Intro

Discover General Ledger Accounts, including account types, ledger templates, and accounting principles, to master financial management and balance sheets with ease.

The general ledger is a crucial component of any accounting system, serving as the central repository for all financial transactions. It is where all the financial data is stored, and from which financial statements are prepared. Understanding general ledger accounts is essential for any business or individual looking to manage their finances effectively. In this article, we will delve into the world of general ledger accounts, exploring their importance, types, and how they are used in financial management.

General ledger accounts are the building blocks of the general ledger, providing a detailed record of all financial transactions. They are used to categorize and store financial data, making it easier to track and analyze financial performance. The general ledger is made up of numerous accounts, each with its own unique characteristics and functions. These accounts are used to record various types of transactions, such as income, expenses, assets, liabilities, and equity.

The importance of general ledger accounts cannot be overstated. They provide a clear and accurate picture of a company's financial position, enabling management to make informed decisions about the business. General ledger accounts are also used to prepare financial statements, such as the balance sheet and income statement, which are essential for external stakeholders, including investors and creditors. By understanding general ledger accounts, businesses can better manage their finances, identify areas for improvement, and make strategic decisions to drive growth and profitability.

Introduction to General Ledger Accounts

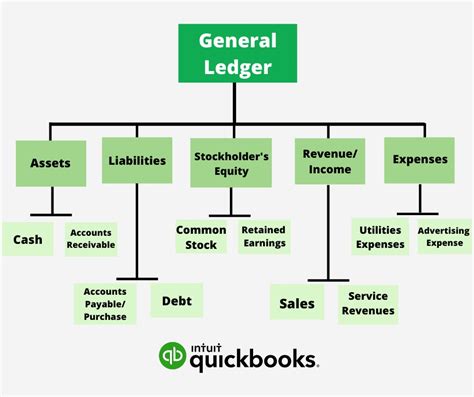

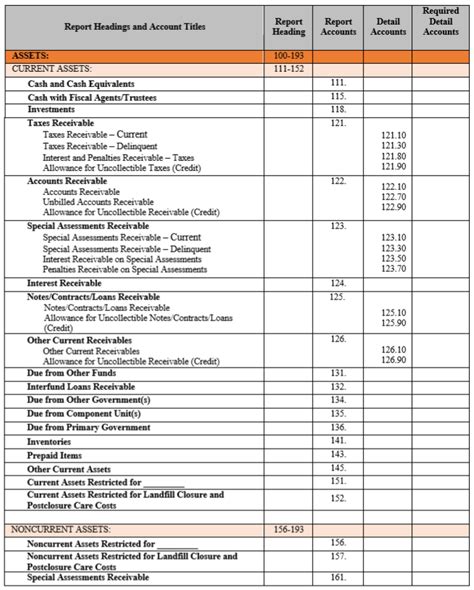

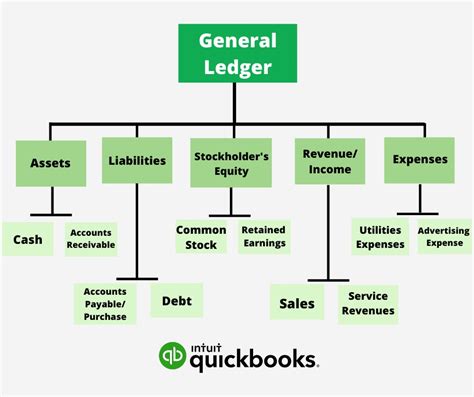

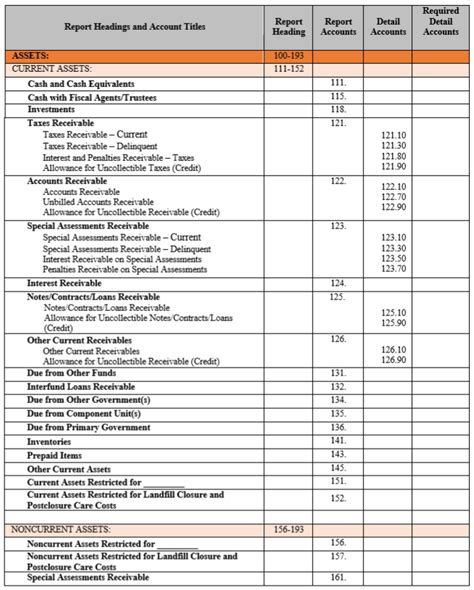

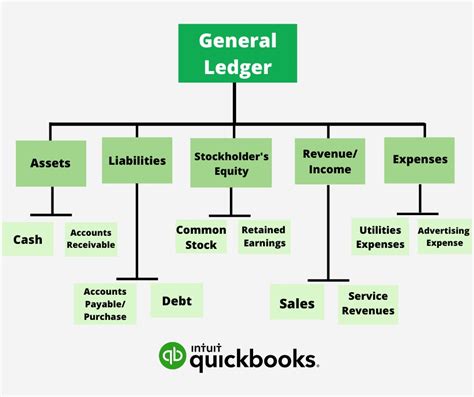

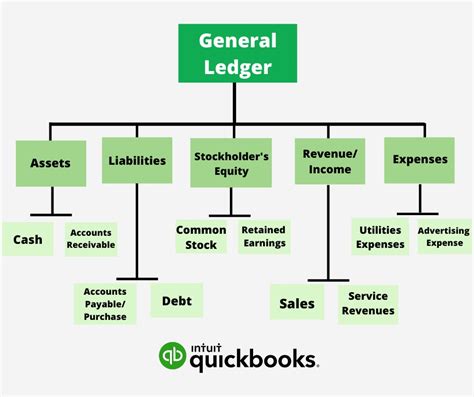

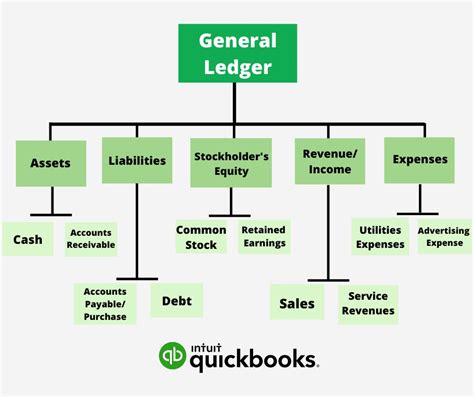

General ledger accounts can be broadly categorized into several types, including asset accounts, liability accounts, equity accounts, revenue accounts, and expense accounts. Asset accounts represent the resources owned or controlled by a business, such as cash, inventory, and property, plant, and equipment. Liability accounts, on the other hand, represent the debts or obligations of a business, such as accounts payable, loans, and taxes owed. Equity accounts represent the ownership interest in a business, including common stock, retained earnings, and dividends.

Revenue accounts represent the income earned by a business, including sales, services, and interest income. Expense accounts, meanwhile, represent the costs incurred by a business, such as salaries, rent, and utilities. Understanding the different types of general ledger accounts is essential for accurate financial reporting and analysis.

Types of General Ledger Accounts

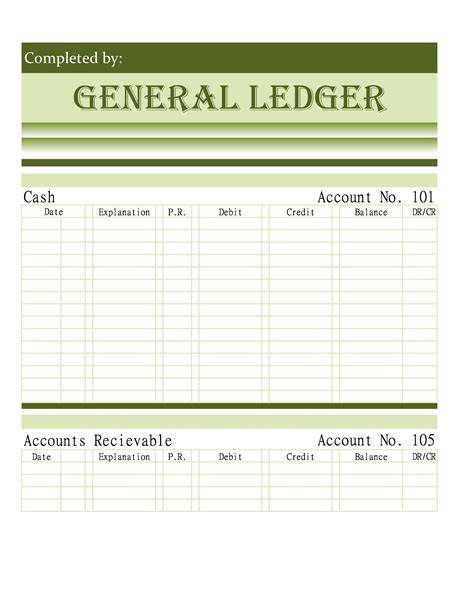

Each general ledger account has its own unique characteristics and functions. Asset accounts, for example, are typically debited when increased and credited when decreased. Liability accounts, on the other hand, are typically credited when increased and debited when decreased. Equity accounts are also credited when increased and debited when decreased. Revenue accounts are credited when increased, while expense accounts are debited when increased.

Understanding the accounting equation is essential for managing general ledger accounts. The accounting equation is: Assets = Liabilities + Equity. This equation represents the relationship between a company's assets, liabilities, and equity. By understanding this equation, businesses can better manage their finances and make informed decisions about investments, funding, and resource allocation.

Accounting Equation and General Ledger Accounts

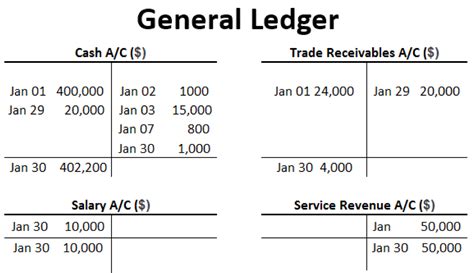

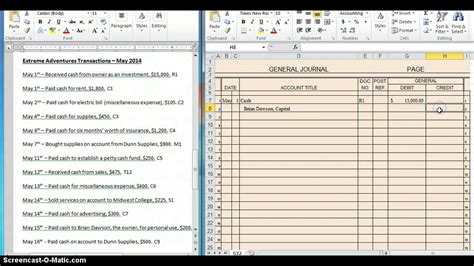

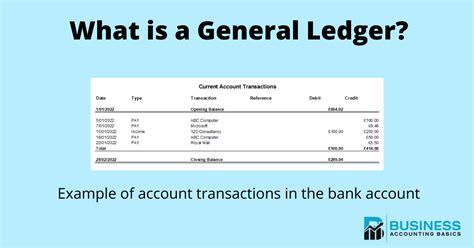

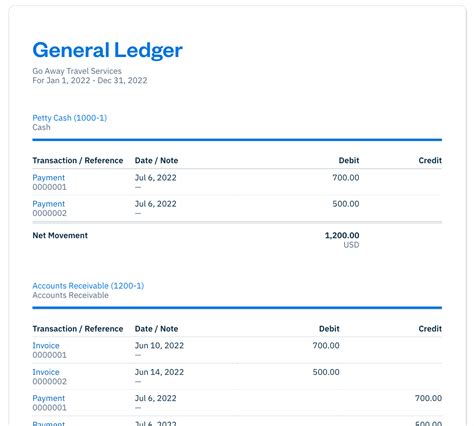

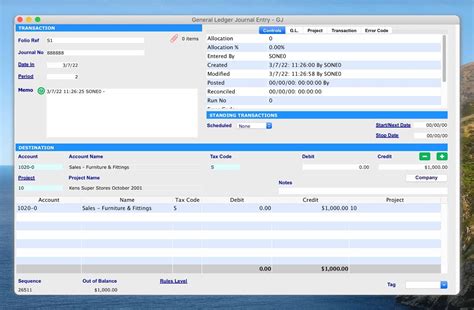

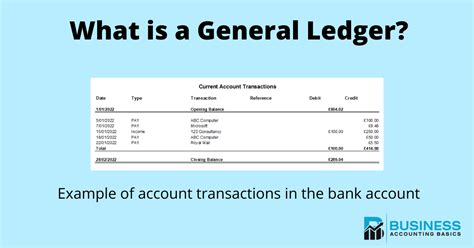

General ledger accounts are used to record various types of transactions, including income, expenses, assets, liabilities, and equity. These transactions are recorded using debits and credits, which are used to increase or decrease the balance of a general ledger account. Debits are used to increase asset accounts and decrease liability and equity accounts. Credits, on the other hand, are used to decrease asset accounts and increase liability and equity accounts.

The process of recording transactions in general ledger accounts involves several steps, including identifying the transaction, determining the accounts affected, and recording the transaction using debits and credits. This process is essential for accurate financial reporting and analysis.

Recording Transactions in General Ledger Accounts

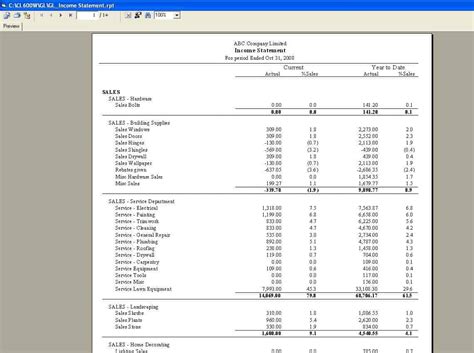

General ledger accounts are used to prepare financial statements, including the balance sheet and income statement. The balance sheet provides a snapshot of a company's financial position at a particular point in time, including its assets, liabilities, and equity. The income statement, on the other hand, provides a summary of a company's revenues and expenses over a specific period.

By analyzing general ledger accounts, businesses can identify trends and patterns in their financial data, making it easier to make informed decisions about the business. General ledger accounts can also be used to identify areas for improvement, such as reducing expenses or increasing revenue.

Preparing Financial Statements using General Ledger Accounts

In addition to preparing financial statements, general ledger accounts can be used to analyze financial performance. This involves analyzing the data in the general ledger accounts to identify trends and patterns, making it easier to make informed decisions about the business.

There are several tools and techniques that can be used to analyze general ledger accounts, including financial ratios, trend analysis, and variance analysis. Financial ratios, such as the current ratio and debt-to-equity ratio, can be used to evaluate a company's liquidity and solvency. Trend analysis can be used to identify patterns in financial data, while variance analysis can be used to identify areas for improvement.

Analyzing Financial Performance using General Ledger Accounts

General ledger accounts can also be used to identify areas for improvement, such as reducing expenses or increasing revenue. By analyzing the data in the general ledger accounts, businesses can identify areas where costs can be reduced or revenue can be increased.

There are several strategies that can be used to improve financial performance, including cost reduction, revenue growth, and asset optimization. Cost reduction involves identifying areas where costs can be reduced, such as reducing labor costs or minimizing waste. Revenue growth involves identifying opportunities to increase revenue, such as expanding into new markets or introducing new products.

Improving Financial Performance using General Ledger Accounts

In conclusion, general ledger accounts are a crucial component of any accounting system, providing a detailed record of all financial transactions. By understanding general ledger accounts, businesses can better manage their finances, identify areas for improvement, and make strategic decisions to drive growth and profitability.

Gallery of General Ledger Accounts

General Ledger Accounts Image Gallery

What is a general ledger account?

+A general ledger account is a detailed record of all financial transactions, used to categorize and store financial data.

What are the types of general ledger accounts?

+General ledger accounts can be broadly categorized into several types, including asset accounts, liability accounts, equity accounts, revenue accounts, and expense accounts.

How are general ledger accounts used to prepare financial statements?

+General ledger accounts are used to prepare financial statements, including the balance sheet and income statement, by providing a detailed record of all financial transactions.

What is the accounting equation, and how is it related to general ledger accounts?

+The accounting equation is: Assets = Liabilities + Equity. This equation represents the relationship between a company's assets, liabilities, and equity, and is used to manage general ledger accounts.

How can general ledger accounts be used to analyze financial performance?

+General ledger accounts can be used to analyze financial performance by identifying trends and patterns in financial data, making it easier to make informed decisions about the business.

We hope this article has provided you with a comprehensive understanding of general ledger accounts and their importance in financial management. Whether you are a business owner, accountant, or financial analyst, understanding general ledger accounts is essential for making informed decisions about the business. If you have any questions or comments, please do not hesitate to reach out to us. We would be happy to hear from you and provide any additional information or guidance you may need. Share this article with others who may benefit from this information, and let's work together to improve our financial management skills.