Intro

Calculate break-even point easily with our guide, covering cost analysis, revenue projection, and financial planning to determine profitability and make informed business decisions.

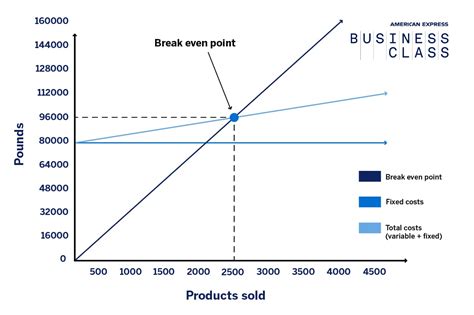

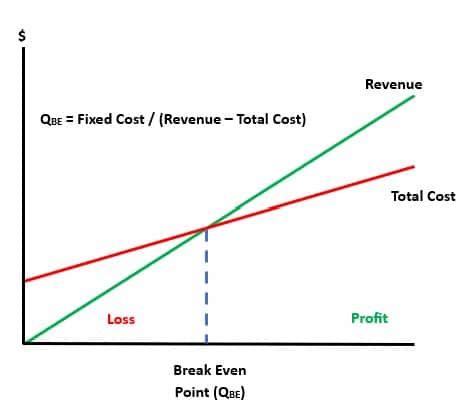

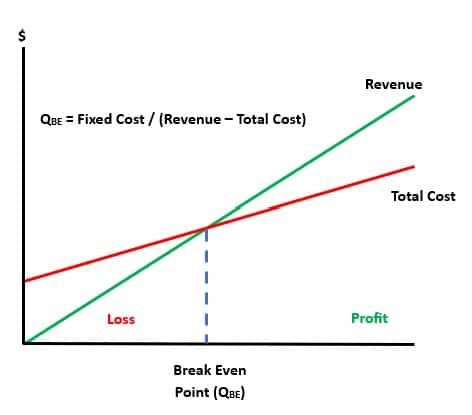

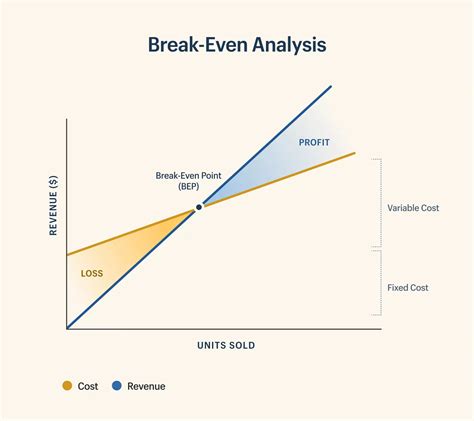

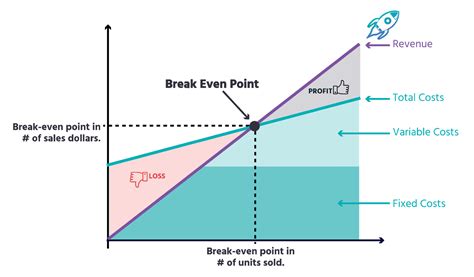

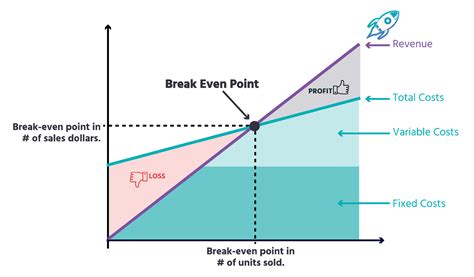

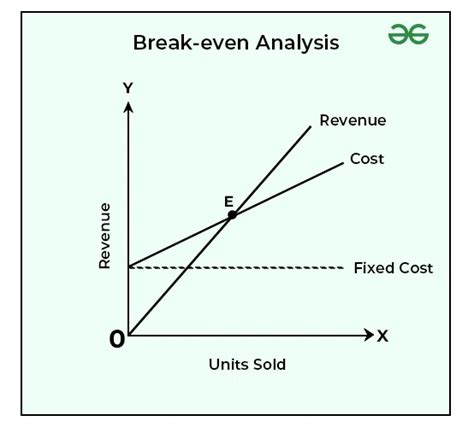

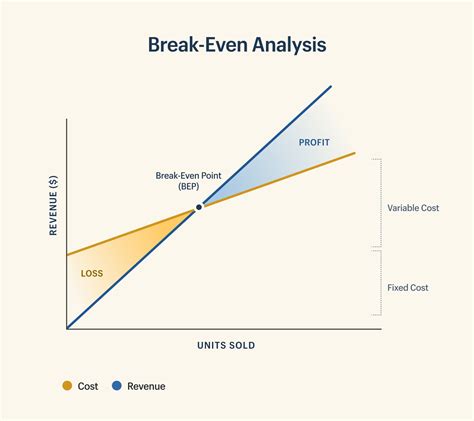

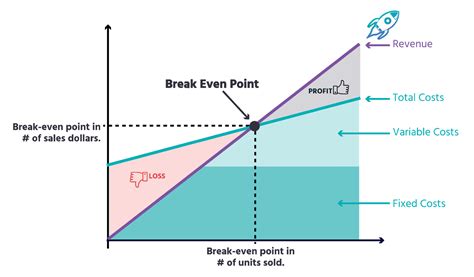

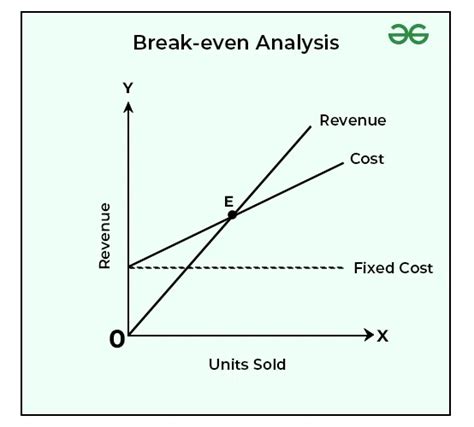

Calculating the break-even point is a crucial step for businesses to determine when they will start generating profits. It is the point at which the total revenue equals the total fixed and variable costs. Understanding the break-even point helps businesses to make informed decisions about pricing, production, and investment. In this article, we will delve into the importance of calculating the break-even point, its benefits, and provide a step-by-step guide on how to calculate it easily.

The break-even point is a critical metric that helps businesses to evaluate their financial performance and make adjustments to achieve profitability. It is essential for startups, small businesses, and large corporations alike. By calculating the break-even point, businesses can identify the minimum sales required to cover their costs and start generating profits. This information can be used to create a pricing strategy, determine the optimal production level, and allocate resources efficiently.

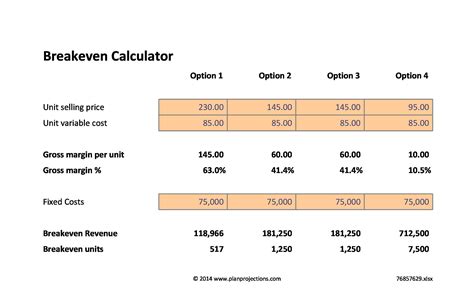

Calculating the break-even point can seem like a complex task, but it is relatively simple once you understand the concept. The break-even point is calculated by dividing the total fixed costs by the contribution margin, which is the difference between the selling price and the variable costs. The formula for calculating the break-even point is: Break-Even Point = Fixed Costs / (Selling Price - Variable Costs).

Understanding Break-Even Analysis

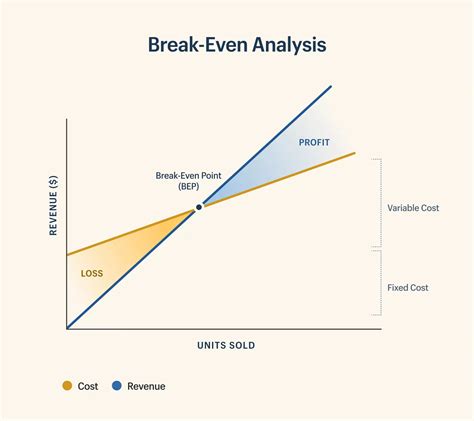

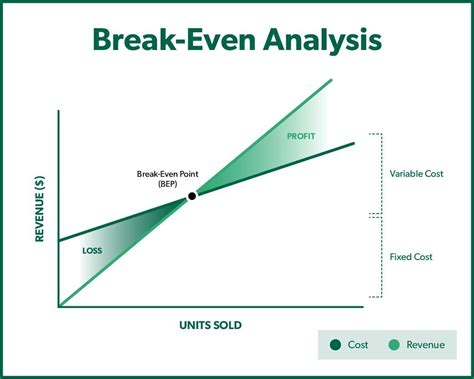

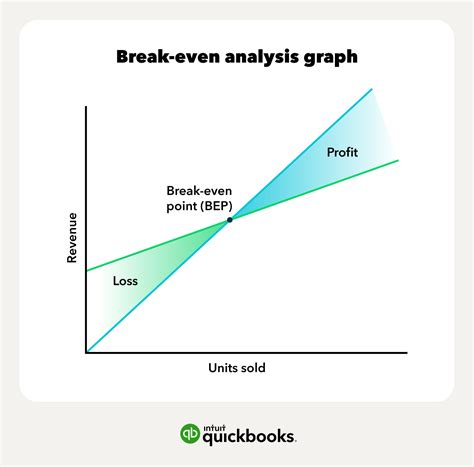

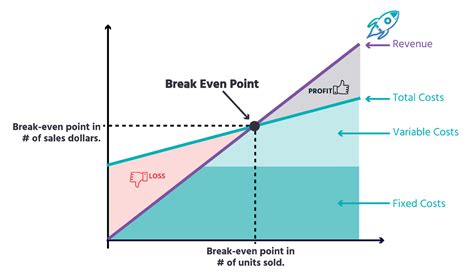

Break-even analysis is a powerful tool that helps businesses to evaluate their financial performance and make informed decisions. It involves calculating the break-even point, which is the point at which the total revenue equals the total fixed and variable costs. Break-even analysis can be used to determine the minimum sales required to cover costs, evaluate the impact of changes in pricing or costs, and identify areas for improvement.

Break-even analysis can be applied to various aspects of a business, including products, services, and projects. It can help businesses to determine the viability of a new product or service, evaluate the impact of changes in pricing or costs, and identify areas for improvement. By using break-even analysis, businesses can make informed decisions and achieve their financial goals.

Benefits of Break-Even Analysis

Break-even analysis offers several benefits to businesses, including:

- Helping to determine the minimum sales required to cover costs

- Evaluating the impact of changes in pricing or costs

- Identifying areas for improvement

- Determining the viability of a new product or service

- Evaluating the impact of changes in production levels or marketing strategies

By using break-even analysis, businesses can make informed decisions and achieve their financial goals. It can help businesses to identify areas for improvement, evaluate the impact of changes in pricing or costs, and determine the viability of a new product or service.

How to Calculate Break-Even Point

Calculating the break-even point is relatively simple once you understand the concept. The break-even point is calculated by dividing the total fixed costs by the contribution margin, which is the difference between the selling price and the variable costs. The formula for calculating the break-even point is: Break-Even Point = Fixed Costs / (Selling Price - Variable Costs).

To calculate the break-even point, you need to know the following:

- Fixed costs: These are costs that remain the same even if the production level changes, such as rent, salaries, and insurance.

- Variable costs: These are costs that vary with the production level, such as raw materials, labor, and marketing expenses.

- Selling price: This is the price at which the product or service is sold.

- Contribution margin: This is the difference between the selling price and the variable costs.

Step-by-Step Guide to Calculating Break-Even Point

To calculate the break-even point, follow these steps: 1. Determine the fixed costs: Identify all the fixed costs associated with the business, such as rent, salaries, and insurance. 2. Determine the variable costs: Identify all the variable costs associated with the business, such as raw materials, labor, and marketing expenses. 3. Determine the selling price: Determine the price at which the product or service is sold. 4. Calculate the contribution margin: Calculate the difference between the selling price and the variable costs. 5. Calculate the break-even point: Divide the fixed costs by the contribution margin.Example of Break-Even Calculation

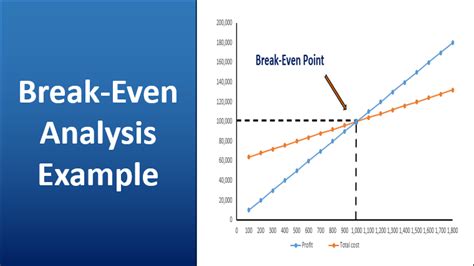

Let's consider an example to illustrate the break-even calculation. Suppose a company has fixed costs of $100,000, variable costs of $50 per unit, and a selling price of $100 per unit. To calculate the break-even point, we need to calculate the contribution margin first.

Contribution margin = Selling price - Variable costs = $100 - $50 = $50

Break-Even Point = Fixed Costs / Contribution margin = $100,000 / $50 = 2,000 units

This means that the company needs to sell 2,000 units to break even.

Importance of Break-Even Analysis in Business

Break-even analysis is a crucial tool for businesses to evaluate their financial performance and make informed decisions. It helps businesses to determine the minimum sales required to cover costs, evaluate the impact of changes in pricing or costs, and identify areas for improvement.

Break-even analysis can be used in various aspects of a business, including:

- Pricing strategy: Break-even analysis can help businesses to determine the optimal price for their products or services.

- Production planning: Break-even analysis can help businesses to determine the optimal production level to meet demand and minimize costs.

- Investment decisions: Break-even analysis can help businesses to evaluate the viability of new projects or investments.

By using break-even analysis, businesses can make informed decisions and achieve their financial goals.

Common Mistakes to Avoid in Break-Even Analysis

There are several common mistakes that businesses make when conducting break-even analysis, including:

- Failing to consider all costs: Businesses should consider all costs, including fixed and variable costs, when conducting break-even analysis.

- Failing to consider changes in costs: Businesses should consider changes in costs, such as increases in raw materials or labor costs, when conducting break-even analysis.

- Failing to consider changes in pricing: Businesses should consider changes in pricing, such as discounts or price increases, when conducting break-even analysis.

By avoiding these common mistakes, businesses can ensure that their break-even analysis is accurate and reliable.

Best Practices for Break-Even Analysis

There are several best practices that businesses can follow when conducting break-even analysis, including:

- Using accurate and reliable data: Businesses should use accurate and reliable data when conducting break-even analysis.

- Considering all costs: Businesses should consider all costs, including fixed and variable costs, when conducting break-even analysis.

- Considering changes in costs and pricing: Businesses should consider changes in costs and pricing when conducting break-even analysis.

By following these best practices, businesses can ensure that their break-even analysis is accurate and reliable.

Break-Even Analysis Image Gallery

What is break-even analysis?

+Break-even analysis is a financial calculation that determines the point at which a business's total revenue equals its total fixed and variable costs.

Why is break-even analysis important?

+Break-even analysis is important because it helps businesses to determine the minimum sales required to cover costs, evaluate the impact of changes in pricing or costs, and identify areas for improvement.

How do I calculate the break-even point?

+The break-even point is calculated by dividing the total fixed costs by the contribution margin, which is the difference between the selling price and the variable costs.

What are the benefits of break-even analysis?

+The benefits of break-even analysis include helping to determine the minimum sales required to cover costs, evaluating the impact of changes in pricing or costs, and identifying areas for improvement.

How often should I conduct break-even analysis?

+Break-even analysis should be conducted regularly, ideally monthly or quarterly, to ensure that the business is on track to meet its financial goals.

In conclusion, calculating the break-even point is a crucial step for businesses to determine when they will start generating profits. By understanding the concept of break-even analysis and following the step-by-step guide, businesses can make informed decisions and achieve their financial goals. We encourage you to share your thoughts and experiences with break-even analysis in the comments below. Additionally, if you found this article helpful, please share it with your network to help others understand the importance of break-even analysis.