Intro

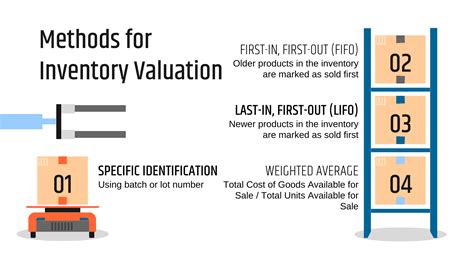

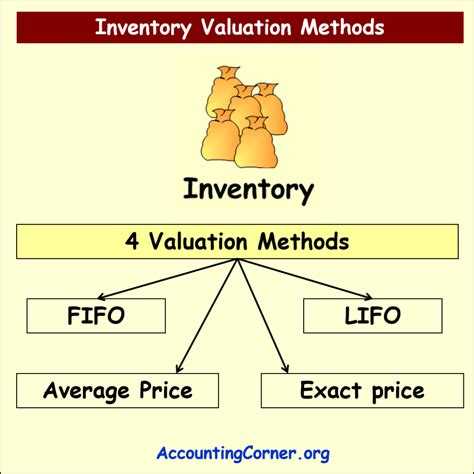

Discover the difference between FIFO and LIFO methods, exploring inventory valuation, cost flow assumptions, and accounting impacts, to optimize your businesss financial management and decision-making processes.

The age-old debate between FIFO (First-In-First-Out) and LIFO (Last-In-First-Out) has been a staple of accounting and inventory management for decades. Understanding the differences between these two methods is crucial for businesses to make informed decisions about their inventory management and financial reporting. In this article, we will delve into the world of FIFO vs LIFO, exploring the key differences, benefits, and drawbacks of each method.

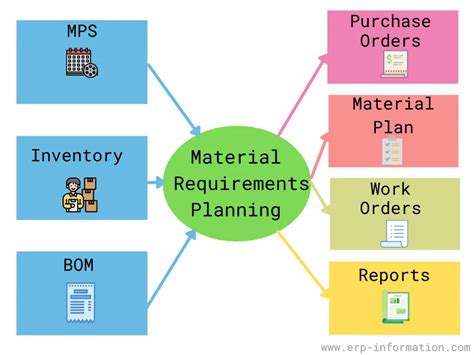

The importance of inventory management cannot be overstated. It is a critical component of any business, as it directly affects the bottom line. Effective inventory management can help companies reduce costs, improve efficiency, and increase profitability. On the other hand, poor inventory management can lead to stockouts, overstocking, and unnecessary expenses. With the rise of e-commerce and global supply chains, inventory management has become more complex, making it essential for businesses to choose the right method for their needs.

In today's fast-paced business environment, companies must be agile and adaptable to stay competitive. Inventory management is no exception. The choice between FIFO and LIFO can have significant implications for a company's financial statements, tax liabilities, and overall performance. As we explore the 5 ways FIFO vs LIFO, we will examine the key aspects of each method, including their benefits, drawbacks, and applications. Whether you are an accountant, a business owner, or an inventory manager, this article will provide you with a comprehensive understanding of the FIFO vs LIFO debate.

Introduction to FIFO and LIFO

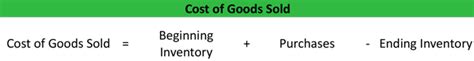

Cost of Goods Sold

For example, suppose a company purchases 100 units of inventory at $10 each in January and another 100 units at $12 each in June. If the company sells 100 units in July, the COGS under FIFO would be $10 per unit, while the COGS under LIFO would be $12 per unit. This difference in COGS can significantly impact a company's gross profit and net income.

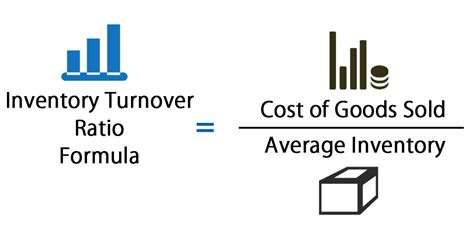

Inventory Valuation

For example, suppose a company has 100 units of inventory that were purchased at $10 each in January and another 100 units that were purchased at $12 each in June. If the company uses FIFO, the inventory would be valued at $10 per unit, while if the company uses LIFO, the inventory would be valued at $12 per unit. This difference in inventory valuation can significantly impact a company's balance sheet and financial ratios.

Tax Implications

For example, suppose a company has a taxable income of $100,000 and uses LIFO to value its inventory. If the company's COGS is $50,000, the taxable income would be $50,000, resulting in lower tax liabilities. However, if the company uses FIFO, the COGS would be $40,000, resulting in higher taxable income and higher tax liabilities.

Financial Statement Impact

For example, suppose a company has a gross profit of $50,000 and uses LIFO to value its inventory. If the COGS is $30,000, the gross profit would be $20,000, resulting in lower net income. However, if the company uses FIFO, the COGS would be $20,000, resulting in higher gross profit and higher net income.

Gallery of Inventory Management

Inventory Management Image Gallery

What is the main difference between FIFO and LIFO?

+The main difference between FIFO and LIFO is the assumption about the order in which inventory is sold or used. FIFO assumes that the oldest items are sold or used first, while LIFO assumes that the most recent items are sold or used first.

How does FIFO affect the cost of goods sold?

+FIFO calculates the cost of goods sold using the oldest costs in inventory, which can result in lower COGS during periods of inflation.

What are the tax implications of using LIFO?

+The use of LIFO can result in lower taxable income and lower tax liabilities, as the COGS is higher. However, this can also result in lower inventory valuation, which can impact a company's balance sheet and financial ratios.

How does FIFO affect inventory valuation?

+FIFO values inventory at the oldest costs, which can result in higher inventory valuation during periods of inflation.

What are the benefits of using FIFO?

+The benefits of using FIFO include higher inventory valuation, lower COGS, and higher net income. However, this can also result in higher tax liabilities.

In conclusion, the choice between FIFO and LIFO is a critical decision for businesses, as it can significantly impact financial statements, tax liabilities, and overall performance. By understanding the key differences between these two methods, companies can make informed decisions about their inventory management and financial reporting. Whether you are an accountant, a business owner, or an inventory manager, it is essential to consider the implications of FIFO vs LIFO and choose the method that best suits your company's needs. We encourage you to share your thoughts and experiences with inventory management in the comments below and to explore our other articles on related topics.