Intro

Discover 5 ways to complete Form CE 200, a customs declaration, with tips on export procedures, commercial invoices, and shipment details, ensuring seamless international trade and compliance with regulations.

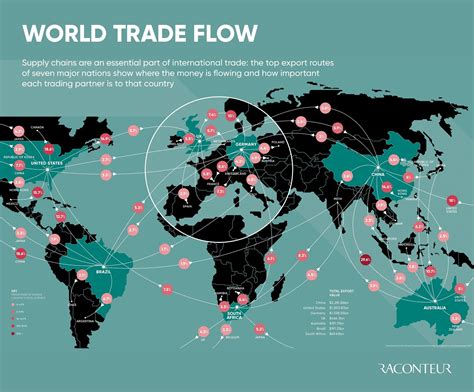

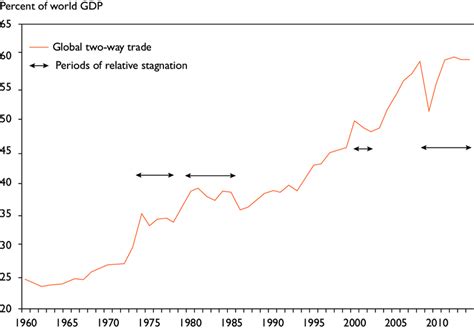

The importance of understanding and utilizing the Form CE-200 cannot be overstated, particularly for individuals and businesses involved in international trade. This form is crucial for reporting and record-keeping purposes, ensuring compliance with regulations and facilitating smooth transactions across borders. As the global trade landscape continues to evolve, the role of the Form CE-200 in managing and documenting exports has become increasingly significant. In this context, exploring the ways to effectively utilize the Form CE-200 is essential for navigating the complexities of international trade with ease and efficiency.

The Form CE-200 is designed to capture detailed information about exports, including the nature of the goods, their value, the countries involved, and the parties to the transaction. This information is vital for statistical analysis, regulatory compliance, and economic planning. By accurately completing and submitting the Form CE-200, exporters can ensure that their activities are properly documented and recorded, which is essential for avoiding legal and financial repercussions. Furthermore, the data collected through these forms helps governments and international bodies to monitor trade patterns, identify trends, and make informed decisions regarding trade policies and agreements.

Effective utilization of the Form CE-200 requires a thorough understanding of its components, the information it requires, and the procedures for its submission. Exporters must be able to accurately classify their goods, determine the correct valuation methods, and identify the appropriate commodity codes. They must also be aware of the deadlines for submission and the consequences of non-compliance. Given the complexity of international trade regulations and the potential for errors or omissions, exporters often seek guidance from trade experts or utilize specialized software to ensure that their Form CE-200 submissions are accurate and timely.

Understanding the Form CE-200

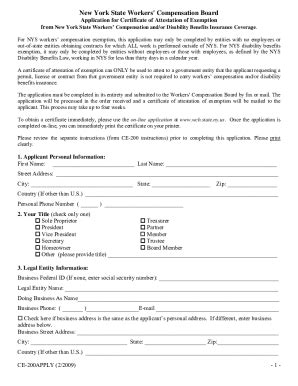

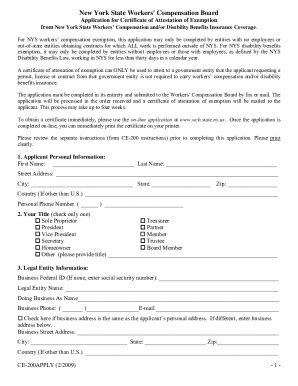

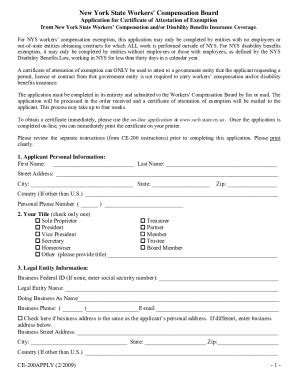

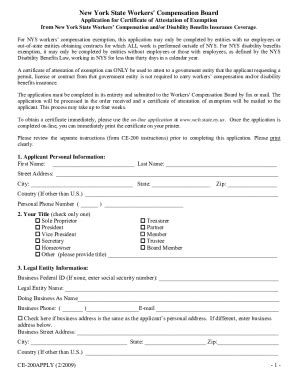

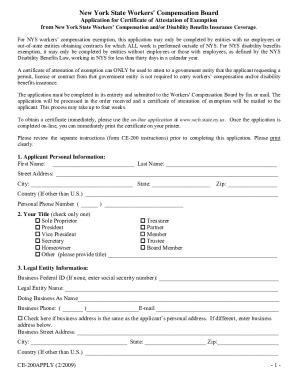

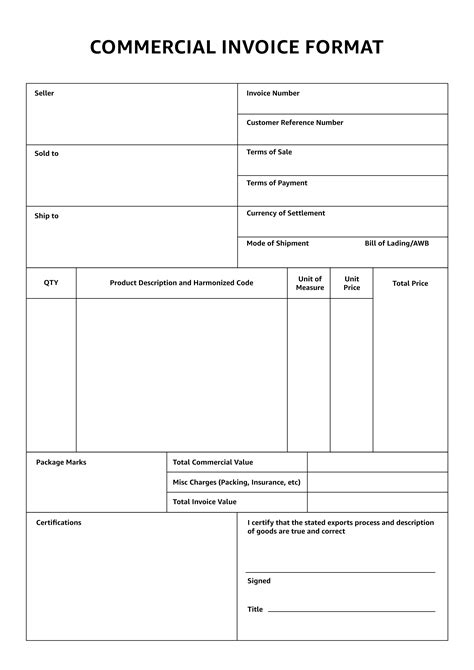

Understanding the Form CE-200 is the first step towards its effective utilization. This involves familiarizing oneself with the form's layout, the information it requires, and the instructions provided for its completion. The form is typically divided into sections, each designed to capture specific details about the export transaction. Exporters must carefully review each section to ensure that all required information is provided accurately and completely. This includes details about the exporter, the goods being exported, the country of destination, and the terms of the sale.

Components of the Form CE-200

The components of the Form CE-200 are designed to elicit comprehensive information about the export transaction. These components may include: - Exporter's information: This section requires details about the exporter, such as their name, address, and contact information. - Goods description: A detailed description of the goods being exported, including their commodity code, quantity, and value. - Country of destination: Information about the country to which the goods are being exported. - Terms of sale: Details about the terms of the sale, including the price, payment terms, and delivery conditions.Benefits of Accurate Form CE-200 Submission

The benefits of accurate Form CE-200 submission are multifaceted. Firstly, it ensures compliance with regulatory requirements, thereby avoiding potential penalties and fines. Secondly, it facilitates the collection of accurate trade statistics, which are essential for economic planning and policy-making. Accurate submissions also help in identifying trends and patterns in international trade, which can inform business strategies and investment decisions. Furthermore, the data collected through the Form CE-200 can be used to negotiate trade agreements and to monitor the impact of trade policies on the economy.

Consequences of Non-Compliance

The consequences of non-compliance with Form CE-200 requirements can be severe. These may include: - Financial penalties: Exporters who fail to submit the Form CE-200 or who provide inaccurate information may be subject to fines and other financial penalties. - Legal action: In severe cases, non-compliance may lead to legal action, including prosecution. - Reputation damage: Non-compliance can damage an exporter's reputation and credibility, potentially leading to a loss of business and revenue.Best Practices for Form CE-200 Completion

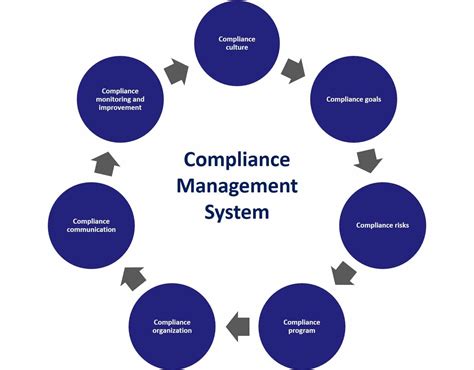

Best practices for Form CE-200 completion include ensuring accuracy and completeness of the information provided, adhering to the submission deadlines, and maintaining detailed records of all transactions. Exporters should also stay updated with any changes to the form or its requirements, and they should seek professional advice if they are unsure about any aspect of the form's completion. Utilizing technology, such as software designed for trade compliance, can also streamline the process and reduce the risk of errors.

Utilizing Technology for Form CE-200 Submission

Utilizing technology can significantly simplify the Form CE-200 submission process. Software solutions are available that can guide exporters through the form's completion, ensure accuracy, and facilitate timely submission. These solutions can also provide real-time updates on regulatory changes and offer tools for record-keeping and compliance management.Common Challenges in Form CE-200 Submission

Common challenges in Form CE-200 submission include understanding the complex regulatory requirements, ensuring the accuracy and completeness of the information provided, and meeting the submission deadlines. Exporters may also face challenges in classifying their goods correctly, determining the appropriate valuation methods, and dealing with changes in trade policies and regulations.

Seeking Professional Advice

Given the complexity of the Form CE-200 and the potential consequences of non-compliance, seeking professional advice is often advisable. Trade experts and consultants can provide guidance on all aspects of the form's completion and submission, helping exporters to navigate the process efficiently and effectively. They can also offer insights into regulatory changes and their implications for exporters.Future of Form CE-200 and International Trade

The future of the Form CE-200 and international trade is likely to be shaped by technological advancements, changes in global trade policies, and the evolving needs of exporters and regulatory bodies. There may be a move towards more digital and automated processes for form submission and compliance management, aiming to increase efficiency and reduce errors. Additionally, there could be changes in the form's requirements and format to accommodate new trade agreements and regulatory frameworks.

Adapting to Changes

Exporters must be prepared to adapt to changes in the Form CE-200 and international trade regulations. This involves staying informed about updates and amendments, investing in training and professional development, and leveraging technology to manage compliance and submissions. By being proactive and responsive to changes, exporters can maintain their competitive edge and ensure continued success in the global market.Form CE-200 Image Gallery

What is the purpose of the Form CE-200?

+The Form CE-200 is used for reporting and record-keeping purposes in international trade, ensuring compliance with regulations and facilitating smooth transactions across borders.

How do I complete the Form CE-200 accurately?

+To complete the Form CE-200 accurately, ensure you understand its components, follow the instructions provided, and seek professional advice if necessary. Utilizing technology, such as specialized software, can also help in ensuring accuracy and compliance.

What are the consequences of non-compliance with Form CE-200 requirements?

+The consequences of non-compliance can include financial penalties, legal action, and damage to an exporter's reputation. It is essential to adhere to the submission deadlines and ensure the accuracy and completeness of the information provided.

In conclusion, mastering the Form CE-200 is crucial for success in international trade. By understanding its importance, benefits, and challenges, and by adopting best practices for its completion and submission, exporters can navigate the complexities of global trade with confidence. As the trade landscape continues to evolve, the role of the Form CE-200 in facilitating compliance, statistical analysis, and economic planning will remain significant. We invite readers to share their experiences and insights regarding the Form CE-200, and to explore the resources and tools available for managing international trade compliance effectively. Whether you are an seasoned exporter or just entering the global market, understanding and leveraging the Form CE-200 will be key to your success.