sold first, and the cost of these items is used to determine the cost of goods sold. The LIFO method is based on the assumption that the most recent items purchased or produced are the first items sold. This method is often used in industries where inventory is sold in the reverse order it is received, such as wholesale or distribution.

The LIFO method has several advantages, including its ability to match the cost of inventory with the revenue generated by its sale. This method is also useful in industries where inventory costs are rising, as it allows companies to defer the recognition of inventory costs until the items are sold.

Benefits of LIFO Accounting Method

The LIFO accounting method has several benefits, including: * Matches the cost of inventory with the revenue generated by its sale * Useful in industries where inventory costs are rising * Allows companies to defer the recognition of inventory costs until items are sold * Often used in industries where inventory is sold in the reverse order it is receivedComparison of FIFO and LIFO Accounting Methods

The FIFO and LIFO accounting methods have distinct effects on a company's financial statements. The choice of method can impact the cost of goods sold, gross profit, and net income. The FIFO method tends to result in a higher cost of goods sold and a lower gross profit, while the LIFO method tends to result in a lower cost of goods sold and a higher gross profit.

In addition to the impact on financial statements, the choice of accounting method can also impact a company's tax liabilities. The LIFO method can result in a lower taxable income, as the cost of goods sold is higher. However, this method can also result in a lower inventory valuation, which can impact a company's balance sheet.

Key Differences Between FIFO and LIFO Accounting Methods

The key differences between the FIFO and LIFO accounting methods are: * Order of sale: FIFO assumes the oldest items are sold first, while LIFO assumes the most recent items are sold first * Cost of goods sold: FIFO tends to result in a higher cost of goods sold, while LIFO tends to result in a lower cost of goods sold * Gross profit: FIFO tends to result in a lower gross profit, while LIFO tends to result in a higher gross profit * Tax liabilities: LIFO can result in a lower taxable income, but also a lower inventory valuationExamples of FIFO and LIFO Accounting Methods

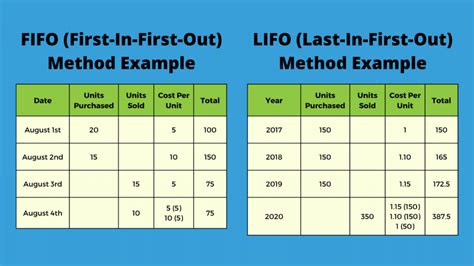

To illustrate the differences between the FIFO and LIFO accounting methods, consider the following example:

Suppose a company purchases 100 units of inventory at a cost of $10 per unit. Later, the company purchases an additional 100 units at a cost of $15 per unit. If the company sells 100 units, the cost of goods sold would be:

- FIFO: $10 per unit x 100 units = $1,000

- LIFO: $15 per unit x 100 units = $1,500

As shown in this example, the FIFO method results in a lower cost of goods sold, while the LIFO method results in a higher cost of goods sold.

Real-World Applications of FIFO and LIFO Accounting Methods

The FIFO and LIFO accounting methods have real-world applications in various industries, including: * Retail: FIFO is often used in retail, as inventory is typically sold in the order it is received * Manufacturing: LIFO is often used in manufacturing, as inventory costs are rising and companies want to defer the recognition of inventory costs * Wholesale: LIFO is often used in wholesale, as inventory is sold in the reverse order it is receivedAccounting Methods Image Gallery

What is the main difference between FIFO and LIFO accounting methods?

+The main difference between FIFO and LIFO accounting methods is the order in which inventory items are sold. FIFO assumes the oldest items are sold first, while LIFO assumes the most recent items are sold first.

Which accounting method is more commonly used?

+The FIFO accounting method is more commonly used than the LIFO method.

What are the benefits of using the LIFO accounting method?

+The LIFO accounting method has several benefits, including its ability to match the cost of inventory with the revenue generated by its sale, and its usefulness in industries where inventory costs are rising.

How do the FIFO and LIFO accounting methods impact financial statements?

+The FIFO and LIFO accounting methods have distinct effects on financial statements, including the cost of goods sold, gross profit, and net income. The choice of method can impact a company's tax liabilities and inventory valuation.

What are some real-world applications of the FIFO and LIFO accounting methods?

+The FIFO and LIFO accounting methods have real-world applications in various industries, including retail, manufacturing, and wholesale. The choice of method depends on the specific needs and circumstances of the company.

In conclusion, the choice of accounting method can have a significant impact on a company's financial statements and tax liabilities. The FIFO and LIFO accounting methods are two of the most commonly used methods, each with its own advantages and disadvantages. By understanding the differences between these methods, businesses can make informed decisions about their inventory management and financial reporting. We encourage readers to share their thoughts and experiences with the FIFO and LIFO accounting methods in the comments section below. Additionally, we invite readers to explore our other articles on accounting and finance to gain a deeper understanding of these topics.